South Florida Foreclosure Filings Increase In The Third Quarter

South Florida foreclosure filings increased during the third quarter of 2021, shortly after the federal moratoriums on evictions and foreclosures were lifted. Housing experts anticipate that this upward trend could continue well into the fourth quarter of 2021.

The moratorium on foreclosures expired for most homeowners on July 31, 2021. It was created in an effort to help struggling homeowners stay in their homes during the worst of the COVID-19 pandemic. However, now that the moratorium has been lifted, many mortgage lenders are moving forward with foreclosure proceedings.

According to ATTOM, 1,871 foreclosure actions were filed during the third quarter in the tri-county area. These numbers represent a 60 percent increase from what was reported in the second quarter of 2021. When compared to the third quarter of 2020, foreclosure filings in the area increased by 137 percent.

When compared to increases across the nation, South Floridas numbers increased at a much faster rate. South Florida reported the seventh highest figures of foreclosure filings in the nation with one foreclosure filing being made for every 1,354 homes. The metro areas with the largest increases in foreclosure filings were in Atlantic City, New Jersey and Peoria, Illinois.

Please click here to read more.

Mortgage Loans In Florida

If you get a loan to buy residential real estate in Florida, you’ll likely sign two documents: a promissory note and a mortgage. The promissory note is the document that contains your promise to repay the loan along with the repayment terms. The mortgage is the document that gives the lender a security interest in the property. If you fail to make the payments, the mortgage provides the lender with the right to sell the home at a foreclosure sale to recoup the money it loaned you.

Whos Covered Under The Cdc Moratorium

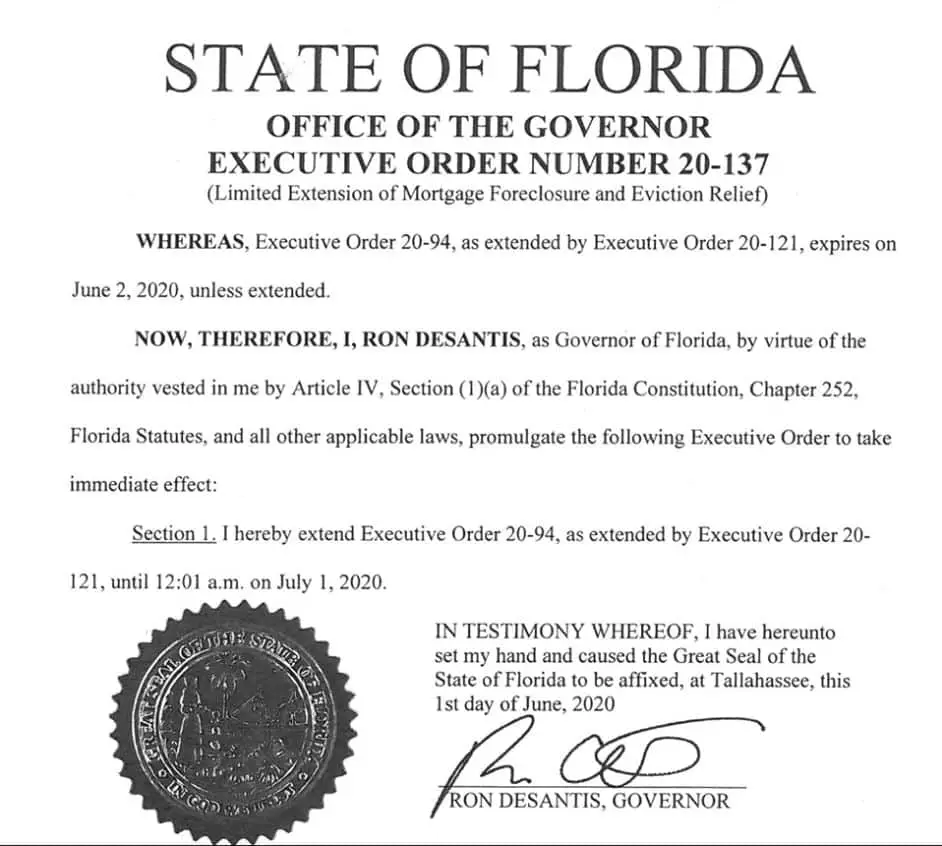

On April 2, 2020, Governor DeSantis signed Executive Order 20-94, which placed a moratorium on mortgage foreclosure actions, as well as residential eviction actions related to the non-payment of rent. The purpose of the moratorium was to provide targeted, temporary relief to Floridians in the wake of the COVID-19 pandemic. Since Executive Order 20-94 was enacted, three additional orders were signed by Governor DeSantis in order to extend the stay.

Most recently, on July 29, 2020, Governor DeSantis signed Executive Order 20-180, which extended the foreclosure and eviction moratorium through September 1, 2020. However, the new order made substantial changes to limit the types of cases that are covered by the moratorium.

Recommended Reading: How Many Times Can You Declare Bankruptcy

Cares Act Mortgage Assistance For Covid

The CARES ACT was passed by Congress earlier this year to help alleviate the financial hardship caused by COVID. Under the CARES ACT, government-backed mortgages may be eligible for a mortgage forbearance of up to 180 days. A forbearance is when your lender suspends payments for a limited amount of time. Forbearance does not forgive or eliminate payments it only delays them. Any missed payments during the forbearance period will need to be addressed when the forbearance ends.

The CARES ACT also prevents foreclosure of government-backed loans until December 31, 2020. No foreclosure case for a government-backed mortgage may be filed until after December 31, 2020. If a foreclosure case was already filled, the CARES ACT would prevent the auction from occurring before December 31, 2020.

Foreclosure Moratorium For Va

The VA’s foreclosure suspension applies to properties secured by VA-guaranteed mortgages, including those previously secured by VA-guaranteed loans but currently in VA’s real estate owned portfolio. The moratorium stops the initiation of foreclosures, the completion of foreclosures in process, and evictions. But vacant or abandoned properties aren’t covered.

The VA later extended its eviction suspension through September 30, 2021. Foreclosure-related evictions are not to be initiated or completed on properties previously secured by VA-guaranteed loans . But the moratorium doesn’t apply to vacant or abandoned properties. Foreclosures may resume after July 31, 2021.

To find out if you have a VA-guaranteed loan, look at the documents you signed when you took out your mortgage. VA-guaranteed loans contain specific language in the note and mortgage that identifies it as a VA loan. Also, fees paid to the VA will be shown in the closing documents.

You May Like: Buy Pallets Of Stuff

Update On Federal And State Law Impacting Evictions And Foreclosures

By: Michael C. Caborn, Esquire, Mya M. Hatchette, Esquire, and Lauren M. Reynolds, Esquire Update on Federal and State Law Impacting Evictions What landlords need to know in a nutshell: All residential evictions are suspended through October 1, 2020 in Florida. In certain circumstances, residential evictions are suspended through December 31, 2020. Landlords may proceed Read more

By: Ryan E. Davis, Heather S. Moraes, and Bradley M. Saxton How does a landlord best protect and shield itself from the economic turmoil of its tenants? The Coronavirus has had pronounced impacts on the retail industry, and likely will continue to affect retail for some time to come. Many retail tenants, for the Read more

Release & Contact Info

Email:

WASHINGTON, Feb. 16, 2021 The U.S. Department of Agriculture announced an extension of eviction and foreclosure moratoriums on USDA Single Family Housing Direct and Guaranteed loans through June 30, 2021. The actions announced today will bring relief to residents in rural America who have housing loans through USDA.

USDA recognizes that the COVID-19 pandemic has triggered an almost unprecedented housing affordability crisis in the United States. Thats why USDA is taking this important action today to extend relief to the hundreds-of-thousands of individuals and families holding USDA Single Family Housing loans, USDA Deputy Under Secretary for Rural Development Justin Maxson said. While todays actions are an important step for them, we need to do more. The Biden Administration is working closely with Congress to pass the American Rescue Plan to take more robust and aggressive actions to bring additional relief to American families and individuals impacted by the pandemic.

A recent Census Bureau survey showed that 8.2 million homeowners are currently behind on mortgage payments, and of that 8.2 million, 3 million homeowners behind on payments were Black or Hispanic.

You May Like: Which Kind Of Bankruptcy Proceeding Is Considered A Liquidation Proceeding

Breadth And Scope Of The Agencies Foreclosure Moratoriums

On June 24, the Federal Housing Finance Agency issued a news release stating that Fannie Mae and Freddie Mac are extending the moratoriums on single-family foreclosures and real estate owned evictions until July 31, 2021. The foreclosure moratorium applies to Enterprise-backed, single-family mortgages only. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratoriums were set to expire on June 30, 2021. The news release stated, this action is just the latest step FHFA has taken to benefit homeowners and the mortgage market during the pandemic.

Fannie Mae updated its Lender Letter LL-2020-02 on June 24, extending the suspension of foreclosure-related activities through July 31, 2021. During the extended period, servicers may not, except with respect to a vacant or abandoned property, initiate any judicial or non-judicial foreclosure process, move for a foreclosure judgment or order of sale, or execute a foreclosure sale. This suspension does not apply to mortgage loans secured by properties that have been determined to be vacant or abandoned. The guidance extends the servicers obligations to meet bankruptcy milestones.

In its contemporaneously released servicing frequently asked questions, Freddie Mac identified some of the activities that it is taking to ensure homeowners can remain in their homes during this critical time:

Foreclosure Moratorium Florida End Date

After nearly 17 months, the Federal Foreclosure Moratorium was not extended, thus expiring at the end of July. Florida Governor, Ron DeSantis, ended the Florida Foreclosure Moratorium in September of 2020. What does the Federal Foreclosure Moratorium ending mean for Florida homeowners?

Well, before we jump into the actual foreclosure lawsuit, it is important to talk about the Notice of Acceleration clause that is in most mortgages. The Notice of Acceleration is generally found in Paragraph 22 of the mortgage and requires the lender/servicer to send a letter to the owner of the property.

Contact us today to schedule your free consultation with our experienced team. The Haynes Law Group is here to help.

This letter informs the homeowner that they are in default, must pay a certain amount to reinstate by a certain date, or a foreclosure case will be filed thirty days after the letter is sent. Once the thirty days are up, the foreclosure case will be filed in a timely manner by the bank.

From my experience of handling thousands of foreclosure cases throughout the entire state of Florida, I would estimate that about 90% of homeowners being foreclosed on want to keep their property, long term. In order to do this, there are three main options to keep the home.

Payoff

This literally means you pay the entire mortgage balance upfront. Hardly anyone chooses this option, as most homeowners dont have that amount of capital handy.

Reinstatement

Loan Modification

Also Check: What’s Better Bankruptcy Or Debt Settlement

Florida Foreclosures Increased 71% From 2021

Premium Getty Image for WFLA USE ONLY

TAMPA, Fla. Foreclosure data from real estate company ATTOM showed Floridas foreclosure rates for over the past year rose 71.26% according to their latest data.

In just the past month, ATTOM reported a nearly 3% increase of foreclosures across the country in September 2022, while in Florida, the number of foreclosures shrank by nearly 4% instead from August to September.

In Florida, ATTOM reported there were 9,284 foreclosure filings in the past quarter, with 6,671 foreclosure starts during that period. Of the top five states ranked by foreclosure starts, Florida was No. 2, with just California ahead.

Foreclosure starts, while rising since the end of the governments foreclosure moratorium, still lag behind pre-pandemic levels, Rick Sharga, executive vice president of market intelligence for ATTOM, said. Foreclosure activity is reflecting other aspects of the economy, as unemployment rates continue to be historically low, and mortgage delinquency rates are lower than they were before the COVID-19 outbreak.

While foreclosures ramped up nationally, but shrank moderately in Florida, data from AgentStory, a firm which tracks active real estate agents, found that the number of agents in service in Tampa had gone down by 11%, while in the U.S. overall, agent activity had decreased 51% in September.

| Rate Rank |

|---|

State And County Eviction Moratoriums

If you arent protected by the state or federal moratorium, there may be county-level protections, in place temporarily, that apply to both residential and commercial tenancies. As of October 1, 2020, Miami-Dade County Police are the only known department that has a continued moratorium in place, meaning they will not serve eviction papers or execute wir. Things are changing day by day, so always check with the clerk of court or an attorney to confirm the status of any policy changes if you have a case filed against you. Legal aid organizations are available to help by phone and online.

Governor Ron DeSantis ended Floridas statewide moratorium on October 1, 2020. Previous statewide moratoriums were put in place to protect residential tenants and single-family homeowners who:

-

suffered a loss of employment, diminished wages or business income, or other monetary loss realized during the Florida State of Emergency directly impacting their ability to make rent/mortgage payments

-

are facing eviction or foreclosure due to their inability to pay

The final action at the conclusion of the foreclosure or eviction cases in these cases was suspended through October 1, 2020.

The Executive Orders did not forgive or cancel payments, but noted that all payments. including tolled payments, are due when an individual is no longer adversely affected by the COVID-19 emergency.

From April 2 to August 1, a previous moratorium halted:

Also Check: Bankruptcy Chapter 13 Vs Chapter 7

Communicate To Your Landlord:

Always express to your landlord the efforts you are making to pay rent. Explain to them the broken unemployment system, and the delay in receiving rental assistance. Ask if they sought forbearance from their mortgage, and/or see if a payment plan can be crafted. Also confirm if the mortgage is federally-backed, or if the apartment was constructed via low-income housing tax credits. Sometimes that can offer additional protections.

In Miami As Elsewhere A House

MIAMI IS hotespecially if you are selling a home. House prices are 20% higher than a year ago. And unlike other big American cities, rents are up too , as the Magic City soaks up newly untethered teleworkers. Ecstatic estate agents describe a bonanza. Buyers are waiving inspections and appraisals entirely, buying units sight unseen, and aggressively bidding up prices. One agent tells of a client bidding $50,000 above the appraised value of a homeand still getting rejected. Another admits sheepishly to recently buying a house of her own without an inspection. All the usual gaudy accoutrements of the city are here: the ostentatious sports cars, the well-trafficked designer stores, the planes circling Miami Beach advertising a prominent rapper playing at a nightclub.

Your browser does not support the < audio> element.

Yet amid this exuberance, almost 8% of mortgage-holders in Miami are delinquent, among the highest share in the nation. Meanwhile, people renting housing face the end of a federal moratorium on evictions at the end of the month. A moratorium on mortgage foreclosures ends at the same time, raising fears of a spike in houses lost amid a house-price boom.

No nationwide freezing of evictions and foreclosures has ever been attempted before. Unwinding the policy is therefore unprecedented. The degree of upheaval may ultimately depend on state and local decisions, which are tremendously varied.

Recommended Reading: Chapter 7 Bankruptcy Georgia

What Will Happen To My Credit Score If I Choose To Defer My Mortgage Payment

While your credit score shouldnt be the thing you are most concerned about at this time, there is currently NO GUIDANCE on credit reporting during this pandemic. If you choose to defer payments on your mortgage your credit score will likely be negatively impacted for years to come. Maybe mortgage servicers will report your account with some sort of statement that indicates your payment history is affected by the pandemic, which could possibly help protect your credit history and credit scores. Again, without any coordinated guidance on this issue, the effect of the pandemic on your credit score is anyones guess.

Community Demands Equity In Confronting Crisis

The current coronavirus outbreak is not just a public health emergency, its an economic crisis, and both will disproportionately impact the most vulnerable among us. As COVID-19 continues to take its toll, we must protect our local communities as they confront and attempt to mitigate its impacts, especially healthcare workers and vulnerable populations. The response must center and support marginalized communities who are already feeling the devastating economic impact of this pandemic, especially workers who are earning low wages and are one paycheck away from crisis, including individuals with disabilities and other special needs. We are a cross section of grassroots organizations from across Florida, led by and rooted in these communities. Weve weathered storms and natural disasters, and know all too well how our communities can be left out of preparation and recovery efforts. As we face this crisis together, we demand:

Recommended Reading: How To File Bankruptcy For Free In Kansas

The Suspension Is Extended

Many states, including Florida, have enacted eviction and foreclosure moratoriums. In general, this legislation restricts landlords and creditors ability to kick people out of their homes for being unable to pay their rent or mortgage. In Florida, the original moratorium went into effect on April 2. Since then, Gov. DeSantis has continued to extend the moratorium each month, changing its terms slightly to match the situation of the pandemic. The Florida governor has made a habit of putting off this decision until the night before the new month begins, leaving landlords, tenants, and homeowners unsure of what the next month will bring.

Before announcing his decision to extend the moratorium to October 1, the number of eviction cases filed rose to new heights. According to reports from the South Florida Sun-Sentinel, landlords in Broward, Palm Beach, and Miami-Dade Counties filed 2,170 eviction cases just in the month of August. When comparing the numbers from previous months, this is much higher than any other month since the moratorium began. With a predicted 749,000 Florida households risking eviction over the next four months, Gov. DeSantis extended the moratorium to last another month.

Experts Warn Of New Foreclosure Crisis In South Florida

With the federal moratorium on evictions and foreclosures set to expire, housing experts are predicting a new foreclosure crisis in South Florida.

The crisis began for many last year as COVID-19 forced thousands of Floridians out of jobs. It was not until April 2020 when the Trump Administration and many states hit the pause on all foreclosure and eviction proceedings on federally backed loans. States and the federal government extended these moratoriums throughout 2020 and into 2021. These extensions allowed individuals to remain in their homes and postpone the foreclosure process.

Federal moratoriums offered through three federal agencies, including the Departments of Housing and Urban Development, Veterans Affairs and Agriculture, and the Federal Housing Finance Agency, which oversees both Fannie Mae and Freddie Mac lending programs, are scheduled to expire finally on July 31.

With foreclosures expected to begin again in the second half of 2021, housing experts fear that the courts will now be flooded with a wave of foreclosure cases that will not only clog the courts but will also depress the real estate market for South Florida.

A similar situation was seen in 2008 where the number of cases hitting the courts led to what experts called rocket dockets or courts pushing for clearing as many cases as possible, leaving homeowners at the short end of the stick.

Please click here to read more.

Don’t Miss: Is My Ira Protected From Bankruptcy