Should I Delay Bankruptcy If I Will Be Incurring New Debt

Since you would only be able to discharge debts that have been included in your bankruptcy petition, it may be in your best interest to delay your filing if you know that you will be incurring new medical debt in the near future. This will help you to ensure that you are not saddled with additional debt after completing the bankruptcy process.

If you are unable to hold off any longer, for whatever reason, it is important to note that you have the option tofile for bankruptcy a second time if necessary. Depending on the chapter that you file under, however, you may be required to wait anywhere from 2 to 8 years before you can file again. That being said, you should not hesitate to weigh your options before filing.

What Does It Mean To Declare Medical Bankruptcy

The phrase medical bankruptcy is a non-legal word for bankruptcy caused by medical debt.

Medical bankruptcy is not covered by any particular chapter of the Bankruptcy Code. However, the phrase medical bankruptcy has gained popularity in recent years due to a rise in the number of people applying for bankruptcy owing to medical debt.

While the actual magnitude of the issue is debatable, there is no question that massive medical expenditures may lead to bankruptcy.

Despite having health insurance, many people have been saddled with medical debt due to expenses not covered by their policys small print. As a result, some people have resorted to bankruptcy as a solution to their financial problems. Individuals may file for Chapter 7 or Chapter 13 bankruptcy relief to get rid of their medical debt.

Chapter 13 Bankruptcy And Medical Bills In Pennsylvania

Unlike Chapter 7, a Chapter 13 bankruptcy case is a repayment plan that lasts three to five years. While this does not sound as attractive as Chapter 7, there are some benefits to paying your debts through bankruptcy. The amount you will be required to pay is based on the type of debt and your disposable income. Some debts, such as mortgage arrears or back taxes, must be paid back in full. However, unsecured debt, including your medical bills, is paid according to your available disposable income. You are not negotiating with creditors in Chapter 13. This means that you could be paying significantly less than what you owe and less than what your creditor would be willing to settle for outside of bankruptcy. Another advantage is that there are no tax consequences on the discharged debt. If you settle your medical bills for a smaller amount outside of a bankruptcy case, you will have to include the forgiven debt as income on your tax returns. If you are considering filing for bankruptcy, our Pennsylvania Chapter 13 bankruptcy attorneys will explain the process and calculate an estimated payment.

Don’t Miss: How Many Times Trump Filed Bankruptcy

Hire A Bankruptcy Attorney

If youre dealing with debt, deciding to file for bankruptcy can be your first step to a fresh start. Whether youre filing Chapter 7 or Chapter 13, the automatic stay can provide temporary relief from harassing phone calls and collection efforts from debt collectors, and youll be able to get your medical bills, along with other unsecured debts, wiped out.

If youre looking for legal assistance to file bankruptcy, call Farmer & Wright, PLLC today to get in touch with experienced bankruptcy attorneys who can discuss your options and help get you out of debt.

Are There Other Options To Repay Medical Debts

If the only debts that you are struggling to pay are medical debts, there could be other options for debt relief. For example, a debt relief company or you could try settling medical debt and getting on a repayment plan with your creditors that is affordable for your income and expenses. You may also be able to negotiate a one-time lump sum payment to satisfy the debt that is lower than the amount you owe. There are also debt consolidation options and other options for repaying medical bills other than filing a Chapter 7 or Chapter 13 bankruptcy case.

You May Like: What Is Epiq Bankruptcy Solutions Llc

Can I Discharge Medical Debt In Bankruptcy

According to research, hundreds of millions of Americans face financial difficulties due to medical costs yearly. Many Americans usually decide to cash in their retirement savings to pay their medical debts. Unfortunately for many, even those savings are never enough to get them out of debt. When medical debts become overwhelming, many Americans choose to file personal bankruptcies.

If you cannot pay medical bills, you might be wondering whether bankruptcy can help you discharge your debt. Filing for bankruptcy allows you to have all or part of your medical debt eliminated, but you cannot limit your bankruptcy case only to medical debts. Bankruptcy laws strive to be as fair as possible to both debtors and creditors. For that reason, once you decide to file for bankruptcy, you will need to list all your debts.

Dischargeable Debts vs. Non-Dischargeable Debts

In bankruptcy, dischargeable debts are those debts that are forgiven and eliminated once a bankruptcy case ends and your Discharge Order is entered. On the other hand, non-dischargeable debts are those debts that cannot be eliminated in bankruptcy. Debtors generally remain responsible for any non-dischargeable debts. Examples of non-dischargeable debts include tax debts, alimony payments, federally guaranteed student loans, and child support payments.

Child support payments, tax debts, and alimony payments are considered priority unsecured debts, and that is why they are treated differently in a bankruptcy case.

Resource:

What Type Of Debt Is Medical Debt

In a bankruptcy case, all of your debts are put in one of three categories:

-

Secured debt: The type of debt is backed by property. The most common secured debts are car loans.

-

Unsecured debt: This type of debt is not connected to a specific piece of property. Unsecured debt includes credit card debt, personal loans, student loans, etc.

-

Priority debt: Unsecured debt that gets special treatment under the Bankruptcy Code. Examples include tax debts, child support, and alimony.

Medical debt is unsecured debt.

Read Also: Kentuckydebtrelief.org Reviews

Debt Relief Alternatives To Bankruptcy

Bankruptcy has serious consequences. A Chapter 7 bankruptcy will remain on your for 10 years, and a Chapter 13 will remain for seven years. That can make it more expensive or even impossible to borrow money in the future, such as for a mortgage or car loan, or to obtain a credit card. It can also affect your insurance rates.

So itâs worth exploring other types of debt relief before filing for bankruptcy. Debt relief typically involves negotiating with your creditors to make your debts more manageable, such as reducing the interest rates, canceling some portion of the debt, or giving you longer to repay. Debt relief often works to the creditorâs advantage, too, as they are likely to get more money out of the arrangement than if you were to declare bankruptcy.

You can negotiate on your own or hire a reputable debt relief company to help you. As with , there are scam artists who pose as debt relief experts, so be sure to check out any company that youâre considering. Investopedia publishes a regularly updated list of the best debt relief companies.

Is Bankruptcy The Best Option To Eliminate Your Medical Debt

Although the idea of getting rid of all your medical debt may be tempting, you need to consider carefully if filing for one is your best option at the moment.

Do you think youll most likely experience financial hardship in the future? If yes, then bankruptcy might not be a good solution. Take Chapter 7 bankruptcy for example. If you get a discharge, youll have to wait for eight years before you can get another. It means youll have to deal with all your debt if you face financial distress during that period.

If you dont have any property or only have income or assets that fall under exempted assets, creditors cannot garnish your wage or seize your belongings. You dont need to file for bankruptcy if thats the case.

If your financial hardship is temporary, check if you can wait out the statute of limitations in your state. Once it expires, creditors can no longer force you to pay the debt. However, if you choose this route, the outstanding debt will negatively affect your credit report.

Read Also: How To Become A Bankruptcy Petition Preparer

Can A Debtor Receive A Second Discharge In A Later Chapter 7 Case

The court will deny a discharge in a later chapter 7 case if the debtor received a discharge under chapter 7 or chapter 11 in a case filed within eight years before the second petition is filed. The court will also deny a chapter 7 discharge if the debtor previously received a discharge in a chapter 12 or chapter 13 case filed within six years before the date of the filing of the second case unless the debtor paid all “allowed unsecured” claims in the earlier case in full, or the debtor made payments under the plan in the earlier case totaling at least 70 percent of the allowed unsecured claims and the debtor’s plan was proposed in good faith and the payments represented the debtor’s best effort. A debtor is ineligible for discharge under chapter 13 if he or she received a prior discharge in a chapter 7, 11, or 12 case filed four years before the current case or in a chapter 13 case filed two years before the current case.

Medical Debt Is Dischargeable Through Bankruptcy

There is no bankruptcy process focused solely on medical debt. While people will file for bankruptcy because of their medical debt, they are not filing a medical bankruptcy. Most people will file either a Chapter 7 or Chapter 13 case. The differences of each will be discussed shortly. However, it is important to understand what medical debt is.

When you file for bankruptcy, you must include all your debt. The type of debt you have is one factor in determining whether it could be discharged. Some debt, such as mortgages or car loans, are secured debt. If you want to discharge those types of debt, you will likely lose the property. Other types of debt, including certain taxes, alimony, and child support, cannot be discharged through bankruptcy. Most other kinds of debt, such as credit card bills and personal loans, are considered unsecured and are dischargeable. Medical debt, including hospital bills, medication expenses, and other costs, is unsecured debt and, therefore, dischargeable. When you meet with one of our Pennsylvania bankruptcy lawyers, we will thoroughly review the type of debt you owe.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

Medical Debt In A Chapter 13 Bankruptcy

Some people prefer a Chapter 13 bankruptcy, also called a “reorganization.” Ohio and Kentucky debtors are eligible for a Chapter 13 if their total unsecured debts, including medical debt, are not more than $360,470.

In a Chapter 13 bankruptcy, you present a plan to pay off your creditors as much as you can in three to five years. It is ideal for people who are overwhelmed with indebtedness but are still making an income, want to avoid liquidation and may be able to pay off some or all debts. The creditors must receive at least as much as they would receive under any other form of bankruptcy.

Medical bills alone can easily exceed $360,000, but your circumstances may allow for a Chapter 13 bankruptcy. Your bankruptcy lawyer can review your situation and help you make that determination.

Lawyer To Help You Discharge Medical Bills In Bankruptcy

Wondering what to do about medical debt? Youve probably heard that medical bills are the kind of unsecured debt that can be discharged in a bankruptcy case. This is true. However, there are three important considerations to keep in mind when deciding to file a bankruptcy case to discharge medical debt.

The point of filing bankruptcy is to get a fresh start. What kind of fresh start has you searching for new medical providers, or dealing with post-petition debts that are not discharged, or having a lien placed on your house that you must satisfy if you sell or refinance?

Medical bankruptcies are very common, unfortunately. And if you have medical debt due to COVID-19, there are additional considerations. If you are dealing with medical debt you cannot pay, contact us to schedule a consultation with a bankruptcy attorney. We will help you time your bankruptcy filing to get the maximum amount of medical debt discharged even if you need to file bankruptcy with no money.

Using careful strategy and forethought to plan the timing of your filing will get the best result possible for you. We have been able to save people tens of thousands of dollars with proper planning, that would otherwise been owed to medical providers.

Don’t Miss: How To File Bankruptcy In Wisconsin

May The Debtor Pay A Discharged Debt After The Bankruptcy Case Has Been Concluded

A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtor’s reputation is important, such as a family doctor.

How To Clear Medical Debt

Medical bills qualify as unsecured debts, which can be discharged in bankruptcy. Discharging debt through bankruptcy offers a number of immediate and long-term benefits. When you file for bankruptcy, the automatic stay begins and forces your creditors to halt any attempts to collect these debts. Garnishments, lawsuits, and harassing collection attempts must stop once you file for bankruptcy.

Read Also: How Many Bankruptcies Has Donald Trump Filed

Can You Declare Bankruptcy On Medical Bills

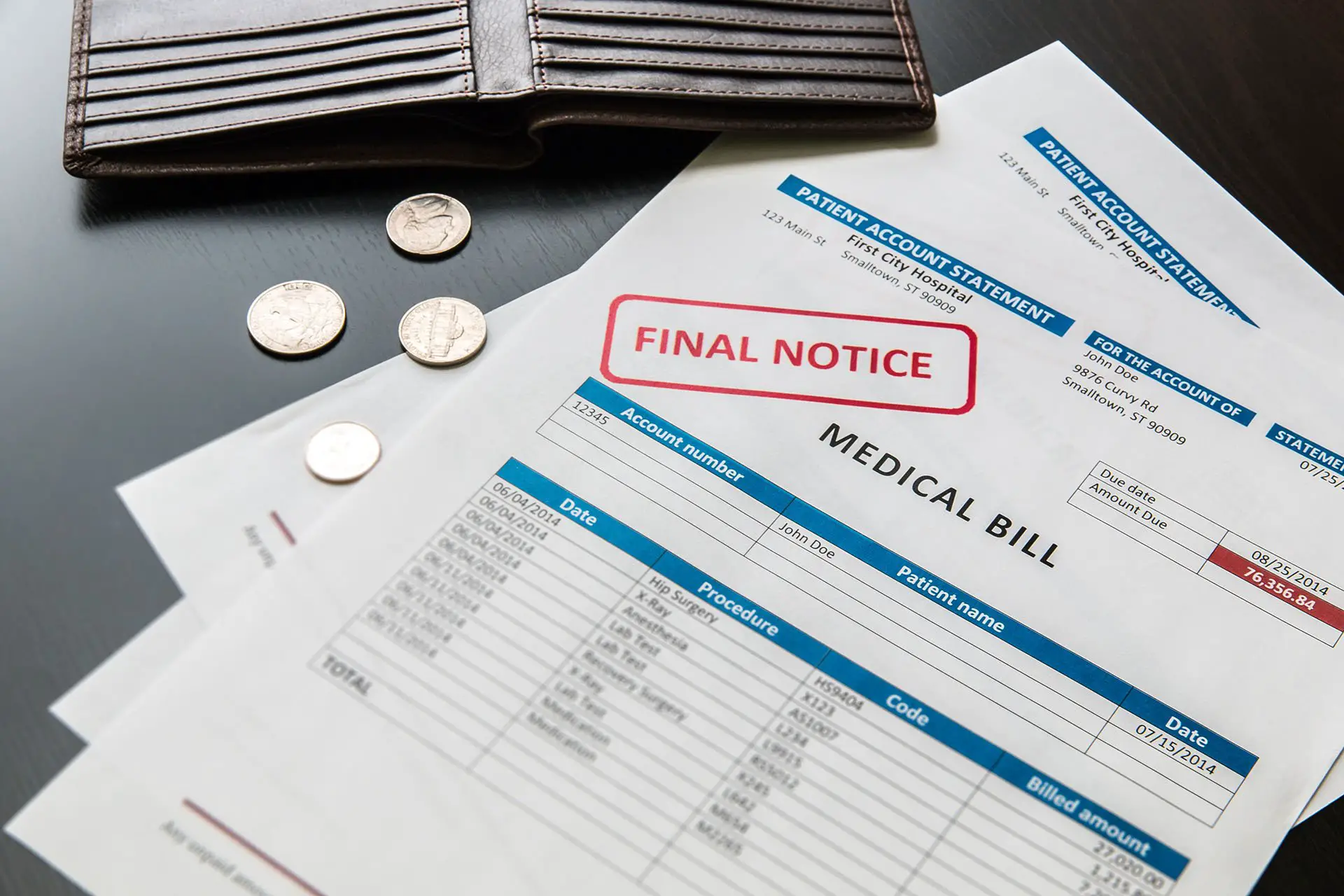

When you need medical treatment, bills may be your last concernand understandably so. Wellness is your first priority when your health is at stake. But medical bills can cause their own kind of injury, specifically aimed at your financial well-being.

If you’re overwhelmed with medical bills and don’t know how you’ll pay them, you may wonder if declaring bankruptcy on your medical debt is a possibility. Technically, it isbut not as a standalone option. There is no such thing as medical bankruptcy, but medical debt is dischargeable through regular bankruptcy proceedings.

Medical Debt Is Dischargeable In Bankruptcy

Fortunately, that debt is dischargeable in both a Chapter 7 straight bankruptcy and a Chapter 13 repayment plan. You may have to qualify for a Chapter 7 case under the means test, which is a calculation using your income and expenses to determine if you can afford to make payments. If you dont pass the means test, you can file a Chapter 13 case and pay some of your debt over three to five years.

Don’t Miss: Has Mark Cuban Ever Filed For Bankruptcy

The Best Way To Free Yourself From Medical Debt

If you have a large load of burdensome medical debt, talk to an Indiana bankruptcy lawyer about using bankruptcy to eliminate your medical bills. Your lawyer can help you address any concerns and prevent mistakes that could interfere with erasing your debt.

At Sawin & Shea, we have decades of experience helping Indiana people clear out medical debt through bankruptcy. Whether you have old bills that just wont go away or new bills from a recent health crisis, contact us as soon as possible.

Kansas City Attorney Explains How Bankruptcy Can Help With Medical Debt

Medical debt is a common problem. The rise of healthcare costs is creating serious financial troubles for people everywhere. Even the most financially prudent find their households turned upside down by the unexpected expense of a medical emergency or the onset of a serious illness.

Dont allow the perceived stigma of bankruptcy to prevent you from educating yourself on the bankruptcy process. In our experience, when prospective clients learn about options for their debts , that information can bring a great sense of relief. With over 30 years of experience, Neil Sader and the attorneys at The Sader Law Firm certainly understand the toll medical debt can take on your life and want to help alleviate your financial stress as soon as possible.

You May Like: Can You Rent An Apartment After Filing For Bankruptcy

Can Bankruptcy Help With Medical Bills In Pennsylvania

There are many reasons why people file for bankruptcy, including job loss, separation, or divorce. However, one of the most common ones is medical bills. The statistics surrounding medical debt are frightening. Every year, approximately 530,000 Americans will file for bankruptcy because of medical bills and indebtedness. On average, 65% of all bankruptcies stem from medical debt. Fortunately, medical debt is unsecured and is dischargeable through bankruptcy.

Healthcare is expensive. One medical issue could drive you and your family into a financial spiral. Some people will ignore medical debt, while others will incur other debt to pay their medical expenses. However, you have other choices. Bankruptcy is a federal legal process that provides relief from debt including medical bills and expenses.

You might know something about bankruptcy, but it is unlikely you understand all the potential benefits. At Young, Marr & Associates, our Philadelphia bankruptcy lawyers provide professional legal representation and guidance for those facing economic hardship. Call 701-6519 in Pennsylvania or 755-3115 in New Jersey to discuss your options in dealing with your medical debt.

Also Check: What Is Better Bankruptcy Or Debt Consolidation

Discharge Medical Debt Today Call

Bankruptcy is a powerful means of relieving the pressure caused by medical debts and an experienced lawyer can help you take action against them. Our lawyers at Jackson & Oglesby Law LLC help clients obtain a fresh financial start by filing either aChapter 7 orChapter 13.

Our law firm is fully prepared to guide you through the legal process. We can help you evaluate your debts and advise you on the best actions for your situation.

If medical bills have resulted in your assumed imminent financial ruin, please take the time to speak with our firm. We can provide you with the legal counsel you need.

Contact our firm today to find out how Jackson & Oglesby Law LLC can solve your debt problem!

- 6520 E. 82nd St. Suite 101Indianapolis, IN46250

- 48 N. Emerson Ave., Suite 300Greenwood, IN46143

- 1106 Meridian St, Suite 459Anderson, IN46016

- 5550 Lafayette Rd, Suite 400Indianapolis, IN46254

- 225 N. High Street, Suite 2CMuncie, IN47305

Also Check: How Many Times Did Donald Trump File For Bankruptcy