Kinds Of Foreclosed Homes In Warren Oh

BankForeclosuresSale.com offers different kinds of houses for sale in Warren, OH. In our listings you find Warren bank owned properties, repo homes, government foreclosed houses, preforeclosures, home auctions, short sales, VA foreclosures, Freddie Mac Homes, Fannie Mae homes and HUD foreclosures in Warren, OH. All Warren REO homes for sale offer excellent foreclosure deals.

How To Find The Best Foreclosure Deals

- Get a comparative market analysis . A CMA will give you an estimate of a homes market value, which will help you make a competitive offer. Your agent should be able to supply you with a CMA.

- Conduct a title search and inspection . Although foreclosures are almost always listed as is, sometimes you can order an inspection and a title search. This could save you from buying a home with expensive problems.

- Tour the home . Most lenders and banks will let you look at REO properties in person. But this probably wont be possible with auctioned homes.

Who Should Buy A Foreclosed Home

People who are willing to do significant research before making an offer, and who are willing to deal with lengthy delays and onerous paperwork, could find this a good strategy.

It very much helps to be able to pay significant cash on short notice for repairs, overdue taxes, and liens.

Eligibility for one of the federal financing programs such as a 203 loan, HomePath ReadyBuyer, or a HomeSteps mortgage, is a plus. These programs were created to help you buy a home.

Failing that, an all-cash offer, if possible, can give you a leg up.

Also Check: Filing Bankruptcy On Car Loans

Conduct A Title Search

Prior to foreclosure, the owner of a house may have taken out a second mortgage or a home equity line of credit forms of credit that use the house as collateral. If the primary mortgage lender forecloses, the lenders that issued those secondary loans may still have liens on the propertythat is, the right to collect what they’re owed when the house is sold. Liens attach to a property, not owners, so if liens are attached to the foreclosed home you buy, you may have to clear those lienspay off the previous owner’s debtsbefore you can sell the property. Undetected liens are hidden costs that can significantly undercut any bargain you get by purchasing a foreclosure.

A title search is a professional investigation that identifies liens, unpaid taxes and legal judgments that may be connected to a property expect to pay a few hundred dollars for the service. Conducting a title search on a foreclosed property you want to bid on an auction can save you big if it alerts you to a lien.

Search For Warren Bank Owned Homes & Government Foreclosed Homes

Get instant access to the most accurate database of Warren bank owned homes and Warren government foreclosed properties for sale. Bank Foreclosures Sale offers America’s most reliable and up-to-date listings of bank foreclosures in Warren, Ohio. Try our lists of cheap Warren foreclosure homes now!

Information on: Warren foreclosed homes, HUD homes, VA repo homes, pre foreclosures, single and multi-family houses, apartments, condos, tax lien foreclosures, federal homes, bank owned properties, government tax liens, Warren foreclosures and more!

You May Like: Overstock Boxes For Sale

Communicate With Your Lender

If you know that you are going to have trouble making your mortgage payments, contact your lender immediately and let them know you are having financial difficulties. This allows your lender time to work with you to create a plan. Remember, do not stop paying your bills, and do not wait until you cannot make payments before you act. Learn how to talk to your lender about trouble making payments.

Government Agencies And Other Options

Some government agencies require you to retain the services of a real estate broker to make an offer to purchase. Others will let you submit offers on your own.

- The U.S. Department of Housing and Urban Development provides a list of its foreclosure homes.

- The Federal National Mortgage Association lists foreclosure homes through its HomePath website.

- Department of the Treasury lists homes seized by the Internal Revenue Service.

Private-sector sources also are available to find foreclosure homes.

Don’t Miss: Can You Get A Loan After Bankruptcy

Find A Knowledgeable Foreclosure Agent

If you’re thinking about buying a foreclosed home, choose your real estate agent carefully.

“An agent who knows how the process of buying a foreclosed property works will be very helpful,” says Santosh Bhatt, a broker at Greater Louisville Homes in Kentucky. “Understanding the process allows the agent to manage buyer expectations. An agent with a lack of foreclosure experience can make the transaction a bit challenging.”

Look for agents in areas with high foreclosure rates or ask your lender if they partner with any REO agents. It can also be helpful to search for agents with Short Sales and Foreclosure Resource or Certified Distressed Property Expert certifications.

Foreclosed Homes For Sale Residential Lakewide

Purchasing a foreclosed home at the Lake of the Ozarks can be a great decision for many people. Regardless of whether your interest in Lake Ozark foreclosures is to save money on a primary residence, for use as a vacation or retirement home, or as an investment property, our listings below are a great place to start for your property search.

Lake Ozark Foreclosures can be a great way to save thousands on the cost of your next home. At Lake Ozark Realty, we will help you along every step of the way during your Lake Ozark Foreclosure real estate purchase. As a locally owned, professional real estate company, we provide a positive and easy real estate experience. Whether you are looking for a foreclosed waterfront home, foreclosed condo, or foreclosed home for sale in Lake Ozark, our site allows you to locate all properties in the simplest and fastest way possible

- Browse our of selection of Featured Foreclosed Homes for Sale below.

- Click on our Property Search to find the foreclosed properties that are within certain Lake Ozark school districts, nearby shopping, in a specific subdivision and more. This feature allows you to search by area, city, zip code, MLS number, subdivision and more!

Also Check: Dti For Home Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

If youre wondering how to buy a foreclosed home, consider this your primer.

Rights Of Tenants During A Foreclosure

If there are tenants in the house that was foreclosed on, the new owner must honor the existing lease. BUT when the tenants have a month-to-month lease or the owner/landlord also lives in the home that is being foreclosed on, the new owner can evict the tenants or former owner/landlord. In these cases, the new owner may either offer the existing tenants a new lease or rental agreement or begin eviction proceedings. If the new owner chooses to evict existing tenants , the new owner must give the tenants at least 90 days notice before starting eviction proceedings.

- There are other rights that tenants have in eviction cases done after a foreclosure. If a tenant is not named in the complaint for the eviction, he or she may be able to challenge the eviction at any time during the case or even after the judgment for eviction is made. If you are an occupant of a foreclosed property where the new owner filed an eviction case, talk to a lawyer or call the Tenant Foreclosure Hotline at 1-888-495-8020 to learn about your rights.

Tenants in some California cities may still have a right to stay in their buildings. Cities with eviction or rent control laws prohibit new owners from using foreclosure as a reason for evicting tenants.

Help for tenants during a foreclosure

Also Check: When Does Bankruptcy Come Off Credit

It’s So Simple To Find The Best Real Estate Deals In Your Area With Foreclosurecom: It’s One Easy Search

And that search can be performed at the state, county and city levels even the exact address and/or zip code so that your house hunt hits the ground running. Once you start digging into the incredible foreclosure deals, each listing will be complete with asking price, exact location, number of beds / baths, property type , available photos, tax roll information, helpful neighborhood / school district details and so much more. Indeed, we provide as much information as possible so that you can make the most informed decision possible.

The Types Of Foreclosure Sale

Finding a foreclosed home depends on where exactly it is in the foreclosure process. Properties in the early stages of foreclosure or offered in a short sale may still be owned by the original homeowner or held by a bank or government.

Here are five types of foreclosure and the approaches to buying:

Recommended Reading: How Many Years Does A Bankruptcy Stay On Your Credit

Some Evidence On The Size Of The Impact

How much of a discount do foreclosed and nearby properties sell for? John Campbell, Stefano Giglio, and Parag Pathak studied home prices in Massachusetts and estimated that foreclosure-related sales have prices about 27 percent lower than comparable properties. They also estimated that each foreclosure lowered the selling price of other properties within a radius of about 260 feet by nearly 1 percent.

In one of the first studies to examine the link between foreclosures and home prices, Dan Immergluck and Geoff Smith found something similar: their data showed that each foreclosure depressed the value of homes within 660 feet by 0.9 percent. Looking at home prices in New York City from 2000 to 2005, Jenny Schuetz, Vicki Been, and Ingrid Gould Ellen measured a somewhat smaller discount.

While a 1 percent drop in housing prices may not seem terribly large, it can become hefty, since this effect increases with the number of foreclosures. If there were five foreclosures in the same vicinity, for instance, the discount would be around 5 percent.

The foreclosure process may vary significantly across states and even across counties, but the following description is general enough that it should be applicable to most of the United States.

Risks Of Buying A Foreclosed Home

Don’t let an appealing price tag lead you into home-buying mistakes. There are serious risks involved.

- Expensive repairs: “Most experienced agents will not take first-time homebuyers to foreclosed properties since, often, they are in rough shape and could become money pits,” says Bhatt. Count all the costs before you close a deal.

- A drawn-out buying process: Because you’re dealing directly with a bank, there can be more red tape involved.

- Steep competition: If home prices continue soaring in 2021, foreclosures may become a popular way for buyers to find a deal, leading to increased buyer competition and higher prices.

- Redemption periods: Most states offer a period of redemption after a foreclosure sale. During this period, the original homeowner could still catch up on payments and earn their home back — even after you’ve moved into the house. Redemption periods can range from 30 days to a year, so be sure to check your state’s laws before you buy a foreclosure.

- Squatters: If a property has been abandoned for a while, squatters may be living there. And if they’ve been there for an extended time, you might run into problems. All states have laws that grant squatters rights of adverse possession after a certain period of time meaning the property legally becomes theirs. In some states, this window is as short as five years, but it’s usually longer. Make sure you assess your property thoroughly to avoid any potential squatter disputes.

Also Check: How Soon After Bankruptcy Can You Apply For Credit

The Impact Of Foreclosures On The Housing Market

A record number of mortgage loans are either in default or in danger of being defaulted upon. Many of the properties that back these loans will end up going through the foreclosure process. A growing body of research shows that foreclosed homes sell at a discount and that foreclosures have a negative impact on the value of other homes that are nearby. The effect on nearby property values happens for two different reasons, but my recent work suggests that one or the other predominates depending on certain characteristics of the neighborhood where the foreclosures are occurring. This finding implies that different approaches might be required to mitigate the negative effects of foreclosures in different neighborhoods.

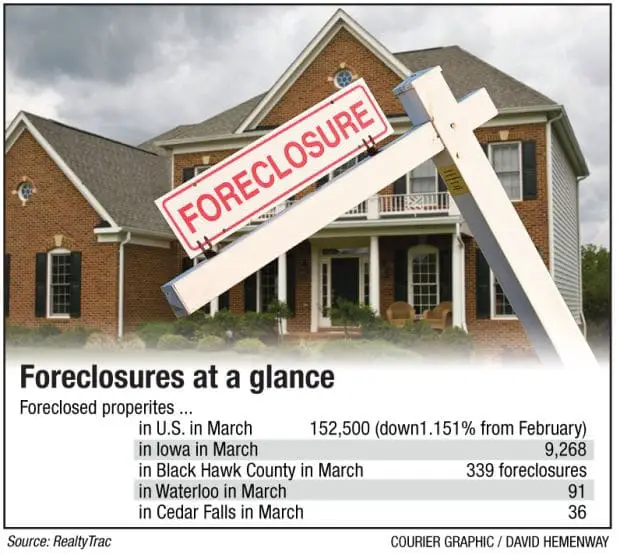

About 2 million homes are somewhere in the midst of the foreclosure process, according to RealtyTrac. Most of these have yet to go on the auction block, and nearly a fourth are owned by the lenders who provided or purchased the homes mortgages. More foreclosures are comingaccording to the Mortgage Bankers Association, the number of mortgages in foreclosure or more than 90 days delinquent is at a record high of about 4.2 million.

Additional Ways To Find Pre

A big part of how you make your money as a real estate investor is your ability to bring in leads. So its vital to get creative and develop your own unique strategy for finding pre-foreclosures and other potential properties. An additional way you can locate pre-foreclosure properties is to network with other real estate professionals in your area.

Aside from wholesalers, real estate agents, attorneys, and mortgage brokers can be a good resource for finding homes in the process of pre-foreclosure. Even just mentioning your real estate business to friends and colleagues in your personal network can be a good way to hear about preforeclosure properties before they are listed online.

Plus, local newspapers are another good resource you can use to locate properties in the process of pre-foreclosure. Lis Pendens or notice of foreclosure are often published in the legal section of the local newspaper. The best way to find the best deal possible is to develop a few different lead pipelines and keep your eyes and ears open for any opportunities that come your way.

Recommended Reading: How To Get A Loan After Bankruptcy Discharge

Foreclosurecom Delivers The Best Real Estate Deals First Well Before They Hit The Mass Market

As you know, perfect timing not just “location, location, location” is critical when it comes to purchasing a new home and/or investment property at the right price. That’s because competition drives prices up. At Foreclosure.com, we target low-priced distressed deals bank-owned homes, government foreclosures preforeclosure listings, real estate owned properties and foreclosure auctions, among others and pass them onto smart homebuyers .

Schedule A Property Inspection

This should be standard procedure with any home purchase, but it’s particularly important with a foreclosure because. Unlike a traditional home sale, the seller of a foreclosed home is not required to disclose material defects in the property when offering it for sale. Knowing about potentially hidden issues with the property so you can plan to address them before taking occupancy.

Read Also: Find All My Debts

Where To Find Foreclosed Houses

The following resources can help you find foreclosed properties for purchase. Real estate professionals in your area may know of additional resources.

- Bank websites. Many bank websites provide lists of REO properties for sale.

- The U.S. Department of Housing and Urban Development lists homes available for purchase from government agencies, including many foreclosures.

- You can search for foreclosure properties on web-based real estate listing services such as RealtyTrac and Zillow.

- Multiple listing services list foreclosure properties. These services are available by prescription to licensed real estate professionals. A real estate agent or mortgage broker can use MLS to access foreclosures in your area.

Find A Good Real Estate Agent

Local real estate agents are experts in finding foreclosures without paying a fee. And you can find an agent who has previous experience buying foreclosures.

Real estate agents are often tuned into their local markets. They can point you to areas where foreclosures are happening. They can also network with other realtors, banks, and lenders to know about foreclosures before theyre listed publicly for sale.

You also wont pay agent commissions to an agent. The seller will be responsible for that payment, which can save you money. Many foreclosure websites, like Foreclosure.com and RealtyTrac, charge a subscription fee.

Ready to get started on your home buying journey?

You May Like: Can You File Bankruptcy On Utility Bills

Buying A Foreclosed Home: Where To Search How To Buy And What To Watch Out For

The deals are real, but there are risks involved.

Luke Daugherty

Luke Daugherty is a freelance writer, editor and former operations manager. His work covers operations, marketing, sustainable business and personal finance, as well as many of his personal passions, including coffee, music and social issues.

If you’re searching for a house to buy — and you’re looking for a deal — a foreclosure may be an enticing option. Foreclosed properties, which have been taken back by a lender after the homeowners defaulted on their loan, usually sell for significantly less than similar homes on the traditional market.

The lower price tag has a few strings attached, though. Buying any house can be complicated — and a foreclosed house especially so, with its own unique set of risks and challenges. Learn more about how to buy a foreclosed home to decide if it’s a good option for you.