Whats The Difference Between Chapter 13 And Chapter 7 Bankruptcy

Generally, Chapter 13 lets people with a steady income keep property, like a mortgaged house or a car, which they might otherwise lose through the bankruptcy process. In Chapter 13, the court approves a repayment plan that lets you pay off some of your debts in three to five years, rather than give up any property. After you make all the payments under the plan, the court discharges your debt so you dont owe anything else.

Chapter 7 is known as straight bankruptcy. In general, Chapter 7 involves liquidating all of your assets that arent exempt. Exempt assets might include cars, work-related tools, and basic household furnishings. Some of your property may be sold by a court-appointed official, called a trustee, or turned over to your creditors.

You Can Get A Free Copy Of Your Consumer Credit Report Every Three Months Or More Frequently In Certain Circumstances

Your credit report is held by credit reporting agencies. There are three separate credit reporting agencies: Equifax, Illion and Experian. You are entitled to get a free copy of your credit report, which will include your credit score, once every three months from each of these credit reporting agencies. You can also request a free credit report, if your application for credit was declined in the past 90 days.

Your credit score is calculated based on what is in your credit report for example, the amount of money youve borrowed, the number of credit applications youve made, whether you pay on time and so on.

Its worth getting a copy of your free credit report at least once a year to check it is correct. The credit score calculated by the credit reporting agency will also be shown in the report.

This page explains how you can access your credit report, the difference between a free and a paid report and how to check your report. It also warns about scams and how to avoid them.

At the bottom of this page we also explain what information can be kept on your credit report, who can add this information, how long this information will stay, what to do if you have been a victim of fraud, recording of financial hardship arrangements, and information about credit scores and ratings.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Recommended Reading: How Often Can You File For Bankruptcy In California

Check Your Bank Account Statements

Given that most debt repayments are taken directly from your bank account via Direct Debit, standing order or using your debit card, checking your statement is a good step to take.

If you use online banking or have copies of old statements you can check these, or ask your bank for help although they may charge for copies of older statements.

A good place to search is the list of cancelled Direct Debits, as this might contain useful information.

Check The Information On Your Credit Report

Review your credit report and if you find information on it that you think is wrong, you have a right to ask the credit reporting agency or the credit provider to fix it for free.

- If theres a simple error, continue to Step 03 to fix it

- If youre finding it difficult to identify whats wrong, continue to Step 04 to contact a financial counsellor for help

Some things to look out for that could impact your credit health:

- Defaults: these are listed against credit accounts where you have been issued with a Default Notice by the creditor for payments over $150 which are more than 60 days overdue .

- Current credit accounts: details of your current credit accounts, such as loans and utility accounts.

- Repayment History Information: details of whether you have made repayments on time .

Also check that all the personal information listed on your report is correct.

Don’t Miss: How Do You File For Bankruptcy In Massachusetts

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

How Can I Find A Credit Counselor I Can Trust

Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone. If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through

Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor.

You May Like: Does A Bankruptcy Clear An Eviction

Go Through Your Mail In Search Of Old Bills

Its almost second nature to kick mails aside to tackle more important concerns of daily life. The funny thing is that every now and then, bills come in those mails. By neglecting those mails, we end up inadvertently ignoring the bills. Looking through the pile of mails will usually reveal those long-neglected debts.

Finding all your debts is a useful activity because when youre aware of what you owe, you can work towards clearing the debts. Debts are harmful to your credit. Utilize these tips to uncover all that you owe, then double your efforts on clearing them!

What Debt Wont Be Erased By Filing For Personal Bankruptcy

Filing for personal bankruptcy usually wont erase child support, alimony, fines, taxes, and most student loan obligations, unless you can prove undue hardship. And, unless you have an acceptable plan to catch up on your debt under Chapter 13, bankruptcy usually doesnt let you keep property when your creditor has a lien or financial interest in it.

Also Check: Declaring Bankruptcy Chapter 13

What Are The Main Types Of Personal Bankruptcy

The two main types of personal bankruptcy are Chapter 13 and Chapter 7. You must file for them in federal bankruptcy court. Filing fees are several hundred dollars, and attorney fees are extra. For more information, visit the United States Courts.

Both types of bankruptcy may discharge and get rid of unsecured debts like credit card or medical debt, and stop foreclosures, repossessions, garnishments, and utility shut-offs, as well as debt collection activities. They also give exemptions that let you keep certain assets, though how much is exempt depends on your state.

Check Emails And Letters From Creditors

You should also check any letters or emails you have, to see if they have important information about what you owe.

If youve changed address and didnt update your creditors, you could try and find out whether any mail went to your previous address by asking the new occupiers, landlord or agency, or providing them with a forwarding address if possible.

Also Check: Declare Bankruptcy What Happens

What Happens After Seven Years Of Not Paying Debt

If you are counting on getting your debt resolved simply by not paying for seven years, then you may be in for a rude awakening. The debt typically does not go away until the creditor has either sued you and won, or they have written it off as bad debt. All of these actions could have a large, negative impact on your credit score, which could affect your ability to qualify for future loans, credit cards, and large purchases.

Prioritizing Paying Your Debt

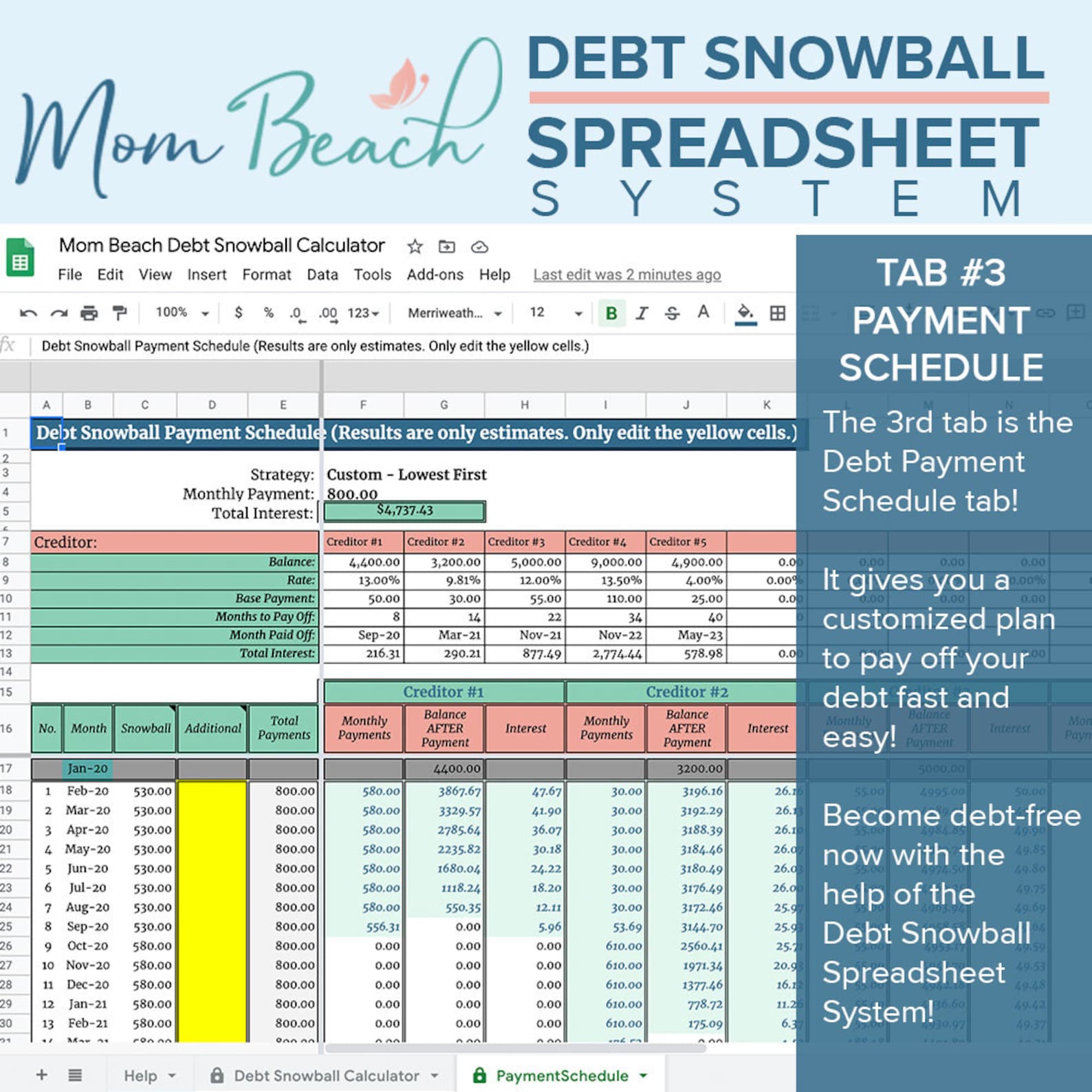

| SNOWBALL METHOD: LOWEST BALANCE FIRST | STANDARD METHOD: HIGHEST APR FIRST | |

| HOW IT WORKS | Pay the minimum on all cards, but pay more on the card with the lowest balance. Once you pay off the first card, repeat with the next-lowest balance. | Pay the minimum on all cards, but pay more on the card with the highest interest. Once you pay off the first card, repeat with the next-highest-APR card. |

| WHY IT WORKS | This is all about psychology and small wins. Once you pay off the first card, youre more motivated to pay off the next one. | Mathematically, you want to pay off the credit card thats costing you the most first. |

This is a source of fierce debate in credit card circles. Technically, the snowball method isnt necessarily the most efficient approach, because the card with the lowest balance doesnt necessarily have the highest APR. But on a psychological level, its enormously rewarding to see one credit card paid off, which in turn can motivate you to pay off others more quickly.

Bottom line: Dont spend more than five minutes deciding. Just pick one method and do it. The goal is not to optimize your payoff method, but to get started paying off your debt.

Ive saved over $3,000and paid offover$3,000 in credit carddebt. The ideaofsnowballing paymentsfrom the smallest cardto the largest had thegreatest impact on mymentalitytowardpaying off the debt.

SEAN STEWART, 31

Read Also: How To Boost Credit After Bankruptcy

How To Find Out What Collection Agency Owns Your Debt

George Simons | July 21, 2022

Summary: Are you trying to track down who owns one of your old debts? Are you worried that a shady debt collector is lying about owning the debt? Here’s how to find out what collection agency owns your debt.

If you have been unable to pay your debt, the creditor may decide to sell off the debt to a collection agency. Other than selling the debt, they may choose to assign it to a third-party debt collector or collection attorney but still retain ownership of the debt account.

This is because they don’t want to go through the hassle of collecting the debt from you. Chances are they tried contacting you for some time to repay the debt, finally gave up, and sold the debt to a collection agency.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Don’t Miss: Liquidation Pallets For Sale Online

How To Find All Your Debts

You could be unaware of your existing debts

There are some debts you might not be aware of.

As odd as it might sound, you could be indebted to certain persons and be entirely unaware of it. Mails sent to you to communicate the debt could go missing, while other bills could be misplaced. Worse even, due to identity theft and credit fraud, an account opened in your name could have been used to rack up a lot of debt – all without your knowledge.

In fact, youre never certain as to how much you owe without a bit of digging.

So this post discusses different ways through which you can identify the various debts that you owe.

Not All Debt Is Bad Debt

You may have heard some debt described as good. And its true. Some debts have the potential to increase your net worth or generate income, such as student loans, a mortgage on your home, or the costs of starting a business. But other debts, such as spending above your means or borrowing money for non-essential items, are considered bad debts.

Its important to evaluate your financial wellbeing and structure your assets and debts appropriately, to ensure youre getting the most benefit. For instance, there can be tax benefits from certain good debts like business or investment lending. Unfortunately its quite common for people to accidentally disadvantage themselves by having debt on the wrong asset or focussing on the wrong debt to repay first according to Rebecca Hurford, Senior Financial Advisor at ANZ.

What category does your debt fall under? Make a list of what you owe including bank or student loans, credit card balances and buy-now-pay-later accounts. Label them good or bad and then well make a plan to pay them off.

Recommended Reading: How To Handle Debt In Collections

Debt And Debt Collectors

Debt is money that is owed to another person or organisation through an agreed contract, whether written or spoken.

A person or organisation in debt, owing money, is known as a debtor. The person or organisation owed money is known as a .

Both debtors and creditors have legal rights.

Quick Answers Video: Debt and debt collection

If you cannot repay a debt by an agreed date, it is important to seek advice and take action as soon as possible. There are free financial counselling services that can help in dealing with debt. Unpaid debt may result in a creditor seizing assets or taking a debtor to court in order to recover costs.

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

Read Also: What Is Us Debt

There’s ‘no Set Rule’ On How Long It Takes For Your Debt To Go To Collections

Six months is the general guideline, but according to Eweka there is “no set rule” on how many times you’ll get a phone call or letter before your debt is turned over to an agency.

“Sometimes, companies use collection agencies to service their debt collection process from the beginning, and other times it can take a longer amount of time,” says Eweka.

Check your at least once a year to reduce any surprise calls from collections, Eweka says. “Sometimes people do not even realize they have some of their debts.”

The three major credit bureaus are offering free weekly credit reports for the next year. They are available on AnnualCreditReport.com through April 2021.

Dont Worry Heres What To Do

There are several debt solutions in the UK that can be used to improve your finances. Choosing the right way to tackle your debt could save you time and money, but the wrong one could cause even more harm.

Its always best to find out about all your options from a professional before you take action.Fill out the 5 step form to get started.

struggling with debt

Read Also: Debt Consolidation Loan For Bad Credit

You May Like: How To Check If A Bankruptcy Has Been Discharged

Checking Emails Documents And Letters

If youve gone through your credit report but still feel that you dont have complete information about all of your debts, the next thing you should look at is your correspondence with your creditors.

This could be in the form of emails or letters. Going through these old letters and emails can help you get an idea of what debts you have and can also remind you about any debts which you may have forgotten about.

If youve recently moved and have stopped receiving updates from your creditors, you can try and find out whether theyve been sending letters to your previous address. You can do this by contacting the new occupants or the landlord.

If you do indeed find letters from your creditors at your old address, you should leave a forwarding address for future letters and also inform your creditors as soon as possible.

Request Your Free Credit Reports

Your credit reports are a perfect starting point for figuring out how much you owe and who you owe it to. This is especially true for old debts you havenât thought about in a while. Your credit report lists your personal information like your name and Social Security number along with your credit history for any credit card, loan, or other credit accounts you have.

Every year, you can request a free copy of your credit report from each of the three credit bureaus: TransUnion, Equifax, and Experian. The easiest way to do this is to go to AnnualCreditReport.com. You can also call 322-8228 to request a copy of your credit report over the phone.

When you get a copy of your credit history, you should make a list of all the collection agencies listed on it. Most debt collectors will report what you owe to one or more of the credit bureaus. You can use these lists to create your own list of debts.

Also Check: What Debt To Income Ratio Needed For Mortgage

What If Im Having Trouble Paying My Car Loan

Most car financing agreements say a lender can repossess your car any time youre in default and not making your car payments. They dont have to give you any notice. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. If you cant, the lender might sell the car.

If you know youre not going to be able to keep up with your loan payments, you might be better off selling the car yourself and paying off the debt. Youll avoid the costs of repossession and a negative entry on your credit report.