Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Sawin & Shea Is Here To Help

No situation is completely straightforward, so dont try to maneuver the intricacies of Indianas bankruptcy codes on your own. At Sawin & Shea, LLC, we understand that hiring an attorney to help you file bankruptcy is scary. We are committed to providing compassionate and non-judgmental representation to all of our clients. Our attorneys have helped thousands of people just like you get the fresh start they deserve. We are here to help.

What Is Credit Reporting And How Does It Affect Me

In Canada there are two major credit reporting agencies Equifax and TransUnion. Most people commonly refer to these agencies as the credit bureaus. Credit reporting agencies do exactly that: they report credit history. They can also be referred to as an information service as they provide copies of your credit report to potential lenders. This allows the banks and other lenders to determine how much risk they are taking when they loan you money. Whenever anyone lends money they are taking a risk that it will not be repaid.

To get any significant credit, you need a good borrowing history.

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

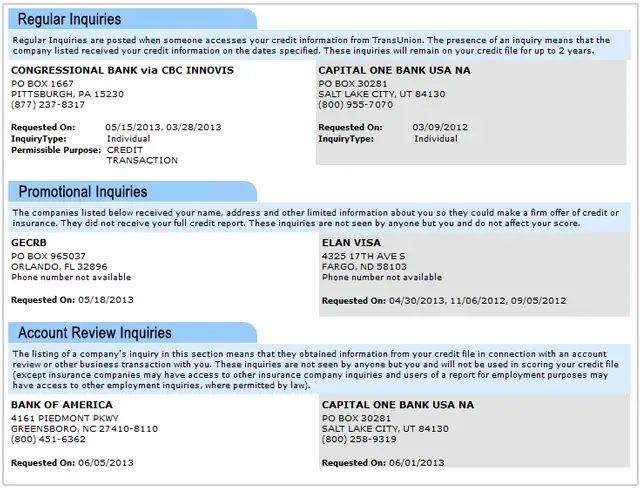

When you apply for credit you normally sign an application that provides the lender consent to access your credit history. Generally this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

Recommended Reading: How Many Times Trump Declared Bankruptcy

What Does Bankruptcy Do To Your Credit

Bankruptcy becomes a negative mark on your , drastically reducing your overall credit score. Even a high credit score wont protect you from the impact of a bankruptcy — in fact, the higher youve climbed, the higher you may fall. Since credit reports and credit scores are all about risk, admitting that a party was a poor risk for payback is essentially a public declaration that this person is not currently a good risk for lending or financing.

Expect to see a good credit score drop by as many as 200 points, and a fair score drop by 130 to 150 points. Exactly how a bankruptcy is filed and the assets involved in the filing will have some impact on how long a bankruptcy stays on a credit report and how the filing affects a score, too. More discharged debt, larger amounts of debt, and lower amounts of paid off creditors are all factors in bankruptcy and credit.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

Recommended Reading: How To File Bankruptcy In Texas Without An Attorney

How Can You Rebuild Your Credit After Bankruptcy

While your credit score will take a hit after bankruptcy, there are steps that you can take to begin building a positive credit history again. First, if there are any credit accounts that weren’t included in your bankruptcy, make sure that you continue to make on-time payments on them each month.

Second, applying for a secured credit card can be one of your best options for rebuilding your score. Since these cards require a security deposit, which limits the issuer’s risk, they’re easier to qualify for with poor or damaged credit.

Payment history on secured cards is reported to the credit bureaus just like regular credit cards. So making consistent on-time payments on a secured card can improve your score over time which can open up more credit opportunities for you down the road.

Before you apply for a secured card, check to make sure that it reports cardholder payment activity to all three major credit bureaus. And to see the biggest positive impact on your score, try to keep the credit utilization rate on your secured card below 30%.

How Long Can Bankruptcy Affect Your Credit Score

Bankruptcy can affect your credit score for some time. Chapter 7 can remain on record for as long as 10 years. Chapter 10 and other forms of bankruptcy are expected to fall off in seven years.

If you’re careful, the negative impact will diminish over time. This means that your while you’re still making payments. Be sure to submit payments in full and on time .

Read Also: How Many Bankruptcies Has Donald Trump Filed

How To Rebuild Credit After Bankruptcy

Accounts included in a bankruptcy filing wont be reported as unpaid or past due anymore on your credit reports. Assuming you pay new debts on time as you incur them, your credit rating will start to recover.

In the meantime, review your credit reports. Accounts that were discharged as part of your bankruptcy filing should be reported as discharged or included in bankruptcy on your credit reports. They should not show any money owed on them a balance of $0.

If there are errors in a credit report, contact the credit bureau to have the report corrected.

You can also start to rebuild your credit standing by obtaining a new credit card. You may have to resort to obtaining a secured credit card, which requires a deposit with the creditor. A third option is to have a family member or friend who has a good credit history apply for a card with you as a co-signer.

Rebuilding your credit is a gradual process. As you use a credit card and pay on time each month, other creditors will see your good financial habits on your credit report when its time to seek additional credit. It is best to avoid carrying a balance. If you must, it should not exceed 30% of the entire line of credit. You may review some tips to improve your credit score.

Must You Wait Until Bankruptcy Is Off Your Record To Fix Your Credit

Not at all.

There are several things you can do to fix your credit while the bankruptcy is still on your record.

It will be difficult for you to find credit or get decent interests rates while the bankruptcy is still on your report. But that doesnt mean you cant repair your credit.

Think of it this way.

People who declare bankruptcy already had a poor credit score. So bankruptcy doesnt necessarily hurt your score. In fact, many people say theyve seen their credit score get better after they declared bankruptcy.

So bankruptcy doesnt have to be a death sentence.

You May Like: How Many Times Has Donald Trump Filed Bankrupcy

Evaluating Credit Card Offers

You will typically begin to receive new offers for credit after bankruptcy. However, be aware that many new credit card offers will have low limits, high-interest rates, and high annual fees. Reviewing the offer terms carefully before signing up for a new credit card after bankruptcy is essential. The goal is to accept a credit card with the highest possible limit because credit reporting agencies rate you based on your total available credit. Not only can lower limits can harm your score, but youll want to pay off the majority of your balance each month.

If you dont qualify for a typical, unsecured credit card, you might want to start rebuilding your credit by getting a secured credit card from your bank. Youll deposit a certain amount of money in the bank as collateral for the card. In exchange, you have a line of credit equal to the amount in the account. A secured credit card rebuilds credit because the creditor typically reports payments on your credit reportyoull want to be sure that will happen.

Do I Need To Keep In Contact With My Trustee

Normally you don’t. In some cases, your trustee continues to manage your bankruptcy, even after it has ended. For example, your trustee has claimed your house as an asset and they havent sold it yet.

Your trustee may still request you to:

- provide information about your financial situation

- make any outstanding compulsory payments.

Recommended Reading: Epiq Bankruptcy Solutions

Fixing Financing After Bankruptcy

Can I Apply For Credit

After your bankruptcy has ended, there is no restriction on applying for loans or credit. Its up to the credit provider to decide if they will lend you money.

Your credit reportwill continue to show your bankruptcy for either:

- 2 years from when your bankruptcy ends or

- 5 years from the date you became bankrupt .

It can take time to rebuild your credit rating.

For more information regarding your credit report, contact a credit reporting agency. Information about credit reporting agencies is available at ASIC’s MoneySmart.

You May Like: How Many Times Has Donald Trump Filed For Bankruptcy

How To Raise Your Credit Score After Bankruptcy

Once a bankruptcy is discharged, raising your credit score is the next goal. This task will seem like climbing Mount Fuji, but it’s possible to achieve.

Here are a few tips for getting reorganized:

When Is It Better To File A Joint Bankruptcy With Your Spouse

So when you share many of the same obligations, filing a joint bankruptcy is usually the better option. On the other hand, if you have few or no joint debts and your spouse has a lot of individual debts, the better course might be to let your spouse file alone. Youll retain the option of filing for bankruptcy later on if necessary.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

How Does Bankruptcy Affect Your Credit Score

A bankruptcy can initially lower your credit score. However, it is not uncommon for people who have filed bankruptcy to start seeing offers for new credit shortly after filing for bankruptcy. Also, bankruptcy can help you get a fresh start financially and decrease the amount of your discretionary income that is used on debt repayment, which can be attractive to creditors.

Bankruptcy is handled by the federal Bankruptcy Court, which makes it a public record that can be listed on your credit reports. How long a bankruptcy stays on your credit report depends on whether you file Chapter 7 personal liquidation bankruptcy or Chapter 13 debt readjustment bankruptcy, as follows:

- A Chapter 7 bankruptcy will stay on your credit reports for up to 10 years.

- A Chapter 13 bankruptcy will stay on your credit reports for up to seven years.

As you may know, it takes three to five years to complete a Chapter 13 bankruptcy and less than a year to complete Chapter 7. Yet, the bankruptcy remains on your credit record as part of your financial history for years after the court agrees that you have satisfied your debts.

The good news is that while a bankruptcy remains on your credit report, its impact on your credit rating diminishes over time if you establish a record of paying your bills on time and being creditworthy.

Also Check: Has Mark Cuban Ever Filed For Bankruptcy

How To Build Credit After Bankruptcy

You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Bankruptcy will show on your record for 7-10 years, but every year you work to improve your credit, the less it will affect you and the financing you seek.

You need to wait 30 days after you receive the final discharge. This means most of your accounts will be at a zero balance, and creditors must stop calling you about debts.

To rebuild your credit score, you should:

Learn Positive Financial Habits

As time goes by after your bankruptcy and you begin to earn new forms of credit, make sure you dont fall back into the same habits that caused your problems. Only use credit for purchases you can afford to pay off, and try using a monthly budget to plan your spending. Also, work on building an emergency fund to cover three to six months of expenses so a random surprise bill or emergency wont cause your finances to spiral out of control.

Read Also: How Many Bankruptcies Has Donald Trump

Stay On Top Of Payments

Unfortunately, people wont be as quick to trust you after a bankruptcy. It could be a while before youre back on your feet. But the best way to prove you wont end up in the hole again is by managing your money better. Go ahead and get yourself on a budget. When you give every dollar a job and focus on being more intentional with your money, you make it easier to pay your bills on time and stop overspending. Staying on top of payments, along with having a steady income, is one of the best things you can do for your credit after a bankruptcy because it shows youre trying to be more responsible with your money.

And if you still have debts that werent erased in a bankruptcylike student loans, government debt, reaffirmed debt , child support or alimonyknock those out as soon as possible with the debt snowball method. Or try settling your leftover debts to get them out of your life as soon as possible.

Returning To Good Credit After Bankruptcy

A personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file:

- Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge

- Chapter 7 bankruptcy stays on your credit report for 10 years after final discharge

Having a bankruptcy on your record for 7-10 years does not mean it will take you this long to repair your credit score or get out of debt.

Right away, the “final discharge” releases you from personal liability in most debts. You need this bankruptcy discharge before you can take steps to build toward better credit, otherwise, you will continue to have large debts.

Once the process starts, you can decide what choices to make to rebuild your credit.

Recommended Reading: Will United Airlines File Bankruptcy