Some Debts May Not Show Up On Your Credit Report

Most major lenders report account activity to the credit bureaus, but they’re not required to. Therefore, a creditor may not share your account information with the credit bureaus.

Old debts may not be included on your credit report, depending on how old they are. Even if they originally appear on your credit reports, accounts closed in good standing are removed from your reports after 10 years. Accounts closed as a result of late payments are removed after seven.

There are also exceptions to the types of debt you might expect to find on your report. Medical debt, for instance, is generally not listed on credit reports unless it becomes severely past due and is reported as a collection account. Retailer payment plans aren’t commonly reported to the credit bureaus, either.

In some cases, the account will only appear on your credit report if the creditor turns your account over to a debt collection agency. Typically, the original creditor will be listed along with the collection account.

If you don’t see a debt on your credit report, you also can search through old bills or contact creditors to nail down all the debts you owe.

These Savings Accounts Are Fdic Insured And Could Earn You Up To 19x Your Bank

Many people are missing out on guaranteed returns as their money languishes in a big bank savings account earning next to no interest. Our picks of the best online savings accounts can earn you more than 19x the national average savings account rate. to uncover the best-in-class picks that landed a spot on our shortlist of the best savings accounts for 2022.

If You Have Federal Student Debt

To obtain federal loans, you applied for them using your FASFA ID. Depending on when you applied for aid you may also have a FSA ID. If you are like me and you did not have a FSA ID but rather a FASFA Pin, the FSA ID replaces Pin. You can easily apply for a FSA ID here. Having a FSA ID is important for using the National Student Loan Data System as well as another tool Ill discuss later.

The National Student Loan Data System allows you to retrieve all of your federal student loan information at once. This is helpful if you have multiple federal student loans with different loan service providers. For example, some of my student loans are serviced by Navient others by FedLoan Servicing. Being able to see everything in one place makes it easier to see the big picture of your student debt.

Recommended Reading: How To Apply Loan In Sss

Read Also: How Many Points Does A Bankruptcy Drop Your Credit Score

Finding Your Federal Student Loan Balances

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Educations central database for student aid, and it keeps track of all your federal student loans.

Youll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you cant have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while youre enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

Read Also: Mortgage Loan Signing Agent

How To Find Student Loan Balance For Private Loans

To find your private student loan balance, you may have to do a little more work since theres no centralized system for private loan information.

The first thing to check is your credit report. You can obtain a free credit report once every twelve months. The report will contain information about your loan providers, loan balance and payment history for loans.

This should provide a good start to determine the balances, although credit reports do have mistakes sometimes. If something seems inaccurate, try finding your original loan contracts, then follow up with the loan provider directly.

You can also check with your schools financial aid office for any information they have on loans you received.

Recommended Reading: What Are 4 Advantages Of Filing Bankruptcy

Should I Just Wait For Creditors To Contact Me

If youve tried checking credit reference agencies, credit files, letters, emails, bank statements, appropriate agencies, yet you cant find any regarding your debts, then the only choice left is to wait for creditors to contact you.

Most of the time, your creditors will use your residential address or the address in your credit file. Thus, you must need to keep this updated. Also, specialist agents will be enforced to find as they are employed by your creditors o the debt collection agencies. This option should only be your last resort.

Here Are Some Options When Negotiating Settlement Of An Unsecured Debt With A Collection Agency

Most debts that go to collection agencies are unsecured debts, such as credit card, cellphone, utility, and medical debt. If the creditor is flexible, it might be willing to accept a settlement below the full amount to avoid spending months futilely trying to collect the whole thing. If you have some cash to offer a payoff of the debt, or you want to change the payment terms so they’re more favorable to you, consider negotiating with the collector.

Options for settling the debt include:

- offering a lump-sum settlement

- negotiating improvement to your credit report, and

- working out a payment plan.

First, though, determine whether you should negotiate with collectors on your unsecured debts or whether you pursue other options, like filing for bankruptcy.

Read Also: Does Bankruptcy Clear Tax Debt In Canada

Finding How Much You Owe In Student Loans

Finding your student loan balance is important for a few reasons.

First, because of interest and fees, your current student loan balance may be higher than when you originally took out your loans if youre just starting to make payments. Knowing your current balance helps you shape your budget and determine whether you still have a good rate.

Its also possible that your lender the company that distributes and processes your loans has transferred or sold your loans to another lender. Keeping up with your student loan information helps you know where to send payments.

Also Check: Usaa Classic Car Loan

Simplify Your Finances Through Debt Consolidation

One of the major advantages of debt consolidation is that it simplifies your finances and in essence incorporates multiple debts into one affordable monthly amount. Therefore, your money should be much easier to manage.

Furthermore, if you consolidate your debts, you might be able to save cash every month.

To find out if youd qualify, click the button below:

Don’t Miss: Does Bankruptcy Fall Off After 7 Years

What Does My Credit Report Show

Your credit report carries a lot of your personal details.

It lists your name, your present address, the date of your birth, your electoral roll details, any financial links you may have, such as a relative with any loans, the last six years of your address history, and details of all the loans you need to repay.

Other than these details, it also contains information on any loan solutions youve opted for, such as bankruptcy, DROs, or IVAs, and even details on any late payments and defaults.

Obtain A Free Copy Of Your Credit Report

There are three major credit reporting agencies: Equifax, Experian, and TransUnion. Companies you owe money to report your debt balances to these credit reporting agencies. This includes credit card companies, mortgage companies, and other loan lenders.

Since your credit report contains the details about virtually all your debts, it’s a good place to start when figuring out what you owe. You’re allowed to get a free copy of your credit report from each of these three major credit reporting agencies once per year by visiting AnnualCreditReport.com. Simply go to this website, select which report you want, and provide the required information including your Social Security number and your current and past addresses.

Your credit report will be delivered to you instantly online and you can use the information it contains to find out your total debt balance.

You May Like: How Long Is A Bankruptcy On Your Credit

Checking How Much Total Debt I Owe

The most convenient and reliable way to find out about your debts is by checking your credit file. Your credit file contains records of your debts and other public details shared by your creditors or lenders.

Moreover, it also contains information about your bank accounts, personal loans, and other types of debt youve had. You can see your credit history and the status of each debt. It can also consist of certain details that are related to your bills. phone contracts, insurance payments, etc. Your credit score relies on your credit file so, any dents unsettled can greatly affect your credit score.

If you wish to check your credit file, there are three credit reference agencies that you can trust in the UK:

You can also find out how debts can affect your credit rating through our guide.

How Much Debt Can You Get Into Before You Need To File Bankruptcy

There’s not a specific amount of debt you need to have to file bankruptcy. The amount of debt you can handle depends on your income, expenses, and the type of debt. Depending on these factors, you may have to file Chapter 13 bankruptcy to repay your debts or you may be eligible to file for discharge under Chapter 7 bankruptcy.

Recommended Reading: Where Do You Go To File Bankruptcy

Remember Your Debt Won’t Go Away

We actively collect debts owed to us, and take the time to trace people who owe us money. One of the ways we do this is by comparing records with other Government departments.

We also have certain legal rights if you don’t repay us, for instance we can have money deducted from your wages or bank account.

Make A List Of All Of The Active Accounts On Your Credit Report

Your credit report shows not just open accounts, but also accounts that have been charged off, discharged, or paid in full. When you’re trying to figure out your total debt balance, you want to focus on open accounts where creditors could try to collect from you.

If debt is charged off, the creditor that you originally owed has given up on trying to collect it — but a collection agency may aim to get the money from you and can pursue claims against you unless the statute of limitations for collecting on debt has expired. If debt has been discharged in bankruptcy, on the other hand, it is no longer collectible — you don’t need to worry about including the account in your total loan balance.

Remember, your credit report is just a snapshot in time, as creditors typically report on your account balance and payment history just once a month. If you have an open , you should include it on your list of debts even if the balance reported on your credit report is $0, as you may have charged something on that account since the last time the creditor updated the reporting agency.

Read Also: How To File Bankruptcy In Ohio

Has My Debt Been Passed To A Collection Agency

If youve been ignoring your debts for a while, then creditors may pass your details over to a debt collection agency. When this occurs, debt collectors will be in regular contact so you should know if these individuals have been tasked with reclaiming what you owe.

If youre concerned though, ask your creditors if theyve passed your details over to a collection agency.

Use Found Money Wisely

If you receive money as a gift, earn a bonus at work or receive extra money you didnt expect, use this found money to make additional payments on your loans. Although you may be tempted to use this money for something more fun, putting it towards your student loans can help you eliminate debt more quickly.

Don’t Miss: How To Buy A House After Bankruptcy

Challenges Of Finding Total Debt

Despite its importance, its not always easy to put your finger on how much you owe. For one thing, theres the possible innate and universal human tendency to forget borrowing money from somebodywhile, of course, recalling with perfect clarity any time someone borrows from you.

Perhaps more importantly, there are lots of ways to borrow money, lots of places to get a loan and lots of reasons to do so. Some debts you owe may not even be recognize as debts. Here are some creditors many consumers owe money to:

- Hospitals and doctors

- Governments

Even utility companies can be considered lenders, because you use the electricity, gas, water and other services they provide and dont pay for them until later. To repay their debts, some consumers will borrow from their own retirement plans, while investors may borrow from their brokerage companies in order to trade securities on margin.

Loans from friends and family represent a notable absence from this list, which is based on government reports that dont track these informal extensions of credit, or IOUs. However, an IOU is a loan, and should be considered when youre calculating your total debt figure.

The types of debt are similarly numerous. They include:

Now You Know How To Figure Out Your Total Debt Balance

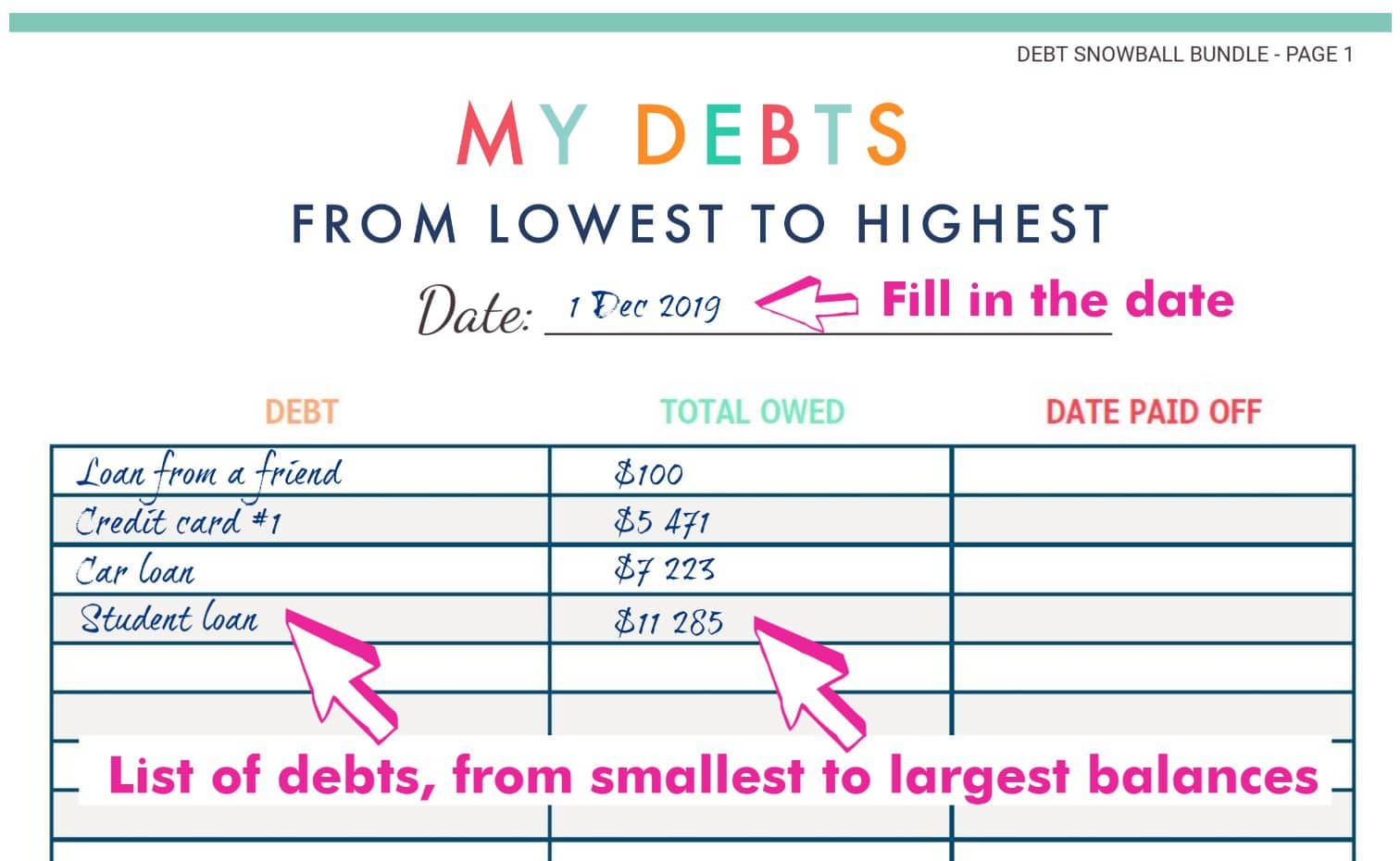

Now you know how to figure out the total amount you owe. Simply obtain your credit report, make a list of the accounts on it, call your creditors or sign into online accounts, and write down the outstanding balance on each debt. Include only debt that can be collected — not any debts that have been discharged in bankruptcy or that creditors can no longer collect because the statute of limitations has passed.

Then, add up the balances on everything you owe and you’ll know exactly what your outstanding financial obligations are. And remember to add in any debts not listed on your credit report by referencing past statements to find others you may owe money too.

Once you’ve done this, you can make a plan to repay what you owe if you hope to become debt free.

Don’t Miss: Did Boy Scouts File For Bankruptcy

How Far Back Can Irs Say You Owe Money

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due. However, there are several things to note about this 10-year rule.

How To Repay Your Student Loan

Your student loan is taken out of your salary once you earn over £26,575 a year, £2,214 a month or £511 a week before tax.

You repay 9 percent of anything you earn over this amount.

How much you repay isnt based on the total amount you owe, it is based on how much you earn.

For example, someone who earns £2,600 a month will repay £34 every month but someone who earns £3,200 will repay £88 a month. It doesnt matter how much these people owe.

Plan 2 loans, which are for those who started their course in the UK after September 1, 2012, are wiped 30 years after the April you were first due to repay.

When Plan 1 loans get written off depends on where you are from and when you took out the loan it could be when you are 65 years old, or 25 or 30 years after you were first due to repay.

This means you dont need to pay the full amount back if you dont manage to by them, and your student loan does not affect your credit rating.

If someone with a student loan dies, the loan will be cancelled.

If you claim certain disability benefits and can no longer work because of illness or disability, you may also be able to cancel your loan.

Recommended Reading: California Mortgage Loan Originator License

Read Also: How Fast Can I File Bankruptcy

Check The Statute Of Limitations For Your State

Debt collectors can only legally sue you for an old debt for so long. At some point, the statute of limitations will expire. If a debt collector hasnât filed a lawsuit by that point, their case will get thrown out of court.

Each state has a different statute of limitations, so youâll need to check your statesâ laws. Depending on the time period, debts you can still be sued for may or may not appear on your credit history.

If a debt is past the statute of limitations, you wonât need to pay it. But, be careful â if you make a partial payment, or even promise to pay an old debt, the limitations period can reset, meaning that you could risk a debt collection lawsuit.

Debt Collectors And The Fdcpa

When a collection agency or debt buyer contacts you, youâll want to exercise your rights under the federal Fair Debt Collection Practices Act . The collection agency or debt buyer must identify themselves. They canât lie to you about who they are, the amount of your debt, or actions they might take. Start by asking for the name of the debt collector and their phone number, mailing address, and any other contact information.

The FDCPA also requires a third-party debt collector to validate the debt if you request it. If you make the request within 30 days of the debt collector contacting you for the first time, they canât take any more collection action until theyâve validated the debt. Outside the 30-day period, you can still request validation, but the collector can keep trying to collect. They can also report the debt to credit reporting agencies.

Also Check: When Should You File For Chapter 7 Bankruptcy