How Discharge Affects Your Belongings

Discharge from bankruptcy doesn’t mean you’ll get back any belongings, even if they haven’t been sold yet. It might take some time for the official receiver to deal with them.

If you come by any new assets after you’ve been discharged, these will usually remain yours and can’t be claimed by the trustee. An important exception to this rule is any payments you receive by claiming for payment protection insurance which was mis-sold before you become bankrupt.

Bankruptcy Discharge Certificate Canada: What Does Trustee Discharge Mean

After the Trustee has fully completed the administration of the bankruptcy estate, the Trustee is entitled to its discharge. The Trustee must prove to the OSB that it has completed the administration. This includes providing the OSB with a copy of the Final Statement of Receipts and Disbursements to get the Superintendents comment letter.

Then the Trustee must provide the final statement, the comment letter, and other documents to the court to prove that the administration is complete, get the final statement approved, and taxed. When that happens, the court issues the Trustees discharge order. The Trustee then files that order with the OSB and closes its file.

It is possible for the Trustee to receive its discharge while the bankrupt remains undischarged. This happens either when the result of the bankrupts discharge hearing results in a no order or sufficient time has elapsed showing the bankrupt is not going to fulfill the conditions to get a discharge. In this case, the Trustee is at liberty to get its discharge.

Once the Trustee gets its discharge, an undischarged bankrupt loses the protection of the automatic stay of proceedings that were invoked upon the bankruptcy occurring. Once this protection is lost, the creditors are at liberty to once again pursue the bankrupt person for collection on the debts owing.

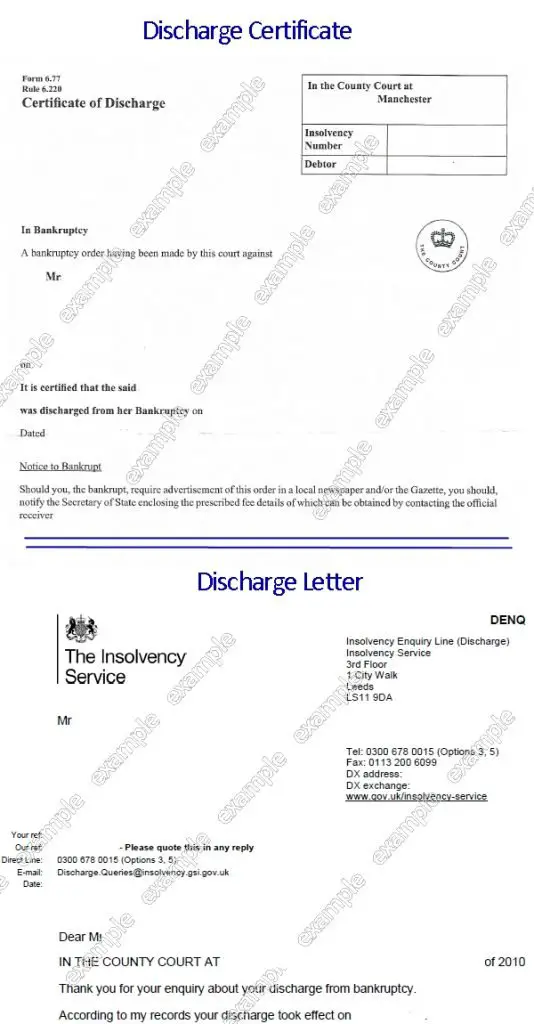

How Do You Get Copy Of Your Discharge Papers

Contact the Clerk of the Court. The first place to check when you need a copy of your bankruptcy discharge papers is with the Clerk of the Court where your case was filed. Some courts will allow you to search the record online for free, while others charge a fee for searches. If you need copies of the document, there will be a fee as well.

Recommended Reading: Donald Trump Files For Bankruptcy

Bankruptcy Discharge Certificate Canada Introduction

What is a bankruptcy discharge? When a bankrupt is discharged from bankruptcy, he/she gets a bankruptcy discharge certificate Canada. The individual is launched from the legal responsibility to repay financial debts that existed on the day that the bankruptcy was filed. This is true other than for certain financial debts that are not discharged when the insolvent receives his/her discharge which I will go over listed below.

Usually, only personal bankrupts are discharged from bankruptcy. Companies that are bankrupt remain that way. The only method a company can exit from bankruptcy is if the claims of creditors are paid off with interest. This never occurs. If it could, the company would have submitted a restructuring strategy under either the Bankruptcy and Insolvency Act or the Companies Creditors Arrangement Act .

Therefore, the balance of this Brandons blog will talk about an individual person who receives a bankruptcy discharge certificate Canada.

Two: Use Secured Credit Cards Or Small Loans To Help Build A Record Of On

Secured credit cards. To begin rebuilding your credit, you may wish to obtain a secured credit card. A secured credit card uses money deposited in a bank account as collateral for the credit card. The creditor can take the money in the account only if you default. Some banks offering secured cards do not require a credit check, and it may be easier to obtain a card from them. However, be sure to shop around. Some secured card providers charge excessive fees and interest. You should also make sure the provider reports to all three credit reporting agencies .

It is important to use no more than twenty percent of your available credit on your secured card .

Example: if you have a limit of $500, avoid carrying a balance of more than $100 on the card at any one time.

The purpose of this card is to rebuild your credit, so responsible use is essential. If you are a couple, it is good to have a separate card for each of you.

Quick Note: A secured credit card is not the same thing as a prepaid credit card. Although very convenient, prepaid credit cards do nothing to improve your credit.

Small Lines of Credit and Vehicle Loans. A small unsecured line of credit can be useful in rebuilding your credit. Likewise, if you need a vehicle, a car loan is another way to rebuild credit. However, I do not suggest getting a car loan just to rebuild your credit. See below for information on obtaining a vehicle loan after bankruptcy.

You May Like: Can I Buy A Car After Filing Bankruptcy

Your House And Other Real Property After Bankruptcy

Here are answers to some common questions about homes and mortgage loans after bankruptcy:

What should I do if I want to keep my home after bankruptcy? Make timely payments if keeping your house. If you did not reaffirm your home mortgage loans in Chapter 7 but are current and plan to keep your property, just continue to make your house payments on time. The bank still has a lien on your home and can foreclose if you fall behind on the payments. Note, as mentioned above, if you did not reaffirm the debt, your payments will not be reported to the credit bureau.

Can I walk away from my home after my Chapter 7 bankruptcy? If you did not reaffirm your mortgage loan in Chapter 7, you have more options than if you reaffirmed the loan. If you do not reaffirm your mortgage loan and decide later that you no longer wish to keep your home, you can simply stop making the payments. Eventually, the property will go into foreclosure, but the bank will not be able to obtain a deficiency judgment against you.

Can I walk away from my home after my Chapter 13 bankruptcy? It depends. Chapter 13 does not discharge your secured loans in most cases unless you surrender the property in your Chapter 13 plan. If you surrendered the property in your Chapter 13 plan, then you can treat it the same as if you had discharged the debt in Chapter 7.

Quick Note: In most instances, modifying a loan that was not reaffirmed will not cause the payments to show on your credit report.

Your Chapter 7 Bankruptcy Case Does Not End When You Get Your Discharge It Ends With The Court’s Final Decree

Updated by Cara O’Neill, Attorney

For most filers, a Chapter 7 case will end when you receive your dischargethe order that forgives qualified debtabout four to six months after filing the bankruptcy paperwork. Although most cases close after that, your case might remain open longer if you have property that you can’t protect . During that time, you must cooperate with the trustee appointed to administer your case. Your case will close after the trustee sells the assets, pays out the funds, and files a report with the court.

You’ll find a complete overview of the bankruptcy process in What You Need to Know to File for Bankruptcy in 2021.

You May Like: How Much Does It Cost To File Bankruptcy In Missouri

Whats The Earliest Date I Can Expect My Chapter 7 Discharge

The earliest date you can get your Chapter 7 bankruptcy discharge depends on the date of the Meeting of Creditors , whether there are any objections, and whether a reaffirmation hearing was requested. Bankruptcy laws give time for creditors, bankruptcy trustees, and U.S. trustees to object.

If there are no objections and a reaffirmation hearing is not needed, the earliest date you can get your Chapter 7 discharge is after the deadline for objections expired. The deadline for creditor and trustee objections is 60 days from the first scheduled 341 meeting.

The official date the discharge order will be entered will also depend on the day of the week, holidays, and the courtâs caseload. You could get your discharge the day after the objection deadline expires. Bankruptcy records show discharge filing dates are around four months after filing a bankruptcy petition. If you have a reaffirmation hearing scheduled after the deadline for objections, the earliest you can get your bankruptcy discharge is after the court makes a ruling on the reaffirmation.

Bankruptcy Case File Record Requests

Please provide the following information:

- name of the court where the case was filed

- case number and name of parties on the case and

- time period the case was filed.

For bankruptcy cases filed 1940 and after, a FRC transfer number is required. This is obtained by contacting the court where the bankruptcy was originally filed. If the court does not have the transfer number due to the age of the case, please note this with your request.

There is no charge to perform a search. Do not send any money or credit card information when you make your initial request. Digital and paper reproductions from the case file will incur a charge. Staff will communicate the fees prior to making the copies.

We receive requests by e-mail, postal mail, or phone.

- National Archives at Kansas City 400 W. Pershing Rd.

- Phone: 816.268.8000

You May Like: Can You Be Fired For Filing Bankruptcy

Bankruptcy Discharge Certificate Canada: What If I Fail To Include One Of My Creditors In My Bankruptcy

If I failed to remember to include one of my creditors in my bankruptcy do I need to pay them? If your Trustee hasnt been discharged yet, simply tell the creditor to call your Trustee to participate in your bankruptcy.

If your Trustee has actually been discharged then the creditor is qualified to be paid the same returns your other creditors obtained from your bankruptcy. You will need to pay this amount.

If you intentionally omitted the lender from your bankruptcy after that the lender can ask the court to enable their financial obligation to survive, and if successful, you will need to pay the full amount.

Things You Should Know About Your Bankruptcy Discharge

A bankruptcy discharge is a United States bankruptcy court order that legally ends the bankruptcy filerâs responsibility to pay the discharged debt. It is proof for creditors you no longer owe the discharged debt. This order is your first sign that debt relief has arrived!

-

One: The United States bankruptcy court order for the discharge is entered automatically, but only if your paperwork is filed and you attended your Meeting of Creditors and completed the required financial management class.

-

Two: Not all types of debt can be discharged in a bankruptcy case. The Bankruptcy Code lists exceptions to discharge in Title 11 Section 523. At the beginning of your bankruptcy case, you listed all your creditors, but itâs possible not all of your debt from those creditors was discharged. As you may know, alimony, child support, most student loans, certain personal liabilities from court actions, and income tax debt from the last three years wonât get discharged in bankruptcy. These types of debts are non-dischargeable and youâll still owe the debt. You may have listed real estate from a secured creditor on your Schedule A/B bankruptcy form but you still owe on the mortgage. At the end of the case, all creditors, discharged or not, will get a copy of the order. A copy of the order of discharge will also be sent to you, your bankruptcy lawyer , the U.S. trustee, and the bankruptcy trustee that handled your case.

Don’t Miss: How Do You File Bankruptcy In Texas

Are You Interested In Filing Bankruptcy

If you havenât filed bankruptcy yet and youâd like to get your debt discharged, you can consult a bankruptcy attorney for legal advice or ask a local legal aid office for assistance. You can even file bankruptcy pro se with Upsolveâs web app to help you reach your goal of obtaining a bankruptcy discharge order for your own fresh start.

May An Employer Terminate A Debtor’s Employment Solely Because The Person Was A Debtor Or Failed To Pay A Discharged Debt

The law provides express prohibitions against discriminatory treatment of debtors by both governmental units and private employers. A governmental unit or private employer may not discriminate against a person solely because the person was a debtor, was insolvent before or during the case, or has not paid a debt that was discharged in the case. The law prohibits the following forms of governmental discrimination: terminating an employee discriminating with respect to hiring or denying, revoking, suspending, or declining to renew a license, franchise, or similar privilege. A private employer may not discriminate with respect to employment if the discrimination is based solely upon the bankruptcy filing.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Your Bankruptcy Discharge Date

5 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Obtaining a bankruptcy discharge is the primary goal of every individual who files bankruptcy. The discharge date is the most important date in a personal bankruptcy, second only to the date the case was initially filed. Letâs take a look at 4 things you should know about your bankruptcy discharge, when your discharge will be granted by the bankruptcy court, and how to figure out the date of your discharge even if you canât find your paperwork anymore.

Written bythe Upsolve Team. Reviewed byAttorney Andrea Wimmer

Obtaining a bankruptcy discharge is the primary goal of every individual who files bankruptcy. The discharge date is the most important date in a personal bankruptcy, second only to the date the case was initially filed. Letâs take a look at 4 things you should know about your bankruptcy discharge, when your discharge will be granted by the bankruptcy court, and how to figure out the date of your discharge even if you canât find your paperwork anymore.

Contact The Clerk Of The Court

The first place to check when you need a copy of your bankruptcy discharge papers is with the Clerk of the Court where your case was filed. Some courts will allow you to search the record online for free, while others charge a fee for searches. If you need copies of the document, there will be a fee as well. Copies of the document are often a charge per page. If it has been many years, the case may have been archived, so additional fees may apply.

Don’t Miss: How To Claim Bankruptcy In Texas

Can You Get Confirmation Of Discharge From A Debt Relief Order

If you used a Debt Relief Order the moratorium period lasts for 12 months. After this time the Order automatically comes to an end. You will not receive any confirmation from the Official receiver that your DRO has finished.

You can check the date that your DRO is due to finish on the Insolvency register. However this record will only remain for 3 months after that date. Then there is then no public record of Order ever having existed.

If you wish you can request a letter confirming your are discharged from your debts. The insolvency service has a dedicated Debt Relief Order team based in Plymouth. The telephone number to contact the team is 01752 635200 Alternatively you can e-mail your request directly to the DRO team at .

Bankruptcy Discharge Certificate Canada: What If My Creditors Still Contact Me And Try To Get Me To Pay Them

If the creditors are consistently calling you and demanding settlement, supply them with a duplicate of your bankruptcy discharge certificate Canada. If the creditor states they were not aware of your bankruptcy, also offer them a duplicate of your sworn statement of affairs revealing them listed as a creditor.

If they are listed, then the Trustee sent them a notice of bankruptcy including a form 31 proof of claim to complete and return to the Trustee.

Recommended Reading: Toygaroo Worst Deal

Where Can I Get A Copy Of My Bankruptcy Discharge Papers

Once your bankruptcy concludes, you will receive what is known as a bankruptcy discharge which states that your case is now closed and all debts included are no longer enforceable. Creditors listed in the petition can no longer contact you about your debt or file any legal proceedings against you. It is important to keep this document as you may need to present it should you apply for a loan in the future. However, if you have misplaced your discharge documents, you can still obtain a copy if you need it for any reason.

Frequently Asked Questions / Testimonials

What if a bankruptcy case can not be found?If bankruptcy paperwork is not available or can not be found, the payment will be refunded.

How fast will I get copies of the bankruptcy papers?Orders are typically emailed in less than 10 minutes, but always within 1 hour.

Our lender is requiring a copy of our bankruptcy paperwork in order to approve our loan, are you able to provide what they need?Yes, the Complete / Lender Package includes all paperwork that they require.

What if I do not know the case number or the year the case was filed?Most cases can be located with the name on the case and the state filed in. For more common names the last four numbers of the persons SS# will assist in narrowing the search . If there is a problem locating a case, a U.S. Bankruptcy Records clerk will contact you via phone or email.

Can bankruptcy records be ordered for someone else?Yes, if the name on the case and the state the person filed in can be provided, a copy of the bankruptcy case can be ordered.

How will I get copies of the bankruptcy papers?All orders are emailed. Fax or mail delivery can be requested for an additional charge.

Are the bankruptcy records I order really official copies?Yes, copies come direct from the United States Federal Bankruptcy Court System and are duplicate copies of the original court filed paperwork.

What if I order bankruptcy records and lose the copies sent to me?Contact us and we will email you another copy, free of charge.

Recommended Reading: Does A Bankruptcy Trustee Check Records