How Long Does It Take To Process A Bankruptcy

- May 23, 2016

- Bankruptcy, Chapter 11, Chapter 12, Chapter 13, Chapter 7

Making the decision to file for bankruptcy is certainly difficult. Once youve decided to file, you must determine which chapter of bankruptcy is most appropriate for your situation. Each chapter of bankruptcy has a different time range for completion.

In general, Chapter 7 bankruptcies are processed the most quickly as they are a form of liquidation. Chapter 12 bankruptcy and Chapter 13 bankruptcy often take longer as they involve repayment plans.

Although youre likely eager to have your case over and done with, you will have to wait for debts to be officially discharged. In this blog post, well look at some of the most common forms of bankruptcy and their average completion times.

Phase 2: 341 Meeting Date Of Discharge

Remember how the date of the 341 meeting determines a lot of deadlines for the rest of the case? Here is how it works:

341 meeting + 30 days = Deadline for the trustee to object to an exemption you claimed. This deadline starts when the 341 meeting is âconcludedâ which can be delayed if the trustee schedules a follow up meeting.

341 meeting + 60 days = Deadline for creditors to object to having their debt discharged. are not very common in typical Chapter 7 cases, but they do happen.

341 meeting + 45 days = Deadline to deal with secured debts, like car loans .

Once the deadline to object to the discharge has passed, the court will enter the discharge order.

Can the discharge date be delayed?

Yes. If you donât take your financial management course after filing and submit a certificate of completion, the bankruptcy court canât grant your discharge. If too much time passes, the court can close your case.

Other Things That Can Delay The Entry Of The Discharge

Asset Chapter 7 Cases Take Longer

If the case involves assets the trustee needs to sell, the case could go on for months or years after the discharge. The amount of time will depend on whether the Chapter 7 trustee needs to file lawsuits against creditors or others or sell assets like real estate, vehicles, or businesses.

Once the trustee has a pool of funds, the court will ask the for what the debtor owes. The trustee will file objections with the court to any claim that is deficient or improper, and the court will hold hearings on them. The trustee mails checks to those creditors with allowed claims and will file a report after distributing funds. Only then will the court close the case.

You May Like: Does Declaring Bankruptcy Affect Your Spouse

Do I Need To Attend My Bankruptcy Hearing

For many, the luxury of having a lawyer for their bankruptcy case helps take a load off their shoulders. From drafting repayment plans to filing paperwork, bankruptcy attorneys work hard so their clients can focus on their other affairs.

However, its important to note that bankruptcy is a collaborative effort. You will be required to put forth some effort, no matter how efficient your bankruptcy lawyer is. One of the major aspects of bankruptcy that you are required to do is attend your bankruptcy hearing. If you do not attend your bankruptcy meeting, you jeopardize having your bankruptcy dismissed.

Delay In Completing The Financial Management Course

Before you receive your discharge, you must take a financial management course within 60 days of your meeting of creditors. Failure to complete this course within the time allotted will delay your discharge and the closure of your case.

In the worst case scenario, the court will close your case without granting your discharge. This means that you leave your bankruptcy still owing your debts. Although you can usually reopen your case in order to file the certificate showing you completed the financial management course, this can be costly and complicated, and take more time.

You May Like: Does Chapter 13 Bankruptcy Cover Student Loans

What Is Business Bankruptcy

The type of bankruptcy that most people think of when they hear this word is Chapter 7. Filing for Chapter 7 bankruptcy usually results in liquidation. Business assets are distributed to creditors, so the business shuts down. This is the most common and least favorable type.

On the other hand, Chapter 11 and Chapter 13 do not share this reputation. These two usually result in the reorganization or consolidation of the businesss debts. Plenty of companies have filed for Chapter 11 or Chapter 13 while maintaining operations and are even alive and kicking today.

The type of bankruptcy you file for depends on your businesss debt and overall financial health.

What Happen If Litigation Occurs

Two kinds of litigation can delay the closing of your bankruptcy case.

- Determining the dischargeability of a debt. If you or one of your creditors files a lawsuit asking the court to determine if one of your debts is dischargeable or not, the court will keep your case open until it decides the fate of that debt. This kind of lawsuit will not usually interfere with your general discharge unless the trustee or the creditor challenges your right to discharge all your debts.

- Trustee’s litigation to gather assets. Sometimes a trustee will have to file a lawsuit against a third party to get access to your nonexempt property. For instance, if you sold a car for half its value to your cousin a month before you filed your bankruptcy case, the trustee may have a right to the full value of the car. If your cousin refuses to turn over the car or pay the full value, the trustee may have to file a lawsuit. Or, the trustee could file a lawsuit to get back an unusually large payment you made to a favorite creditor before you filed your Chapter 7 case. Your duty to cooperate also applied when the trustee files one of these lawsuits.

Find out more by reading What Is Bankruptcy Litigation?

Also Check: Can You File Bankruptcy And Keep Car

How Long Does Probate Take In Ontario For A Large Estate Vs A Small Estate

How long does it take to prepare a probate application? Once all of the facts are properly collected, it is a matter of hours to prepare and finalize all of the necessary documentation. The probate application can all be submitted online.

How long does it take to grant probate? The delay between filing the application and grant of probate varies greatly from Court registry to Court registry. In smaller regions, it does not take long at all. Historically in the Toronto region, without a court order requesting the court to expedite the issuance of the Certificate of Appointment of Estate Trustee, it could take many long months.

The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. Estates in Canada that are valued at over $150,000 are covered by the larger probate process. The larger process is really the one that historically was in place in Ontario.

Since April 1, 2021, the province of Ontario has a new estate designation, a âsmall estateâ. A small estate is for the probate legal process when it is valued at $150,000 or less. You can use a streamlined procedure if you are requesting probate of an estate that fits this definition.

Why Do Businesses File For Bankruptcy

A myriad of circumstances can render a business unable to repay their debts. What makes bankruptcy different than other possible solutions to this problem is the opportunity to start fresh. The debts you are unable to pay are forgiven, and your creditors are given some degree of compensation.

In other words, any debts you incurred before the filing are eliminated once the bankruptcy case comes to an end.

You May Like: What Do You Lose When You File For Bankruptcy

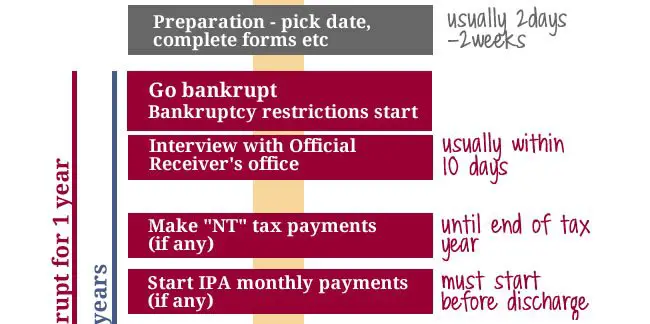

Bankruptcy Timeline What Happens & When

This bankruptcy timeline shows WHAT is likely to happen and WHEN if you go bankrupt in England, Wales or Northern Ireland.

Some of the times are fixed the bankruptcy marker is definitely going to drop off your credit file after six years.

Others are less definite, but the indications in the timeline here should be right for a large majority of the people who go bankrupt.

Timeline For A Chapter 13 Bankruptcy Case

At Fear Waddell, PC, I am frequently asked: what is the timeline for a typical Chapter 13 bankruptcy? In general, Chapter 13 bankruptcies can take;between 36-60 months. This timeline can vary but it typically takes between 3 and 5 years to complete a Chapter 13 bankruptcy case.;There are a wide variety of things that can happen in Chapter 13, but here is a summary of the basic things to expect :

Don’t Miss: Will Bankruptcy Get Rid Of Irs Debt

File Petitions And Other Paperwork

Your attorney will file a substantial amount of paperwork with the bankruptcy court. This includes the petition and forms describing your assets and liabilities, income and expenses, and contractual obligations and leases. Obviously, completing and submitting these documents will take some time. This can take a few weeks or a few months, depending on the size and complexity of your assets and debts.

Talk To A Credit Counselor Before Filling

It may also be wise before embarking on the process, to participate in , so you can fully assess your situation. Such credit counseling agencies are listed with the National Foundation for Credit Counseling. Counselors may recommend a debt management plan, in which the agency negotiates lower interest rates with creditors, usually credit card companies. You would pay one monthly payment to the debt management agency over three to five years, and the agency pays your creditors.

While theres a small monthly fee as part of the monthly payment, bankruptcy, if hiring an attorney, can end up costing more. Also, unlike bankruptcy, a debt management plan doesnt appear on your credit report, and will eventually result in a higher credit score, so it doesnt have the negative impact on your ability in the future to get loans or financing that a bankruptcy would.

9 Minute Read

Also Check: Are Medical Bills Dischargeable In Bankruptcy

First Step: Fill Out The Bankruptcy Form And Pay The Fee

You can apply for bankruptcy yourself via the;Gov.uk website, with no need to go to court. You can take as long as you like filling this out, saving your progress as you go along and coming back to it later.

This fee can be paid online, either upfront in full or via instalments to spread the cost. We understand the likelihood of being able to pay it upfront is low if you are applying for bankruptcy, and many people opt to pay in instalments.

You can also pay in cash, but please be aware if you wish to pay this way, then the whole £680 will need to be paid up front. The fee must be paid in full before you can be made bankrupt.

Can A Lawyer Expedite My Bankruptcy Case

Depending on which type of bankruptcy you file, a lawyer can take the steps to make sure your case moves along in a brisk fashion. For example, if you file for Chapter 13 bankruptcy, you will be required to submit a repayment plan. A bankruptcy lawyer can advise you on the structure of your repayment plan so the court can approve it the first time you present it. Be sure to choose an experienced bankruptcy lawyer that has the knowledge and history to make sure your bankruptcy runs efficiently.

Read Also: Who Pays For Chapter 11 Bankruptcies

Two Weeks After The Bankruptcy Order Is Made

The Official Receiver will get in touch to discuss your bankruptcy. This is usually through a telephone call. Its unlikely the official receiver will ask to meet in person. The Official Receiver is there to help the bankruptcy process run as smoothly as possible and deals with all legalities and creditors on your behalf.

Its important you work with the Official Receiver and help them with any requests they may have for information. They may need further detail about something on your application form or ask you to present something as proof.

You could also now look into setting up a basic bank account as yours may still be affected by the Official Receiver investigating your finances. This will need to be a standard type of account, with no overdraft, because you wont be able to apply for credit. This is simply so you can have your wages or benefits paid electronically and still pay any bills.

Where To File A Will

To begin executing a will, file it with the probate court. Usually, a will is filed with the probate court in the county where the will’s owner has died or the county in which he last lived. Some states do not have separate probate courts, but your local telephone directory should provide numbers for your court so you can determine the proper place to file the will. Filing the will as soon as reasonably possible after the testator’s death has two advantages: it sets the probate process in motion more quickly, and it ensures probate begins long before any state deadlines.

Don’t Miss: Will Filing Bankruptcy Stop Irs Debt

What Happens After Probate Is Granted

After the grant of probate is when the fun really starts. That is when most of the activities of the Estate Trustee really happen like:

- Putting parties on notice regarding estate assets, property before probate that the Estate Trustee identified.

- Collection of the property or making sure that jointly owned property is properly transferred.

- Identifying and paying all rightful claims against the Estate before making any distribution to the beneficiaries.

- Making sure that no beneficiary or 3rd party is contesting the will or the actions of the Estate Trustee.

- Final tax return preparation and filing.

- Dealing with insurance companies.

- Making sure the correct probate fees have been paid.

- Understanding the Estate law issues or going to the Estate lawyer for advice when unsure.

- Handling the entire Estate administration process properly.

- Estate tax return preparation and filing and all the other activities I have already mentioned above.

All of this is before coming up with a scheme of distribution to the beneficiaries and getting either their unanimous approval or if opposed, an Order from the court approving the proposed distribution. It is important for an Estate Trustee to make sure that they have the proper authority to take the actions they need to and that nobody is opposing the Estate Trusteeâs actions.

how long does probate take in ontario

How Does Business Bankruptcy Affect Credit

Compared to other business entities, sole proprietors will take the biggest hit to their personal credit after filing for bankruptcy. Unlike registered entities like LLCs and corporations, sole proprietors have no legal distinction between personal and business debts. After all, you cant expect to have your debts discharged without paying some price. Sole proprietors should expect to see their scores go down by at least 120 points, and the bankruptcy will stay on their credit report for at least seven years.

Owners of registered business entities are not personally responsible for business debts. Hence, their personal credit scores may take little if any damage from bankruptcies. The unpaid debts and bankruptcy also wont show up on their personal credit reports. They will, however, show up on your business credit report. Individual financial institutions might review your business credit before approving financing. Vendors and suppliers will look at your business credit score before deciding to work with you as well.

But, there is one condition in which business debts can affect registered business entities personal credit scores.

Recommended Reading: How Long Does Bankruptcy Show Up On Credit Report

The Timeline For Chapter 7

A Chapter 7 bankruptcyis usually the faster of the two personal filing types, but that doesnt mean that its a fast track to a clean slate. Chapter 7 filings take anywhere from four months to one year to complete. The specific time depends on the number of assets you have to liquidate and the details of your specific case.

Fact: About 2/3 of the filings submitted in the 3rd quarter of 2014 were Chapter 7.

So if you have a limited number of assets to liquidate and everything goes smoothly with your means test and the rest of your filing, then you could be done in just a few months. But if there are any complications or issues with the asset liquidation, your filing may take long. The majority are complete in six months, but there are Chapter 7 filings that take up to one year.

Keep in mind that once the filing is complete and all of your remaining balances are discharged, the Chapter 7 bankruptcy creates a negative item that remains on your credit for ten years from the date of discharge.

May The Debtor Pay A Discharged Debt After The Bankruptcy Case Has Been Concluded

A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtor’s reputation is important, such as a family doctor.

Read Also: What Are The Different Types Of Bankruptcies For Individuals

How Long Does The Bankruptcy Process Take

The time it takes a person to file for bankruptcy and have his or her debts discharged varies greatly. It depends on what type the person intends to file, and also how quickly he or she can gather together information about his or her income and debts. Most private individuals file either Chapter 7 or Chapter 13, but the type of filing greatly changes the process.

Chapter 7 bankruptcy is the most common proceeding, and it is usually filed when a person doesnt have a large number of assets that he or she needs to protect. Generally, the person uses a lawyer who specializes in bankruptcy to help file all the papers required. The part that typically requires the most amount of time when someone is preparing to file for Chapter 7 is gathering all the required information for the form. If a person owes money to numerous creditors, and these creditors have sold their accounts to collection agencies, it may be challenging to figure out who exactly is owed money.