National Debt Relief Reputation & Consumer Reviews

Consumer reviews on National Debt Relief are a mixed bag. Many find it hard to glean information about the program without first providing sensitive information or undergoing a soft credit pull. Others claim NDR does not deliver what it promises. Some consumers feel they were misled by NDR and feel it failed to disclose just how much it would be taking in fees. Some were not made aware theyd have to pay federal income taxes. The main problems seem to be misinformation and lack of communication.

National Debt Relief is a real company working to eliminate consumer debt, but there are more than a few strings attached. Dont start adding up your savings without first considering the taxes and fees you will owe and the impact on your long-term credit history.

Dont expect to be in the clear after a phone call. The process takes time and patience, and though debt settlement comes with drawbacks, its benefits outshine at least one alternative. NDR may not be all its cracked up to be, but in many cases, it still beats bankruptcy.

6 Minute Read

Compare Debt Relief Companies

Before you sign up with a debt relief company

Debt relief companies typically charge a percentage of a customers debt or a monthly program fee for their services. And not all companies are transparent about these costs or drawbacks that can negatively affect your credit score. Depending on the company you work with, you might pay other fees for third-party settlement services or setting up new accounts, which can leave you in a worse situation than when you signed up.

Consider alternatives before signing up with a debt relief company:

- Payment extensions. Companies you owe may be willing to extend your payment due date or put you on a longer payment plan if you ask.

- Nonprofit credit counseling. Look for free debt-management help from nonprofit organizations like the National Foundation for Credit Counseling.

- Debt settlement. If you can manage to pay a portion of the bill, offer the collection agency a one-time payment as a settlement. Collection agencies are often willing to accept a lower payment on your debt to close the account.

National Debt Relief Can Help You Settle Your Debts For Less Than You Owe

A Tea Reader: Living Life One Cup at a Time

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

National Debt Relief

Our Take

National Debt Relief is a highly rated debt relief company that offers a free consultation with debt counselors who can help. Founded in 2009, this firm helps consumers settle debt for less than they owe. In our independent comparison of debt relief companies, National Debt Relief earned the highest ranking as “best overall.”

-

Free consultation can help you compare your options

-

Client portal lets you track your progress in real time

-

Fees can run as high as 25% of your settled debt

-

No mobile app available with the program

- National Debt Relief aims to help consumers settle their debts for less than they owe, saving them time and money in the process.

- No upfront fees are required. You only pay when you get results.

- A free consultation can help you decide if debt settlement is right for you.

- Get help settling credit card debt, medical debt, personal loans, payday loan debt, and even private student loans.

- Year Founded2009

- Program LengthAs little as 24 to 48 months

- Fee Schedule15% to 25% of settled debts

- Customer ServiceTelephone and email

- Phone Number800-300-9550

Recommended Reading: Credit Services Collection Agency

When To Consider Debt Relief

Debtors often turn to for-profit debt relief programs if other options havent worked. The strategy can damage your credit rating and might not work. If you think you can repay your unsecured debt within five years, consider contacting your creditors to propose a repayment plan. The plan might include consolidating debts with a lower interest credit card and following a strict budget until your debts are repaid.

Keep in mind that the for-profit debt relief industry is known for shady operators. They often demand large fees and deliver unsatisfactory results, so beware. The strategy works for some, but make sure you understand all the costs and the consequences.

Before contacting a debt relief company, consider an appointment with a nonprofit credit counselor who can review your options. In some instances, a low-cost debt management plan might achieve your goals in others, bankruptcy might be the best alternative. Before moving forward, you should review all alternatives.

Types Of Debt Addressed

National Debt Relief aims to help consumers pay off unsecured debt, which includes any type of debt that is not secured by collateral. Fortunately, this company has a debt qualifications page on their website where they explain which debts do and do not qualify. The main types of debt they address are highlighted below.

Also Check: How Does Bankruptcy Affect My Partner Australia

What Is Debt Relief

Debt relief refers to a variety of strategies for making debt easier to handle. What debt relief looks like for you may hinge on the types of debts you have and what you need help with most.

For example, you may need credit card debt relief if youre struggling to pay off credit card bills. Or you may be interested in debt consolidation if you have several types of debt to pay off.

Is National Debt Relief Right For Me

Debt settlement is a gamble. Its not for everybody, but it shouldnt be dismissed outright. Just dont let the benefits suck you in without considering the whole picture.

National Debt Relief is for consumers with over $7,500 in unsecured debt, who have exhausted all other debt-relief options apart from bankruptcy.

If you dont settle the debt, you will continue paying late fees and racking up interest as your credit score plummets. If you settle, you still have fees and taxes to pay, but you will 1) be free of all unsecured debt, and 2) be on the right track towards improving your credit score.

Heres an example that may help you decide if National Debt Relief is right for you.

Say you have $10,000 in debt and NDR gets it chopped down to $5,000. Great, right? Now, consider how much of that forgiven 5k you get to keep.

You have to pay taxes on the forgiven debt. The amount you pay usually corresponds with your tax bracket.

If youre in the 24% bracket that means you will pay $1,200 to the IRS . National Debt Relief may take up to 25% of the enrolled debt, which means theyll keep up to $2,500.

In this example, NDR saves you $5,000, but $3,700 will be gobbled up by unavoidable taxes and fees. That leaves you with $1,300 in savings.

Depending on your situation, walking away with a couple of grand may not be worth a scarred credit report.

National Debt Reliefs program would work better for 5 or 6 figure debt, especially when paired with the lower end of NDRs fee scale.

You May Like: Why Is The Us In Debt

How To Get Off A Mailing List

How To Get Off A Mailing List Consumer Assistance. To receive less commercial advertising mail, you can register for The DMAs Mail Preference Service , which allows you to opt out of national mailing lists. Find out more about MPS. Please note, The DMA does not provide marketers with consumer mailing lists or do consumer mailings.

The Bottom Line On National Debt Relief

When debt balances are growing and making payments becomes a struggle, it can be hard to see the light at the end of the tunnel. While negotiating a debt settlement may not be the ideal scenario, it could help you clear your balances so you can get back on your feet.

If youre not sure whether National Debt Relief is right for you, then Freedom Debt Relief is another company you might consider. Our head-to-head comparison of National Debt Relief vs. Freedom Debt Relief can help you see how their services line up.

Debt settlements are something that you can try to negotiate on your own for free. However, using a company like National Debt Relief puts experts on your side, and this could be an option if you prefer not to communicate with creditors directly.

- One-on-one evaluation with a debt counseling expert

- For people with $10,000 in unsecured debts and up

Also Check: Can You File For Bankruptcy During A Divorce

National Debt Relief Reviews And Complaints

| BBB accredited | |

|---|---|

| 4.7 out of 5 stars, based on 35,434 customer reviews | |

| Customer reviews verified as of | 02 August 2022 |

Many people have had positive experiences with National Debt Relief although many of the reviews come with the caveat that they haven’t finished the program. The few negative reviews complain about fees and unexpected costs, which unfortunately is common among debt relief companies.

While some customers claim they only had to pay a fraction of their debt thanks to the company, others left reviews stating they ended up paying more by enrolling in National Debt Relief’s program. And some claim the company tried to keep the money they’d saved in their escrow account when they canceled their enrollment in the program.

Pros Of Debt Consolidation Loans

- Can help improve credit through on-time payments.

- Lower monthly interest rate and more affordable monthly payments.

- Easier to manage than multiple debts with different due dates.

- Secured loans are fairly easy to get.

- Unsecured debt consolidation loans dont require collateral, so theres less risk to the borrower if they default.

- One payment means you can save money on late fees.

- Longer loan terms mean minimum monthly payments can be kept low.

Also Check: How Does Bankruptcy Work In Indiana

Is Debt Settlement Bad For Credit Scores

Yes. Debt settlement will negatively affect your credit score for up to seven years.Thats because, to pressure your creditors to accept a settlement offer, you must stop paying your bills for a number of months. Once your balances have become quite high and your creditors are worried they might not see any more money from you, its believed they are more likely to settle your debt for less than what you owe.

Where Do You Find Your Fee Amount

Unfortunately, most debt relief companies are not forthcoming about the fees. The best way to find what your National Debt Relief fees would be is by:

The Debt Negotiation Agreement is about 20-page document that outlines the fees, what National Debt Relief will do for you, and other pertinent information about the program.

On or around page 3 of the Debt Negotiation Agreement, under the Fees section, you should see the % amount for your program. It may also include the estimated number of months and the annualized percentage basis. I do not consider the annualized percentage basis as this is not a loan. If you have not received a debt negotiation agreement yet, you may be able to find that exact amount from the National Debt Relief sales representative.

When we were a debt relief company, we would communicate the fee on the phone and also have it in easy to find place on the client services agreement. See an example below:

Recommended Reading: Ct Jud Gov Foreclosure

What Do Reputable Debt Relief Providers Charge

One of the biggest things Ascend has worked towards is debt settlement fee transparency. As such, we built the following debt settlement fee calculator to allow you to compare fees between multiple debt settlement companies to help you make the most informed decision.

You can use the free resource below.

We also have helped many individuals do a consolidation of settlements to consolidate their settlement program into a program that charges much less in fees.

What Are My Options For Debt Relief Besides Filing Bankruptcy

What are Other Debt Relief Options Other Than Bankruptcy?Consolidating Your Debts. Getting a lower interest rate on some of your debts can give you the option to finally start repaying them.Selling Assets. Making the choice to sell some of your most expensive assets to get some debt repayment money is never an easy task.Call Your Debt Collectors/Creditors. Speak to Family or Friends. Start Budgeting.

Recommended Reading: Liquidation Pallets Orange County

Government Protection Against Debt And Debt Collectors

One of the biggest government debt relief programs is the legal protections that it offers. This includes the Fair Debt Collection Practices Act , which limits the actions of debt collectors. If you are behind in payments, then the last thing you want to face is harassment from a debt collector. The FDCPA prohibits debt collectors from very specific behavior including the use of abusive or threatening language, and threats of arrest.

Another area that the government offers debt relief is through collection laws and statute of limitations. These offer you protection in the case of a lawsuit and a potential judgment. These laws are both state specific and relate to the type of debt and assets.

One final area that the government offers debt relief is through a court approved bankruptcy, either a Chapter 7 liquidation, or a Chapter 13 court payment plan. Bankruptcy is generally considered a last-resort solution and not many people can qualify for a Chapter 7 bankruptcy or complete a Chapter 13 bankruptcy.

Is Debt Settlement Right For Me

While debt settlement may save you money by lowering your balances and reducing the time it takes to pay back your debt, the costs and risks are high. There are large fees, there is potential for collections and legal action, it will negatively impact your credit and theres no guarantee that adequate settlements can be made.

Donât Miss: Reviews Of National Debt Relief

Read Also: Can You File Bankruptcy During Divorce

How Does Debt Settlement Work

Debt settlement is a debt relief option that involves working with your creditors to create a debt reduction plan. It is different from a debt management plan in that, with debt management, you are still paying your creditors the full amount of your debt. With debt settlement, on the other hand, your creditors are making an agreement with you to accept less than what you owe to them.

You may wonder why creditors would agree to accept less than what you owe. The simple answer is that, when a person is experiencing financial hardship and having real trouble paying bills, creditors are aware that it is quite possible that they will be unable to recoup any money if the person declares bankruptcy. So, to avoid the possibility of getting none of their investment back, your creditors may be willing to negotiate a settlement to ensure they recoup at least some of their money.

That is not to say that creditors will make this decision lightly. For this reason, most people who choose to try debt settlement do so with the help of a debt settlement company that specializes in negotiating with creditors on behalf of their clients.

Heres how it works:

Once you decide on which plan fits you best, you will set up an escrow account and begin making payments to the account. Once sufficient funds have accumulated in your escrow account, our skilled negotiators start the process of negotiating with your creditors. And there are no upfront fees to get any of this done.

National Debt Relief Customer Reviews

National Debt Relief has an average of 4.31 out of 5 stars from customer reviews posted with the BBB. The company has also had 254 complaints filed with the BBB in the last three years.

Comparatively, New Era Debt Solutions, one of National Debt Reliefs top competitors, has an average 4.85/5 stars from BBB customer reviews. New Era Debt Solutions also has a very low complaint rate, with just 3 complaints in the last three years. Freedom Debt Relief, another top competitor, has an average 4.35 out of 5 stars from BBB customer reviews. They have had 395 customer complaints in the past three years.

Overall, National Debt Relief is a highly rated and accredited debt relief company whose scores and customer reviews are on par with their top competitors.

Recommended Reading: Buying Pallets Of Goods

When You Should And Shouldnt Use Debt Relief

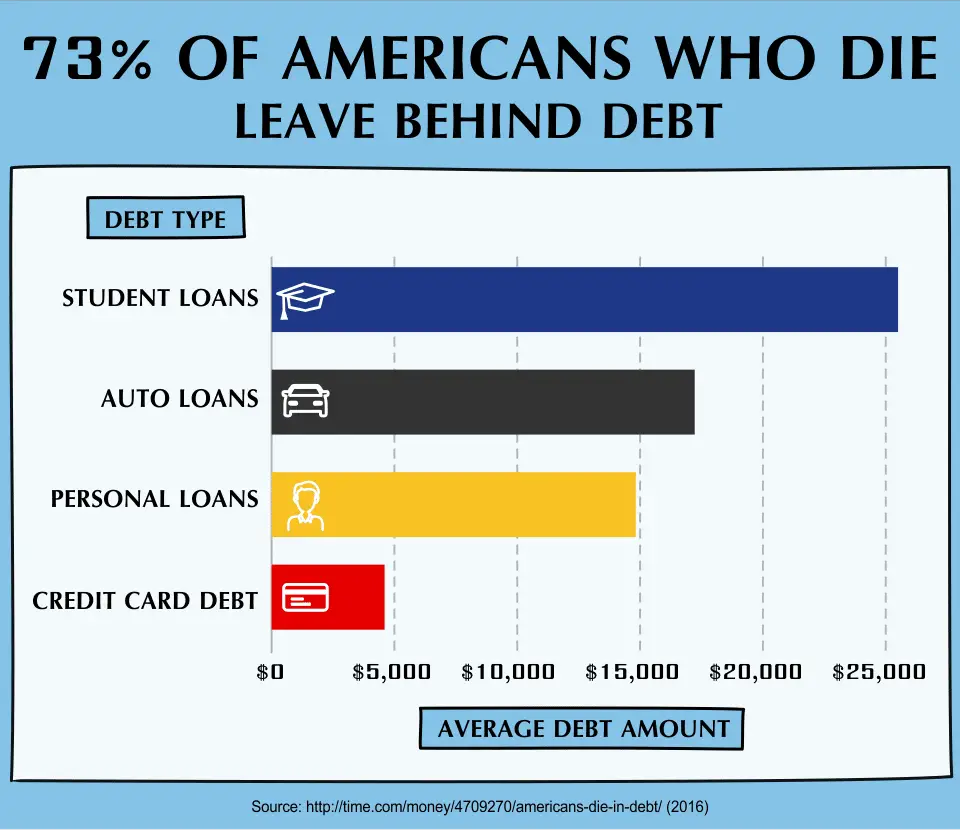

Many Americans carry debt, but owing money doesnt have to be a fact of life. If any of the following describes your current situation, consider looking into a debt-relief solution ASAP:

- You have no means to pay your unsecured debts which includes credit cards, medical debt or other debts that have no property as collateral within the next five years.

- Youre making monthly payments but, due to high interest rates, your balances arent decreasing.

- Youre behind, or about to fall behind, on bill payments.

- Youre facing serious consequences for overdue debt, such as home foreclosure or vehicle repossession.

- You struggle to choose between covering monthly debt payments and necessities.

- You avoid answering calls or opening mail for fear of being contacted by debt collectors.

Keep in mind that some debt-relief options have costs. Consider the fees and the impact to your credit before signing up for any program or new financing. If you can manage the debt yourself, at a lower cost or less credit risk, it might be worth doing on your own.

What Happened To The Debt Counsellor In The Ncr Debt Help System

The consumer has withdrawn from the debt review process prior to issuance of Form 17.2 and the credit bureaus have been updated accordingly via the NCR Debt Help System. The debt counsellor has suspended provision of service due to non-cooperation by the consumer. The debt counsellor remains the debt counsellor on record.

Read Also: Best Consolidate Credit Card Debt

You May Like: Houses For Sale Bank Owned