$58 Billion In Student Loans Discharged For Borrowers With Disabilities

In August last year, the Department of Education implemented a regulation change that allowed 323 million student loan borrowers with “total and permanent” disabilities to have more than $5.8 million of their federal loans canceled. Borrowers with these disabilities no longer have to apply for relief — they’ll be determined by data matches in the Social Security Administration, which began identifying these borrowers on a quarterly basis in September last year.

Before the policy change, only about half of borrowers with total and permanent disabilities who were identified as eligible via Social Security matches had received loan forgiveness.

If you believe that you might qualify for student loan relief from a total disability, complete the online disability application on the Social Security website.

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

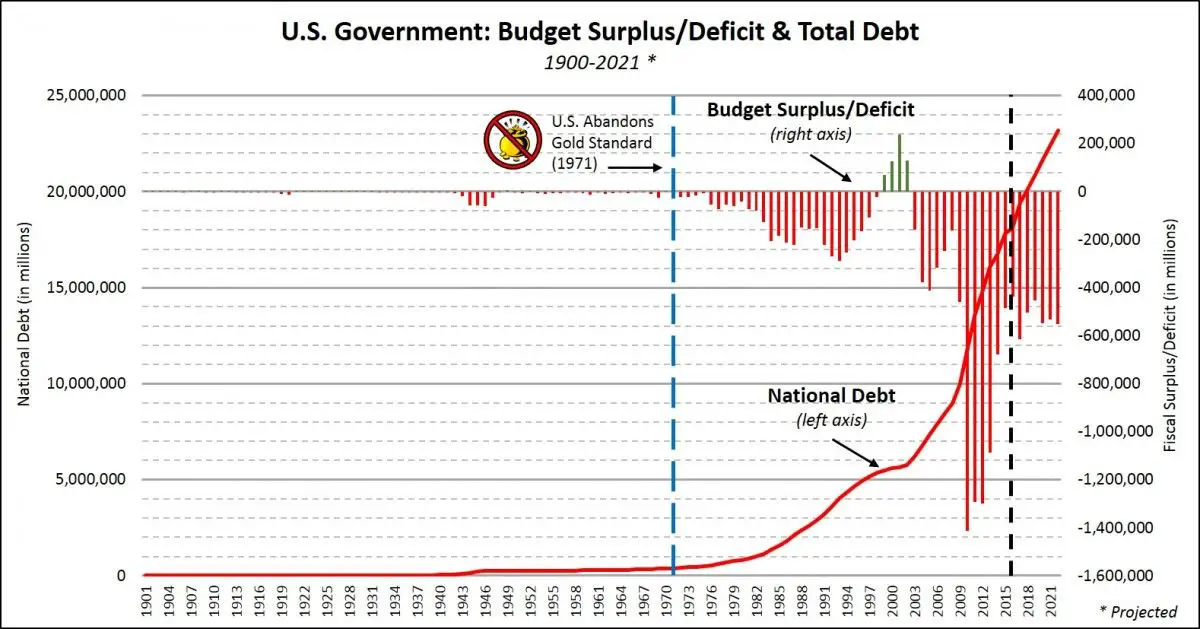

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Is China’s Strategy Working

China’s low-cost competitive strategy seems to be working. Its economy grew more than 10% for the three decades before the 2008 recession. In 2019, it grew at 6.1%, an even more sustainable rate.

China has become one of the largest economies in the world. And if you measure it by gross domestic product and consider purchasing power parity , China is seen as the worlds largest economy.

China also became the world’s biggest exporter in 2009. China needs this growth to raise its low standard of living. For these reasons, we’ll likely see China remain one of the world’s largest holders of U.S. national debt.

Read Also: What Is Consumer Debt In Bankruptcy

Our $23 Trillion National Debt: An Inter

While Americans may not personally feel the effects of our mounting debt today, we eventually will. The good news is that policy solutions can help address the issue before the bill comes due.

A founding pillar of American strength is our enduring commitment to building a bright future for the next generation. The very concept of the American Dream is rooted in this ideal.

When it comes to our nations finances, were falling short. Our federal budget will run a deficit of more than $1 trillion this year, and the national debt exceeds $23 trillion. Worse yet, our deficits and debt are projected to increase year after year, as far as the eye can see. Americas fiscal outlook is the definition of unsustainable.

While many Americans may not personally feel the effects of our mounting debt right now, the bill will ultimately come due, with interest. Running huge budget deficits damages our economy over time and eventually will diminish our leadership role in the world.

In fundamental terms, fiscal irresponsibility represents an inter-generational injustice, and a moral failure. Piling on trillions in red ink is making a choice to benefit ourselves today, at the expense of our own children and grandchildren.

In fundamental terms, fiscal irresponsibility represents an inter-generational injustice, and a moral failure. Piling on trillions in red ink is making a choice to benefit ourselves today, at the expense of our own children and grandchildren.

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

You May Like: Are Tax Debts Discharged In Bankruptcy

Why The National Debt Of The United States Is Rising

Ad Disclosure: We earn referral fees from advertisers. Learn More

Quick Navigation

The national debt of the United States stands at over $26.7 trillion as of now. This translates to almost $81,000 per person in the US.

The key reason why the national debt of the United States continues to rise is due to expenses exceeding revenue. That is, government revenue is usually less as compared to its revenue owing to several factors.

Since the government spends more than what it earns, it faces a budget deficit each year. The government has to borrow money in order to cover the deficit. But when it borrows money to cover the budget, the national debt of the United States also continues to rise.

Certain factors like social security, foreign wars, financial recessions and healthcare challenges have contributed immensely to the United States national debt.

The current state of the economy virtually guarantees that borrowing will persist well into the future. An inadequate tax system , aging population, rising health problems and overseas intervention mean that the government will have to continue borrowing to cover the budget deficit. Thus, the national debt of the United States will continue to climb.

Here is an explanation behind the key factors behind the rising national debt of the United States.

Why Is The Us In Debt

Countries around the world currently hold a national debt in order to grow the economy and the country, debt is oftentimes needed to fund expansions and programming. The United States debt levels are extremely high, and can be attributed, in part, to income inequalities and trade deficit. These two factors indicate that some level of debt must be taken on in order to keep the economy moving. The U.S.s national debt increased 840% during the period from 1989 to 2020.

Don’t Miss: Does Filing Bankruptcy Clear Student Loans

$34b In Student Loan Debt Forgiveness: Who’s Had Their Student Loans Canceled

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

What’s happening

President Biden has finally made his decision on widespread student loan forgiveness, but millions of borrowers have already had $34 billion in debt canceled during his term.

Why it matters

With 1 in 5 Americans owing student debt, loan forgiveness can help ease the pain of soaring inflation and economic uncertainty.

President Joe Biden’s decision on widespread student loan forgiveness will cancel at least $10,000 in student loan debt for all borrowers earning $125,000 or less per year. However, about 1.7 million Americans have had their entire student loan debt canceled during Biden’s term, adding up to about $34 billion in total student loan forgiveness.

The Education Department announced Tuesday that it was discharging $1.5 billion in federal loans for students who attended Westwood College, which the department says “routinely misled prospective students.” Students included in loan forgiveness will not need to file borrower defense claims — they’ll receive the debt cancellation automatically.

Less To Spend On Other Government Initiatives

The more money the U.S. has to spend on meeting its debt obligations as interest rates increase, the less financial capacity it could have to fund programs focused on education, veterans benefits and transportation.

This breakdown of the 2019 Federal Budget from the Council on Foreign Relations shows how the budget pie is only so big, so when one area increases , another must decrease.

Read Also: How To File Chapter 7 Bankruptcy Without An Attorney

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Which President Created The Most Debt

In terms of percentages, President Franklin Delanor Roosevelt added the most debt with a 1,048% increase in national debt from his predecessor President Herbert Hoover. With $236 billion added to the national debt, President Roosevelt served as president during the time of the Great Depression which largely depleted the countrys revenue. To combat this, he set up the New Deal which included relief programs and government spending to address unemployment, severe droughts and agriculture disruptions, and bank failures. The largest part of the addition to the national debt was World War II – the war cost the country $209 billion from 1942 to 1945.

Read Also: Can Income Tax Be Included In Bankruptcy

Budgeting Isnt A Priority

So how do we get away from needless spending and find the money we need to pay off our debt? Why, by keeping a budget, of course! A budget tells us how much we have to spend on all the true essentials in our life, how much we have left over, and how we can best spend that leftover money.

But for most Americans, budgeting simply isnt a priority, and its easy to understand why. When our paychecks come in, were rushing to the store to restock on groceries, buying the kids new shoes since theyve outgrown their last pair, and paying bills. We dont have time to sit down and make a budget, but without them, our money vanishes and were left with thousands in debt.

Repaying The National Debt

The national debt has to be paid back with tax revenue, not GDP, although there is a correlation between the two. Using an approach that focuses on the national debt on a per capita basis gives a much better sense of where the country’s debt level stands.

For example, if people are told debt per capita is approaching $90,000, it is highly likely they will grasp the magnitude of the issue. However, if they are told the national debt level is approaching 122.5% of GDP, the magnitude of the problem will not be properly conveyed.

Comparing the national debt level to GDP is akin to a person comparing the amount of their personal debt to the value of the goods or services they produce for their employer in a given year. Clearly, this is not the way one would establish their own personal budget, nor is it the way the federal government should evaluate its fiscal operations.

Don’t Miss: How To Select A Bankruptcy Attorney

No Light At The End Of The Tunnel

The trouble with leaving your debt until a later date is that the longer you leave it, the uglier it becomes. Charges pile up, interest accrues, and before you know it, youre staring down the barrel of a five-figure credit card statement with no idea how to pay it off. It becomes even harder to face, turning your debt into a vicious cycle.

For many Americans, the idea of ever paying off their debt seems impossible. Its just too big a number, and they dont know how theyll be able to get by and pay off their debt in their lifetimes. And because it feels like such a hopeless cause, many prefer not to tackle it at all, simply enjoying their lives and trying to ignore the mountain of debt looming over them.

How Did The Debt Get Where It Is Today

More on:

The United States has run annual deficitsspending more than the Treasury collectsalmost every year since the nations founding. The period since World War II, during which the United States emerged as a global superpower, is a good starting point from which to examine modern debt levels. Defense spending during the war led to unprecedented borrowing, with the debt skyrocketing to more than 100 percent of gross domestic product in 1946.

Also Check: What Happens To A Foreclosure After Bankruptcy

$73 Billion In Student Loans Discharged For Public Servants

In October last year, the Department of Education announced “transformative” changes to the Public Service Loan Forgiveness program, immediately making 22,000 borrowers immediately eligible for debt cancellation. The department expects its policy changes to enable more than 550,000 borrowers who had consolidated their loans to eventually become eligible for debt forgiveness.

The PSLF program cancels the remaining balance on a student loan after the borrower makes 120 qualifying monthly payments. Anyone who works for a federal, state or local government agency can apply for the program, including teachers, firefighters, military members, nurses and other employees in the public sector. The PSLF program has canceled $7.3 billion in student loan debt for 127,000 borrowers so far during Biden’s term.

The biggest changes to PSLF let borrowers count all previous payments made on Federal Family Education Loans and Perkins Loans and waive requirements of full-amount and on-time payments. However, to receive this relief, borrowers need to submit a PSLF application by . Note: if you need to consolidate your debt to qualify for PSLF relief, that process can take 45 days, so build time into meeting that end of October deadline.

For more information about PSLF policy changes and to see if you are eligible for the program and the waiver for previous payments, visit the PSLF Help Tool on the Federal Student Aid website.

Theres Never Enough Money

Think back to when you were first starting your career and what your financial situation was like then. If youre like most of us, you rented the nicest apartment you could manage to pay for and never felt like you had any money.

Now think about your present life and what your financial situation is like. You probably live in the nicest house you can afford to pay for. And even though you make far more than you did when you were younger, you likely still feel like you never have any money.

The truth is that most of us live on the outside edge of our means if we can afford a nicer house, car, or dinner, we get one. This means that no matter how much money we make, it will never feel like theres enough money, and that leads us into debt.

Read Also: Will Capital One Approve Me After Bankruptcy

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.