Does Bankruptcy Clear All Debts

Bankruptcy eliminates most unsecured debts. People often file bankruptcy because they are no longer able to keep up with the minimum payments on their credit cards or may be struggling in a cycle of payday loans. However, bankruptcy discharges a wide range of legal obligations including:

- unsecured lines of credit and bank loans

- financial company and installment loans

- unpaid bills

- accounts in collection

- judgments and lawsuits

- government obligations including tax debts and student loans if you have been;out of school for 7 years.

There are however a few debts not discharged by bankruptcy include family responsibility arrears , court fines, traffic tickets and debts due to fraud.

An unsecured creditor is required to file a proof of claim to be eligible to receive a dividend from your bankruptcy estate. However, even if they do not file a claim, unsecured debts included in your bankruptcy that exist at the date of bankruptcy are erased.

Bankruptcy also does not affect a secured creditor. As long as you keep up with your mortgage or car loan payment, you can continue to keep that asset. If you miss payments, bankruptcy does not prevent secured creditors from enforcing their rights to foreclose on your home or repossess your vehicle. If there is equity in any property beyond any exemption limit, for example substantial equity in your home, your trustee can provide you with options to keep your house or car if you can afford the monthly payments.;

Phase : Filing Date 341 Meeting Of Creditors

The 341 meeting is scheduled about 30 days after the petition date. The meeting itself typically takes less than 10 minutes to complete.

While waiting for your 341 meeting, youâll likely hear from your trustee. Theyâll let you know what documents they need from you to prepare for your 341 meeting. As long as youâve kept the documents you used when preparing your bankruptcy forms, doing this shouldnât take very long.

Most filers also get the financial management course out of the way while they wait for their 341 meeting. Bankruptcy law requires every person filing bankruptcy to complete this education course. It tends to be a little longer than the first course, usually around 2 hours.

You Must Tell The Truth At The 341 Meeting Of Creditors

The Trustee and any creditor or other party in interest is entitled to ask questions regarding your assets and liabilities, as well as any questions that are relevant to the administration of the bankruptcy case, or your right to a discharge.

Be prepared to raise your right hand, be placed under oath, and to tell the truth with an honest and open heart. The only wrong answer to a question from the trustee or a creditor is an untruthful answer.

You May Like: Bankruptcy Document Preparer

Adversary Claims And Objections

If a creditor believes its debt should not be discharged, it may file an adversary case during the bankruptcy proceeding. The most common ground for a creditor filing an adversary case is fraud.

Fraud in this context is not criminal. In this context, fraud means that the debtor abused his relationship with the creditor and bankruptcy process. Fraud supporting a creditors discharge objection could, for example, refer to a bankruptcy debtor who used a credit card to buy property or take cash advances prior to filing bankruptcy when the debtor was financially insolvent.

If a debtor incurred a debt when the debtor planned to file bankruptcy the creditor could have a basis to set aside a discharge of that debt for fraud during an adversary case.

Take Bankruptcy Course 2

One of the final hurdles you will have to clear before the court can grant you a bankruptcy discharge is the financial management course. The court will even send you a notice about this course shortly after your case is filed, although you cant actually take this course until after your case has been filed.

In fact, it doesnt even have to be completed before the meeting of creditors, but it makes sense to get it out of the way. This way, you know you are completely done with all of the minimum requirements when you are done with your creditors meeting.

You have to make sure that you go to a company approved to offer this course to folks filing bankruptcy in Arizona. If you liked the company you used for your first class, you may want to find out right then and there if they are approved to offer this second course, too. You may even be able to get a package deal!

You May Like: What Is Epiq Bankruptcy Solutions Llc

Read Also: How To File Bankruptcy In Wisconsin

How Can The Debtor Obtain Another Copy Of The Discharge Order

If the debtor loses or misplaces the discharge order, another copy can be obtained by contacting the clerk of the bankruptcy court that entered the order. The clerk will charge a fee for searching the court records and there will be additional fees for making and certifying copies. If the case has been closed and archived there will also be a retrieval fee, and obtaining the copy will take longer.

The discharge order may be available electronically. The PACER system provides the public with electronic access to selected case information through a personal computer located in many clerk’s offices. The debtor can also access PACER. Users must set up an account to acquire access to PACER, and must pay a per-page fee to download and copy documents filed electronically.

Concluding The Meeting Of Creditors

The bankruptcy trustee will conclude the meeting after asking questions if no further information or documentation is required from you. If the trustee concludes your hearing, you don’t have to come to another hearing. You’ll receive your discharge after meeting all other requirements.

However, if the trustee requires further informationor wants to give a creditor additional time to examine youthe trustee will usually set another hearing date to allow you time. If all that is required is additional documentation, the trustee might take the continued meeting off the calendar if you provide the information promptly . But, if the trustee has more questions, you’ll have to go to the next hearing.

Recommended Reading: How Many Bankruptcies Has Donald Trump

Previously Filed Chapter 13 And Filing Chapter 7 Now

If you received a discharge from Chapter 13,;you will need to wait six years from the date you filed that case before you filing Chapter 7. It should be noted that there is an exception to this rule. The six-year limit does not apply if, during the Chapter 13 you did the following:

- paid back all of your unsecured debts, or

- paid back at least 70% of unsecured debts and your plan was proposed in good faith and your best effort.;

What Happens If The Trustee Concludes Your Meeting Of Creditors

If the bankruptcy trustee has no further questions and is satisfied with the information provided in your bankruptcy papers and supporting documentationand any creditors who might have appeared are satisfied, as wellthe trustee will conclude your meeting of creditors. You won’t need to appear at another hearing in front of the bankruptcy trustee.

However, this doesn’t mean that you will receive your discharge immediately. Your creditors have 60 days from the date of your initial meeting of creditors to object to your discharge. If no creditors object and you’ve completed all other requirements , then you’ll receive your discharge after the deadline for filing objections passes.

Don’t Miss: How To File For Bankruptcy In Wisconsin

Speak With A Professional

The U.S. Bankruptcy Court strongly suggests that those filing get an attorney. Court officials, including judges, are barred by law from offering advice to people whove filed for bankruptcy. The court does have information and documents available for those doing it themselves, legally called pro se.

What If You Get Into Debt Again

Depending on the timing between discharges, you may be able to file for bankruptcy again. Here is the timeline:

- From Chapter 7 to another Chapter 7: Eight Years

- From Chapter 13 to another Chapter 13: Two years

- From Chapter 7 to Chapter 13: Four Years

- From Chapter 13 to Chapter 7: Six Years

If you don’t qualify for another bankruptcy or you simply don’t want to file again, you also have other options to becoming debt-free.

You May Like: Epiq Corporate Restructuring Llc

Providing Additional Required Information

In some cases, the bankruptcy trustee asks for more information either because your documents are incomplete or one of your creditors has raised an objection. Once the trustee has all the required information, they will conclude the hearing. After the hearing, your creditors have 30 days to make an objection.

Youll Need To Verify Your Identity

Every bankruptcy attorney and trustee has their stories about mistaken identities, and the issues that follow. Although the bankruptcy system is built on trust, it is also built on verification.;The trustee is required to verify your identity.

Bring photo identification, and a document showing your social security number such as your social security card, or a pay stub.

Recommended Reading: Filing For Bankruptcy In Wisconsin

Filing Bankruptcy Without Your Spouse In Arizona

Spouses typically apply for loans and credit cards jointly, in both of their names. This makes each of them contractually liable for the debt. But occasionally debt is taken out in only one spouses name during marriage. In these situations, the spouse named on the debt is contractually liable for the debt, and the other spouse is not. People often mistakenly assume this means the un-named spouse has no liability for the debt, and therefore need not consider filing bankruptcy if the debt isnt paid. Unfortunately, that is not a correct assumption here in Arizona.

Dont Miss: How To File Bankruptcy In Wisconsin

Phase : Discharge Case Closed

Once the bankruptcy trustee has determined that thereâs no property they can sell for the benefit of creditors, theyâll file a Report of No Distribution. This lets everyone know that itâs a no-asset case and can happen anytime after the 341 meeting. No asset cases are typically closed by the court within 1 – 2 weeks or so.

If the trustee hasnât filed a Report of No Distribution, the case will stay open until the trustee signals to the court that theyâve completed their work on the case. How long this process takes can vary greatly, as it depends on what kind of property the trustee is selling and what else is going on in the case.

In some cases, all the trustee is waiting for is the filer’s tax return for the year their bankruptcy case is filed in. If no specific exemption for a tax refund exists, a portion of the refund may be used by the trustee to pay creditors.

Usually, not much else is required from the filer during this process. But, if the trustee asks for additional information or otherwise requests assistance with the sale of property, the filer has a duty to help.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Florida Bankruptcy Means Test

The Florida bankruptcy;means test;is a complex formula to determine eligibility to file Chapter 7 bankruptcy. Debtors whose household income is under their states median income, and debtors whose debts are primarily business-related debts, are exempt from means test qualification. Bankruptcy debtors whose gross household income is above median income must;pass the means test;to file Chapter 7 bankruptcy.

A Basic Guide For Filing A Chapter 7 Bankruptcy Case

Determine whether filing for bankruptcy is the best option for you. Filing for bankruptcy is not always the best solution, so it is best to discuss your situation with an Ohio bankruptcy;attorney so that you can learn about all of your alternatives. With the right legal advice, you should be able to make an informed decision about whether filing for bankruptcy is the right choice for you.

Read Also: Bankruptcy Falls Off Credit Report

The Conclusion Of The Meeting Of Creditors Will Bring A Feeling Of Relief

The trustee will adjourn the 341 meeting of creditors when all questions have been asked and answered, which often takes less than five minutes.

For most parties that file bankruptcy, there are no Court hearings with a judge, and the meeting of creditors is the only face-to-face interaction with the trustee or the court system.

In the majority of cases, the bankruptcy proceeding will automatically proceed to a discharge of debt after the 341 meeting is adjourned.

It is entirely natural to focus some nervous energy on the meeting of creditors, but most people say that wasnt so bad when the meeting is over.

For many people, the conclusion of the meeting of creditors is the time when their relief from debt seems real, and they experience the opportunity of their fresh start and start to move forward with a second chance.

What Is A Bankruptcy Discharge

A bankruptcy discharge is the legal order that officially releases you from paying back certain debts following a Chapter 13 or Chapter 7 bankruptcy case.

Bankruptcy discharges not only release you from paying back their debts , but they legally prohibit creditors from taking action to collect outstanding debts. So you shouldn’t receive any more letters, phone calls or threats to sue once your bankruptcy has been discharged.

In the case of Chapter 13, the discharge occurs once the debtor completes all the payments set out in the bankruptcy plan. That process can take up to four years. For Chapter 7 cases, discharges are granted around four months after filing a bankruptcy petition with the courtas long as additional objections to the discharge aren’t filed.

It’s important to know that not all debts can be discharged, and depending on what chapter you file under, you may be responsible for paying outstanding debts even if you’ve received a discharge.

Read on for more information about which debts can be discharged and what effect the process might have on your credit.

You May Like: What Is A Bankruptcy Petition Preparer

What If The Trustee Didnt Say Anything Like That

In some cases, the trustee wonât yet know whether theyâll be treating your case as a no-asset case at your creditorsâ meeting. If the trustee asked for more documents or another meeting was scheduled, youâll need to provide the trustee the documents they requested and attend the meeting unless you receive confirmation that the meeting was canceled.

Otherwise, they will still conclude the meeting but they will not be filing a report of no distribution with the court. Instead, theyâll continue working on your case until they know which way to go with it.

If the trustee determines at any point after your 341 meeting that you donât have any unprotected property that they could use to pay your creditors, theyâll file the âno distributionâ report with the court. If your discharge has already been granted when that happens, the only thing left in the case is for the court to close it.

Are All Of The Debtor’s Debts Discharged Or Only Some

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523 of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy. Congress has determined that these types of debts are not dischargeable for public policy reasons .

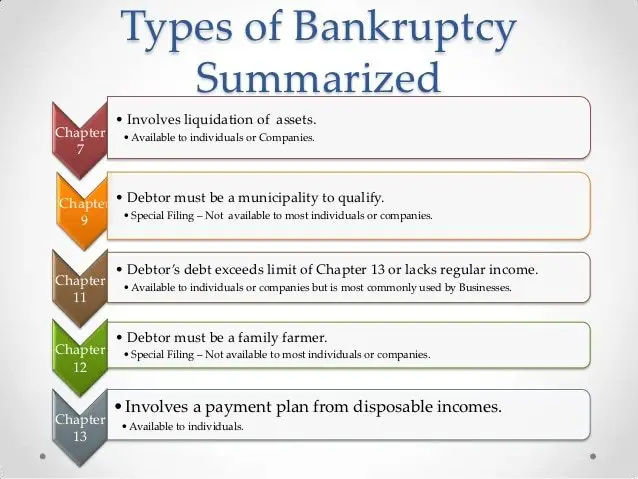

There are 19 categories of debt excepted from discharge under chapters 7, 11, and 12. A more limited list of exceptions applies to cases under chapter 13.

Generally speaking, the exceptions to discharge apply automatically if the language prescribed by section 523 applies. The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units for fines and penalties, debts for most government funded or guaranteed educational loans or benefit overpayments, debts for personal injury caused by the debtor’s operation of a motor vehicle while intoxicated, debts owed to certain tax-advantaged retirement plans, and debts for certain condominium or cooperative housing fees.

You May Like: When Does Chapter 7 Bankruptcy Fall Off Credit Report

Bankruptcy Timeline Step 5 Financial Freedom

About 90 days after the filing of the case, you can start checking the mail.; The United States Bankruptcy Court will mail you the official order discharging you of all your debts.; Now, the majority of your debts are officially history! ;At this point, you can check out Detroit Lawyers Credit Repair Kit to increase your score as quick as possible.

Remember, the bankruptcy timeline starts with a FREE INITIAL CONSULTATION.; So, contact Detroit Lawyers at 248.237.7979 to take your first step towards financial freedom!!

Find Out What Happens In Your Bankruptcy Case When Your Meeting Of Creditors Is Over

Updated by Cara O’Neill, Attorney

COVID-19 Updates: Retirement and Stimulus Fund Protections; Safe Filings.

If you’re one of the millions laid off due to COVID-19, bankruptcy can erase bills while keeping most retirement accounts intact. And you don’t need to worry about losing your stimulus fundsthe new bankruptcy “recovery rebate” law protects stimulus checks, tax credits, and child credits. Bankruptcy lawyers will consult with you virtually, and courts continue to hold 341 creditor meetings telephonically or by video appearance unless an in-person meeting is necessarysee the U.S. Trustee’s 341 meeting status webpage for details.

Streamline your researchtake our bankruptcy quiz to identify potential issues with your bankruptcy case.

Everyone who files for Chapters 7 and 13 must attend a hearing called creditors’ meeting . Here’s what happens after the initial creditors’ meeting:

- If the trustee or a creditor needs documents or more questions answered, the trustee will continue the meeting to another day.

- If the trustee and creditors are satisfied, the trustee will conclude the creditors’ meeting.

What happens after the trustee concludes the meeting will depend on whether it’s a Chapter 7 or 13 case.

- In Chapter 7, you’ll file your debtor education certificate and wait for your discharge.

- In Chapter 13, you’ll go to a repayment confirmation hearing and, if the court confirms your plan, you’ll make the required payments over three to five years.

Recommended Reading: Who Is Epiq Corporate Restructuring Llc