Chapter 11 Filing Fees And Administrative Fees

As of 2020, you will pay $571 to file a Chapter 11 bankruptcy. This is considered an administration fee.

If you ask to divide a joint case , you will pay another $571 in administration fees. Then, you will pay $1,167 to file the new motion with divided cases. It is $1,167 to reopen a dismissed case.

Where Can I Find Chapter 11 Bankruptcy Forms

All bankruptcies are filed with a federal bankruptcy court. The bankruptcy court you choose should be close to where you live, operate your business, or hold significant assets during the six months before filing. Otherwise, your case could be dismissed or delayed.;

You can find forms for Chapter 11 bankruptcy on the U.S. Courts website. Its also possible to get forms at the clerks office at the bankruptcy court closest to you.;

What Are The Disadvantages Of Filing Chapter 11

Chapter 11 bankruptcy is the most complex of all bankruptcy cases. It is also usually the most expensive form of a bankruptcy proceeding. For a company that is struggling to the point where it is considering filing for bankruptcy, the legal costs alone might be a bit onerous. Plus, the reorganization plan has to be approved by the bankruptcy court and must be manageable enough to where they can reasonably pay off the debt over time. For these reasons, a company must consider Chapter 11 reorganization only after careful analysis and exploration of all other possible alternatives.

Don’t Miss: What Is Bankruptcy Code In India

After Chapter 11 Bankruptcy

In many cases, a business may re-emerge from Chapter 11 and continue to operate normally. In other cases, the reorganized business can be sold after some period of time.

Disclaimer: The content in this article and on this website is for informational purposes only. The author is not an attorney or tax professional. Every business bankruptcy situation is different, and bankruptcy laws and regulations. If you are considering business bankruptcy, find a bankruptcy attorney and financial advisors who can help you with this process.;

When Company Files Chapter 7 Or Chapter 11 Investors Often Lose Out

If a company you’ve invested in files for bankruptcy, good luck getting any money back, the pessimists sayor if you do, chances are you’ll get back pennies on the dollar. But is that true? The answer depends on a number of factors, including the type of bankruptcy and the type of investment you hold.

Also Check: What Can They Take In Bankruptcy

Appointment Or Election Of A Case Trustee

Although the appointment of a case trustee is a rarity in a chapter 11 case, a party in interest or the U.S. trustee can request the appointment of a case trustee or examiner at any time prior to confirmation in a chapter 11 case. The court, on motion by a party in interest or the U.S. trustee and after notice and hearing, shall order the appointment of a case trustee for cause, including fraud, dishonesty, incompetence, or gross mismanagement, or if such an appointment is in the interest of creditors, any equity security holders, and other interests of the estate. 11 U.S.C. §;1104. Moreover, the U.S. trustee is required to move for appointment of a trustee if there are reasonable grounds to believe that any of the parties in control of the debtor “participated in actual fraud, dishonesty or criminal conduct in the management of the debtor or the debtor’s financial reporting.” 11 U.S.C. §;1104. The trustee is appointed by the U.S. trustee, after consultation with parties in interest and subject to the court’s approval. Fed. R. Bankr. P. 2007.1. Alternatively, a trustee in a case may be elected if a party in interest requests the election of a trustee within 30 days after the court orders the appointment of a trustee. In that instance, the U.S. trustee convenes a meeting of creditors for the purpose of electing a person to serve as trustee in the case. 11 U.S.C. §;1104.

As discussed above, a trustee is appointed in each subchapter V case. 11 U.S.C. §;1183.

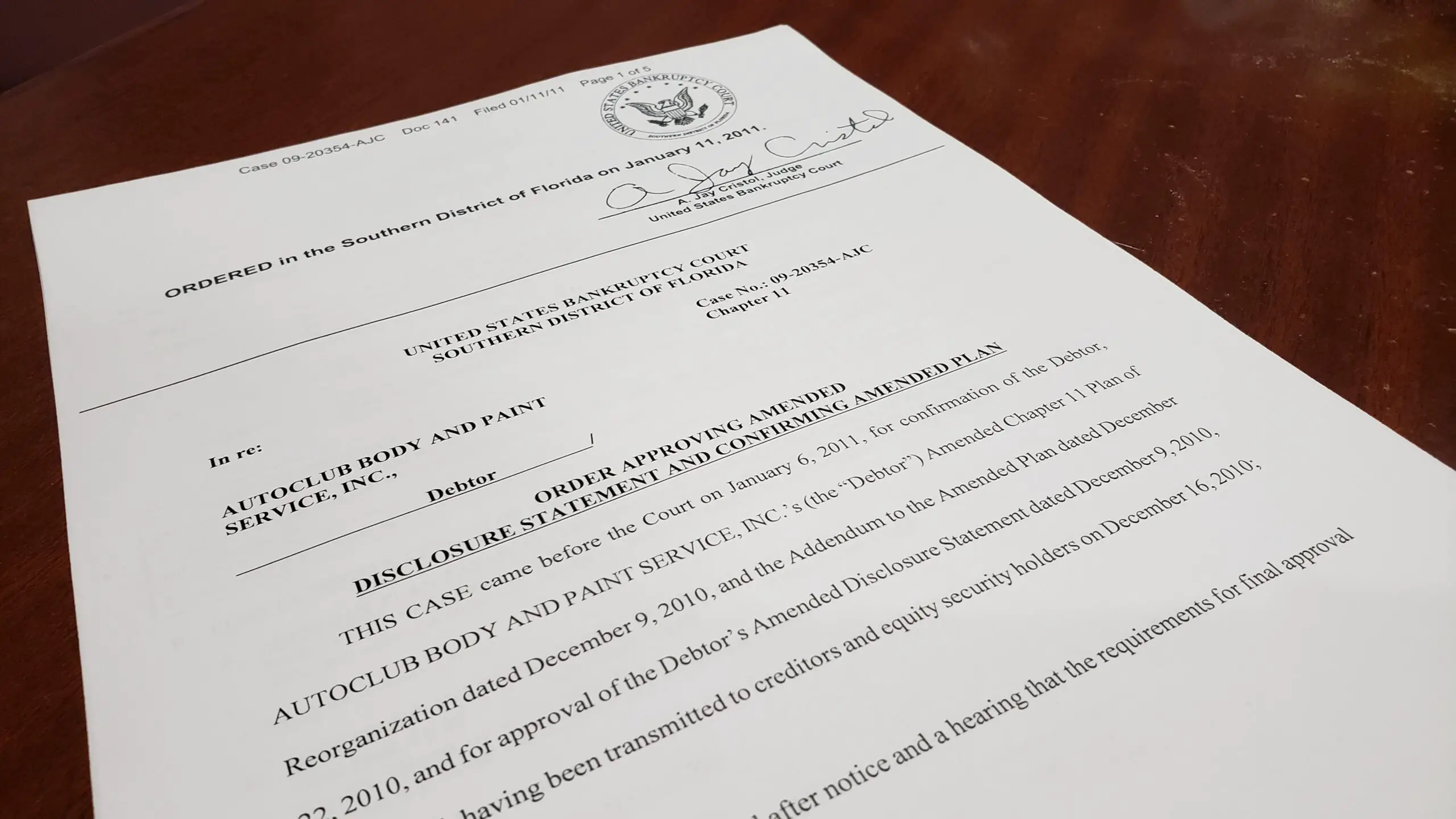

What Is The Process

Begin with the disclosure statement, describing the debtors structure and how it conducts its business. Its here the business seeking relief attempts to convince the court reorganization will help it survive and recover to the point of profitability.

Confirmation follows, in which creditors vote on the reorganization plan. Creditors are parceled into classes, and their votes weighed, based on the type and amount of debt they hold. Generally, the judge and creditors must approve the plan, although there is an exception in which the debtor company gets its way through whats known as cram down.

Next comes the post-confirmation period, in which the company attempts to make good on its restructuring, making promised payments, through a third party, to creditors.

If successful, the final phase arrives: The companys restructuring has prevailed, the creditors are substantially repaid, and the bankruptcy is discharged.

Going through Chapter 11 isnt cheap. Theres a $1,167 filing fee, administrative costs for the U.S. Trustee, and, most likely, an experienced bankruptcy attorney banking endless billable hours.

Read Also: How To File For Bankruptcy For Credit Card Debt

Chapter 11 Personal Bankruptcy

So why would an individual choose Chapter 11? Its a viable option if they A) dont want to liquidate all their assets in Chapter 7, or B) have too much debt to qualify for a reorganization plan under Chapter 13.

Your debts cant exceed $1,184,200 in secured debt and $394,725 in unsecured debt in order to qualify.

Thats why celebrities and pro athletes often file Chapter 11. Real estate investors also find it handy since it allows assets to be written down.

For instance, if you own a property worth $98,000 but owe $150,000 on the loan, you can reduce the principle balance of the mortgage to the value of the property. So your new mortgage number would be $98,000.

Chapter 11 also allows you to reduce the interest rate and extend repayment terms. That would mean lower monthly payments.

New Easier And Faster Small Business Bankruptcy Option Explained

Chapter 11 Business Bankruptcy is a legal process by which a business may declare bankruptcy but continue to operate the business under supervision. This process is called “reorganization,” because the bankruptcy process reorganizes the business to be more efficient and to be able to pay the creditors of the business. It’s kind of like getting a “reboot” for your business, to bring new life into it.

Chapter 11 is available to any type of business, including sole proprietorships,Limited Liability Companies , and corporations.

The bankruptcy process for Chapter 11 and other types of bankruptcies;are run through a special legal system , called bankruptcy court.;It’s under the circuit court system in the U. S. Courts website.

You May Like: How To Access Bankruptcy Court Filings

Rare Cases: Chapter 11 For Individuals

Chapter 11 bankruptcy reorganization was initially intended for businesses. The 1991 U.S. Supreme Court case Toibb v. Radloff decided that non-business, individual consumers are also eligible.

This is exceedingly rare. This unusual route usually is pursued by individuals who:

- Still have substantial personal earning potential

- Have debts exceeding the limits set forth by Chapter 7 and Chapter 13

A typical non-business Chapter 11 bankruptcy filer might be a celebrity who got in over their head with bad investments. They would possibly still have earning potential through product endorsements, for example.

Chapter 11 is generally considered more debtor-friendly than other types of bankruptcy, including the ability to “cram down” certain forms of debt. This means the court pushes through a plan over the objections of some creditors.

Speak With A Credit Counselor

If youre in enough debt that youre considering the extreme step of filing bankruptcy, the first thing you should do is speak to a credit counselor. , which is available free through nonprofit accredited debt management agencies, can be a good way for a nonjudgmental person who understands the ins and outs of personal finances, to help you fully assess what your situation is. Credit counseling can also help if you need financial advice after a bankruptcy.

Nonprofit accredited debt management agencies can be found through the NFCC. The counselor may recommend a debt management plan, in which they negotiate lower interest rates with creditors, usually credit card companies. You would pay one monthly payment to the debt management agency over three to five years, and the agency pays your creditors. Unlike bankruptcy, this doesnt appear on your credit report, and is a less catastrophic way to pay down debt without filing bankruptcy.

10 Minute Read

Recommended Reading: How Many Different Chapters Of Bankruptcy Are There

Lease Or Executive Contract Debt

Chapter 11 permits you to accept or reject your leases and executive contracts. For example, imagine you are a hotel owner and previously contracted with a cleaning service for the next five years. You find you can now obtain similar services for half the price, thus increasing the profitability of the business. Chapter 11 will allow you to sever the contract with the current cleaning service. You may then ask the court to allow you to seek a new, more affordable service. As long as you can show that the new contract and corresponding service will contribute to the profitability of the business, the judge will authorize the new contract.

Another example would be if your company leased office space. That same office space may be leasing for twice as much since you originally signed the lease. The bankruptcy code requires you to affirm your intent to retain that lease within a certain number of days after filing or you are automatically deemed to have rejected it. Failure to act may cause you a great deal of time and money and the bankruptcy judge will be powerless to help you correct your mistake.

Failure To Pay Your Employees During Chapter 11 Bankruptcy

Failure to pay your employees during Chapter 11 bankruptcy can result in the following adverse actions:

Also Check: How Does Bankruptcy Affect Buying A House

The Role Of An Examiner

The appointment of an examiner in a chapter 11 case is rare. The role of an examiner is generally more limited than that of a trustee. The examiner is authorized to perform the investigatory functions of the trustee and is required to file a statement of any investigation conducted. If ordered to do so by the court, however, an examiner may carry out any other duties of a trustee that the court orders the debtor in possession not to perform. 11 U.S.C. §;1106. Each court has the authority to determine the duties of an examiner in each particular case. In some cases, the examiner may file a plan of reorganization, negotiate or help the parties negotiate, or review the debtor’s schedules to determine whether some of the claims are improperly categorized. Sometimes, the examiner may be directed to determine if objections to any proofs of claim should be filed or whether causes of action have sufficient merit so that further legal action should be taken. The examiner may not subsequently serve as a trustee in the case. 11 U.S.C. §;321.

Examiners may not be appointed in subchapter V cases. 11 U.S.C. §;1181 .

Chapter 11 Title 11 United States Code

Chapter 11 of the United States Bankruptcy Code permits reorganization under the bankruptcy laws of the United States. Such reorganization, known as “Chapter 11 bankruptcy”, is available to every business, whether organized as a corporation, partnership or sole proprietorship, and to individuals, although it is most prominently used by corporate entities. In contrast, Chapter 7 governs the process of a liquidation bankruptcy, though liquidation may also occur under Chapter 11; while Chapter 13 provides a reorganization process for the majority of private individuals.

Also Check: How To File Bankruptcy In Iowa For Free

Filing A Chapter 11 Petition

You can start the petition process with an attorney or by yourself. The debtor then begins to develop their reorganization plan.

The bankruptcy court will accept a reorganization plan if it is:

- Developed and structured “in good faith.” This means it was created honestly and with good intentions. Courts will review all the paperwork in the case to determine if you had good or bad faith.

- In compliance with all applicable laws, local laws, court orders, Bankruptcy Code, reformed laws, Bankruptcy Rules, and all current temporary laws

Once approved, the court will confirm the plan. Any debts that existed before the confirmation date but were not directly addressed in the plan may be discharged. The company is obligated to pay the remaining creditors following the reorganization plan.

Some debt is dismissed or negotiated to be less money. This allows repayment plan amounts to be much lower than the original debt.

The debtor will need to:

- Examine each creditors’ claims throughout the process

- Make objections where it makes sense

- Provide monthly operating reports to keep the court updated on progress

The business gets to continue their day-to-day work after the petition is filed. While they carry on without interruption, the debtor will create a repayment plan under the bankruptcy court’s supervision.

How Much Does It Cost To File A Chapter 11 Bankruptcy

The fee for Chapter 11 bankruptcy filings is $1,738. In comparison, the fees for Chapter 7 and Chapter 13 are significantly lower. In addition to court costs, those filing for Chapter 11 are likely to pay much more.;

Attorneys, advisors, accountants, and consultants typically play a major role in Chapter 11 filings. Some experts estimate that a Chapter 11 bankruptcy can cost as much as 1-5% of the value of the debtors assets.;

Also Check: How Often Can You File Chapter 7 Bankruptcy

Downsides To Chapter 11 Bankruptcy For Small Businesses

If you own a small business, you will want to seriously consider whether Chapter 11 is right for you.

Chapter 11 gives small businesses extra time to create a plan, file it, and renegotiate repayment terms with their creditors . But it also has its drawbacks.

It can cost tens of thousands of dollars in legal fees, which may be unsustainable for a struggling small business.

If the emergence from bankruptcy protection proves successful, these costs are offset by the ultimate reward of becoming profitable. In any case, it’s best to discuss your options with a seasoned business bankruptcy attorney before deciding.

Chapter 11 Vs Chapter 7

With a Chapter 7 bankruptcy, there is no reorganization plan or restructuring of debt to continue operations. Its a straight liquidation of assets in which a trustee is appointed to sell a persons non-essential assets.

Houses and cars are usually put up for sale. Among the items that can be protected are pensions, reasonable necessary clothing, household goods and jewelry up to a certain value.

The proceeds go to creditors and the filer is legally cleared of debt. Legal fees are usually not an issue, though there is a $245 filing fee.

Thats the good news. The bad news is your is wrecked and you will have a near-impossible time getting a loan at a reasonable interest rate.

» More about:Chapter 7 vs. Chapter 11 Bankruptcy

You May Like: How Do You Get A Bankruptcy Off Your Credit Report

Priority Claims Vs Non

Unsecured Creditors with a priority claim are not secured by collateral, however they are treated with higher priority over other claims by Federal law. A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims.;

These might include bank lenders, employees, the government if any taxes are due, suppliers, and investors who have unsecured bonds. This class of bankruptcy claims are dependent on unrestrained assets of a bankruptcy estate for payment. This class of claims typically carry priority for public policy reasons, and thus under law are required to be paid out as a matter of priority to fulfill their special obligations. For instance, priority claims may include: employee compensation owed, unpaid tax obligations, and accounting and legal costs for administering the bankruptcy case.

Unsecured creditors with non-priority claims, otherwise known as general unsecured claims, are debts that possess no priority and are not supported by any secured interest or collateral in the Debtors bankruptcy estate. These types of bankruptcy claims might include credit card debts, student loans, personal loans, or utility and medical bills. Non-priority unsecured creditors have the lowest position in the priority scheme.;

Speak To An Experienced Chapter 11 Bankruptcy Attorney Today

This article is intended to be helpful and informative. But even common legal matters can become complex and stressful. A qualified chapter 11 bankruptcy lawyer can address your particular legal needs, explain the law, and represent you in court. Take the first step now and contact a;local chapter 11 bankruptcy attorney to discuss your specific legal situation.

Recommended Reading: What Does Declaring Bankruptcy Do For You