When Should I Take The Debtor Education Course

In a Chapter 7 case you should sign up for the course soon after your case is filed. If you file a Chapter 13 case, you should ask your attorney when you should take the course. Although the debtor education course may be taken later in Chapter 13 cases it is recommended that you take the course as soon as possible after filing your case. In any event, and regardless of which chapter your case is filed under, the debtor education course is not valid if taken before your case is filed.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada;will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Read Also: Get Personal Loan After Bankruptcy

Can Bankruptcy Help Prevent Or Slow Down An Eviction From An Apartment

The automatic stay described above again may apply to protect you from, or at least delay, an eviction. However, if a landlord has already received a judgment for possession in unlawful detainer, you may be too late.

Some states may be kind enough to allow you to cure your rent default. However, it is likely you will not be able to stop eviction after judgment. Of course, if you file bankruptcy before judgment, the creditor will have to discontinue any efforts to obtain your payments. This includes eviction and possession proceedings.

How Can I Avoid Going To Jail Over My Debts

Usually, no one is sent to jail from not paying debts. That is a thing of the past. However, there are certain things on top of not paying debt that land people behind bars.

The first, and perhaps most common, is when people intentionally violate a court order. If the court has ordered the payment of certain debts or child support, and you disobey this order, you may face jail time in contempt. However, most judges want to see you have the ability to pay your debts, which is difficult when spending time in jail. Contempt will usually only put you in jail if you intentionally do not pay in order to send a message.

Perhaps the more obvious way to end up in jail is to stop paying income taxes. This is one payment that should not be missed.

Finally, if you are involved with a debtor investigation, and you do not show up as ordered, you can be thrown in jail to insure your cooperation.

In short, it is very unlikely you will end up in jail regardless of nonpayment if you are diligent in obeying other laws.

Don’t Miss: Does Declaring Bankruptcy Affect Your Spouse

Alternatives To Filing Chapter 7 Bankruptcy

If you are wondering;if you should file for bankruptcy, there are many nonprofit consumer credit counseling organizations that have the ability to negotiate more favorable terms with creditors. Its particularly effective with credit-card companies. The repayment program will be managed expertly and fees could be avoided.

Here are some options:

Debt Management Plan; Entering into a debt management program can provide relief from interest rates, late fees and penalties from creditors. Under a DMP, which is negotiated by credit counselors, you promise to pay back the full principal over time in an efficiently managed manner.

The debt management program provides an organized monthly payment plan. It provides an opportunity to handle the debt more efficiently than trying to sort it out yourself. By keeping the payments on track, it will be good for your credit score.

Some caveats: There is generally an enrollment and maintenance fee and the DMP is never a guaranteed option. Creditors have no obligation to participate.

Debt Consolidation This option reduces interest rates and combines all of your debts into one manageable monthly payment. Under debt consolidation, you take out a loan, which is used to consolidate and pay off all of your other debts.

Personal Loan for Bad Credit; Yes, you can get a personal loan with bad credit, depending on your situation. You can expect high interest rates and should only consider this option if you can truly afford the monthly payment.

Delay In Completing The Financial Management Course

Before you receive your discharge, you must take a financial management course within 60 days of your meeting of creditors. Failure to complete this course within the time allotted will delay your discharge and the closure of your case.

In the worst case scenario, the court will close your case without granting your discharge. This means that you leave your bankruptcy still owing your debts. Although you can usually reopen your case in order to file the certificate showing you completed the financial management course, this can be costly and complicated, and take more time.

You May Like: Does Chapter 13 Bankruptcy Cover Student Loans

Read Also: What Is Epiq Bankruptcy Solutions Llc

Bankruptcy Myths And Misinformation

The majority of anxiety clients face in deciding whether to file bankruptcy is often from lack of information or incorrect information from other people who do not understand Colorado bankruptcy. These people perpetuate stereotypes which put you in a worse position and create a barrier to your fresh start and financial freedom.

A quick initial consultation with a Colorado bankruptcy attorney can resolve most of your questions and allow you to make an informed decision. The attorney can explain Colorados local procedures and bankruptcy rules. In addition, they can help you explore alternatives to bankruptcy including debt settlement.

To help educate our clients on common bankruptcy myths, we have created this web page.

Can I File Bankruptcy Without A Lawyer

Although it may be possible for some people to file a bankruptcy case without an attorney, it is not recommended. The process is difficult and you may lose property or other rights if you do not know the law. Bankruptcy law is complex. Filing bankruptcy takes patience and careful preparation. If you start a bankruptcy case and: you fail to complete it; you make a mistake and are denied a discharge; or you make other errors, you may be barred from filing again for many years. While hiring an attorney may seem expensive it may be money well spent in the long run, and in a chapter 12 or 13 bankruptcy the attorneys fees may be paid through the repayment plan.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Rebuild Your Credit After Filing Bankruptcy

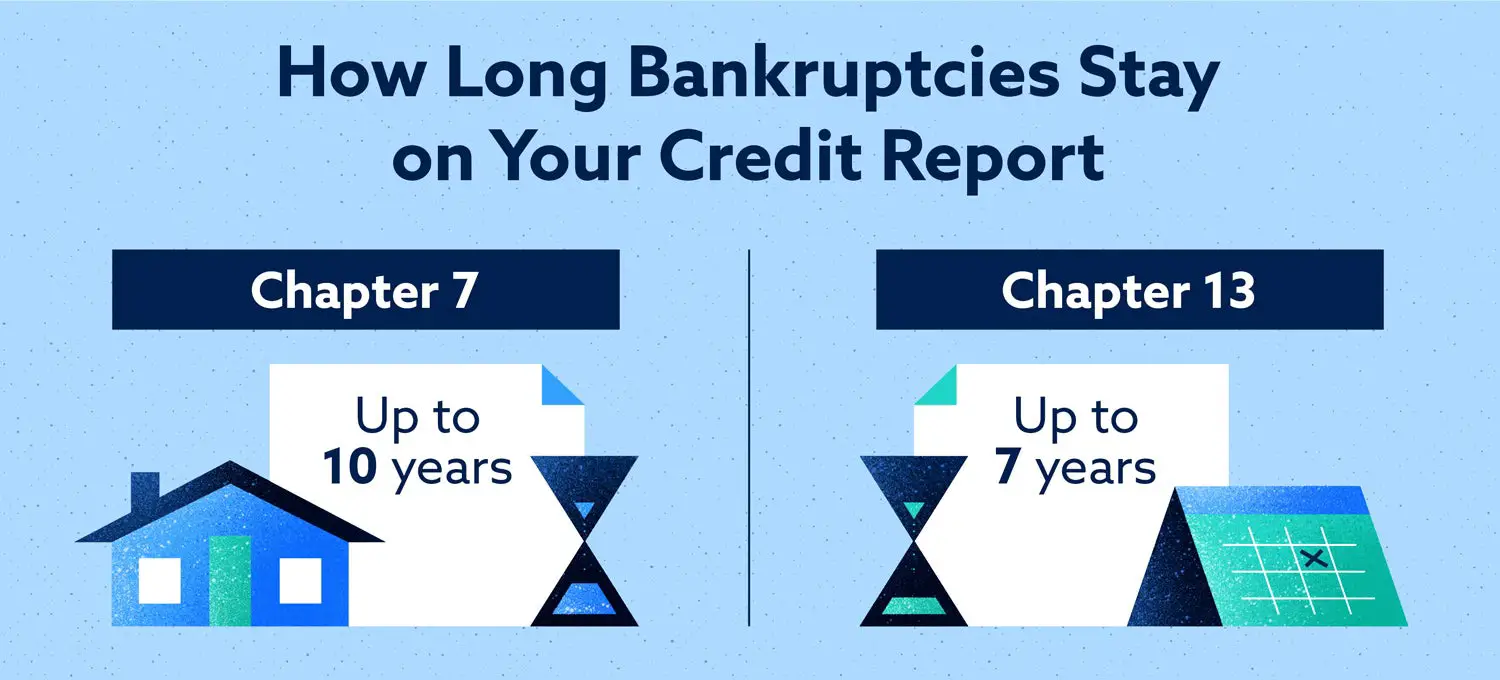

Unfortunately, Chapter 7 bankruptcy can negatively impact your credit;and Chapter 13 can negatively impact your credit. That said, you have an opportunity to rebuild your credit shortly after bankruptcy. To assist, you can use our free credit rebuilding portal designed to help you increase your credit score by 100 points in less than 6 months.;

Attend The Meeting Of Creditors

The 341 meeting of creditors and the hearing where all debtors must attend in a bankruptcy proceeding. The meeting often occurs between 21 and 50 days after filing the petition. It generally takes 10 to 15 minutes. The meeting is a recorded conversation between the trustee, your bankruptcy attorney, and yourself about the paperwork you filed. The bankruptcy trustee will ask questions to ensure that you understand the bankruptcy process.

Do Creditors Show Up?

Understand Colorado Court Locations

Many 341 meetings of creditors have been over the phone or over Zoom due to the pandemic. That said, you may want to see where the courthouse is in Colorado if there are any meetings that need to take place in person. Below are the court locations for filing bankruptcy based on the bankruptcy district.

- 901 19th Street Denver, CO 80294

- 1929 Stout Street Denver, CO 80294

- 212 N. Wahsatch Avenue Colorado Springs, CO 80903

- 400 Rood Avenue Grand Junction, CO 81501

- La Plata County Courthouse1060 E. 2nd Avenue, Suite 150Durango, CO 81301

Recommended Reading: Getting A Personal Loan After Bankruptcy

Withdraw Some Money For Your Living Costs

There may be a delay of several days between your bankruptcy order being made and the official receiver taking control of your money and property. However, your bank or building society accounts may be frozen immediately, meaning you won’t be able to access any money. Therefore, you should take enough money out of your account to cover your costs for the next few weeks, if possible.

Can I Transfer Assets Before Filing Bankruptcy

When you file for bankruptcy, a trustee is sometimes allowed to recover any transferred property as part of the bankruptcy estate. Of course, like most answers to legal questions, this depends on the circumstances. When exactly was the transfer made? How were the proceeds spent? Why did you make the transfer? Was the property exempt?

If your property is exempt, there is really no bad faith reason for you to transfer or sell that property. Exempt property cannot be used to settle your debts, so you can keep that property after bankruptcy. However, it is important that you get the fair value price for this property. If you did not, it may be obvious you were just trying to dump the property to hide it from the trustee.

Thus, any planning done before bankruptcy in deciding to sell or transfer assets should be done with the consultation of an experienced attorney.

Recommended Reading: How Many Bankruptcies Has Trump Had

Which One Should I Choose

Chapter 7 is, by far, the more popular form because its cheaper, quicker and effective at relieving responsibility for debt if you qualify! And thats a big if. You must pass a means test, meaning your disposable income is under the median income in your state. If you dont qualify for Chapter 7, you can always fall back on Chapter 13.

Will They Send Someone Out To My House To Look Through All Of My Things

Although this is very unlikely, there are circumstances where a trustee may be required to visit your home. Typically this is required if you fail to report certain assets or properly provide values to your property. If you are honest, and you properly report your assets you will protect yourself from such an intrusion.

A trustee will never, of course, show up unannounced. They must set a time with you, but you must also show up as requested. Trustees will also not be allowed to take things from your home without your permission. Even so, an attorney can be by your side to protect you from these intrusions.

Your attorney will help you to make certain you have appropriately and accurately reported your assets so no one will need to come to your home.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Understand The Costs Of Filing Bankruptcy In Colorado

When you file for bankruptcy, you need to understand the cost and affordability of bankruptcy. The costs primarily consist of the filing fee and the attorney fee . Firstly, most attorneys offer payment plans. Some also offer $0 down payment options. The cost of the attorney can be variable based on such factors like your location and the difficulty of the case.

We built this Colorado attorney fee calculator to help you estimate costs based on your specific zip code.;

If you cannot afford a payment plan, you may also look at the legal aid options in your state and also how the filing fee waiver works.

Legal Aid In Colorado

There are certain situations where you could get help through legal aid. Please note that each legal aid may have criteria set for who they will help. Here are legal aid option in Colorado.

Filing Fee Waiver in Colorado

Theres a filing fee to file bankruptcy. You can check the Colorado filing fee waiver requirements to see whether you may be eligible for the filing fee waiver.;

Is Filing Bankruptcy Expensive

Filing anything in court can be an expensive process. Filing fees alone can make bankruptcy an unattractive option.

Chapter 7 filing fees total to $335. and Chapter 13 costs $310.

These payments can be made in installments with permission from the court.

In rare circumstances, the court may even waive the fee entirely for indigent individuals. This means you must make less than 150 percent of the poverty line, and you must be unable to make the necessary installments.

You will also be required to receive credit counseling within six months. This can cost around $50 per class, but there are places that do offer it cheaper.

You will also have the fees of an attorney if you choose to hire one. The cost of an attorney is dependent upon your specific circumstances and what Chapter of bankruptcy it is determined is best for you.

There are clear advantages to hiring an attorney so you do not end up losing any of your property or otherwise doing anything to potentially impact your ability for a discharge.

Read Also: Bankruptcy Court Filings

Additional Factors That Can Affect How Long A Chapter 7 Bankruptcy Takes

There are many factors that can affect how long a Chapter 7 bankruptcy will take. In Phase 1 of a bankruptcy we are completely dependent upon you to provide us with information. We do not know anything about you except what you tell us. Filing a case can be delayed if the information you give us is incomplete, inaccurate, or disorganized. A filing can also be delayed by failing to utilize the technology we have in place to streamline the process. We have a cloud-based document management system in place to allow documents quickly and easily to be shared with us. If you chose to mail your documents to us, we must receive, process, and scan them. This means it may take us weeks instead of minutes to be able to utilize those documents.

During Phase 2 there are many events that can delay a discharge. For instance, anything which requires the Meeting of the Creditors to be re-scheduled will push back the deadline for filing objections and as a result your discharge. The Meeting of the Creditors may be re-scheduled due to the discovery of the need to amend the petition and schedules, if you fail to appear, or if you don’t have the proper identification . If you own your home or a vehicle loan and you want to negotiate a re-affirmation agreement or redeem the property this too might cause a delay in your discharge. Finally, in event that there is any objection or other issue that needs to be decided by the court could also cause a delay in your discharge.

Vincent G. Trott

Wait For The Adjudicator’s Decision

After you submit your application, the adjudicator will decide either to make a bankruptcy order or reject your application. The adjudicator has 28 days to make their decision.

If they need more information about your case, they will contact you. If they do need to contact you, they will have 14 more days to make a decision.

If they decide to reject your application, you can ask them to review their decision. If they confirm their decision to reject your application after the review, you can appeal to the court against the decision.

To request an appeal, you need to submit form N161 to your local court that deals with bankruptcy. You can find form N161 on the GOV.UK website.

Read Also: Can You File Bankruptcy On Unemployment Overpayment

Days After The Meeting Of Your Creditors

Your creditors have 60 days after the date first set for the;Meeting of Your Creditors;to object to the discharge of any of the debts listed in your petition and schedules.

Your creditors can object to your request to discharge a debt if the debt was obtained or incurred as a result of any of the following types of misconduct: fraud; embezzlement or larceny; and any willful or malicious injuries you have caused others; or a divorce or separation .

Additionally, your creditors can object to the discharge of all your debts if you have engaged in any of the following conduct: concealment or destruction of property or financial records; false statements; withholding information; failing to explain losses; failure to respond to material questions; or a discharge in a prior case filed within the last 6 years.

The trustee must move to dismiss your case within this time period if he finds that the granting of relief would be an abuse of the provisions of;Chapter 7. You will receive your;Chapter 7;discharge 60 days after the meeting of your creditors You will receive your discharge as soon as the 60-day time period for objecting to discharge or moving to dismiss your case expires. Even if you receive your discharge, the trustee may, however, move to set it aside if you do not turn over nonexempt property or if you commit other bankruptcy violations.