How Does The Bankruptcy Code Treat Medical Debt

Bankruptcy law categorizes the debts that an individual owes creditors as secured or unsecured debt. Secured debt is backed by collateral that can be seized for nonpayment, such as an automobile serving as collateral for a car loan. Unsecured debt is money owed on credit cards, to public utilities, or for services, such as medical care. The third type of debt is what the Bankruptcy Code considers priority debt, including child support, alimony and taxes.

The law recognizes that, in personal bankruptcy, some debt will have to be forgiven for the debtor to emerge from bankruptcy. Some debt may be discharged. Unsecured debt, including medical bills, has the lowest priority for repayment in the eyes of the Bankruptcy Court.

Depending on the type of bankruptcy pursued a Chapter 7 liquidation or a Chapter 13 reorganization outstanding medical bills may be discharged or potentially reduced.

Medical Bills In Chapter 7 Bankruptcy

Chapter 7 bankruptcy requires the debtor to sell off assets to pay creditors. It is known as a liquidation. But some assets are protected under Chapter 7 rules, and some debts may be forgiven. Among the debts that may be discharged are medical bills.

However, there are income limits you must meet to file a Chapter 7 bankruptcy. The Chapter 7 bankruptcy means test focuses on whether you have adequate regular income to pay some amount of money toward your debts. If you cannot, many of your debts can be discharged. If your current monthly income is less than the median income for a household of your size in North Carolina, you are presumptively eligible for bankruptcy under Chapter 7.

If not, the cost of your living expenses compared to your income may make you eligible for Chapter 7 bankruptcy. Several types of allowable expenses are considered, and each is calculated according to the number of people in your household. Recurring health care costs are calculated separately according to whether individuals in the household are younger or older than 65 years old.

Whats left when you deduct allowable expenses from your income is your disposable income. If your disposable income is more than the median monthly income in North Carolina, you may not be eligible for a Chapter 7 bankruptcy. You may have to pursue a Chapter 13 bankruptcy, which involves developing a plan to repay your debts.

Medical Debt Statistics To Know

Can you file bankruptcy on medical bills? Over 66.5% of all bankruptcies are tied to medical issues, according to a CNBC study. While the Affordable Care Act has helped 20 million people gain insurance coverage, the number of uninsured Americans is creeping back up and subsequently more medical bankruptcies in the US. According to KFF, 45% of uninsured adults based in the United States said they cant afford the cost of health care coverage and expensive medical treatments.

These high medical care costs can lead people to cut corners in their healthcare management, which leads to medical bankruptcies. On top of how many people file bankruptcy, The Burden of Medical Debt report from the Kaiser Family Foundation and The New York Times found the following:

- 65% of participants postponed going to the dentist.

- 62% used over the counter medicine in lieu of seeing a doctor when sick.

- 43% did not fill a needed prescription.

- 43% did not get medical treatment recommended by a doctor.

- 41% claimed that an individual in the household needed to take on more work to compensate.

Recommended Reading: How To File Bankruptcy In Wisconsin

Americans Medical Debts Are Bigger Than Was Known Totaling $140 Billion

A new study finds that health care has become the countrys largest source of debt in collections. Those debts are largest where Medicaid wasnt expanded.

- Read in app

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

- Read in app

By Sarah Kliff and

Americans owe nearly twice as much medical debt as was previously known, and the amount owed has become increasingly concentrated in states that do not participate in the Affordable Care Acts Medicaid expansion program.

New research finds that collection agencies held $140 billion in unpaid medical bills last year. An earlier study, examining debts in 2016, estimated that Americans held $81 billion in medical debt.

This new paper took a more complete look at which patients have outstanding medical debts, including individuals who do not have credit cards or bank accounts. Using 10 percent of all credit reports from the credit rating agency TransUnion, the paper finds that about 18 percent of Americans hold medical debt that is in collections.

The researchers found that, between 2009 and 2020, unpaid medical bills became the largest source of debt that Americans owe collections agencies. Overall debt, both from medical bills and other sources, declined during that period as the economy recovered from the Great Recession.

The new paper does not include data during the coronavirus pandemic, which is not yet available.

Drug Pricing Continues To Influence Candidate Choice For 35% Of Adults

About one-third of Americans say that lowering the cost of prescription drugs is either the single most important issue or among the most important issues that will influence their vote in 2020. This is up five percentage points since February, returning to the level measured in September 2019. Another 40% report that the issue is of “mid-range” importance, while 24% report that it is the least or among the least important.

Across key subgroups, little change has been measured since September. Views of women and men have converged since last fall, but neither is significantly different from 2019 views. Race and household income, in turn, currently closely match 2019 results. Non-White adults continue to place much higher importance on the issue than their White adult counterparts , while half of respondents from households earning under $40,000 per year continue to report that the issue will be highly influential to their vote.

| Gallup-West Health U.S. Healthcare Study, July 2020 |

Also Check: What Happens When You File For Bankruptcy In California

Despite Aca Health Insurance Has Become Less Affordable Since 2015

More people with health insurance have had a difficult time affording their health care since 2015. For premiums in 2017, 37% now find it difficult to pay versus 27% just two years ago. Meanwhile, 43% are having a hard time paying their deductibles in 2017 while just 34% were struggling in 2015. And finally, copays and prescription drugs seriously affected 31% of people in 2017 versus 24% in 2015.

Chapter 13 Bankruptcy And Medical Debtif You Cannot Qualify For Chapter 7 Bankruptcy You Will Likely Be Able To File Under Chapter 13

Chapter 13 bankruptcy allows people who have a steady income to develop a plan that enables them to pay all or a portion of their debts over three to five years. Chapter 13 bankruptcy is a reorganization program and is sometimes referred to as a wage earners plan. It requires the debtor to devote their disposable income to the repayment plan for its duration.

In a Chapter 13 bankruptcy, the debtor submits to the Bankruptcy Court a plan for paying their debts, often through payroll deduction and a trustee who ensures distribution of payments to creditors. The plan must be confirmed by a North Carolina bankruptcy judge and is subject to objections from creditors, which the judge will hear and rule on.

Once the payment plan is completed, the court will grant a discharge of remaining low-priority debts, which includes medical bills and other unsecured debt. However, unsecured creditors must receive at least what they would have been paid if the debtors assets had been liquidated under a Chapter 7 bankruptcy. This is referred to as the liquidation test.

Because of the liquidation test and/or disposable income test, a Chapter 13 bankruptcy may result in paying all debts in full but, in many cases, remaining general unsecured debt such as medical bills and credit cards are reduced or discharged at the conclusion of the payment period.

You May Like: How Many Times Has Trump Filed Bankrupsy

Financial Assistance By Organizations

The PAN Foundation is considered to be “an independent, national 501 organization dedicated to helping federally and commercially insured people living with life-threatening, chronic and rare diseases with the out-of-pocket costs for their prescribed medications” and the non-profit organization has provided approximately 1 million patients those are underinsured with a financial aid equaling to $3 billion since 2004. Apart from that, the national organization “providing free, professional support services and information to help people manage the emotional, practical and financial challenges of cancer”, CancerCare has provided $39.7 million as a financial assistance to reportedly 24,767 people in order to help with treatment-related medical costs.

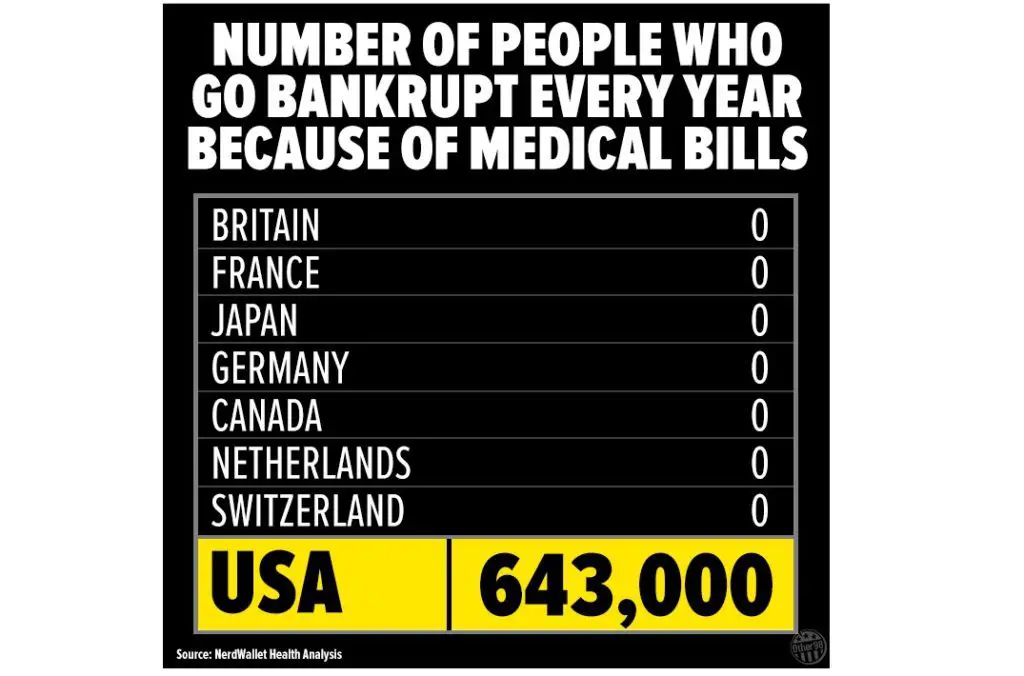

Medical Bankruptcies In The Us

Declaring a Chapter 7 bankruptcy is one of the ways to eliminate medical debt. However, you must first check whether you qualify for one. To do so, you can use a Chapter 7 Bankruptcy Means Test Calculator.

Now:

Do you wonder how often healthcare-related expenses force people into bankruptcy? Read on!

18. Medical costs caused bankruptcy every 30 seconds before the Affordable Care Act.

President Obama said in March 2009 that the cost of healthcare causes a bankruptcy every 30 seconds and that 1.5 million Americans were expected to lose their homes during the year.

In 2010, the Affordable Care Act was signed into law. The healthcare reform aimed to provide affordable health insurance coverage for all US citizens. And while still a problem, we cant ignore the decline in medical bankruptcies since Obamacare.

19. Medical bankruptcies represent 66.5% of all personal bankruptcies.

The declining healthcare affordability remains one of the major issues in the US. A simple injury or a minor medical inconvenience can run you thousands of dollars. Even those with health insurance can be charged absurd amounts of money. This is the main reason why two-thirds of all personal bankruptcies in the US are due to medical bills.

More than half a million American families are forced to file for bankruptcy every year as they cant repay their healthcare-related debt, 2019 medical bankruptcy statistics show.

20. The average age of those who file for medical bankruptcy is 44.9 years.

Read Also: Has Trump Declared Bankruptcy

Poor Or Excess Use Of Credit

Some people simply can’t control their spending. bills, installment debt, car, and other loan payments can eventually spiral out of control until finally, the borrower is unable to make even the minimum payment on each type of debt.

Having an emergency fund, medical insurance, and keeping your debt-to-credit ratio low are all ways to protect yourself from a future declaration of bankruptcy.

If the borrower cannot access funds from friends or family or otherwise obtain a debt-consolidation loan, then bankruptcy is usually the inevitable alternative.

Statistics indicate that most debt-consolidation plans fail for various reasons, and usually only delay filing of bankruptcy for most participants. Although home-equity loans can be a good remedy for unsecured debt in some cases, once it is exhausted, irresponsible borrowers can face foreclosure on their homes if they are unable to make this payment as well.

Top 5 Reasons Why People Go Bankrupt

Medical Costs In The Us

1. National health expenditure reached $3.8 trillion in 2019.

In 2019, the nation increased its healthcare-related expenditure by 4.6% compared to 2018. Data shows that American health expenditure accounted for 17.7% of the GDP. Medicare spending grew to $799.4 billion, or by 6.7%.

The 2020 update is yet to be released. According to CMS estimates, the figure will reach $4.01 trillion. But the Covid-19 health crisis is likely to have an adverse effect on the total amount, just like on the other medical bankruptcies statistics on this list.

2. The average medical insurance premium has increased by over 50% in the past decade.

The average annual employer-sponsored family premium was $21,342 in 2020. This is a 4% increase from the previous year. Since 2010, the cost has gone up by 55%.

And the national average premium for a benchmark marketplace plan in 2021 is $452 a month.

3. Americans spend an average of $5,000 a year on out-of-pocket health care costs.

This figure includes insurance, medical supplies, and prescribed drugs. For comparison, in 1984, the typical household spent about $2,500 a year on healthcare. Unsurprisingly, insurance accounts for most of that increase, having skyrocketed by a whopping 740%.

4. Drug prices rose 4.2% in the second half of 2020.

Not only insurance costs are rising.

The latest GoodRXs semi-annual update shows that drugmakers have hiked the prices of a total of 589 medications.

Also Check: Do Bankruptcies Affect Getting An Apartment

Impact On Nonmedical Debt

Chapter 7 bankruptcy eliminates many types of unsecured debt, including debt from credit cards and personal loans, so filing may not be a great solution if you hold other debts but only want to solve an issue with medical bills.

Debts not backed by property or other collateral are considered unsecured. Unsecured debt generally includes, but isnt limited to, medical debt, credit card debt and certain kinds of personal loans.

The Best Way To Avoid Medical Debt Bankruptcy

One of the best ways to skip bankruptcy related to medical bills is disease prevention, primarily by managing chronic illnesses and keeping away from their medical complications. However, it is clear that accident-related medical costs cant be avoided.

Furthermore, health insurance cant wholly protect from higher medical prices since there can be unforeseen out-of-pocket expenses. If this is the case, a financial backup is needed. Unfortunately, according to medical bankruptcies for 2021 statistics, only one-third of Americans have more than $1,000 in savings. Its recommended that people store away 36 months of expenses in savings to cover at least the amount of possible deductibles.

Recommended Reading: How Many Times Has Trump Filed Bankrupcy

Concerns Mount Over Looming Surge In Bankruptcy As Covid Medical Debt Soars

Case numbers and daily death tolls continue to drop, the majority of U.S. adults are fully or partly vaccinated, mask mandates are vanishing and summer socializing looks like it’s back on the calendar. But even as America keeps marching steadily toward a post-pandemic future, another COVID-19 crisis loomsa debt and bankruptcy disaster fueled by mounting medical bills associated with treatment, especially among the most financially vulnerable parts of the population.

As many as 12.5 million Americans could already be saddled with COVID-related medical debt, based on a LendingTree survey conducted in March. The nationally representative poll found that 60 percent of the respondents polled had medical debt, with about 10 percent stemming from the virus the amount typically owed ranged from $5,000 to $9,999. That suggests the collective debt for COVID treatment so far could be between $60 billion and $125 billion.

“A lot of people are getting bills they can’t pay,” says David Himmelstein, a professor at City University of New York School of Public Health at Hunter College and author of several seminal studies on medical bankruptcy. “We’re heading towards a mounting debt crisis for many people who have been sick during this COVID period that will ripple through the economy unless something is done about it.”

How Many Bankruptcies Are Due To Medical Bills

This is a difficult question to answer because there are different ways medical bills can lead a person to file bankruptcy:

-

cases where hospital bills make up most of the debt

-

cases where the cost of medical care and lack of insurance coverage caused the filer to use credit cards to pay for other expenses

-

cases where the filer used credit cards to pay for medical expenses not covered by their health insurance

In 2005, then-Harvard professor Elizabeth Warren published a paper concluding that more than 40% of personal bankruptcies are due to medical debt. This number was updated to more than 60% in 2009.

From experience, we can tell you that almost all low-income Americans who file bankruptcy have some sort of medical debt. Hereâs just a small sampling on questions related to medical debts from our Facebook Community.

You May Like: Can You Rent An Apartment After Filing Bankruptcy

What Is Medical Debt

The SIPP shows that in 2017, 19% of U.S. households carried medical debt, defined as medical costs people were unable to pay up front or when they received care. Among households with medical debt, the median amount owed was $2,000, meaning half had more and half had less.

Like other debt, medical debt means that households have less money to spend on other essential items, such as food and housing. People with medical debt, or at risk of accumulating medical debt, may also forgo needed medical care or treatment. Medical debt can also lead to bankruptcy.

Medical Debt Is A Costly Burden On Americans Finances

Whether youre scheduling a mammogram or calling an ambulance in an emergency, it should be a no-brainer to seek medical treatment when you need it. But Americans who cant afford medical care might think twice before visiting a doctor to avoid getting stuck with debt over it.

Sixty percent of Americans have been in debt due to medical expenses, our survey found.

Medical debt can weigh as heavily on a households budget as any other debt, such as , auto loans or even student loans. On average, Americans with medical debt owe between $5,000 to $9,999. Most owe more than $1,000, and 13% owe more than $20,000.

Medical debt affects virtually everyone, but it can be most burdensome for the people who need chronic treatment, such as patients with cancer, heart disease or diabetes. Long-term illnesses can keep patients in and out of the hospital, and the only thing they know for certain is that theyre getting a bill at the end of their visit. Of those with medical debt, 82% said they or a member of their household have an underlying health condition.

Recommended Reading: Taco Bell Bankruptcy Closing