Is China In A Debt Crisis

Their outstanding debt amounted to $8 trillion at the end of 2020, Goldman Sachs estimated, equivalent to around half of China’s gross domestic product last year they also replaced property developers as the biggest Chinese debt issuers offshore, with $31 billion of dollar bonds coming due in 2022.

Is Ireland Richer Than Usa

The economy: Irish people are now richer than Americans, according to the report. For the first time since the report was compiled, the Irish GDP per capita, adjusted for purchasing power to $36,360, is higher than the US figure of $35,750.This is about half the levels found in the US or Scandinavian countries.

Why China Loves To Own Us Debt

Chinese lenders snap up so much of the U.S. debt for one basic economic reason: protecting its dollar-pegged yuan.

Ever since the establishment of the Bretton Woods System in 1944, the value of Chinas currency, the yuan, has been connected or pegged to the value of the U.S. dollar. This helps China hold down the cost of its exported goods, which tends to make China, like any nation, a stronger performer in international trade.

With the U.S. dollar considered one of the safest and most stable currencies in the world, dollar-pegging helps the Chinese government maintain the stability and value of the yuan. In May 2018, one Chinese yuan was worth about $0.16 U.S. dollar.

With most forms of U.S. debt, like Treasury bills, redeemable in U.S. dollars, worldwide trust in the dollar and the U.S. economy, in general, remains Chinas main safeguard for the yuan.

Recommended Reading: Debt To Income Ratio For Heloc

How Many Countries Are In Debt To China

Researchers found that these nations’ debt obligations to China are significantly larger than international research institutions, credit ratings agencies or intergovernmental organizations estimate. The report claims that 42 countries now have public debt exposure to China that exceeds 10% of their GDP.

What Percentage Of Us Taxes Go To Military

Defense and security spending is considered a discretionary portion of the federal budget. Spending in this category includes Department of Defense and Homeland Security Agency expenses. For the fiscal 2019 budget, defense spending equaled about $697 billion, or approximately 16 percent of the federal budget.

Recommended Reading: Can You File Bankruptcy On Back Taxes

Why Is China Americas Biggest Banker

Why China Is Americas Biggest Banker. Thats 19 percent of the $6.3 trillion in Treasury bills, notes, and bonds held by foreign countries. The rest of the $21 trillion national debt is owned by either the American people or by the U.S. government itself. China holds the greatest amount of U.S. debt by a foreign country.

Less To Spend On Other Government Initiatives

The more money the U.S. has to spend on meeting its debt obligations as interest rates increase, the less financial capacity it could have to fund programs focused on education, veterans benefits and transportation.

This breakdown of the 2019 Federal Budget from the Council on Foreign Relations shows how the budget pie is only so big, so when one area increases , another must decrease.

You May Like: Number One Cause Of Bankruptcies In Us

What We Learned About Chinas Overseas Lending

Our data show that almost all of Chinas lending is undertaken by the government and various state-owned entities, such as public enterprises and public banks. Chinas overseas lending boom is unique in comparison to capital outflows from the United States or Europe, which are largely privately driven. We also show that China tends to lend at market terms, meaning at interest rates that are close to those in private capital markets. Other official entities, such as the World Bank, typically lend at concessional, below-market interest rates, and longer maturities. In addition, many Chinese loans are backed by collateral, meaning that debt repayments are secured by revenues, such as those coming from commodity exports.

The Peoples Republic has always been an active international lender. In the 1950s and 1960s, when it lent money to other Communist states, China accounted for a small share of world GDP, so the lending had little or no impact on the pattern of global capital flows. Today, Chinese lending is substantial across the globe. The last comparable surge in state-driven capital outflows was the U.S. lending to war-ravaged Europe in the aftermath of World War II, including programs such as the Marshall Plan. But even then, about 90% of the $100 billion spent in Europe comprised grants and aid. Very little came at market terms and with strings attached such as collateral.

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

Don’t Miss: What Happens To Your Credit Score When You File Bankruptcy

Countries That Owe The Us The Most Money

Heres a fun fact: most of the 10 countries that owe the U.S. the most money also own a lot of U.S. debt. But it actually makes a lot of sense once we get past the initial absurdity of it all.

In the same way that federal debt can be owned by foreign entities, whether they are governments, companies, or individuals, foreign debt can be owned by the U.S. government, as well as American companies or people. Every year, the U.S. Department of the Treasury releases a report on how much foreign securities are being held by U.S. entities. These securities include equity holdings such as stocks and similar assets, as well as long-term and short-term debt.

According to the latest report of the U.S. Department of the Treasury, which was released in October 2016, the U.S. owns a total of $9.46 trillion in foreign securities, including $6.76 trillion in equity and $2.70 trillion in debt. This debt can come from foreign governments, institutions, or companies, so most of these debts are not exactly a countrys debt. The report covers holdings accrued as of the end of 2015, so it will be likely that information on American holdings of foreign debt as of 2016 will not be released until later this year.

vipman/Shutterstock.com

10. Luxembourg

9. Mexico

8. Germany

7. Japan

IamDoctorEgg/Shutterstock.com

6. France

Ioan Panaite/Shutterstock.com

5. Netherlands

Christian Mueller / Shutterstock.com

4. Australia

Victor Maschek / Shutterstock.com

3. Cayman Islands

2. United Kingdom

1. Canada

Why Do Countries Accumulate Foreign Exchange Reserves

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a countrys central bank. First, sovereign debt frequently comprises part of other countries foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

Don’t Miss: Is Bankruptcy State Or Federal Law

How Much Money Do We Owe The Chinese

Continuing a trend that began early in 2021, China’s portfolio of U.S. government debt in May dropped to $980.8 billion, according to Treasury Department data released Monday. That’s a decline of nearly $23 billion from April and down nearly $100 billion, or 9%, from the year-earlier month.18-Jul-2022

Top 10 Countries The Us Owes Money To

In 1989, New York real estate investor Seymour Durst spent $120,000 to erect a “National Debt Clock” in Times Square to track the exact amount of money that the U.S. federal government was borrowing to pay its bills. At the time, the country had run up a $2.7 trillion tab, but that figure seems almost quaint today. In 2008, the clock briefly ran out of available digits when the debt topped $10 trillion. By June 2021, the upgraded clock which can now display up to a quadrillion dollars registered more than $28 trillion .

Now, it’s important to understand that U.S. doesn’t owe that entire $28 trillion to its creditors, which include individuals, businesses and foreign governments who purchased U.S. Treasury bonds and securities. More than 20 percent of the national debt, or $6.2 trillion, is incurred for intragovernmental holdings, which are funds the U.S. government owes itself, mainly for the Social Security and Medicare trust funds . In June 2021, these two trust funds alone accounted for some $2.4 trillion of the national debt.

But the question we want to answer today is, who owns the bulk of that $28 trillion in public debt? You can find out by perusing our global parade of America’s biggest sugar daddies, according to the U.S. Department of the Treasury.

Contents

Read Also: Pre Foreclosure Homes Zillow

What Would Happen If The Us Paid Off Its Debt

According to a report published by Moody’s Analytics, the US GDP would decline, approximately 6 million jobs would be lost and the unemployment rate would increase dramatically. And, just as significantly, the country’s track record, at least as far as paying its debts is concerned, would be irrevocably stained.

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

Don’t Miss: When Can You Get A Home Loan After Bankruptcy

What Countries Hold Us Debt

Use this visualizationJapan holds more U.S. debt than any other country in the world at $1,271.7B, or 18.67% of the total.China used to own the most debt but is now in second place at $1,081.6B or 15.88%.No other country besides Japan and China holds more than 6% of total foreign-held debt. The U.K. Foreign countries control only about 30% of the entire national debt.

How Much Us Debt Does China Own

Nations borrowing from each other may be as old as the concept of money. Foreign debt provides the opportunity for countries to secure the financing they ordinarily wouldn’t have access to and to stimulate their economy.

However, the concept of foreign debt carries a negative connotation, especially when it concerns large amounts owed to nations embroiled in controversy. For example, the huge amount of debt that the U.S. government owes Chinese lenders has been the subject of countless debates, headline news stories, and political platforms for decades.

Recommended Reading: How To Claim Bankruptcy In Nj Without A Lawyer

Who Owns Most Of China’s Debt

Comprehensively measured, the property industry may account for roughly 29 percent of China’s GDP and about 30 percent of all loans at financial institutions. Overseas bond defaults by Chinese companies are increasing, reaching $8.7 billion in 2021, 34 percent of which were bonds from real estate companies.

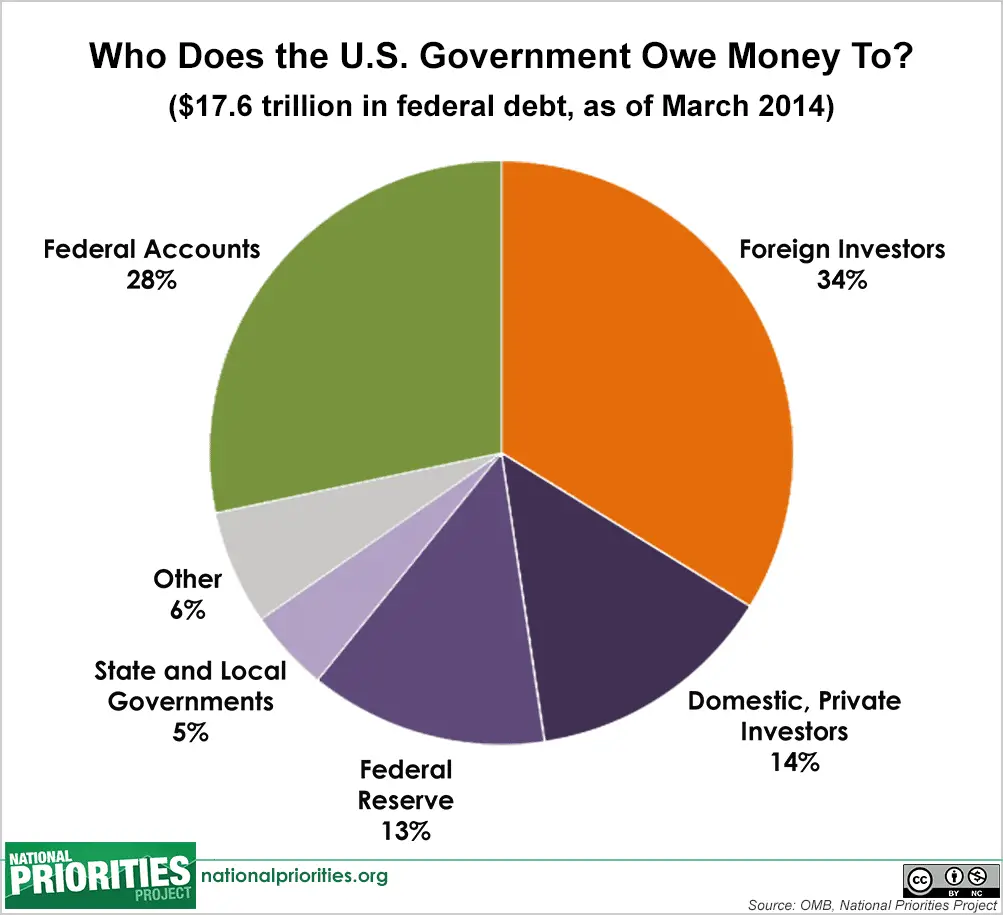

Who Owns The Most Us Debt

Around 70 percent of U.S. debt is held by domestic financial actors and institutions in the United States. U.S. Treasuries represent a convenient, liquid, low-risk store of value. These qualities make it attractive to diverse financial actors, from central banks looking to hold money in reserve to private investors seeking a low-risk asset in a portfolio.

Of all U.S. domestic public actors, intragovernmental holdings, including Social Security, hold over a third of U.S. Treasury securities. The secretary of the treasury is legally required to invest Social Security tax revenues in U.S.-issued or guaranteed securities, stored in trust funds managed by the Treasury Department.

The Federal Reserve holds the second-largest share of U.S. Treasuries, about 13 percent of total U.S. Treasury bills. Why would a country buy its own debt? As the U.S. central bank, the Federal Reserve must adjust the amount of money in circulation to suit the economic environment. The central bank performs this function via open market operationsbuying and selling financial assets, like Treasury bills, to add or remove money from the economy. By buying assets from banks, the Federal Reserve places new money in circulation in order to allow banks to lend more, spur business, and help economic recovery.

The biggest effect of a broad scale dump of US Treasuries by China would be that China would actually export fewer goods to the United States.

Scott Miller

Also Check: Homes Repossessed For Sale

America Owes China $1 Trillion

The Observer has managed, once again, to not quite understand this difficult economics stuff. They note, correctly, that China owns some $1 trillion of US Treasuries. This apparently is some sort of nuclear option. If the Donald Trump and Xi Jinping trade talks don’t go well then China could just dump these and cause havoc to the American economy.

Well, no, sorry, it’s just not a large enough amount of money to be a problem.

This might sound counter-intuitive given that Beijing can deploy the economic nuclear option if Trump makes good on his campaign pledge to slap whopping tariffs on Chinese imports. The US owes China more than $1 trillion and Xi could send Americas economy into a tailspin by sanctioning a dumping of US Treasury bonds.

But the problem with nuclear missiles is that they are never really intended to be fired, and if they are, there are no winners. Sure, China could cause enormous damage to the US, but only by damaging itself.

No, it’s just not a large enough number.

Think it through for a moment. The public in general hold about $14 trillion of US Treasuries. So China holds perhaps 7% of the market. OK, that’s a bit of a bolus, there would certainly be a bit of indigestion. Imagine the phone call:

“Morning, XYZ Bank”

“This is China, we’d like to sell $1 trillion in Treasuries today please”

“Gulp”

But it is still only 7% of that market. Prices will move, certainly, there would be a spike in yields. But this isn’t something existential at all.

How Much Does The Us Owe In Debt

4.9/5U.S. debtdebtdebtin-depth answer

The truth is, most of it is owed to Social Security and pension funds. This means U.S. citizens, through their retirement money, own most of the national debt. U.S. national debt is the sum of these two federal debt categories: Public debt held by other countries, the Federal Reserve, mutual funds, etc.

One may also ask, can the US pay off its debt? It’s unlikely America will ever pay off its national debt. It doesn’t need to while creditors remain confident they will be repaid.

In this regard, how much is the US in debt?

The U.S. government’s public debt is now more than $22 trillion the highest it has ever been. The Treasury Department data comes as tax revenue has fallen and federal spending continues to rise. The new debt level reflects a rise of more than $2 trillion from the day President Trump took office in 2017.

How much debt does China owe the US?

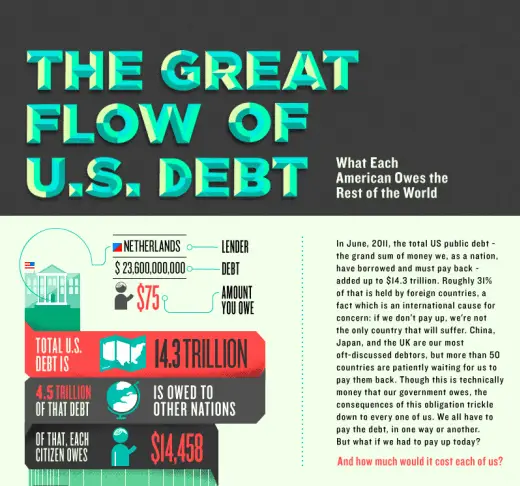

China owns about $1.1 trillion in U.S. debt, or a bit more than the amount Japan owns. Whether you’re an American retiree or a Chinese bank, American debt is considered a sound investment. The Chinese yuan, like the currencies of many nations, is tied to the U.S. dollar.

Read Also: Can Sba Loans Be Discharged In Bankruptcy

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?