However 7% Of Adults Struggling With Medical Bills Over The Past Two Years Have Declared Bankruptcy

A 2015 poll done by NPR, Robert Wood Johnson Foundation, and the Harvard T.H. Chan School of Public Health found that 7% of respondents declared bankruptcy due to their health care costs over the previous two-year period. Other ways medical bills affected families? Nearly 20% reported taking out a loan that would be difficult to pay back, while 23% piled on credit card debt.

See also:How Many People Filed for Bankruptcy in 2016?

Medical Debt Is A Uniquely American Problem Caused By A Very Broken System Expert Explains

The cost of health care in the U.S. has grown worse in recent years as Americans continue taking on unprecedented levels of medical debt.

The issue has gotten so bad that one New York-based 501 charity, RIP Medical Health, uses donations to buy up peoples medical debt. The organization recently announced a purchase of $278 million in medical debt owed by roughly 82,000 patients in the Tennessee and Virginia regions.

Medical debt is the no. 1 cause of bankruptcy in the United States, which is something thats obviously a uniquely American problem, Allison Sesso, executive director of RIP Medical Debt, said on Yahoo Finance Live . So were out there trying to give people relief from this economic burden. Weve got donors that are excited across the country to do more of this debt relief. That number 278 million were very proud of that, but we have a lot more debt relief ahead of us.

RIP Medical Debts recent purchase involved buying peoples medical bills directly from the Ballad Health hospital system, which has previously been criticized for using lawsuits to collect on medical debt. Sesso noted that most of the patients affected by RIP Medical Debts latest move are considered low-income.

Roughly 21 million Americans holding $46 billion of medical debt as of April 2021 face collections meaning that a third-party debt collector is trying to obtain the money owed according to Credit Karma data previously provided to Yahoo Finance.

Health Care Costs Number One Cause Of Bankruptcy For American Families

The cost of health care is a major concern for nearly all Americans and there is no shortage of health care related news coverage recently. Understandably, there are lots of questions and forecasts about what might be about to happen. Will the Affordable Care Act a/k/a Obamacare be repealed? Will anything replace it? If so, what will replace it? How much will it cost taxpayers and consumers? And while there are many questions and much uncertainty at present, one thing seems inevitable to me at least. The cost of health care will almost certainly continue to rise. These costs will continue to be a major expenditure for many Americans. At times, these costs will be overwhelming regardless of what happens in Washington, D.C.

Don’t Miss: How Many Times Has Sears Filed Bankruptcy

Experts Say This Is The No 1 Cause Of Bankruptcy In The United States

The cost of health care in the United States has become an increasing problem over recent years, and experts are saying it is now the No. 1 cause of bankruptcy among Americans.

Yahoo Finance reports the New York-based 501 charity, RIP Medical Health, used donations to buy up people’s medical debt, recently announcing a purchase of $278 million in medical debt owed by about 82,000 patients living in the Tennessee and Virginia regions.

Medical debt is the No. 1 cause of bankruptcy in the United States, which is something thats obviously a uniquely American problem, said Allison Sesso, executive director of RIP Medical Debt. So were out there trying to give people relief from this economic burden. Weve got donors that are excited across the country to do more of this debt relief. That number 278 million were very proud of that, but we have a lot more debt relief ahead of us.

The charity’s recent purchase involved buying people’s medical bills directly from the Ballad Health hospital system, which had previously gained criticism for using lawsuits to collect medical debt.

Sesso said most of the patients affected by the purchase are considered to be in the low-income financial bracket.

Credit Karma data previously provided to Yahoo Finance revealed roughly 21 million Americans holding $46 billion of medical debt as of April 2021 face collections, which involves a third-party debt collector trying to obtain the money owed by the individual.

Contact Attorney Joseph P Doyle For A Free Review

It is important to contact an attorney to begin fighting your debt. We know that your personal finances are important to you and we can provide you with compassionate legal assistance. Our firm knows that handling debt and filing for bankruptcy sometimes means that you cannot stop until you obtain a successful result. We know to help you achieve the best outcome available.

Read Also: Liquidation Direct Morrisville Pa

Top 10 Reasons People File For Bankruptcy

The number of people filing for Chapter 7 bankruptcy across the United States has risen at a drastic rate. According to statistics, approximately 1.5 million people filefor bankruptcy every year, and 97% of those filings are individuals. Ohio has the tenth highest personal bankruptcy rate in the country. Here are 10 of the most commonreasons that so many people go bankrupt.

Medical Debt In The United States

Medical debt has been the leading cause of American bankruptcy for years. In 2013, a CNBC report revealed that unpaid medical bills would affect the finances of two million people in one year. Even of those who do not file for bankruptcy, an estimated 56 million adults will suffer in some way because of medical expenses, which accounts for more than 20% of the American population between the ages of 19 and 64.

Even if you have health insurance, you are not safe from the dangers of medical debt. Many insurance plans include high deductibles. Even for people with stable finances, the deductibles can be steep enough that a few medical issues could plunge them into serious debt, an occurrence that can eventually lead to bankruptcy. An unexpected medical bill for $500 is too much for many Americans to pay. In 2017, 45% of Americans said they would have a hard time paying an unexpected $500 medical expense. Such an expense would require them to take out a loan, pay it slowly over time, or not pay it at all. Many serious health problems have deductibles that are significantly higher than $500. More than half of Americans who have insurance end up using most or all of their savings to pay medical bills. Avoiding medical debt often requires serious financial sacrifices.

You May Like: Liquidation Pallets New Jersey

Why Americans Are Drowning In Medical Debt

Healthcare is the number-one cause of personal bankruptcy and is responsible for more collections than credit cards.

After his recent herniated-disk surgery, Peter Drier was ready for the $56,000 hospital charge, the $4,300 anesthesiologist bill, and the $133,000 fee for orthopedist. All were either in-network under his insurance or had been previously negotiated. But as Elisabeth Rosenthal recently explained in her great New York Times piece, he wasn’t quite prepared for a $117,000 bill from an assistant surgeon”an out-of-network doctor that the hospital tacked on at the last minute.

It’s practices like these that contribute to Americans’ widespread medical-debt woes. Roughly 40 percent of Americans owe collectors money for times they were sick. U.S. adults are likelier than those in other developed countries to struggle to pay their medical bills or to forgo care because of cost.

Earlier this year, the financial-advice company NerdWallet found that medical bankruptcy is the number-one cause of personal bankruptcy in the U.S. With a new report out today, the company dug into how, exactly, medical treatment leaves so many Americans broke.

Americans pay three times more for medical debt than they do for bank and credit-card debt combined, the report found. Nearly a fifth of us will hear from medical-debt collectors this year, and they’ll gather $21 billion from us, collectively.

Types of Debt Collected From Consumers in 2013

Us Medical Debt And Bankruptcies

6. The total medical debt in the United States in 2020 totaled $45 billion.

A study by Credit Karma reveals that the total medical debt in the US was $45 billion. This information was based on the credit reports of over 20 million Americans. The same medical debt statistics established that medical debt rose 3% from the moment the COVID pandemic started until August 2020 when the research was conducted.

7. Every year about 530,000 families file for bankruptcy due to healthcare bills.

For hundreds of thousands of American households, it is easier to file for bankruptcy than to deal with medical costs. Medical-related bankruptcies, according to a Nasdaq article, are killing the middle class in the USA. The author mentions other worrisome facts about medical debt like a Nobel laureate who paid healthcare bills by selling his medal. It also stated that over 250,000 people seek help to pay medical bills through the GoFundMe crowdfunding service.

8. Medical indebtedness is the number one cause of bankruptcies in the US.

About 62% of people highlight healthcare bills as the leading cause of bankruptcies in America. Its more shocking to note that over three-fourths of those people had some type of insurance, medical bankruptcy statistics show. This number indicates that medical bankruptcies with insurance are a real thing in the USA.

9. Almost 20% of all consumer credit reports include one or more collections originating from healthcare.

Read Also: How Much Does An Attorney Charge To File Bankruptcy

Medical Costs In The Us

1. National health expenditure reached $3.8 trillion in 2019.

In 2019, the nation increased its healthcare-related expenditure by 4.6% compared to 2018. Data shows that American health expenditure accounted for 17.7% of the GDP. Medicare spending grew to $799.4 billion, or by 6.7%.

The 2020 update is yet to be released. According to CMS estimates, the figure will reach $4.01 trillion. But the Covid-19 health crisis is likely to have an adverse effect on the total amount, just like on the other medical bankruptcies statistics on this list.

2. The average medical insurance premium has increased by over 50% in the past decade.

The average annual employer-sponsored family premium was $21,342 in 2020. This is a 4% increase from the previous year. Since 2010, the cost has gone up by 55%.

And the national average premium for a benchmark marketplace plan in 2021 is $452 a month.

3. Americans spend an average of $5,000 a year on out-of-pocket health care costs.

This figure includes insurance, medical supplies, and prescribed drugs. For comparison, in 1984, the typical household spent about $2,500 a year on healthcare. Unsurprisingly, insurance accounts for most of that increase, having skyrocketed by a whopping 740%.

4. Drug prices rose 4.2% in the second half of 2020.

Not only insurance costs are rising.

The latest GoodRXs semi-annual update shows that drugmakers have hiked the prices of a total of 589 medications.

General United States Bankruptcy Statistics

1. 62% of personal bankruptcies in the United States were due to medical expenses.

A study conducted by Harvard University has shown that, without doubt, the most significant of all US bankruptcy statistics is that nearly two-thirds of all bankruptcies were due to medical expenses. One of the most interesting figures to come out of this study was that 72% of the bankruptcy filings had come from people with some form of health insurance. While this was a shock, it also crushed the myth that medical bills only affect the uninsured.

Medical bankruptcy statistics show that people taken by a rare disease or some form of serious illness will be left with hundreds of thousands of dollars in medical bills. Medical bills of this size can easily wipe out any savings, equity accounts, and college funds and leave no other option but to go bankrupt. Eventually, a surge in the US bankruptcy rate is likely to happen.

Moreover, with advancements in technology, healthcare costs in the United States are at an all-time high. As new illnesses emerge and more people become patients, health insurance is becoming expensive and extremely confusing.

It is no secret that Americans face their greatest financial difficulties regarding medical care. Since 26% of Americans between the ages of 18 and 64 are struggling to pay their medical bills, its no wonder these bankruptcy filing statistics show that medical expenses cause more people to go bankrupt than anything else.

Also Check: What Happens If Bankruptcy Is Dismissed

This Is The Real Reason Most Americans File For Bankruptcy

- Two-thirds of people who file for bankruptcy cite medical issues as a key contributor to their financial downfall.

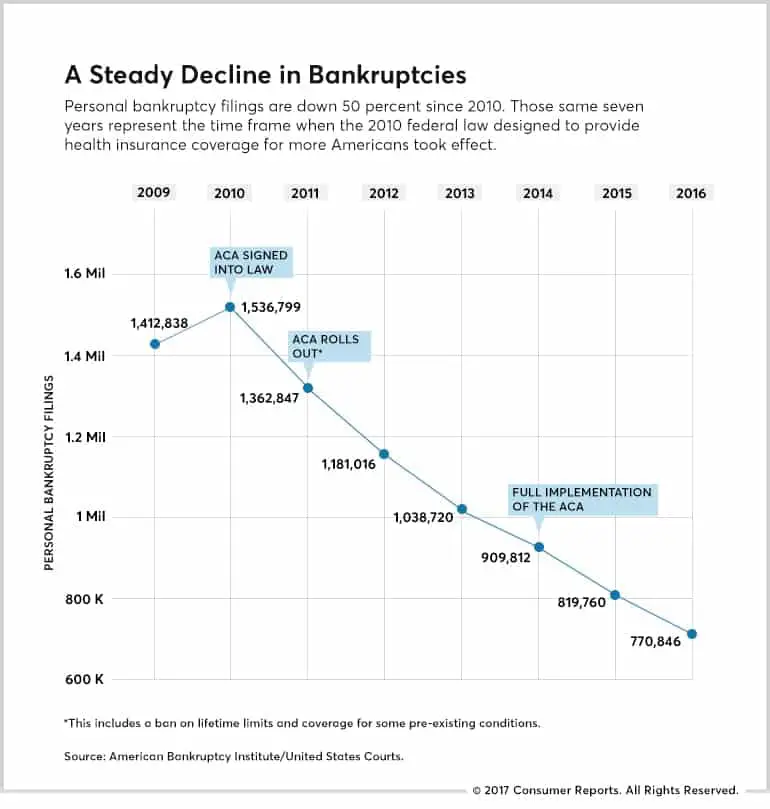

- While the high cost of health care has historically been a trigger for bankruptcy filings, the research shows that the implementation of the Affordable Care Act has not improved things.

- What most people do not realize, according to one researcher, is that their health insurance may not be enough to protect them.

Filing for bankruptcy is often considered a worst-case scenario.

And for many Americans who do pursue that last-ditch effort to rescue their finances, it is because of one reason: health-care costs.

A new study from academic researchers found that 66.5 percent of all bankruptcies were tied to medical issues either because of high costs for care or time out of work. An estimated 530,000 families turn to bankruptcy each year because of medical issues and bills, the research found.

Other reasons include unaffordable mortgages or foreclosure, at 45 percent followed by spending or living beyond one’s means, 44.4 percent providing help to friends or relatives, 28.4 percent student loans, 25.4 percent or divorce or separation, 24.4 percent.

While the findings are consistent with past studies on bankruptcy, the data also highlight a key new factor: whether the Affordable Care Act has reduced the burden of medical debt for people.

More from Personal Finance:Medicare for All could take center stage in the 2020 election. Here’s what that means

Contact Tom Bible Law

If you are seeking effective debt relief, we are here for you. Contact us today online or by telephone at to arrange a consultation with a knowledgeable Hamilton County bankruptcy law attorney. We offer remote consultations, affordable rates and flexible payment plans. Our Tennessee bankruptcy lawyers are committed to helping you achieve your debt relief goals.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

You May Like: Best Site For Foreclosures

Five Major Reasons For Bankruptcy

There have been a number of studies of why people file for bankruptcy in recent decades, and while the reasons may shift around in order, the major ones seldom change. The order of the following list is based primarily on a paper published in February 2019 in the American Journal of Public Health.

In that study , researchers asked a sample of Americans who had filed for bankruptcy between 2013 and 2016 about the factors that had contributed to their decision. Because people could cite more than one reason, the numbers below overlap and add up to more than 100%.

Bankruptcy Comes From Unavoidable Circumstances

At Joseph P. Doyle, our Chicagobankruptcy lawyer, strongly believes you can fix your financial situation with our legal assistance. Bankruptcy is a solution that caneliminate a large portion of one’s debt, no matter what the cause. Below, our firm has explained the most common causes of bankruptcy in more detail.

Every day,thousands file for bankruptcy to get out of a serious debt problem they are facing. This is the result of a serious issue that is affecting bank individual’s bank accounts and lives. This is not just a circumstance that occurs without cause. It comes from an unavoidable circumstance or as a consequence of an action. Whatever the reason, bankruptcy, is the primary go-to solution for many whose financial states have gone out of control. There many causes of bankruptcy, but they can all lead to the samesolution.

The common causes of bankruptcy include:

- Expensive Medical Bills caused by a disability or illness

- Poor Financial Management related tostudent loans, purchasing acar orhome, etc.

- Reduced income or job loss

- Unexpected emergencies, such as a car breaking down or catastrophic damage to your property

If an unforeseen tragedy has taken place and caused your financial circumstance to become negative, it is important to understand what the initial cause was so that it can be effectively solved.

To learn more about how to recover from severe debt, call to discuss your options.

Recommended Reading: Will Bankruptcy Get Rid Of Irs Debt

About 1 In 10 Adults Delay Medical Care

Nearly one in 10 adults reported delaying or not receiving medical care due to cost in 2015. However, the rates of cost-related access barriers were lower than in any other year during the period of 1998 to 2015 for low-income people as well as those classified in worse health. Dental care, prescription drugs, and eyeglasses are the first things people give up because of health costs.

The Good News: Nearly 13 Million Fewer People Have Medical Bill Problems Today Than They Did 5 Years Ago

According to the National Center for Health Statistics, the percentage of persons under age 65 who were in families having problems paying medical bills over a 12-month period decreased from 21.3% in 2011 to 16.2% in the first 6 months of 2016. Of all families with persons under age 65 in 2016, heres the breakdown of those who had trouble paying their medical bills: 28.5% were uninsured, 21.1% had public coverage, and 12.6% had private coverage.

Read Also: What Does Chapter 11 Bankruptcy Mean