Understand Alternatives To File Bankruptcy

There are many bankruptcy alternatives to consider. We will cover the two most common alternatives, but you can find more in our bankruptcy alternatives article. As a reference, filing Chapter 7 bankruptcy is often the least expensive and the shortest.

Debt Settlement

Debt settlement is also known as debt negotiation, debt relief, or a debt consolidation program . In debt settlement, a company or you will negotiate with your creditors for a lower amount. You can save money and avoid filing bankruptcy. You may also be exposed to lawsuits, so its important to understand which creditors are likely to sue. A debt settlement programs often last 2 – 5 years.

Debt Management

Debt management is also known as credit counseling. In debt management, a company will negotiate with your creditors for a lower percentage interest rate. You can save money on interest and avoid filing bankruptcy. Debt management can be more expensive than debt settlement and Chapter 13. Debt management programs often last 5 years.;

What Property Can A Debtor Keep

The Bankruptcy Code allows the individual debtor to retain certain property as exempt. Exempt property is free of the claims of creditors and cannot be taken by the trustee to be liquidated. Virginia law determines the types and amount of exempt property. The debtor is entitled to a homestead exemption which allows each debtor to claim a one-time exemption of up to $5,000 in any kind of property.;Debtors over the age of 65 are entitled to claim a homestead exemption of up to $10,000.;The debtor is also entitled to a specific exemption, sometimes referred to as the poor debtors exemption, in different types of property . Other types of property may also be exempt under Virginia law. You must claim the property as exempt in your bankruptcy schedules and, to claim the homestead exemption, you or your lawyer must also properly prepare and file a homestead deed within a certain time limit. Creditors or the bankruptcy trustee can challenge the type or amount of the exemptions claimed by the debtor.; Once you have claimed an exemption, you cannot claim it again in another case.

A debtor may reaffirm his or her obligations to a secured creditor who holds a lien on a house, car, or other significant item. A reaffirmation agreement must be in writing, signed by the debtor and, sometimes, the debtors attorney, and must be filed with the bankruptcy court. A debtor may rescind a reaffirmation agreement within sixty days after signing the agreement.

Am I Eligible For Bankruptcy In Virginia

You will only be allowed to file for Chapter 7 bankruptcy if you can show that your income is under certain thresholds.

The easiest way to qualify is by demonstrating that your household income is less than the median household income for Virginia households of the same size. For example, if you live in a three-person household, you would need to earn less than $97,056, which the U.S. Census Bureau says was the median income for a three-person Virginia household as of November 2020.

If your household income is more than the state median, you may still qualify to file under Chapter 7 if you can show that you have little to no disposable income each month. This is done by subtracting your estimated monthly expenses from your monthly income.

There are also eligibility requirements for filing under Chapter 13. To file under that chapter, you will need to show that you have a steady income, unsecured debt of less than $419,275, and secured debts of no more than $1.26 million.

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

Estimate Whether You Will Qualify For Chapter 7 Bankruptcy In Virginia

As stated above, you often have to qualify to file Chapter 7 bankruptcy. Qualification is based on US means testing. The means testing is based on the household income and size of the household for Virginia.;

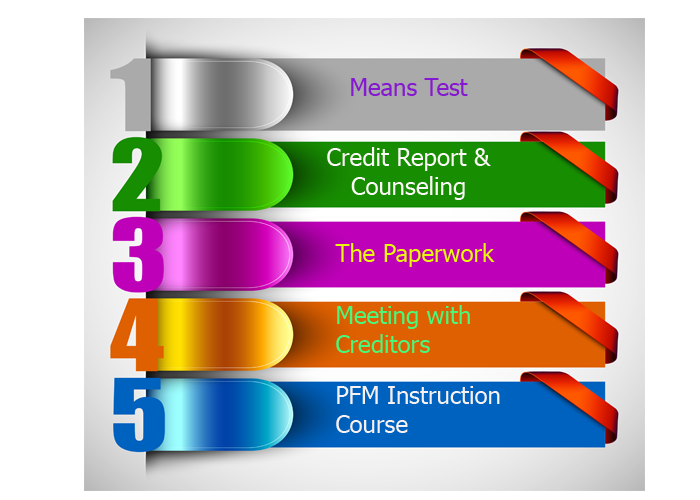

Bankruptcy Means Test In Virginia

The bankruptcy means test in Virginia often changes every 6 months. To help, we built the following bankruptcy means test calculator to help you estimate qualification, understand the cost and compare bankruptcy alternatives.

Virginia Chapter 7 Bankruptcy Income Limits;

| # of People |

|---|

| $161,328 |

Secured Vs Unsecured Debt

Not all debt is treated the same during bankruptcy and it is helpful to understand the different types of debt and how they will be treated. As a general rule, when you declare bankruptcy your debt will be categorized as either secured or unsecured. How your debt is classified will often determine how much you can eliminate through bankruptcy.

Also Check: Can You Rent An Apartment After Filing For Bankruptcy

Rebuild Your Credit After Filing Bankruptcy

Unfortunately, Chapter 7 bankruptcy can negatively impact your credit;and Chapter 13 can negatively impact your credit. That said, you have an opportunity to rebuild your credit shortly after bankruptcy. To assist, you can use our free credit rebuilding portal designed to help you increase your credit score by 100 points in less than 6 months.;

Virginia Bankruptcy Law: Can I Discharge My Tax Debt

Determining whether you should file for bankruptcy can be a difficult decision and once youve decided that bankruptcy is for you, it can be just as difficult to successfully navigate the bankruptcy process and take advantage of all opportunities available under the bankruptcy code. One common misconception, for example, is that you cant discharge taxes under a bankruptcy filing. But in the Commonwealth of Virginia, however, you can discharge some tax debt if certain technical requirements are met.

At the Law Office of Rebecca L. Evans, our lawyers understand the difficulties you face when filing for Chapter 7 or Chapter 13 bankruptcy. Thats why we work tirelessly to make sure all of your options are thoroughly researched and realized, striving constantly to get you the best possible outcome in your bankruptcy case.

You May Like: How To File Bankruptcy In Wisconsin

Eastern District Of Virginia Requirements

The Eastern District is broken into four divisions with courthouses located in Alexandria, Norfolk, Richmond, and Newport News. Anyone filing for Chapter 7 bankruptcy in Virginia in the eastern district without an attorney should take a moment to review the Court’s detailed overview of what to expect and look out for.

Chapter 7 Will Do The Following For You:

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

Bankruptcy In West Virginia

There’s no reason to be ashamed if you are considering filing for bankruptcy in West Virginia. Due to the economy and other factors, many people are finding that it is their only way out of debt. There’s nothing wrong with filing for bankruptcy; it is a perfectly legal process that was created in order to encourage entrepreneurs and others to take chances in business. Not only business owners are allowed to file for bankruptcy though. Individuals may file for bankruptcy for their personal finances under Chapter 7 and Chapter 13. If you find yourself unable to make minimum payments, or you are getting foreclosure notices, then bankruptcy is the thing to do.

Learn More By Contacting An Attorney

If you are facing bankruptcy proceedings and need the services of an experienced attorney to help you correctly file your bankruptcy paperwork and deftly navigate the court system, contact the Law Office of Rebecca L. Evans today at or reach out to us online to schedule your consultation. From our office in Springfield, we help people throughout Northern Virginia.

For our clients benefit, we are considered to be a debt relief agency because we help people file for bankruptcy relief under the Bankruptcy Code.

Also Check: Can You Rent An Apartment After Filing For Bankruptcy

Do I Have To Go To Court

In the early stage of a bankruptcy case, you must attend a meeting of creditors at which you must provide information and answer questions under oath from the bankruptcy trustee, the United States Trustee, or your creditors. The bankruptcy judge does not participate in such meetings. Although the meetings are not formal court hearings, testimony is taken under oath and you are subject to criminal penalties for perjury.;You must provide your tax return and the pay stubs to the trustee at least seven days before the meeting of creditors .;Some trustees will require other financial documents as well.;If you do not attend your creditors meeting, your case may be dismissed.Bankruptcy courts are part of the federal judicial system, and federal bankruptcy judges decide most disputes that arise in bankruptcy cases. If any challenges are raised by creditors in your bankruptcy case, it may be necessary for you to testify in court.;Although many of the typical legal issues and procedures can be handled by an attorney without requiring your attendance at a bankruptcy court hearing, it is important that you attend, on time, if you are required to be there.

Attend Your 341 Meeting

The 341 meeting tends to be the most stressful part of filing for bankruptcy in Virginia; after all you have to go to court to answer questions under oath. What most people don’t realize is that as long as you are prepared and have everything you need you will probably spend more time waiting for your case to be called than you will answering questions. The meetings are semi-public and usually several folks who have filed Chapter 7 bankruptcy in Virginia will have the same hearing time as you. Your creditors may appear to ask you some questions as well. This does not happen often, but if it does, just remember to take a deep breath and tell the truth. It’s the easiest thing to remember anyway.

Read Also: How To Access Bankruptcy Court Filings

Successfully Passing The Chapter 7 Bankruptcy Means Test

Passing the means test is not the last step in the process, as it is not the only qualifying factor. In Virginia, petitioners will be required to also submit two forms. These forms are known as Schedule I and Schedule J . If the individual has an income surplus, he or she will be court ordered to pay creditors monthly. This changes the case to a Chapter 13 bankruptcy.

Finally, qualifying for a Chapter 7 bankruptcy does not mean that a petitioner must file one. The test will simply determine that the petitioner can file for a Chapter 7 bankruptcy. It is important to explore all the available alternatives prior to making a decision. A qualified bankruptcy attorney versed in the laws local to Virginia is a invaluable resource for determining if a Chapter 7 bankruptcy is the best decision.

Need Help with the Chapter 7 Bankruptcy Means Test?

Despite the wealth of information available to help us understand the Means Test and who qualifies, the particular circumstances of individual filers can greatly vary. A qualified Pennsylvania bankruptcy attorney at your side can help fully allay your concerns, and help you understand how you can pass the means test and file for Chapter 7 bankruptcy.

What Is A Chapter 7 Bankruptcy

Chapter 7 is the most common type of bankruptcy.; A Chapter 7 bankruptcy will discharge most all types of debts; including medical bills, credit cards, deficiency balances, credit union loans, personal loans, store cards, credit lines, payday loans and more.; There are a few debts a Chapter 7 bankruptcy may not discharge including student loans, debts incurred through fraud, child support obligations and certain tax debts.

The Chapter 7 bankruptcy will stop most collection activity; including wage garnishments, liens against bank accounts, harassing phone calls, etc. An individual may only file a Chapter 7 bankruptcy once every eight years. The debtor has to wait six years after having filed a successfully completed Chapter 13 wage earners plan before filing a Chapter 7 bankruptcy.

Recommended Reading: Dave Ramsey Bankruptcy

West Virginia Bankruptcy Exemptions

The laws that protect your property from the trustee are often referred to as the Chapter 7 bankruptcy exemptions. In practice, exemption laws apply to any West Virginia bankruptcy case. If you have lived in the Mountain State for at least 2 years when your case is filed, you have to use the West Virginia bankruptcy exemptions to protect your assets. Anything that is not protected by one of these exemptions can be sold for the benefit of your creditors as part of your Chapter 7 bankruptcy in West Virginia.

How Long Does It Take To Rebuild Credit After Chapter 7

It is still possible to achieve a credit score of 700 or more within two years after filing for Chapter 7 bankruptcy. It requires dedication, timing, and patience to achieve that. In order to achieve this you must follow these steps:

-

Check your score

-

Apply for a loan that builds credit

-

Apply for a credit card

-

Get another credit card

Don’t Miss: How To Claim Bankruptcy In Massachusetts

What Does Bankruptcy Include

Once you file for bankruptcy in WV, the courts put in place an order called an Automatic Stay. This order will stop debt collection calls, wage garnishments, and additional claims. Keep in mind that payments regarding child support and criminal cases will still need to be made during this time.

In any event, Bankruptcy will be able to include:

- utility bills

- medical expenses

Again, unless you are filing a complex Chapter 13 case, you will lose all assets associated with a Chapter 7 Bankruptcy protection. You will, however, be able to prevent any and all collections from occurring as long as they were incurred before the date of filing and discharge.

West Virginia Bankruptcy Means Test

Everyone who wants to file a Chapter 7 bankruptcy in West Virginia has to pass the West Virginia means test for bankruptcy first. The purpose of the test is to make sure that only people who can’t afford to pay any significant amount of their income to their creditors are allowed to file Chapter 7 bankruptcy in West Virginia even though their income exceeds the income limits.

Data on Median income levels for West Virginia

West Virginia Median Income Standards for Means Test for Cases Filed On or After May 1,2021 |

|---|

| Household Size |

| $6,717.50 |

Recommended Reading: What Does Dave Ramsey Say About Bankruptcy

Working With An Attorney

For most people, it is usually in ones best interest to work with a bankruptcy attorney. A bankruptcy lawyer is there to represent you and not in the interest of creditors.

An attorney is also keenly familiar with exemption laws. Plus, they can come up with creative strategies to keep your assets through practical repayment strategies that are fair to everyone involved.

While you may have the fight and ability to manage a Bankruptcy on your own, it tends to make things a lot easier on an already stressful situation, especially when there is so much at stake.

Understanding How A Chapter 7 Means Test Works

The Chapter 7 means test was designed to limit the use of a Chapter 7 bankruptcy to individuals who can no longer pay off their debts. The Chapter 7 bankruptcy works by subtracting certain monthly expenses from the individuals present monthly income. The current income will be determined by the persons last six months income prior to filing for bankruptcy. This will determine the persons available income.

If a person has a high amount of available income, the more likely it is that he or she will not be able to use a Chapter 7 bankruptcy to pay off the accrued debt. Instead, the individual will be expected to use the available funds to repay creditors.

Another important factor is that you only need to take a means test if the bankruptcy filer has predominantly consumer debts in Virginia, not business debts.

Also Check: Renting An Apartment After Bankruptcy

Can You Keep Your House Or Car After Filing For Bankruptcy

When good people fall on hard times and begin considering getting a fresh start through bankruptcy, perhaps the most feared potential losses are ones house and car. Transportation has become a necessity in terms of gainful employment and everyone needs a roof over their heads.

In Virginia, the law allows for a variety of bankruptcy exemptions and with the help of an experienced personal bankruptcy attorney, you may be able to keep your house and car. At the Law Office of Rebecca L. Evans, we work with everyday people just like you to help them get the fresh start they deserve. We wont judge you, criticize you or talk down to you we have your best interest in mind and work with the sole purpose of helping you make your life better.

Dont Miss: Chapter 7 Falls Off Credit Score

Virginia Legal Aid Organizations

There are several resources available for folks looking to file Chapter 7 bankruptcy in Virginia without an attorney. If your household income is below 125% of the federal poverty guidelines, you should contact an organization providing Virginia legal aid in your area to find out how they can help you.

Recommended Reading: Getting Personal Loan After Bankruptcy