S To Take To Rebuild A Credit Rating

While it will be seven to 10 years before the bankruptcy event is removed from a credit report, this does not mean that credit scores will be low for this period of time.

In fact, some who spend the years following the bankruptcy to re-build their credit may have a good rating within a few years after the filing.

Using debt responsibly is the best way to re-build credit after filing for bankruptcy, and there are several ways to accomplish this. First, it is necessary to open an account that can be used for this purpose.

Report Credit Repair Fraud

State Attorneys General

Many states also have laws regulating credit repair companies. If you have a problem with a credit repair company, report it to your local consumer affairs office or to your state attorney general .

Federal Trade Commission

You also can file a complaint with the Federal Trade Commission. Although the FTC cant resolve individual credit disputes, it can take action against a company if theres a pattern of possible law violations. File your complaint online at ftc.gov/complaint or call 1-877-FTC-HELP.

Also Check: How Do I File Bankruptcy In Texas

What Happens After Bankruptcy

Its almost certainly going to be hard to get any kind of loan or credit once you have a bankruptcy on your record.

However, here are some things you can do in order to start the process of rebuilding your credit.

It wont happen overnight. Therefore, its important to understand that its going to take time.

There is an old riddle you may have heard: How do you eat an elephant? One bite at a time.

Read Also: Can You Get A Bankruptcy Off Your Credit Report Early

Ways To Rebuild Credit After Bankruptcy

Regardless of the type of accounts you open, be sure to make every payment on time. With credit cards its also important to pay your balance in full monthly and keep a low debt-to-limit ratio on the accounts.

How To Remove A Bankruptcy From Your Credit Report Quickly

Sometimes, finances can get the better of us. Debt can begin to accumulate, or the economy changes, and you end up in an impossible situation. Filing for bankruptcy can help get you out from underneath the worst of it, and it might seem like an easy solution. However, the record of bankruptcy can hang around.

As unfortunate as it is, bankruptcy can make it difficult to build back what you might have lost. Your credit score inevitably drops after filing for bankruptcy. The presence of it on your record can make it difficult to borrow in the future. However, it is possible to remove it.

Bankruptcy filings indicate personal information about youlike your official name or social security number. As such, any errors in the record can be a cause to expunge the record of bankruptcy.

While this can be difficult, this article explains the essential things you need to know about bankruptcy. We go over its effect on your credit score and how to get it dropped from your record.

Bankruptcy promises to give you a chance to start fresh. But, so long as the record prevents you from recovering your previous credit score, it can be challenging. These sections will outline how to remove bankruptcies from credit reports. With these simple steps, you can clear your record and start fresh.

Also Check: How Many Times Has Donald Trump Go Bankrupt

Check Your Credit Report For Bankruptcy Errors

In this step, youll need a copy of all 3 of your credit reports. This is where having a comes in handy. TransUnion is the best credit monitoring service in my opinion, plus you get a free credit score.

Review the credit report carefully for any inaccurate or incomplete information. Here is a list of the most common bankruptcy errors. Names, addresses, and phone numbers Incorrect dates Discharged debts that still show a balance

If you have found no inaccuracies within the information on your credit report, then unfortunately theres nothing that can be done to remove it prematurely, youll have to wait 7-10 years for it to fall off your credit report.

How Does Filing For Bankruptcy Impact Your Credit Score

Bankruptcies are one of the most detrimental items that can appear on your credit report. Like judgments and tax liens, they report as a public record and tank your credit score.

If your credit profile was stellar and you had a high FICO score prior to filing for bankruptcy, you should expect a huge drop in score, according to myFICO. But if your credit was already in the trenches due to the presence of negative items on your report, you would probably only see a modest drop in score, the article adds.

The more accounts included in the bankruptcy filing, the greater the impact on your score. Why so? These accounts will report for seven years from the original date of delinquency. And the impact is the same even if they get discharged through bankruptcy.

Your credit score will start to bounce back over time, and it may not take as long as you think. This is due to the fact that discharged debts are no longer owed. This means your credit utilization ratio will now be much lower. And since amounts owed account for 30 percent of your credit score, you will start to see small increases as creditors update the balances.

But if can get the bankruptcy removed from your credit report, that means good news for your credit score much sooner than later. More on that shortly.

Don’t Miss: When Did Kodak Filed For Bankruptcy

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

Make Sure The Right Accounts Were Reported

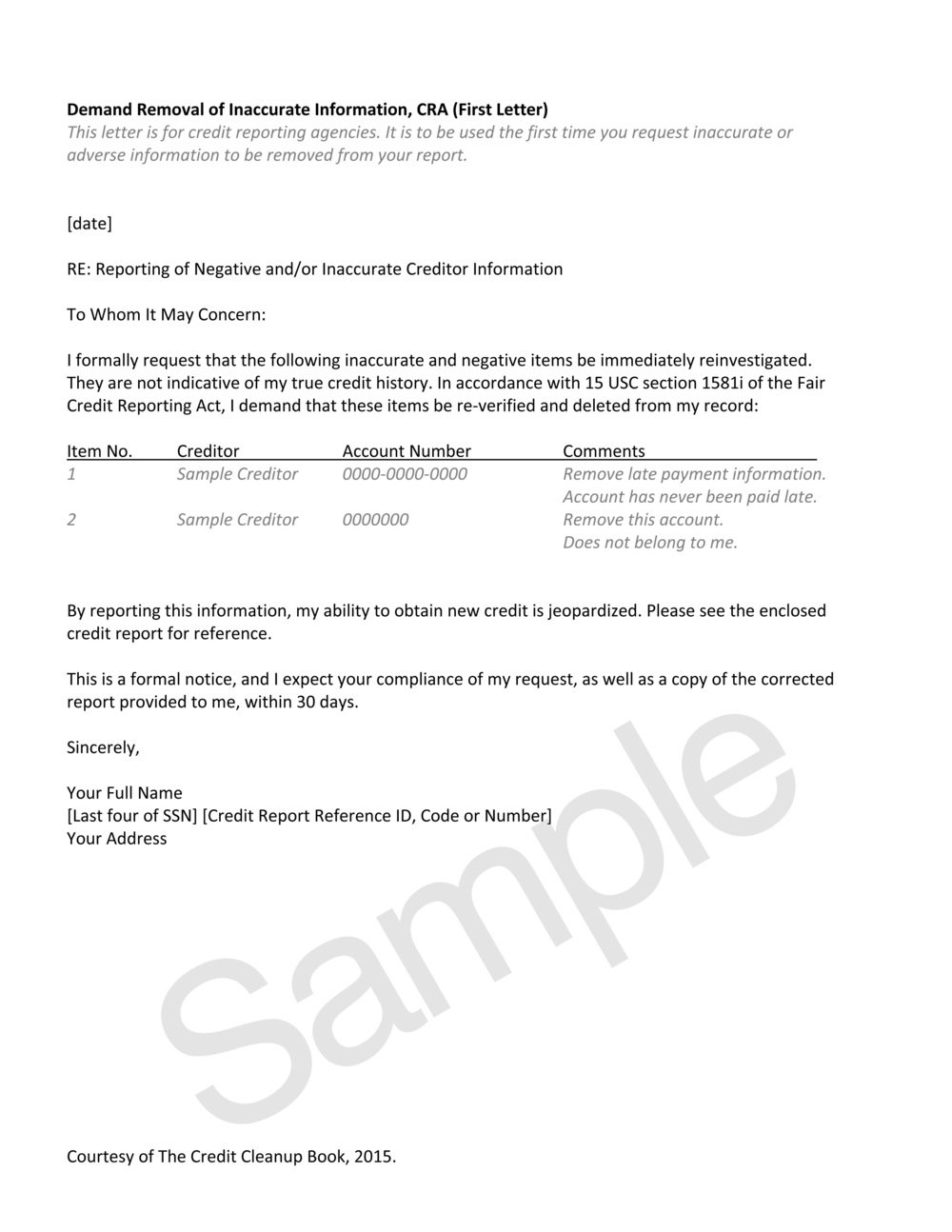

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

Read Also: How Often Can You File Chapter 7

Consider A Credit Repair Service

You may also want to consider getting professional help in the form of a credit repair service to assist in cleaning up your credit report.

The majority of these services will cost you a fee, varying on the extent to which they work on your credit for you. For more in-depth clean-up and credit reports with many negative marks, the fee may be higher.

Simply put, you provide the credit repair agency with your personal information and credit report. They will discuss the plan of action of the individual accounts you would like to fix.

These companies are designed to help individuals with bad credit improve their personal finances by providing an opportunity to get new credit and a higher credit rating through improving your credit score. In addition, they work with the credit bureaus and financial institutions to remove your credit reports original delinquency date.

A few of the credit repair companies that are said to be the best options for those who wish to remove or reduce the effect of a bankruptcy on their credit report include the following: Credit Saint, Sky Blue Credit Repair, The Credit People, Ovation, and Lexington Law. As some of the best credit repair services available, you can expect competitive pricing and good results.

Rebuilding Credit After Bankruptcy

You can work to improve your credit scores even while a bankruptcy is still listed on your credit reports. Establishing new credit can help. You shouldnt expect those positive accounts to fix everything, but they can be a step in the right direction if you manage them carefully.

Its true that qualifying for new credit after bankruptcy can be tricky. Yet if you apply for the right kinds of accounts, your odds of success should be higher.

Read Also: How Many Bankruptcies Did Trump Have

Main Types Of Bankruptcy For Consumers

Consumers primarily use Chapter 7 and Chapter 13 for filing bankruptcy. Either will activate an automatic stay to prevent creditors from collecting debt while your case is being processed. Filing either type of bankruptcy will decrease your anywhere from 130 to 240 points. People with higher credit scores will see their credit scores drop more than those whose credit scores were lower at the time of filing. But regardless of what your credit score is, when you file for bankruptcy, you will likely end up with a bad credit score for a while.

Bankruptcy can be complicated, so it might be a good idea to hire a bankruptcy attorney. If you have a simpler, Chapter 7 case, you can use Upsolveâs online tool to file for free without an attorney.

How Does Bankruptcy Impact My Credit Report

![How to Remove a Bankruptcy from Your Credit Report [See Proof] How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

A bankruptcy will affect your credit report in two ways.

The bankruptcy stays on seven or ten years after filing.

So the agency will typically remove the accounts the bankruptcy includes from your credit report first.

Their delinquency dates will pretty much always precede the bankruptcy filing date.

Bankruptcies will always negatively impact your credit report. However, the severity of the impact will vary case by case.

If you have several accounts included in your bankruptcy, its going to have a more significant impact than if you only have a single car loan or credit card.

Public court records are always accessible via the Public Access to Court Electronic Records system.

If you have a fraudulent bankruptcy on your record, due to identity theft or perhaps a clerical error, it shouldnt be hard to track down.

Read Also: How Much Does A Bankruptcy Lawyer Cost In Florida

When Can I Get A Bankruptcy Off My Credit Report

Article updated by Mia Taylor May 21, 2018

Filing for bankruptcy in order to deal with overwhelming debts can be a frightening and confusing prospect.

But if youre among those who have opted to use this approach in order to turn a troublesome financial picture around, youre probably wondering what the next step should be. And more importantly, how long it takes to get that bankruptcy removed from your credit reports.

The good news is, bankruptcy filings dont mean the end of obtaining credit and in fact you can try to speed up the removal process, while also rebuilding your financial profile quite successfully.

How Can I Wipe Out A Bad Borrowing History

Some items will stay on your credit report for several years anyway:

- A bankruptcy will stay on your credit report, from the date of discharge, for six or seven years , depending on the credit bureau, the province you live in, and whether you were also previously bankrupt.

- A consumer proposal will stay on your credit report, from the date of discharge, for three years.

However, some lenders will consider giving you credit anyway, if you eliminate the other bad history and create some good history.

To eliminate bad borrowing history from your credit report as quickly as possible:

Recommended Reading: Toyguru Shark Tank

Different Types Of Bankruptcies

There are many types of bankruptcy. The most common for individuals and small businesses are Chapter 7 and Chapter 13.

The differences between the two are essential to note. They determine your options for how to remove bankruptcies from credit reports. Ultimately, its the different maximum duration on your records and the repayment plans that determine how much your credit scores drop.

In both cases, it might be prudent to consult a bankruptcy lawyer or consultant. Legal advisors can help you to understand the details of each plan. Knowing the details of the type of bankruptcy can help in understanding how to contest the procedure. Plus, it will help you assess how bankruptcy affects your credit score in the long run.

Can You Remove Incorrectly Reported Negative Items From Your Credit Report

Many people are not aware that it is possible to dispute entries in so they just accept whatever is there without questioning if there are credit report errors or not. If you are wondering whether you could dispute entries in your credit report, the answer is YES.

There is a federal law that gives you the right to dispute incomplete or inaccurate information in your credit reports. This law is called the Fair Credit Reporting Act or FCRA which was passed in 1970. The FCRA regulates the collection and access to consumers credit reports to ensure that the personal data included in the credit reports are accurate, fair, and private.

Recommended Reading: Toygaroo Shark Tank

Professional Help From A Credit Repair Company

Any time you try to dispute a negative item on your credit report, whether its a bankruptcy or a credit card late payment, its bound to be a long, arduous journey.

To save yourself a major headache, consider hiring a professional credit repair company. Theyll not only review your bankruptcy entries, but everything else on your credit report as well, so you can benefit from a holistic strategy for repairing your credit.

Tips To Help Rebuild Your Credit After Bankruptcy

If youve already felt the wrath of bankruptcy, chances are youre not feeling too optimistic about your future credit score. However, the good news is filing for bankruptcy wont haunt you forever, and the odds of rebuilding your credit are definitely in your favor.

Of course, having the bankruptcy removed from your credit report is the easiest way to get your credit back on track in the shortest period possible. You can also take the following actions to boost your score:

You May Like: Getting Apartment After Bankruptcy

How Can I Rebuild My Credit After Bankruptcy

The most important thing you can do to improve your credit score after a bankruptcy is remove the bankruptcy from your credit report.

Equally important is learning and changing your personal finance habits so that it doesnt happen again. This might involve reviewing your income and expenses or building your emergency fund to prevent future financial hardships.

The most important ongoing habit you can begin is to pay all of your bills on time because your payment history accounts for the largest portion of your credit score. Even a single 30-day late payment can cause a significant dip, so imagine how bad it could be if you regularly miss a payment.

Your other best bet for rebuilding your credit after bankruptcy is to avoid accruing new debt.

Depending on the type of bankruptcy filing, you probably had much of your debt discharged. So even though the bankruptcy itself is a major negative item on your credit report, consider the rest a blank slate.

Avoid racking up additional debt because that also has a significant impact on your credit score.

You may also want to get a secured credit card. Its a credit card designed for people who want to rebuild their credit. The credit card issuer will give you a credit limit based on the security deposit you pay upfront. By making monthly payments on time, you can start to rebuild your credit immediately.