How Does Filing For Bankruptcy Affect Your Credit

Filing for bankruptcy is one of the worst things you can do for your credit since it’s a signal to future creditors that you were unable to meet your debt obligations. Fortunately, a bankruptcy filing doesn’t leave a permanent mark on your credit reports, and you can start rebuilding your credit while you’re trying to get your finances in order.

No matter whether you’ve filed for Chapter 7 or Chapter 13 bankruptcy, it’ll show up on credit reports for card issuers and other lenders to see. Chances are, lenders will take your bankruptcy into consideration when you apply for credit. Once you’ve wrapped up the bankruptcy process, your credit reports will indicate that the bankruptcy and the debts covered by your filing have been discharged.

A Chapter 7 bankruptcy will stay on your credit reports and affect your credit scores for 10 years from the date your court case is filed a Chapter 13 bankruptcy stays on your credit for seven years. As time goes by, however, a bankruptcy’s effect on your scores slowly decreases.

When you apply for credit, lenders might not OK your application unless the bankruptcy has been discharged. Even then, you might find it difficult to obtain certain kinds of loans. If your application does go through, you might be confronted by high interest rates and other less-than-favorable lending terms.

Can I Claim A Homestead Exemption In California If Im Not On Title

Courts have provided guidance on the types of property interests that are available for a homestead exemption. As a judge in the Central District of California explained in 2020, some legal interests may be entitled to a homestead exemption. In re Nolan, 618 B.R. 860, 86667 . For most homeowners, being a legal owner on record title along with living at the house as their residence on the date that the judgment attaches or that the bankruptcy is filed will generally suffice.

Dealing With Your Car

If you own your car free and clear , make sure to claim the appropriate bankruptcy exemption under California law to protect this value. If you have a car loan, bankruptcy law gives you 3 options for dealing with it. You can surrender it to the bank and discharge the loan, you can purchase the car for its current value and discharge the rest of the loan, or you can keep everything the same by entering a reaffirmation agreement with the bank.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Can I File Bankruptcy Twice In California It Depends Borowitz & Clark

COVID-19 UpdatePlease see here07/25/2019

Youve already filed for bankruptcy once and received your discharge in court. Congratulations, this is a big step!

Your financial fresh start has been going well but now the bills are starting to pile up again. Maybe its a variable rate mortgage, medical expenses, or simply the increasing cost of living in Los Angeles. Whatever the reason, your finances are in jeopardy, and youre considering filing for bankruptcy again. But how does it work to file for bankruptcy twice in California?

This post lays out the rules and laws regarding a second personal or consumer bankruptcy. Youll find the answers to these and other frequently asked questions: how soon can I file for bankruptcy again? Whats different about filing a second or subsequent bankruptcy? How common is a second bankruptcy?

Lets delve into the facts and begin the path to financial recovery.

Article at a Glance

Contents

How To Prevent Exemption Problems In A Bankruptcy Case

Its highly recommended for individuals to exempt their property carefully. The court-appointed official assigned to handle your case, also known as the bankruptcy trustee, is required to review these exemptions. If a bankruptcy trustee disagrees with an exemption, they are likely going to try to resolve this issue informally. However, if this attempt is unsuccessful, the trustee is required to file an objection with the court. From here, the judge decides whether you can keep the property in question or not.

One example where the trustee might disagree with a filers exemption could be the classification for art. An individual might own a rare and collectible car with an equity of $15,000. The Los Angeles vehicle exemption doesnt entirely cover this car. From here, the individual might believe that the vehicle qualifies as a piece of art. Thus, the filer exempts the car using the Los Angeles unlimited art exemption. However, the trustee might disagree with these classifications and file an objection to the court. Its the judges decision if the car is exempt because of the states unlimited artwork exemption or not.

These exemption problems can become more serious, as purposely making inaccurate statements can be deemed fraudulent. If found guilty, bankruptcy fraud is punishable by up to 20 years, $250,000, or both.

Don’t Miss: Has Trump Ever Declared Bankruptcy

California Exemption System : Protect Your Home

Section 704 is most commonly used by debtors who wish to protect personal property in their homestead. The homestead exemption applies only to a home that you live in as your primary residence investment property is not protected by homestead exemptions. California Code Civ. Proc. § 704.010

Please note that neither exemption path allows married couples to double their exemptions, while in some states, you can.

Ive included the highlights of the 704 exemptions below. Please note that the list below is not complete and figures are updated every three years, for both exemption systems. For additional details, contact a California licensed lawyer.

Why Hire A Bankruptcy Lawyer

Many people find it incredibly beneficial to gain credit counseling. A bankruptcy attorney can provide legal advice and help with the entire filing process for debt relief. You can expect a bankruptcy attorney to help you:

- Determine when to file for bankruptcy

- Qualify for your chosen chapter

- Protect the property you want

- Avoid bankruptcy fraud or any exemption problems

- Understand when you can stop making any payments you want to erase in your case

When you file for bankruptcy, you can expect your creditors to continue calling. In these instances, its best to ignore these calls. This is because informing creditors about your bankruptcy might encourage them to take more drastic approaches to collect this debt before they lose the right to do so. However, hiring a bankruptcy attorney and referring creditors to your counsel can stop them from contacting you.

Read Also: How Many Times Has Trump Declared Bankruptcy

Can A Chapter 7 Bankruptcy Trustee Take Away A Homestead Exemption For Bad Faith Conduct In Bankruptcy

Luckily for California homeowners and Chapter 7 bankruptcy filers, the homestead exemption cannot be taken away by the Bankruptcy Court for bad faith conduct. This issue went to the United States Supreme Court in 2014, where the court found that: The Bankruptcy Court thus violated § 522s express terms when it ordered that the $75,000 protected by s homestead exemption be made available to pay s attorneys fees, an administrative expense. In doing so, the court exceeded the limits of its authority under § 105 and its inherent powers. Law v. Siegel, 571 U.S. 415, 42223 .

Alternatives To Filing Chapter 7 Bankruptcy

If you are wondering if you should file for bankruptcy, there are many nonprofit consumer credit counseling organizations that have the ability to negotiate more favorable terms with creditors. Its particularly effective with credit-card companies. The repayment program will be managed expertly and fees could be avoided.

Here are some options:

Debt Management Plan Entering into a debt management program can provide relief from interest rates, late fees and penalties from creditors. Under a DMP, which is negotiated by credit counselors, you promise to pay back the full principal over time in an efficiently managed manner.

The debt management program provides an organized monthly payment plan. It provides an opportunity to handle the debt more efficiently than trying to sort it out yourself. By keeping the payments on track, it will be good for your credit score.

Some caveats: There is generally an enrollment and maintenance fee and the DMP is never a guaranteed option. Creditors have no obligation to participate.

Debt Consolidation This option reduces interest rates and combines all of your debts into one manageable monthly payment. Under debt consolidation, you take out a loan, which is used to consolidate and pay off all of your other debts.

Personal Loan for Bad Credit Yes, you can get a personal loan with bad credit, depending on your situation. You can expect high interest rates and should only consider this option if you can truly afford the monthly payment.

Recommended Reading: Has Donald Trump Filed Personal Bankruptcy

Business Or Consumer Bankruptcy

Why does it matter whether the bankruptcy is a consumer or business bankruptcy? If you file a Chapter 7 bankruptcy, and your debt is primarily consumer debt, you have to pass the means test to receive a discharge . However, if your bankruptcy is a business bankruptcy, you get to skip this step. You don’t have to take the means test.

A business bankruptcy is one in which the majority of the filer’s debt is business debt. It’s evident that if a business entitysuch as a partnership, limited liability company, or corporationfiles for bankruptcy, categorizing the bankruptcy will be straightforward. The filing will be a business bankruptcy.

But it isn’t always that simple. An individual who files a personal case yet operates a business canand probably willhave business debt and another type, tooconsumer debt. If the filer’s debt is primarily consumer in nature, the bankruptcy will be a consumer bankruptcyeven if the filer has some business debt, as well. Whichever type the filer has more of will determine the classification.

Business debt and a profit motive go hand-in-hand. Simply put, you incur business debt while trying to make money. For instance, if you borrow money to buy a food truck, the loan would be of a business nature. The same would hold true if you purchased tools for your construction business.

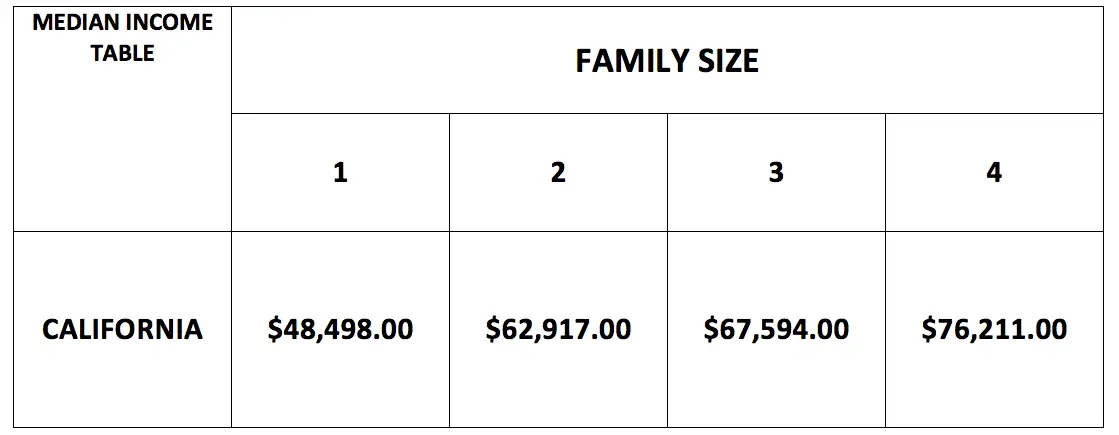

Are You Eligible For California Chapter 7 Bankruptcy Take The Bankruptcy Means Test To Find Out

TheChapter 7 bankruptcy means test can determine if a California petitioners income level and expenses are eligible to file for a Chapter 7 bankruptcy. The formula is designed to prevent individuals from Chapter 7 bankruptcy if they make enough money to pay down unsecured debts. If an individual does not qualify for Chapter 7 as determined by the Means Test of California, he or she may be able to file for a Chapter 13 bankruptcy to repay a fraction of the accrued debt.

Taking the Chapter 7 means test does not necessarily entail that an individual has to be impoverished to be able to file for a Chapter 7 bankruptcy. An individual who qualifies for a Chapter 7 bankruptcy in California may still have a high income if he or she has high car and/or mortgage payments, high taxes, and/or other expenses.

Recommended Reading: Who Is Epiq Corporate Restructuring Llc

Is There An Income Limit For Chapter 7 Bankruptcy

To automatically qualify for Chapter 7, your disposable income must be below the median level for your state. That number varies from state-to-state. If your disposable income exceeds the median in your state, you still may be able to qualify through a means test that includes looking at your income and reasonable expenses to see if you can get that number under the median income for your state.

To Qualify For Chapter 7 Bankruptcy Your Disposable Income Must Be Low Enough To Pass The Means Test

By Baran Bulkat, Attorney

Chapter 7 bankruptcy provides relief from debt bywiping out most unsecured debtand giving the debtor a fresh start. But not everyone qualifies for Chapter 7 bankruptcy. To prevent consumers from abusing the system, filers must meet eligibility requirements before receiving a debt discharge in a Chapter 7 case. In this article, you’ll learn about the main requirements you’ll need to meet before qualifying for Chapter 7 Bankruptcy relief.

Don’t Miss: Can You Rent An Apartment After Filing For Bankruptcy

Who Is Not Required To Take The Means Test

-

Individual Debtors with Income BELOW the State Median

Such individual debtors do not need to take the Means Test and automatically qualify for a Chapter 7 bankruptcy. However any nonexempt assets are is still subject to liquidation.

-

Disabled Veterans

Disabled veterans can also bypass the means test irrespective of their income.

-

Active Duty Military Servicemen and Women

Active Duty Military men and woman also do not need to take the means test.

-

Business Debtors

While business debtors are not required to take the Means Test, the business itself will usually be shut down and liquidated by the trustee. Any nonexempt assets such as inventory and equipment will be sold off the proceeds will be distributed to creditors.

Chapter 13 Debt Limits

Unlike Chapter 7 bankruptcy, in which a person can file for a discharge of unlimited amounts of debt, there are debt limits for individuals with regular income under a Chapter 13 plan, which means that it is not the right option for everyone.

Chapter 13 bankruptcy is more complex than Chapter 7 and takes more time because there is an intricate set of rules for how different types of creditors are repaid over the three to five year period. These rules provide debtors with many advantages and can help debtors deal with things like vehicle loans, home mortgages income tax liens, unprotected assets, and more. Since there are so many advantages to this type of filing, Congress has imposed certain debt limits.

As of 2021, the current debt limit for Chapter 13 filing is $394,725 for unsecured debts and $1,184,200 for secured debts. Every individuals situation is different, so please contact Wadhwani & Shanfeld for an assessment of your unique financial situation.

Read Also: Can I Be Fired For Filing Bankruptcy

How To Look Up California Bankruptcy Cases

Is bankruptcy in California a reasonable way to take control of your finances, or is it a disaster that will potentially haunt you for years? It can be either, or both, depending on a person’s outlook and circumstances. One thing is true in either case: it’s a complex legal proceeding that generates an incredible amount of paperwork. Maybe that’s because both federal bankruptcy rules and California-specific court rules apply to the procedures and filing requirements. Many bankruptcy records in California are public, and you can access them online or at the courthouse. It is easier to find the records you want if you have a basic understanding of the bankruptcy court, its requirements and its filings.

How To File For Bankruptcy In California: A Comprehensive Guide

In many instances, filing for bankruptcy in California is the same when filing bankruptcy in any other state. Undergoing the bankruptcy process in California falls under federal law. Nonetheless, this procedure of bankruptcy filing can be complex, which is why our comprehensive guide is a helpful source of information. Continue reading to gain a better understanding of what individuals need to do to file for bankruptcy in California.

Don’t Miss: Credit Score After Bankruptcy Drops Off

You Havent Had A Recent Bankruptcy Discharge

The law stops people from constantly acquiring debts and discharging them in court. You cant get another Chapter 7 bankruptcy discharge if you obtained a discharge of your debts in a Chapter 7 bankruptcy case within the last eight years, or a Chapter 13 case within the previous six years.

Please note, the filing period begins from when your prior bankruptcy was brought .

Do I Need To Record A Homestead Exemption In California

Under California law, two species of homestead protection are available to judgment debtors, the automatic homestead exemption and the declared homestead protection, respectively. These protections are available under different circumstances, they serve different purposes and they confer different rights on debtors. In re Pass, 553 B.R. 749, 757 .

Don’t Miss: How Many Times Did Donald Trump File For Bankruptcy

How To Benefit From A Homestead Exemption In Chapter 13 And Chapter 11 Bankruptcy Reorganizations

The homestead exemption also plays an important role in bankruptcy reorganizations, such as Chapter 13, Chapter 11, and even the rarely-used Chapter 12. Specifically, debtors are bound in reorganizations to pay their debts over time, such as a 60 month plan in Chapter 13, from their disposable income as calculated by the court under specific formulas.

However, there is a special rule in Chapter 13 and Chapter 11 that a debtor must pass the best interest of creditors test. 11 U.S.C. Section 1325 & 1129 . This test requires that the debtor pay as much to the creditors as they would receive in a Chapter 7 liquidation. In other words, if the debtor has considerable assets, but minimal disposable income, they cant choose the chapter of bankruptcy, notably a reorganization, that allows them to pay less than creditors would receive if their assets were simply sold off in a liquidation.

Luckily for debtors, this comparison under the best interest of creditors test includes that the creditors would not receive the benefit of the California homestead exemption in Chapter 7. Since home equity is often one of the largest assets that debtors would have in bankruptcy, the increased California homestead exemption will mean that the best interest of creditors test will rarely show that creditors will receive more in Chapter 7.

What Is The Exemption Amount In California

Some assets have value-based exemptions in the Golden State. For example, you can protect up to $600,000 in home equity in some cases. The motor vehicle equity exemption usually varies between $3,325 and $5,350. Other exemptions are item-based. For example, retirement accounts are normally 100% exempt, regardless of their value.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed