Can I Refinance A Mortgage With A Bad Debt

Yes, you may be able to. The same rules generally apply if youre taking out a new mortgage or refinancing an existing one.

If your debt-to-income ratio has risen significantly since you took out your mortgage, refinancing with the same provider might be difficult, though it all depends on how flexible theyre willing to be.

It is, however, possible to remortgage with a new lender, as you may be a better fit for their affordability and eligibility criteria.

If you have previously remortgaged to consolidate debts then youll be subject to extra scrutiny from underwriters and they may apply a lower debt-to-income threshold.

Make an enquiry and the advisors we work with can talk you through your options and search the whole market to find the best deals.

What If I Have A High Debt To Income Ratio

Your best bet to lower your debt to income ratio is to start paying down your debts. Pick off the smaller balances first, then start to work on the larger ones, starting with the ones with the highest interest rates.

Earning a higher income will also be helpful in lowering the debt ratio. Doing both will have you in your own home in no time!

Dominion Lending Centers can help you get into your own home, contact us today!

Find Ways To Make Debt Less Expensive

When paying off debt, the name of the game is making your debt as cheap as possible. If youre carrying high-interest credit card debt, try to find less costly alternatives, such as:

- The balance transfer offer mentioned above.

- Asking your current card companies/debtors for a lower interest rate.

- If you already own a home, you might consider a cash-out refinance to consolidate debt.

- Applying for a personal loan with a fixed repayment schedule to consolidate debt to a lower interest rate.

Read Also: Can You Lose Your Home In A Bankruptcy

What Are Common Debt Ratios

The total debt service ratio is the percentage of gross annual income required to cover all other debts and loans in addition to the cost of servicing the property and the mortgage .

The gross debt service ratio is the percentage of the total of annual mortgage Ratio payment relative to annual household income.

You May Like: Can You Do A Reverse Mortgage On A Condo

Aids In Loan Eligibility

When you seek a personal loan to pay for your domestic appliances, your DTI is a crucial consideration. Your DTI wins over prospective lenders, who give you a loan with favorable conditions and a cheap interest rate.

A low DTI will help you qualify for the lowest rates if you apply for a house loan. The smaller your DTI, whether you want to purchase a house or refinance your current loan due to historically low mortgage rates, the better.

Don’t Miss: What Does Filing For Bankruptcy Do

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

You May Like: How Do You Repair Your Credit After Bankruptcy

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wonât likely have money to handle an unforeseen event and will have limited borrowing options.

Can I Get A Mortgage With A 50% Dti

It could be hard to find a mortgage lender that will grant you a home loan with a 50% DTI, but not impossible. Fannie Mae, a government-sponsored mortgage finance entity, will allow a DTI of “over 45%” on a case-by-case basis if the borrower has six months in payments reserves plus other qualifying factors.

You May Like: How Do I Find My Debt Collectors

Tips For Getting A Mortgage

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, consider hiring a financial advisor who can help you plan and invest for the future. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

Recommended Reading: Reverse Mortgage Manufactured Home

The Qualified Mortgage Debt Ratio Rules

Regardless of the loan program you choose, most lenders follow the Qualified Mortgage Debt Ratio rules. The QM rules began after the housing crisis to keep lenders more accountable and borrowers choosing smarter loans.

According to the Qualified Mortgage Guidelines, your total debt ratio cannot exceed 43%. This means all of your debts cannot take up more than 43% of your gross monthly income. Some lenders work around this rule and dont worry about offering Qualified Mortgages, but these lenders are few and far between. Most lenders want to make sure you can afford the loan beyond a reasonable doubt in order to avoid foreclosure.

Read Also: How Long Can You File Between Bankruptcies

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

In Summary: What Is A Good Debt

Its good to have a low DTI because it increases your ability to take on debt if you need to, and it also indicates that youre likely able to manage the debt load you currently have. If youre looking to get a new loan, its good to know how your DTI is calculated and whether yours may help, or hurt, your chances of qualifying. Normally in life, the higher the score, the better. In the case of DTI, low is the way to go.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice, legal, financial, or tax advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Calculators do not include the fees and restrictions that certain products may have. This calculator does not indicate whether you would qualify for a Laurel Road loan. Please visit the applicable banking product pages on laurelroad.com for specific terms and conditions.

In providing this information, neither Laurel Road nor KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Recommended Reading: Can Filing Bankruptcy Stop Wage Garnishment Student Loans

Calculating Debt For A Mortgage Approval

For most mortgage applicants, calculating debt is more complex than calculating income. Not all debt on a credit report should be included in your DTI, and some debt which is not listed on a credit report should be used.

Lenders split debts into two categories: front-end and back-end.

- Front-end ratio: Includes debts that relate to housing expenses: your mortgage payment, property taxes, and homeowners insurance premiums, for example

- Back-end ratio: Includes minimum payments to your credit card companies, car payments, and student loan payments as well as your total monthly housing payment

The Standard Mortgage To Income Ratio Rules

All loan programs have their own maximum debt ratio allowances as follows:

- FHA 31%

- Conventional 28%

- USDA 29%

The VA doesnt have a maximum housing ratio they focus on the total debt ratio, which compares your total monthly debts . Any subprime loans or loans from lenders that arent one of the above will have their own guidelines per the lenders discretion.

You May Like: How To File Bankruptcy Chapter 7 Yourself In Nj

This Number Gives Lenders A Snapshot Of Your Financial Situation

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Also Check: How To Get Rid Of Student Loans In Bankruptcy

What If You Have A High Dti Ratio

If your DTI is higher than 41%, the above residual income rule may be able to help you. With 20% more in residual income per month, you can qualify for a VA loan even with a higher-than-allowable debt-to-income ratio.

However, if coming up with that extra residual income is not possible, you can also work on improving your DTI instead.

To do this, you would need to either reduce your debts or increase your income. This might entail getting a side gig, having your spouse seek employment, or, if theyre already employed, asking for a raise or more hours.

Searching for a lower-priced home or making a larger down payment can help, too. The less you need to borrow, the smaller your mortgage payment will be. Since your mortgage payment is a big part of your back-end DTI, buying a more affordable home can help lower it, improving your chances of qualifying for the loan.

Who Is This Calculator For

The Maximum Mortgage Calculator is most useful if you:

- Want to know exactly how much you can safely borrow from your mortgage lender

- Are assessing your financial stability ahead of purchasing a property

- Would like to compare the impact of different interest rates on the amount you can feasibly borrow.

You May Like: What Are The Requirements To File Chapter 7 Bankruptcy

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Can You Discharge Medical Bills In Bankruptcy

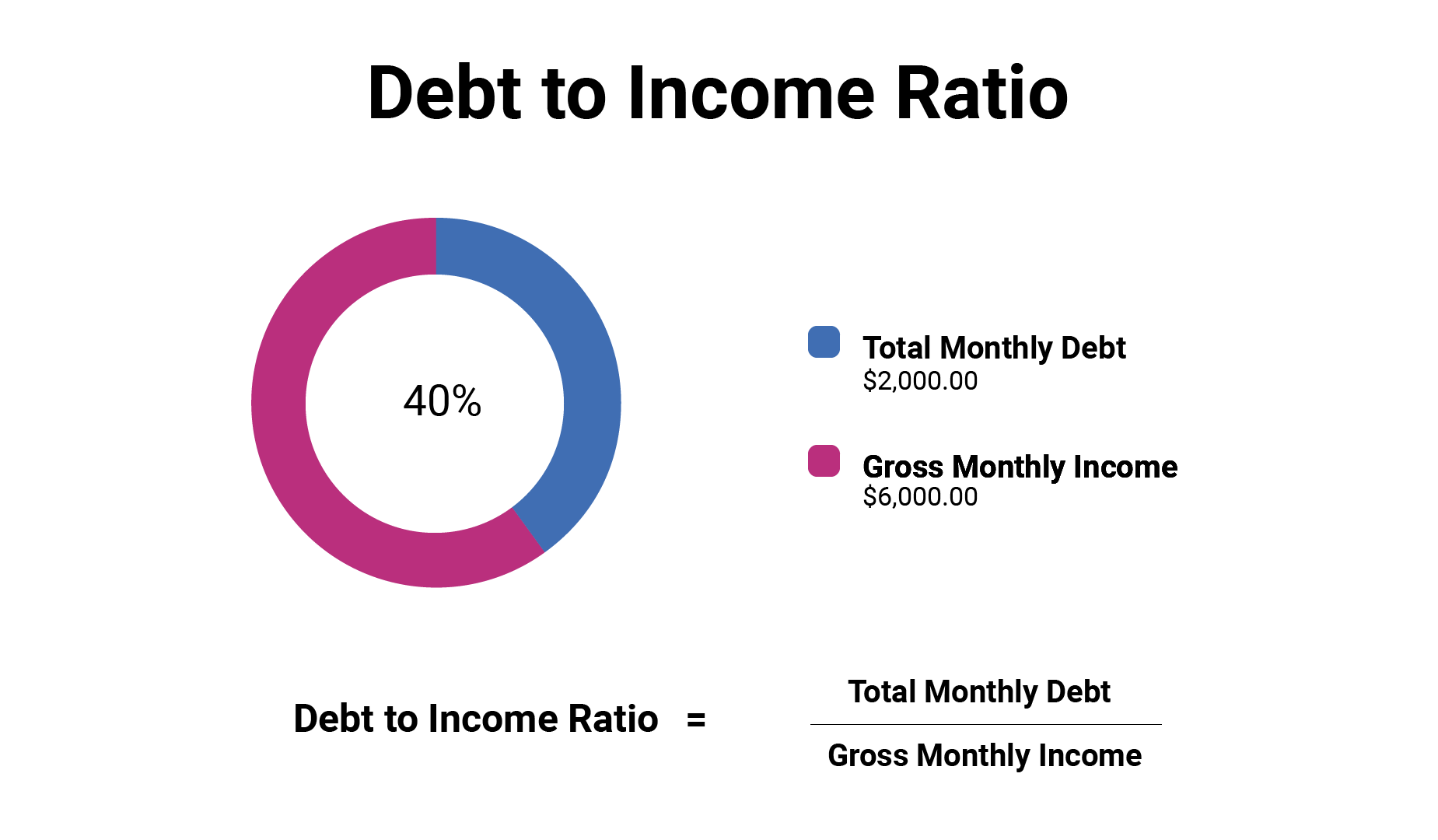

How To Calculate Your Dti Ratio

- Take your gross monthly income

- And divide it by your proposed housing payment

- And then your proposed housing payment and monthly liabilities

- To get both debt ratios

If youd like to figure out your debt-to-income ratio, simply take your average gross annual income based on your last two tax returns and divide it by 12 .

So if you made on average $100,000 gross each year for the past two years, that would equate to $8,333 per month in income.

Next, add up all your monthly liabilities and your proposed housing payment and divide that total by your monthly income and voila.

For that proposed housing payment, you can use my mortgage payment calculator to get the P& I payment. Then gather the insurance, taxes, and other costs from each source for an accurate estimate.

When I say liabilities, I mean all the minimum payments that appear on your credit report. Bills that dont show up on your credit report generally arent counted toward your debt-to-income ratio because they arent credit-related and/or documented.

For example, health insurance premiums, a cell phone bill, cable bill, gardening bill, gym membership, or a pool service may not figure into your DTI. This is a good thing if youre cutting it close.

Keep in mind that youll need a free credit report to accurately see what all your monthly payments are. Fortunately, these are very easy to come by these days.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Don’t Miss: Where Do You Go To File Bankruptcy

Has An Indirect Effect On Your Credit Rating

Since they dont keep track of your income, credit reporting organizations do not look at your DTI. Therefore, your DTI has no immediate effect on your credit score. Your credit usage ratio will be impacted by revolving debt like credit cards.

This comes in at number two when determining your score. It gets computed by dividing your current debt by the sum of all your credit limits. Generally speaking, you should maintain your credit usage below 30%.