Stats On The Us National Debt By Year

- In June 2022, the total US public debt hit $30.46 billion.

- The US interest on the national debt is projected to be $305 billion in 2022.

- The US per capita national debt in 2021 stood at $85,552.

- Interest payments are the US governments 6th largest budgetary expense as of 2022.

- Japan holds the most of the US national debt .

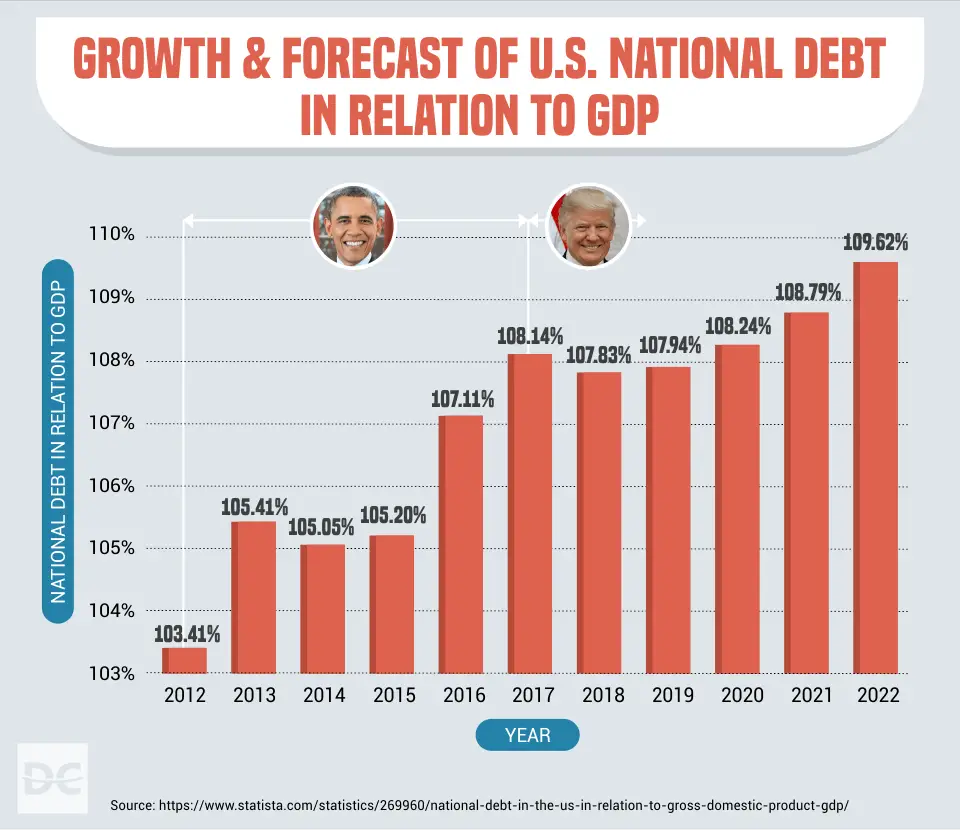

- In terms of Dollar value, Barack Obama was the US President who grew the debt burden the most.

- The wars in Afghanistan and Pakistan have cost the US more than $2.3 trillion.

Tracking The Federal Deficit: November 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $146 billion in November, the second month of fiscal year 2021. This deficit was the difference between $365 billion of spending and $219 billion of revenue. Spending in November, however, was artificially lowered by the fact that November 1 fell on a weekend, causing $63 billion worth of payments that would normally be made in November to be made in October instead. If those payments had been made in November as usual, this months spending and deficit would each have been $63 billion greater, or $428 billion and $209 billion . In the first two months of this fiscal year, the federal government has run a deficit of $430 billion, $87 billion more than at this point last fiscal year. Compared to this point last fiscal year, spending has run 9% higher while revenues have fallen by 3%.

Revenues also fell by 3% from last November, mostly reflecting a drop in withheld individual income and payroll taxes due to lower levels of employment.

Tracking The Federal Deficit: July 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $212 billion in July 2022, the tenth month of FY2022. This deficit was the difference between $272 billion in receipts and $484 billion in spending. This is the second largest single month deficit this fiscal year, but still $90 billion less than July 2021. July receipts were up by $10 billion , as outlays decreased by $80 billion compared to this time last year.

Analysis of notable trends: Over the first 10 months of FY2022, the federal government ran a deficit of $727 billion29% the size of the $2.5 trillion deficit over the same period in FY2021. So far this year, revenues were $789 billion higher than over the same period in FY2021. Individual income and payroll tax receipts increased by $709 billion over the same period, in part because wages and salaries remained high amid a tight labor market. Customs duties and excise tax receipts went up by $18 billion and $11 billion respectively, reflecting increased domestic and international economic activity this year.

You May Like: How Long After Bankruptcy Can You Get A Credit Card

How The National Debt Has Changed Under Trump

The national debt over the nationâs history has grown from a modest $83.7 million under George Washington to a whopping $23.3 trillion today.

But the debt has had some significant spikes for some very important reasons, and there was a brief period of time, one year to be exact, where the debt was entirely paid off.

In 1835, Andrew Jackson paid off the national debt through severe cost-cutting and land sell-offs. Jacksonâs distrust of banks led him to redistribute funds to the states, which in turn caused an economic bubble, which led to recession. Restarting the national debt to reinvigorate the economy was inevitable.

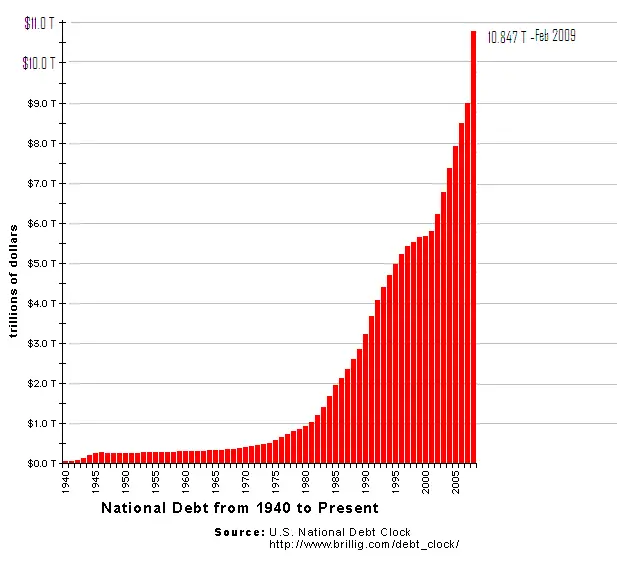

World War I led to the debt increasing by more than $21 billion to a total of $24 billion. Two decades later, Franklin Delano Roosevelt would see the national debt rise from $22 billion to over $205 billion dollars, largely due to World War II. The Wars in Iraq and Afghanistan added $2.1 trillion to the debt just in George W. Bushâs administration alone. US Debt by President: By Dollar and Percentage Both Bush and Obama had massive stimulus packages to fight the 2008 recession that each added hundreds of billions to the national debt.

The Early 20th Century: 1900

In first 50 years or so following the Civil War, the national debt generally fluctuated between $1.5 billion and $2.5 billion. But that changed quickly as Europe began to tear itself apart in 1914 in World War I.

Although America didn’t join the war until April 1917, our impending involvement began to drive borrowing in the years before that. Between 1915 and 1917, the country’s borrowing climbed to over $5.7 billion as the country prepared for and ultimately entered war. And over the course of 1918 and 1919, borrowing soared to $27 billion and would never again end the year below $16 billion.

This borrowing also created the debt ceiling. As President Woodrow Wilson’s administration needed to borrow more and more money to pay for World War I, Congress’ previous approach of approving each bond sale individually became unworkable. Instead, Congress issued an overall cap, telling the U.S. Treasury how much it could borrow overall and allowing the administration to manage the sale of individual rounds of debt. This law has remained in place ever since.

Borrowing ticked up again during President Franklin Roosevelt’s administration during Great Depression. Once the New York Democrat took over from President Herbert Hoover, he began his program of vast, active spending called the New Deal. Roosevelt pushed borrowing to over $40 billion fighting the Depression — nearly doubling the national debt when he took office.

You May Like: What Can You Keep When You File For Bankruptcy

Can The Us Pay Off Its Debt

As budget deficits are one of the factors that contribute to the national debt, the U.S. can take measures to pay off its debt through budget surpluses. The last time that the U.S. held a budget surplus was in 2001. Much of the world depends on U.S. bonds to fund their own countries, and it has become a way of life for governments around the world. While it is unlikely that the U.S. will stop doing this, measures can be taken in other areas to decrease the national debt.

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

You May Like: When Does Chapter 13 Bankruptcy Get Discharged

Tracking The Federal Deficit: September 2019

The Congressional Budget Office reported that the federal government generated a surplus of $83 billion in September, the final month of Fiscal Year 2019. This brings the total FY2019 deficit to $984 billion,26 percent higher than last years deficit. If not for timing shifts of certain payments, this years deficit would have been21 percent larger than the deficit inFY2018. On an apples-to-apples basis, total revenues inFY2019increased by4 percent , while spending increased by7 percent , compared to the prior fiscal year.

Analysis of Notable Trends for Fiscal Year 2019: Corporate income tax revenue increased by 14 percent relative to 2018, although that year notably was tied for the lowest corporate revenue level as a share of the economy since 1965, a result of the Tax Cuts and Jobs Act of 2017 . Customs duties increased by 71 percent versus last year due to the imposition of tariffs, specifically on certain imports from China. On the spending side, outlays from the refundable earned income and child tax credits increased by 14 percent versus last year, reflecting expansions enacted in TCJA. Finally, payments for net interest on the public debt rose by an alarming 14 percent , largely due to higher short-term interest rates and a growing federal debt burden on which those interest payments are owed.

Us National Debt Statistics

- The current US national debt is $26,498,433,296,171 TreasureDirect – The debt to the Penny and Who Holds It

- Thatâs an increase of $3,326,434,162,341 since January 2nd 2020

- In 2020, national debt has increased $14,850,152,510 per day or $1.031 million per minute

- By December 31st 2020, the national debt is currently set to increase a further $2.15 trillion to $28,651,705,410,186

- The national debt per citizen equals $80,274 per person

- Between 2010 and 2020, national debt increased $9,157,778,722,542, an increase of 71.9%

- Since Jan 12nd 2020, national debt has increased more than $2.9 trillion

- National debt has increased for the last 64 years consecutively – the last time it fell was 1956 – 57

- The most expensive decade in American history was the 1860s, where national debt increased 3,726% from $64.8 million to $2.48 billion.

- 1836 – 37 saw the fastest ever increase in US national debt, soaring 882%. This was even quicker than the second fastest debt increase in history, 1835 – 1836, when it rose 798%

- National debt was almost eradicated in in the 1830s, dropping 99.4% during Andrew Johnsonâs Presidency

The U.S. national debt gets a lot of attention from the media and politicians. Still, few Americans truly understand what it means.

Recommended Reading: Pros And Cons Of Filing Bankruptcy In Texas

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

Also Check: Can You File Bankruptcy And Keep Your House

The Federal Debt Ceiling

The federal debt ceiling is the legal amount of federal debt that the government can accumulate or borrow to fund its programs and pay for fees such as the national debt interest. Since its creation through the Second Liberty Bond Act in 1917, the debt ceiling has grown about 100 times. These instances have included permanent raises, temporary extensions, and revisions to what the debt limit can be defined as. When the debt ceiling isnt raised, the federal government is unable to issue Treasury bills and must rely solely on tax revenues to pay for its programs this has occurred 7 times since 2013.

Us Debt By Presidential Term

The national debt between the Ronald Reagan era and Bill Clintons administration slowly increased, but it nearly doubled during the presidential term of George W. Bush to more than $9 trillion.

Here, then, is a brief timeline of how American debt has grown since John Hancock signed the Declaration of Independence on July 4, 1776.

Recommended Reading: How To Claim Bankruptcy In Texas

Coronavirus Lockdown & Unemployment

But by far, one of the most significant impacts on the national debt occurred very recently during Donald Trumpâs administration. President Trump inherited a rising economy which continued to rise through the last two and a half years. The Dow reached 20,000, more than 140,000 jobs were added to the economy, and low unemployment persisted.

Then in February 2020, the COVID-19 pandemic, which had already caused economic havoc in China and Europe, reached the United States.

A highly contagious disease, COVID-19 could not only kill the very old, very young, and very sick, it could also be spread by carriers not displaying any symptoms who were completely unaware that they had it. And, it could live for hours in the air and up to days on surfaces. Faced with what was deemed an âinvisible enemy,â governors across the US ordered schools and non-essential businesses closed, and citizens to self-isolate, telling them to leave their homes only for essential supplies and only when absolutely necessary.

Needless to say, the economic impacts of these decisions were staggering. The eight largest drops in the Dow Jones Industrial Average were recorded during this period. 26 million people had filed for unemployment benefits by late March . And, Congress passed multiple large stimulus bills to assist individuals, families, and businesses.

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Read Also: What Is A Bankruptcy Petition Preparer

Us National Debt By Year Statistics & Facts

The growing debt of the United States has been a matter of discussion for several years. Given the countrys position as the worlds biggest economy, this issue impacts everyones lives.

These essential statistics on the US national debt by year give a detailed understanding of the issue. How and why has the US national debt grown over the years? What is the current situation? What risks, if any, could come about as a result of this growing national debt? Read on to learn the answers to all these questions and more.

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

You May Like: Buy Pallets Of Returned Merchandise

Tracking The Federal Deficit: April 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $308 billion in April 2022, the seventh month of fiscal year 2022. This surplus was the difference between $864 billion in receipts and $556 billion in spending. Aprils surplus compares to a $226 billion deficit in April 2021, with the dramatic change primarily due to the winding down of most pandemic relief spending and income tax receipts arriving in April 2022 that were delayed during the last fiscal year. In both 2021 and 2022, May 1 fell on a weekend, shifting some outlays into April that would normally have occurred in May. If not for those shifts, the April 2022 surplus would have been $373 billion and the April 2021 deficit would have been $166 billion. The following discussion excludes the effects of those timing shifts.

Analysis of notable trends: The federal government typically runs a surplus in April, the month when most taxpayers pay individual income taxes. However, due to high levels of pandemic relief spending and the IRSs decision to delay Tax Day in 2020 and 2021, April 2022 marked the first April surplus since 2019.