Success Rate For Chapter 13 Bankruptcy

Consumers should be aware that there is less than 50-50 chance filing for Chapter 13 bankruptcy will be successful, according to a study done by the American Bankruptcy Institute .

The ABI study for 2019, found that of the 283,313 cases filed under Chapter 13, only 114,624 were discharged , and 168,689 were dismissed . Thats a success rate of just 40.4%. People who tried representing themselves call Pro Se filing succeeded just 1.4% of the time.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Bankruptcy Dismissed Vs Discharged: Whats The Difference

Now that you know why bankruptcies matter when doing tenant screening, its time to get into the nitty-gritty of a bankruptcy dismissed vs discharged.

Whats the difference between these two bankruptcy outcomes?

In the simplest terms, a dismissed bankruptcy indicates that a change occurred during the filing process that led the bankruptcy to be dismissed.

On the other hand, a discharged bankruptcy shows that the bankruptcy is no longer a debt on the individuals record.

Recommended Reading: Can One Spouse File Bankruptcy Without The Other

Can I Convert To Chapter 7 To Avoid A Dismissed Chapter 13 Case

Depending on why youâre at risk of having your Chapter 13 case dismissed, you may be able to convert it to a Chapter 7 case. Most bankruptcy courts allow you to do so by filing a simple ânoticeâ and paying a small conversion fee.

Whether conversion is an option depends on your situation. For example, if youâre unable to stay in the Chapter 13 payment plan because youâve lost your job and itâs not looking like youâll be able to get anything comparable anytime soon, you likely qualify for Chapter 7 relief even if you didnât when the case was first filed.

Of course, you want to make sure that you will not have any other problems when converting to a case under Chapter 7 to avoid a dismissed Chapter 13 case. If youâre behind on your mortgage payments or have property with non-exempt equity, you could face losing this property in a Chapter 7 case.

What Are Alternatives To Chapter 13 Bankruptcy

The process to file bankruptcy is long, stressful and costly. When youre struggling to keep food in the fridge and bills at bay, you might think Chapter 13 Bankruptcy is your only optionbut its not.

Listen, Chapter 13 Bankruptcy is just another debt management tactic. But instead of providing complete relief, it brings years of headache and financial setback. It should be used as a last resort only.

Please hear this: There is hope on the other side of all the financial stress youre feeling. There is hope when creditors are calling and letters are piling up on the kitchen table. You are not hopeless.

Heres the truth: There are other ways to get out of debt and come out on the other sidewithout filing for bankruptcy or worrying about your credit score. Not only will these bankruptcy alternatives give you relief from the endless piles of bills, but theyll also give you your life back:

Donât Miss: How Much Debt Can I Afford

Read Also: Where Can I Buy Pallets Of Merchandise

Common Reasons For Dismissal

2005 changes to the U.S. Bankruptcy Code now require all debtors to complete a credit counseling course from an approved credit counseling agency within 180 days before filing their petition. Failure to comply with this requirement will result in an automatic dismissal of the case. Similarly, a bankruptcy case will be dismissed if the debtor fails to appear at the meeting of creditors or does not file a financial management certificate with the court soon thereafter.

Other common reasons for a bankruptcy dismissal include:

- Concealing property or transferring property within one year of filing for bankruptcy, in an attempt to defraud creditors

- Unable to explain missing assets

- Destroying or failing to keep good records

- Lying under oath

See also:How to Screw Up Your Bankruptcy Discharge

If The Court Dismisses Your Chapter 7 Or Chapter 13 Bankruptcy Case Without Prejudice You Can Refile Your Case Right Away

If the court dismisses your bankruptcy case without prejudice, you can file another bankruptcy caseright away, even. But you’ll typically have to fix your original mistakes before your second case is successful. Also, if you want to keep creditors at bay, you should plan to file a motion to extend or impose the automatic stay in your new case.

Read on to learn more about what happens if the court dismisses your case without prejudice and how the dismissal can affect the automatic stay in your next bankruptcy filing.

For more information about what to do if the court dismisses your bankruptcy, see When Your Bankruptcy Case Is Dismissed.

Read Also: Help With Credit Card Debt

Failing To Make Your Chapter 13 Plan Payments

In Chapter 13 bankruptcy, you can keep all of your property , but you must pay back some or all of your debts through a Chapter 13 repayment plan. Chapter 13 plans typically last three to five years, and the court will enter your discharge upon successful completion of all plan payments. If you stop making your Chapter 13 plan payments, the court will typically dismiss your bankruptcy.

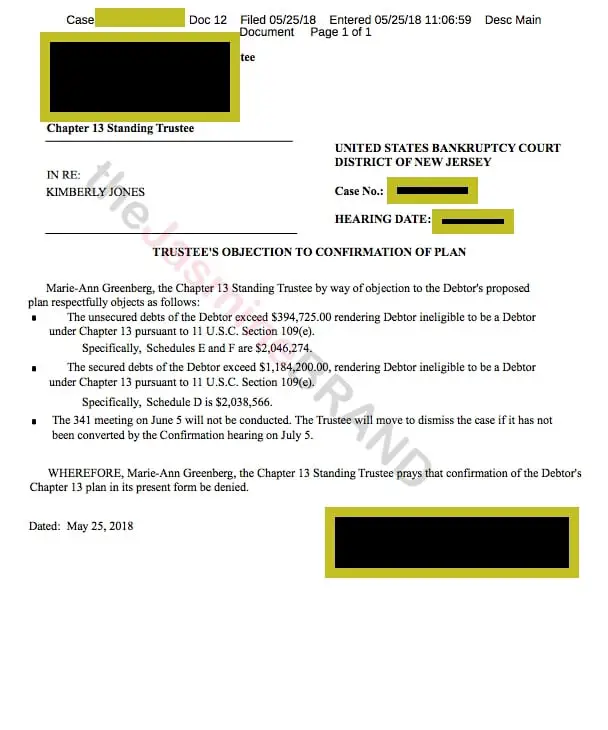

Procedures Followed During The Dismissal Of A Chapter 13 Case

If a Chapter 13 bankruptcy is dismissed, bankruptcy protections will no longer apply, and creditors may take action to collect debts owed by the debtor. In some cases, a debtor may choose to convert their case to a and receive a discharge of their outstanding debts. However, this raises the question of what will happen to funds that were paid to the trustee in the Chapter 13 case but had not yet been distributed to the creditors in the repayment plan.

Section 349 of the U.S. Bankruptcy Code states that a dismissal of a Chapter 13 bankruptcy revests the property of the estate in the entity in which such property was vested immediately before the commencement of the case under this title. This indicates that funds paid to a trustee that were not distributed to creditors before the dismissal of the case should be returned to the debtor. However, the trustee may deduct administrative fees before returning the funds.

Don’t Miss: Bankruptcy Attorney Rochester Ny

What Is Debt Consolidation

Debt consolidation is the practice of taking out one large loan to pay off a bunch of smaller debts that are charging higher interest.

Debt consolidation may or may not be a good idea, depending on your situation. Lower interest is a good thing, but turning unsecured debts into secured debts can be a costly mistake if you eventually file bankruptcy anyway. Unsecured debts can often be eliminated in bankruptcy, while most secured debts cannot. If you can’t pay your secured debt — or if the payments are late — you may lose your home.

Also, the fees for setting up such loans can be expensive.

1. Learn what to do.2. Get help if you need it. 3. Get on with your life.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The sponsored attorney advertisements on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Your use of this website constitutes acceptance of the Terms of Use, Privacy Policy and Cookie Policy.

Bankruptcy Dismissal Without Prejudice

If your case is dismissed without prejudice, it means that you can refile immediately. Unless you disobey court orders, abuse the bankruptcy system, or engage in other intentional misconduct, the court will typically dismiss your case without prejudice. In general, if the court dismisses your case without prejudice, it’s usually a better idea to simply refile your case rather than appeal the dismissal.

Don’t Miss: How To Declare Personal Bankruptcy In Quebec

Life After Chapter 13 Bankruptcy

Chapter 13 can be useful for people with serious debts who worry about losing their homes to bankruptcy. If you adhere to your repayment plan, youll have a new lease on financial life.

Unsecured debts will be gone, but mortgages and car payments might linger. Hopefully, youll have developed the habits needed to meet those obligations.

Chapter 13 And The Cares Act

The federal government rolled out all sorts of Covid-19 relief packages, and the CARES Act made bankruptcy filings available to businesses and individuals affected by the pandemic.

Among other things, repayment plans were extended to seven years. The bill was signed in March 2020, and many provisions have expired. Your bankruptcy attorney should be able to apply any provisions that are still applicable.

You May Like: Household Finance Personal Loans

Also Check: How Do You Get A Copy Of A Bankruptcy Discharge

Bankruptcy Dismissal With Prejudice

If you engage in willful misconduct or file for bankruptcy multiple times to delay your creditors, the court might decide to dismiss your bankruptcy with prejudice. Depending on the judge’s order, a dismissal with prejudice can have significant consequences including:

- time limits on when you can file for bankruptcy again, and

- restrictions on which debts you can discharge in a future bankruptcy filing.

Because a dismissal with prejudice can have several negative consequences, it might be worthwhile to appeal the decision to a higher court for further review.

Downsides Of Voluntary Dismissal Of Chapter 13

Some of the disadvantages to being dismissed from a Chapter 13 bankruptcy voluntarily can be quite serious, but sometimes being dismissed could be your best option. Here are some of the downsides to a voluntary Chapter 13 dismissal:

- Interest and Penalties May Be Added to Your Debts

- Debts may not be discharged

- Opportunities to credit can be greatly decreased

- Waiting period before eligibility to file again

You May Like: B& p Liquidation Pallets

Understanding How Chapter 13 Dismissal Refund Works

After filing for bankruptcy, the courts will assign a Chapter 13 trustee to you. When making payments to your creditor following the new plan, you will not be in contact with your creditors. Your trustee will be holding the money and passing it to your creditors. If your trustee holds an amount of money that they are yet to distribute to the creditor at the time of the dismissal, the trustee should return the money to you.

However, there is a process the trustee must follow before returning the money. They must file detailed accounting for the funds before making a refund. The law allows the trustee to deduct pending administrative fees from the money before returning it. While the process may seem straightforward, it could take several weeks or months to get a Chapter 13 dismissal refund.

If you have hired a bankruptcy lawyer to help with your case, the lawyer can also claim unpaid service fees from the funds. In some cases, the refund can be subject to an IRS levy or wage garnishment order since the automatic stay is lifted once the case is dismissed.

How Do I Refile Bankruptcy After Dismissal How Long Do I Have To Wait To Refile

What to do in the event of a dismissal? The answer will turn on exactly why your case was dismissed. If youve dismissed your case in bad faith or it appears youre trying to game the system, you might have to wait 180 days before refiling. Section 109 of the Bankruptcy Code prevents a debtor whose case was dismissed from filing another bankruptcy for 180 days if:

the case was dismissed by the court for willful failure of the debtor to abide by orders of the court, or to appear before the court in proper prosecution of the case or the debtor requested and obtained the voluntary dismissal of the case following the filing of a request for relief from the Automatic Stay.

While exactly what constitutes a willful failure to abide by the orders of the court is a fact-specific inquiry that must be decided on a case-by-case basis, it is unlikely that a creditor or U.S. trustee would object to a case being refiled that has been dismissed for failure to take the credit counseling or financial managements courses. In these cases, the debtor will almost always be permitted to refile right away without any hassle.

See also: How Often Can You File for Bankruptcy and Receive a Discharge?

Read Also: How Many Years After Bankruptcy Can You Get A Loan

Failure In Chapter 13 Payments

Failure to comply with the repayment plan duly approved by the court can end up with a Chapter 13 bankruptcy dismissal. The repayment plan typically lasts three to five years. The filer needs to be faithful with their monthly repayment. Failure to do so could merit a bankruptcy dismissal. Not Attending Meeting With Creditors

If you file for Chapter 7 or 13, a meeting with your creditors is necessary. It gives chance to the designated trustee and creditors to ask questions about your bankruptcy documents and finances. The whole meeting is done under oath. You face bankruptcy dismissal if you are a no-show in this meeting.

Hello Lawsuit Risk No More Collection Stay After Dismissal

Like most people who file bankruptcy due to financial stress, you probably felt pretty bad emotionally about having to do it. However, at least it brought the peace of mind of knowing that none of your creditors could bring collection lawsuits against you.

Thats because filing a bankruptcy petition puts an automatic stay on any further collection activity by creditors, including the use of the courts to file lawsuits for recovery on collection accounts. In fact, one of the main reasons people file bankruptcy is to put a stop to collection lawsuits, whether they have already been filed or are being threatened by collection attorneys.

Unfortunately, once your Chapter 13 bankruptcy is dismissed by the court the automatic stay is no longer in force. This means its hunting season against you all over again. Creditors are no longer blocked from trying to recover money from you via court judgments. And judgments can lead to garnishment of wages, liens on property, or levy of non-retirement bank accounts. So the fear experienced by many consumers after having their bankruptcy case dismissed can be very intense.

Read Also: How Much Debt To File Bankruptcy

What Are The Requirements To Be Eligible For A Dismissed Bankruptcy

A person is eligible to be discharged from bankruptcy if they have met the following requirements:

1. They have completed the terms of their bankruptcy plan and are current on all payments owed to creditors

2. They have filed all required tax returns, or if they are not required to file taxes, they have met their tax obligations for three years

3. They have paid all child support payments due within one year of filing for bankruptcy protection

How Does A Chapter 13 Dismissal Refund Work

Any money thats undistributed to creditors is returned after a Chapter 13 dismissal. However, before they can return the money to you, the Chapter 13 trustee must file a detailed report with the court. At this stage, the trustee has the right to deduct any administrative fees from the remaining sum before returning the money. Additionally, your bankruptcy attorney can claim any unpaid professional fees, and your case may be subject to wage garnishmentor an IRS levy.

Read Also: Bankruptcy Lawyer Bethlehem Pa

Dismissal Conversion & Closing Of A Bankruptcy Case What Are The Differences Between Them

A) Dismissal vs. Closing of a Bankruptcy Case — The main differences between dismissal and closing of a bankruptcy case involve discharge, ability to file another bankruptcy case, and the consequences of filing another bankruptcy case.

Closing does not mean that a discharge was entered unless all activities related to determining discharge have been completed. If a bankruptcy case is closed without a discharge because an individual debtor did not timely file a Certificate of Completion of Instructional Course Concerning Personal Financial Management, a debtor must file a Motion to Reopen the Case.