What Is The National Debt Costing Us

As the debt grows, so does the interest we pay.

Similar to a home or car loan, interest payments represent the price we pay to borrow money. As we borrow more and more, federal interest costs rise and compound. Rapidly growing interest payments are a burden that hinders our future economy.

Interest will become the fastest growing part of the federal budget.

In ten years, our interest will nearly triple from where it is today.

Income Tax Calculator: Estimate Your Taxes

One reason we cut corporate taxes was to make US companies more competitive. It worked. Do we really want to lose that? Not to mention what it will likely do to the stock market. Just saying

2. Debt is future income brought forward. There is a point at which debt becomes a drag on US economic growth, and we have likely reached it.

GDP growth in the US is going to increasingly look like Japan and/or Europe, i.e., almost nil. So, the CBOs continued 2% average growth forecasts will simply get thrown out the window and the deficits will get worse.

Dont shoot me Im just the messenger.

3. It is possible Im being overly pessimistic about the need for a Great Reset which would include national debt. Japan reached 250% debt to GDP a few years ago, since which the Bank of Japan bought around half of total government debt , and Japan is doing just fine. The European Central Bank is buying anything not nailed down and is muddling through.

4. Let me point out that, while the practical results of quantitative easing look similar to modern monetary theory , the actual results and practice are completely different. I am not persuaded that the US Congress can understand the difference. Dear gods, I hope they can.

I was just explaining this to a friend. He asked me what we should do, somehow believing that there has to be an answer. There isnt one.

We have no good choices left. It is as if we are on a trip through a desert and know for certain we dont have enough water to go back.

Where Can I Trade Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Recommended Reading: How Long Does A Bankruptcy Stay On Equifax

Consequences Of Us Debt At $50 Trillion

With the US set to breach the $50 trillion mark in debt by 2030, here are five things we should start thinking about sooner rather than later.

1. Raising taxes will not solve the problem. Of course, it could help reduce the deficit some, but it would be more of a token. That is just the reality. From the Tax Foundation, here are the real numbers as of 2017.

If we double taxes on the top 25%, it would only bring in another $1.3 trillion, assuming people didnt change their behavior.

A less-shocking 20% to 25% increase would only bring in about $3 billion to $400 billion, and would have to raise rates on incomes above $83,000.

Not exactly the rich. They already think they pay their fair share.

If we raise taxes next year in the teeth of a recession, it will only make the recession worse. If we raise taxes but they dont actually take effect until 2023 and then get phased in? That would probably avoid creating a double-dip recession.

What Is A Cookie

We make use of cookies on this website. A cookie is a simple small file sent to pages of this website and stored by your browser on your hard drive from your computer. The information stored therein can be returned to our servers at a subsequent visit. Via the site Your Online Choices you can customize the online privacy settings for your computer.

Recommended Reading: Can You Cancel A Chapter 13 Bankruptcy

President Andrew Jackson Cuts Debt To Zero

The War of 1812 more than doubled the nations debt. It increased from $45.2 million to $119.2 million by September 1815. The Treasury Department issued bonds to pay a portion of the debt, but it was not until Andrew Jackson became president and determined to master the debt that this national curse, as he deemed it, was addressed.

The time of prosperity was short-lived, as state banks began printing money and offering easy credit, and land value dropped.

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt moved above $30 trillion on Jan. 31, 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

When the debt gets so big that it hits the debt ceilingthe limit put in place by Congressinvestors may worry that the U.S. will default on the debt. In that case, the government will need to raise the debt ceiling or reduce the debt through higher taxes, spending cuts, and more.

You May Like: What Happens If An Llc Files Bankruptcy

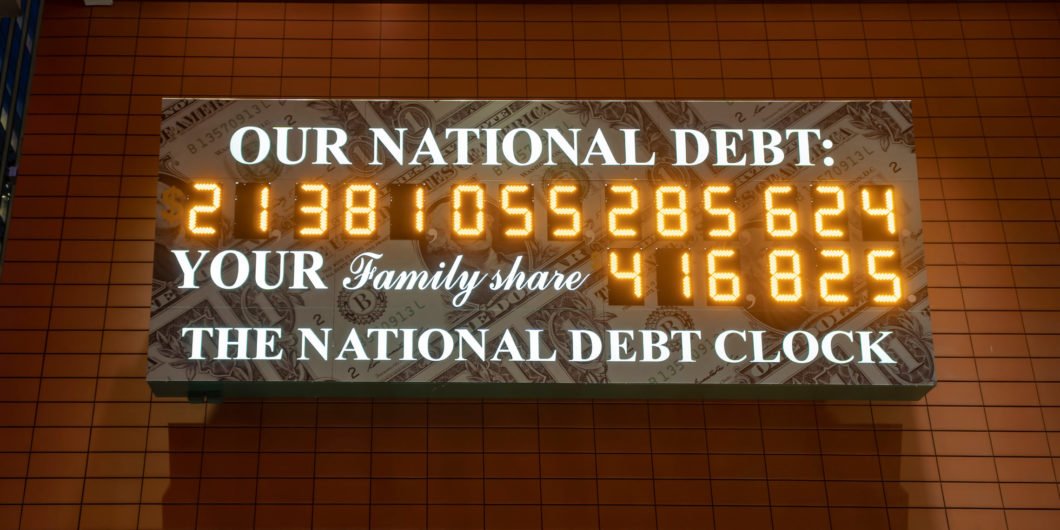

Why The Debt Clock Is Important

The U.S. national debt is the sum of all outstanding debt owed by the federal government. It’s an accumulation of each year’s budget deficits. About three-fourths of the national debt is public debt, which is held by individuals, businesses, and foreign governments that bought Treasury bills, notes, and bonds. The government owes the rest to itself, mainly to Social Security and other trust funds, and that’s known as intragovernmental holdings.

The debt clock shows how much the U.S. government owes its citizens, other countries, and itself. Most federal revenue comes from individual taxes. The government counts on you to pay the debt back one day. Corporations pass their tax costs through to you by raising prices. In other words, you, your children, and your grandchildren must pay 100% of the debt through higher taxes. The higher tax burden that the level of U.S. debt causes dampens expectations. It’s a big threat to the quality of life for future generations.

On Dec. 14, 2021, the debt ceiling was raised again. The increase of $2.5 trillion set the new limit around $31.4 trillion. This increase constituted the largest dollar amount increase of the national debt.

Twin Towers Attacks Corporate Scandals And Wars In Afghanistan And Iraq

The terrorist attack of September 11, 2001, led to the War in Afghanistan, and eventually, the invasion of Iraq in March of 2003. The war lasted more than eight years, ending on December 18, 2011.

The stock market had experienced a brief slide after the terrorist attacks. But after rallying, the market began to fall again in March of 2002, partially due to corporate fraud scandals of 2001, such as Enron, Tyco, and WorldCom.

National Debt: $6.783 trillion

Also Check: Who Does The Bankruptcy Trustee Represent

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

At the end of the fourth quarter in 2021, the national debt was about $29.6 trillion. Based on the fourth-quarter GDP of $23.9 trillion, the debt-to-GDP ratio was about 124%.

| End of Fiscal Year |

|---|

| COVID-19 and American Rescue Plan Act |

Savings And Loan Crisis

During the Savings and Loan Crisis, more than 1,000 of the nation’s savings and loans failed, costing taxpayers $132 billion and bankrupting the Federal Savings and Loan Insurance Corporation. This year marked the end of what had once been a secure source of home mortgages.

National Debt: $2.602 trillion

Also Check: Can You File Bankruptcy Alone When Married

Us National Debt Clock

The US National Debt Clock covers the outstanding debt owed by the federal government. Two-thirds of the clock shows the public debt by way of treasury bills, notes, and bonds – this covers individuals, businesses, and foreign governments. The other third of the debt is what the government owes to itself – this covers federal programs like Social Security.

The largest budget items include: Medicare and Medicaid, Social Security, defense, and interest paid on the national debt. The former two items are a part of the mandatory programs that the government is required to fund with federal expenses. To give you an idea of how much more the U.S. spends compared to other countries, for the defense budget alone the U.S. spends more than China, India, Russia, Saudi Arabia, France, Germany, the United Kingdom, Japan, South Korea, and Brazil combined.

The Debt Clock also gives statistics on the demographics of the country, which is helpful in understanding where program funding may go. With a population of over 329 million, 60 million people are enrolled in Medicare and 79 million people receive Medicaid. In addition to this, there are currently 54 million retirees who seek Social Security benefits.

How Much Would Each American Owe To Pay Off Its National Debt

The US Census Bureau estimates the American population is 324,356,000 at the end of 2019. The US national debt as of 2019 was approximately $22.7 trillion. Thus, every American, regardless of age, would have to pay nearly $70,000 to resolve the US national debt. If only adults are taken into account, then the per capita debt would be about $90,500.

Also Check: How Many Times Has Trump Declared Bankruptcy

What Can You Do

The national debt continues to grow, and it is important to be informed and proactive. Up to Us is an organization that empowers young adults to be educated about fiscal policy through on-campus activities. Get involved by hosting an event, attending a program, and connecting with other like-minded individuals.

Breakup Of Northern Securities

In 1902, President Theodore Roosevelt ordered the Justice Department to break up the Northern Securities Company. This holding company controlled the main railroad lines from Chicago to the Pacific Northwest.

Roosevelt took the position that the company was an illegal monopoly. The company appealed the move, and the case went all the way to the Supreme Court, which ruled in favor of the federal government.

National debt: $2.3 billion

Also Check: How To Look Up Bankruptcy Filings

How Government Debts Affect You

The approximate interest rate on the cost of market debt in Canada is about 2.01 percent. Interestingly enough, the country accrues $75 million of debt per day in interest charges alone. That trickles down to the taxpayers, many of whom are seeking debt relief options for themselves.

According to the Financial Post, a study shows that Canada is a world leader in debt. One hypothesis for the debt getting so high is the fact that Canada came out largely unscathed from the last financial crisis. Low interest rates encouraged more borrowing, which led to bankruptcies and other economic downturns.

Stock Market Crash & The Great Depression

On October 29, 1929, wild speculation and rapid expansion finally caught up with Wall Street. The Black Tuesday stock market crash resulted in billions of dollars lost. In its aftermath, America and the rest of the industrialized world spiraled into the Great Depression, which lasted until 1939. It was the deepest and longest-lasting economic downturn in the U.S. up to that time.

National Debt: $17 billion

Read Also: How Long Does Bankruptcy Show On Credit Report

Can America Keep Piling Up Debt

Economists debate whether the spending is sustainable. The U.S. finances the debt by selling bonds at auction. Demand has traditionally been high due to the size of our economy and a historically stable government, but the Treasurys auction of bonds in March 2021 was met with a tepid response.

Historically low interest rates meant the U.S. borrowed money cheaply, and it would theoretically invest it in an economy that would produce higher rates of return.

But interest rates are not expected to stay low forever. The 10-year rate on Treasury notes was expected to rise from 1.7% in March 2021 to at least 2.0% by the end of 2021, according to Kiplingers forecast.

The cost to just finance our debt is expected to be $378 billion in 2021 and increase to $665 billion by the end of the decade, according to CBO estimates. That money will be spent only on interest, not on the principal.

The U.S. is by far the most indebted organization in world history. While debt has been an issue since the inception of the U.S., its rapid growth will continue to challenge lawmakers into creating better programs to reign in expenditures, as well as American consumers who must develop improved way of managing their personal debt.

6 Minute Read

How Has The Covid

According to the Congressional Budget Office, debt held by the American public will rise to 98% of GDP due to the economic impact of the coronavirus pandemic and legislative actions taken as a result. The CBO says that the main driver of the increased debt is a federal budget shortfall of $3.3 trillion, the largest since 1945.

Read Also: How To Get A Copy Of My Bankruptcy Discharge Letter

Cryptocurrencies Go Mainstream & Tax Reform

This was the year that Bitcoin and other cryptocurrencies reached a level where awareness really spread among ordinary people not just those seeking a means of keeping transactions out of the central banking system.

This was also the year for the first major tax reform in nearly three decades. The Tax Cuts & Jobs Act of 2017 cut taxes for corporations and individuals, giving the country a short-term economic boost.

National Debt: $20.245 trillion

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

You May Like: Can You File Bankruptcy On Disability

What Is The Canada Debt Clock

The Canada Debt clock is a visual representation of the countrys total debt, in real-time. With the current debt figure where it is, its hard to believe the Canadian government balanced the budget in 1997. The Canada Debt Clock came out of retirement in 2011, and the federal government has been dealing with long-term debt for years now. However, the 2015 budget states a balance that ran up to February of 2016.

Does The National Debt Affect American Citizens

The US national debt does have the potential for ramifications that individual citizens may be impacted by. According to the Congressional Budget Office, US citizens could feel the effects of a large national debt in higher taxes, lower ability to fund benefits and services, and less money to meet economic crises like wars or natural disasters like the coronavirus pandemic.

Recommended Reading: What Is An Unsecured Claim In Bankruptcy

We Can Do Too Little And Sputter

That brings us to now. How should the government think about the debt at a moment with such an overwhelming public health and economic need for government intervention?

Because of the current economic situation, we can do more for future generations by containing the virus and getting the economy going right now than we could by trying to restrain debt accumulation, Gale of the Brookings Institution said.

Biden himself echoed that point in February.

The one thing we learned is we cant do too much here, he said. We can do too little. We can do too little and sputter.”

Most of what we hear about the debt we hear in the context of Bidens stimulus spending bill. Democrats, committed to going it alone on the bill, are split on how targeted the bill should be that is, which expenditures will best justify the expense.

There’s money that we need to spend, said Strain. I think we need to spend the money on state and local governments. We need to spend money on public health considerations, and we need to spend money to reopen schools and I think it’s appropriate that that money be deficit-financed. But I don’t think it makes sense to just let it rip and pretend that there’s a money tree out there.

De Rugy, by contrast, said the debt should be a massive consideration for policymakers in debating more fiscal stimulus. For the last generation, debt has only gone up, and at some point it has to go down, she said.