Bidding At The Foreclosure Sale

The Public Trustee schedules sales of properties in foreclosure on Thursdays at 2 p.m. on the GovEase website.

Lenders that intend to sell property at a foreclosure sale must submit a written bid to the Public Trustee no later than noon two business days prior to the scheduled date of sale.

You can determine if a bid has been submitted on a particular property by either of the following methods:

- Select the Foreclosure Property Search and search for the property you are interested in purchasing. You will be able to view the foreclosure records on each property in foreclosure. Click on the Sale Information tab for the holder’s initial bid. The bid will be available for viewing by selecting the View Documents link under Property Details.

- Select the Foreclosure Reports on the Pre Sale List to view all the properties going to sale and the opening bid submitted by the lender. This list is uploaded to our website on Tuesday afternoon and updated on Wednesday and Thursday

If a bid has not been submitted, the sale date may be continued.

You can determine the new sale date by either of the following methods:

- Select the Foreclosure Property Search to find the property you are interested in purchasing. Use only one search criteria to get the best search result. The rescheduled sale date will be shown if you select the Basics link under Property Details

- Select the Foreclosure Reports on the Final Sale Continuance List to see all files on which the scheduled sale date has been continued.

Bidding At Trustees Sales

Trustees Sales are public auctions with a minimum bid. Often, the minimum is not the entire amount of the debt and additional bids up to the total amount of the foreclosing debt may be made by or on behalf of the Beneficiary. A person bidding at Trustees Sale can determine the approximate total amount of the foreclosing debt by examining the Notice of Trustees Sale. The Bidder is buying the property subject to any and all liens and encumbrances which are senior to the Deed of Trust being foreclosed. It is the Bidders sole responsibility to determine the value of the property being auctioned and how high they will bid. It is also the Bidders sole responsibility to determine the number and amount of any and all encumbrances and/or liens which are recorded against the property and which are senior in priority to the Deed of Trust which is the subject of the Trustees Sale. RESS Financial Corporation does not furnish legal advice, title information, or opinions as to the value of the property being auctioned.

All bids at Trustees Sale must be accompanied by Cashiers Check or cash for the total amount of the final bid and must be presented at the time of sale. All funds are subject to clearing before a Trustees Deed will be issued.

If you have general questions regarding this process, you may contact our office. For specific questions, we recommend that you contact a real estate attorney.

Other Ways To Find Public Records

| Find public records by category |

| Select a different public record category below to view all online resources for that category. |

| Find public records by state |

| Go to the public records pages for any state. |

free directory of public records links

None of the information offered by this site can be used for assessing or evaluating a person’s eligibility for employment, housing, insurance, credit, or for any other purpose covered under the Fair Credit Reporting Act. Please visit GoodHire for all your employment screening needs.

California Privacy Notice: If you are a California resident, you have the right to know what personal information we collect, the purposes for which we use it, and your options to opt out of its sale. To learn more, click the following link: Do not sell my info

Search Public Records

Also Check: How Long Can A Bankruptcy Remain On A Credit Report

See What People Are Saying About Us

I just received my automatic discharge and want to thank the trustees for providing their expertise and all that they do on this phenomenal site. Ive read every single archived blog dating back to 2005 and this truly is the best and most informative site out there. Trust me, I looked! The entire bankruptcy process was easier than I ever expected. To all those who are or will be filing soon, just do whats expected of you. Dont stress over surplus payments and complain about fees. Just go with it because its a very small price to pay for debt relief. Thanks again Gentlemantake care.

I filed for bankruptcy back on March 18th. I really was not in a bad financial situation and am still not today but I had to do something to get CRS off my back for $80,000. They went back and dissallowed many of my deductions which were legitimate but i could no longer prove because of a nasty divorce and the burning of my papers. I recieved my discharge papers from my Trustee last week. Over the past 9 months I have visited this site on a daily basis and it has been a huge help. I really appreciate this site will continue to come back and read. For all of you out there that are fearing what the future holds for you before, during and after filing please take a deep breath and know that everything will work out for the best. You life is not over it is just beginning. Thanks again for the site.

Stop The Trustee Sale By Going Through Your Mortgage Lenders Loss Mitigation Process

You may be able to work out a new agreement with your lender to avoid the Trustee Sale and fully resolve the default:

It is important to understand that loss mitigation options like the ones listed above may resolve the matter but that its not a guaranteed solution. If you get denied for one of the options above, the bank may still move forward with the Trustees sale.

Or, if youre applying too close to a Trustees Sale, the bank may decline to review your loss mitigation option due to bad timing.

So, if you are considering pursuing one of the options above and have a Notice of Trustees Sale, it is always advisable to have an attorney consultation as soon as possible to ensure you make the right decision. If you cant afford legal advice, check with a housing counselor to see if they can help you stop or delay the foreclosure proceedings.

Recommended Reading: How To Get Approved For A Car Loan After Bankruptcy

Avoid The Trustee Sale By Completing An Equity Sale Of Your Property Before The Foreclosure Sale Date

If you want to sell your home and recover your equity, you may want to consider selling the property on the real estate market before your foreclosure auction date.

Stop the Trustee Sale by using foreclosure defense laws and protections:

- For homeowners in Washington State, you may be eligible for Foreclosure Mediation under the Foreclosure Fairness Act. This is a government-help program designed to stop foreclosure so you can communicate directly with your bank. In Washington, you become eligible for Mediation once you receive your Notice of Default . A Foreclosure Mediation stops the foreclosure activity on the property until the Mediation is complete. You can still be eligible for Mediation even if you get a Notice of Trustee Sale but only for 20-days after the Notice of Trustee Sale was recorded. So, it is imperative that you reach out to an attorney or housing counselor as soon as you get your Notice of Trustee Sale document to take advantage of foreclosure mediation.

- You can sue your bank using the foreclosure litigation process if there is some violation of state law. Or, you may be able to sue your bank under federal regulatory laws like RESPA, TILA, the FDCPA and the CFPB. With that said, you want to make sure that you have a valid legal reason for suing your bank before you do so suing your bank just to get more time in the home isnt always the best option.

What Is A Notice Of Trustee Sale

A Notice of Trustee Sale is a recorded document that gives notice of the date, time, and location of an upcoming public auction of real property facing foreclosure.Vegan culture and nutrition: 10/26/09 sildenafil 100mg buy oxanabol 10mg bodybuilding steroids safarimatch.The Notice of Trustee Sale is a legal notice delivered by both first-class and certified mail to a borrower informing them of the foreclosure sale. The Notice of Trustee Sale will indicate the names of the grantor, current beneficiary of the deed of trust, the current trustee, the current mortgage servicer, and the parcel number of the property.

The public auction is referred to as a Trustees Sale and is typically the final step in the non-judicial foreclosure process. .Buying Steroids Online l No Prescription Needed l Safe Delivery buy halotestin online anabolic digital fat moviesThe Trustee works on behalf of your lender and the beneficiary of your loan. The Trustee legally executes the Trustee Sale. Typically, before the Notice of Trustees Sale is issued, the Trustee assigned to your deed at the time of mortgage origination will be replaced by a Substitute Trustee. The Substitute Trustee is normally a local law firm that specializes in conducting foreclosure sales.

So, if you have received a Notice of Trustees Sale, you need to take this matter seriously if you intend to try to avoid foreclosure.

Also Check: What Debt Is Included In Debt To Income Ratio

Foreclosure Sale Bidding Policy

Effective May 14, 2021

The Garfield County Public Trustee holds a foreclosure sale every Wednesday at 10:00 a.m. at 109 8th St, Suite 204, Glenwood Springs, CO 81601. If you wish to attend a foreclosure sale, please make sure that you are present and registered before 9:45 a.m. Garfield County receives beginning bids from the foreclosing lender by 12:00 noon two business days prior to the sale, and will post the beginning bids on our website no later than 10:00 a.m. the day prior to the sale.

Office Of The Public Guardian And Trustee Rfp For Realty Services

The Office of the Public Guardian and Trustee of Ontario posted a Request for Proposal for Realty Sales Services for the Office of the Public Guardian and Trustee on the MERX Electronic Tendering System on Thursday June 14, 2012.

The mandate of the Public Guardian and Trustee is to provide financial, trust, legal and guardianship services to mentally incapable adults, certain estates of deceased persons and other estates and trusts. In this capacity, the Public Guardian and Trustee may be responsible for the management and sale of real property located in the Province of Ontario, Canada. This RFP is for a vendor to act as the listing and selling agent of the Public Guardian and Trustee in the provision of realty sales, for properties administered by the Public Guardian and Trustee in the Province of Ontario, as well as valuation services. The successful proponent must be registered, licensed and legally authorized to sell real estate in Ontario, have a central administration office in Ontario, be able to service all of the Province and the Public Guardian and Trustees six regional offices, and agree to comply with the procedures of the Office of the Public Guardian and Trustee with respect to the sale of real property.

The proposed contract is for a term of three years, commencing October 1, 2012, with an option to renew for two further years.

Read Also: How Long After Creditors Meeting Is Bankruptcy Discharged

Federally Licensed Trustees Reputable & Local

Below is a list of Licensed Insolvency Trustees in Ontario, experts on Ontario bankruptcy law, licensed by the federal government, that specialize in both bankruptcy and alternatives to bankruptcy, such as consumer proposals. Follow the links below to contact a professional to either set up a free initial consultation or to ask a question by e-mail or by phone they are happy to answer any of your questions regarding bankruptcy in Ontario or Ontario bankruptcy law.

Ajax

Title To The Property:

Upon the expiration of all redemption periods allowed to all lienors entitled to redeem or, if there are no intents to redeem filed, upon the close of the eighth business day after the sale, title to the property sold shall vest in the holder of the Certificate of Purchase. In the case of a lienor redemption title vests with the holder of the last Certificate of Redemption at the end of all redemption periods.

Upon receipt of all statutory fees and costs, the Public Trustee will execute and record a Confirmation Deed to the holder of the Certificate of Purchase or, in the case of redemption, to the holder of the last Certificate of Redemption confirming the transfer of title to the property

The office of the Public Trustee has a written policy regarding the conduct of a foreclosure sale. You are encouraged to review the sale policy prior to attendance at the sale for information regarding methods of payment, required forms and when those forms are due.

Also Check: What Happens When You Claim Bankruptcy In Australia

Clerk Of The Circuit Court & Comptroller Palm Beach County

- How much do I owe in my case?See simple instructions to look up your cases and see how much you owe.

- Do I need an appointment for a passport application and what do I have to bring? Passport services are available BY APPOINTMENT ONLY in our branch offices. Request an appointment.For more information about passports and application requirements, please see the U.S. State Department’s website.

- How do I get an appointment for a marriage license?Complete this form to request an appointment for a marriage license or ceremony.

Foreclosure sales are conducted online, generally Monday through Thursday, at 10:00 a.m. Proxy bidding begins as soon as the case appears on the auction calendar. No sales are conducted on designated holidays. Check the online auction calendar for the exact dates of upcoming sales.

The Clerk of the Circuit Court & Comptroller cannot assist in researching properties, nor can we give legal advice. The Clerk sells property pursuant to court order and cannot guarantee a clear title. It is the responsibility of the purchaser to research the property prior to the sale date.

If you are trying to avoid foreclosure or already have a foreclosure case in court, the Homeowner Support page provides a starting point for you to get the help you need from trusted sources.

What Happens After The Trustee Sale

If you do nothing to resolve the matter, on the date listed within the Notice of Trustee Sale, your home will be sold at a public auction to a third party buyer. If no one buys the home, the property will become bank-owned property.

The bank will eventually list it on the open market and sell the home.

Following the auction, regardless of whether a third party buyer purchases the property or whether it goes back to the bank, you will have to vacate the home based on the required timeframe in your state.

In Washington, you have 20-days to vacate a home following a Trustees Sale.

If youre a homeowner in Washington state who has received a Notice of Trustee Sale, feel free to give me a call for a free attorney consultation at 654-1674.

Recommended Reading: Where To Go To File Bankruptcy

Trustee Postings And Sales

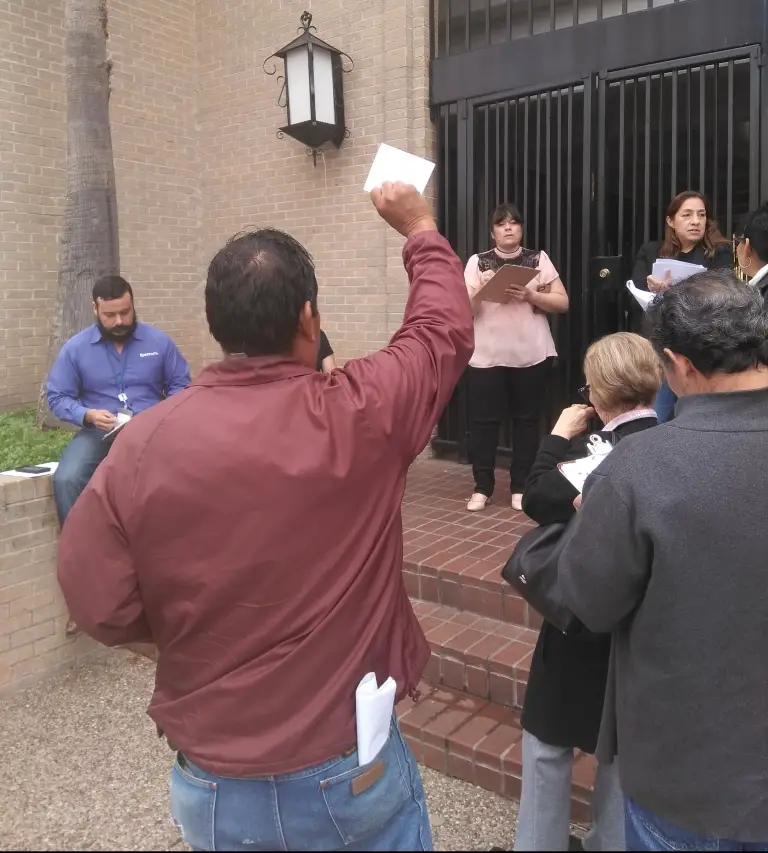

In reference to Court Order 2009-0463 all Foreclosure Postings and Sales will take place on the North Side of the George Allen Courts Building Facing Commerce Street below the overhang, or as designated by the County Commissioners.

Texas is a non-judicial foreclosure state. Default is defined in the Deed of Trust and/or Promissory Note. When a debt is defaulted a Substitute Trustee’s sale will take place in the manner authorized by the Deed of Trust/Promissory Note.

Where can I obtain a list of properties to be sold?

Who can I talk to at the County Clerk’s Office to answer questions about how to purchase a property at the sale?

What type of payment is required when purchasing a property at the sale?

State Law Determines How Much Time You Have After You Receive Your Notice Of Trustees Sale

Lenders and Trustees must abide by state law when scheduling an auction date. Your states laws have rules around how much time can be between the recording of the Notice of Trustee Sale and the actual auction.

For example, in Washington the Trustee must give a homeowner 120-days after the recording of the Notice of Trustee Sale before they can auction the home. So, homeowners who receive a Notice of Trustee Sale in Washington have four months between the notice and the auction.

Receiving the Notice of Trustee Sale doesnt necessarily mean you are out of options to avoid the public auction. There may still be some things you can do, but you need to act quickly.

Also Check: How To File Bankruptcy Chapter 7 Yourself

Use Bankruptcy To Stop The Trustee Sale

If youve run out of time to work with your lender or servicer, youve been denied loss mitigation options, are very close to your auction date, or need to stop the foreclosure sale quickly, you may need to consider bankruptcy to stop the auction.

A Chapter 7 or a Chapter 13 Bankruptcy stops foreclosure actions. Once you file Bankruptcy, an automatic stay goes into place which stops the foreclosure. Your mortgage lender can ask the Bankruptcy court to lift the stay but even if this happens, you will likely still be able to delay the Trustee Sale for 1-2 months using the Bankruptcy process.

A Chapter 13 Bankruptcy may also help you keep your home long-term by establishing a payment plan that allows you to pay back the missed mortgage payments over a certain amount of time.

A Chapter 7 Bankruptcy doesnt allow you an opportunity to catch up on mortgage payments or keep the home long-term, so this type of Bankruptcy is mostly beneficial in delaying the Trustee Sale and getting rid of other unsecured debt, not in figuring out a long-term solution.

If youre considering filing Bankruptcy, the first step is always to have a consultation with a Bankruptcy attorney about your particular situation so you get the best advice.