Getting Started With Our Office

Our office is always ready and able to help. Never hesitate to reach out. Whether you are already our client or you would like to be our client, contact our law offices today at . Dont forget we do provide free bankruptcy consultations.

We are a debt relief agency. We help people for relief under the U.S. Bankruptcy Code.

What To Do Before Filing For Bankruptcy

Bankruptcy is generally considered a last resort for people who are deep in debt and see no way to pay their bills. Before filing for bankruptcy, there are alternatives that are worth exploring. They are less costly than bankruptcy and likely to do less damage to your credit record.

For example, find out if your creditors are willing to negotiate. Rather than wait for a bankruptcy settlementand risk getting nothing at allsome creditors will agree to accept reduced payments over a longer period of time.

In the case of a home mortgage, call your loan servicer to see what options may be available to you. Some lenders offer forbearance , repayment plans , or loan modification programs .

Even the Internal Revenue Service is often willing to negotiate. If you owe taxes, you may be eligible for an offer in compromise, in which the IRS will agree to accept a lower amount. The IRS also offers payment plans, allowing eligible taxpayers to pay what they owe over time.

Types Of Personal Bankruptcy

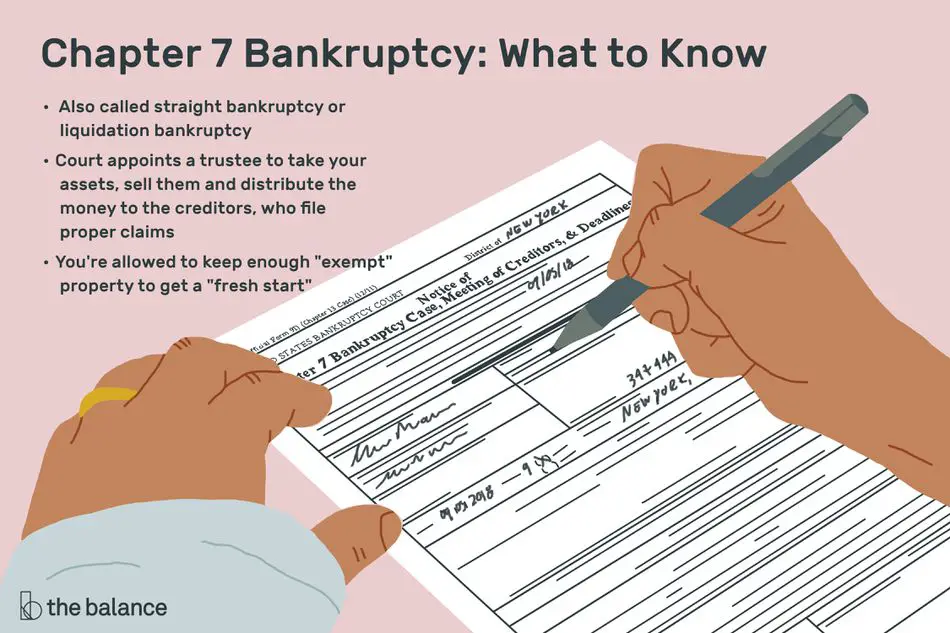

In the case of individuals, as opposed to businesses, there are two common forms of bankruptcy: Chapter 7 and Chapter 13. Here is a brief description of how each type works:

Chapter 7. This type of bankruptcy essentially liquidates your assets in order to pay your creditors. Some assetstypically including part of the equity in your home and automobile, personal items, clothing, tools needed for your employment, pensions, Social Security, and any other public benefitsare exempt, meaning you get to keep them.

But your remaining, non-exempt assets will be sold off by a trustee appointed by the bankruptcy court and the proceeds will then be distributed to your creditors. Non-exempt assets may include property , recreational vehicles, boats, a second car or truck, collectibles or other valuable items, bank accounts, and investment accounts.

At the end of the process, most of your debts will be discharged and you will no longer be under any obligation to repay them. However, certain debts, like student loans, child support, and taxes, cannot be discharged. Chapter 7 is generally chosen by individuals with lower income and few assets. Your eligibility for it is also subject to a means test, as explained bellow.

You May Like: What Is Epiq Bankruptcy Solutions Llc

Phase : The Filing Process

The hard part is now behind you. Filing itself very little effort on your part, assuming youve retained the services of an attorney.

With that being said, its important to note that filing requires precision. So, dont get complacent while your bankruptcy attorney does the heavy lifting. You may need to supply missing documents or information at times so make sure youre available and maintain regular communication with both your attorney and case trustee.

Step 1. File Your Petition: Your attorney will submit your completed forms and schedules, creditor matrix, credit counseling certificate and debt repayment plan to the bankruptcy court in your area.

At this time, you must also pay the filing fee unless youve completed an application to pay it by installment or you filed a motion to waive the fee. Upon filing, you will receive a case number from the court, and a bankruptcy estate will be created.

Step 2. Collection Efforts Cease: Immediately after submitting your petition, an Automatic Stay Order will stop most collection efforts directed at you and your property.

Keep in mind that not all collection attempts are stopped. Other actions are only temporarily ceased, depending on whether youve previously filed another bankruptcy case or a creditor has requested relief from the automatic stay.

WalletHub’s Automatic Stay guide covers information about this injunction in greater detail.

Alternatives To Chapter 7

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. § 707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.

Don’t Miss: Buying A New Car After Bankruptcy Discharge

How Chapter 7 Works

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. In addition to the petition, the debtor must also file with the court: schedules of assets and liabilities a schedule of current income and expenditures a statement of financial affairs and a schedule of executory contracts and unexpired leases. Fed. R. Bankr. P. 1007. Debtors must also provide the assigned case trustee with a copy of the tax return or transcripts for the most recent tax year as well as tax returns filed during the case . 11 U.S.C. § 521. Individual debtors with primarily consumer debts have additional document filing requirements. They must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. Id. A husband and wife may file a joint petition or individual petitions. 11 U.S.C. § 302. Even if filing jointly, a husband and wife are subject to all the document filing requirements of individual debtors.

Attend Your 341 Meeting

Your 341 meeting, or meeting of creditors, will take place about a month after your bankruptcy case is filed. Youâll find the date, time, and location of your 341 meeting on the notice youâll get from the court a few days after filing bankruptcy. Due to the COVID-19 pandemic, all 341 meetings are held either by video conference or via telephone until at least October.

The main purpose of the 341 meeting is for the case trustee to verify your identity and ask you certain standard questions and most last only about 5 minutes. Your creditors are allowed to attend and ask you questions about your financial situation, but they almost never do.

ââ You must bring your government-issued ID and social security card to the meeting. If you donât bring an approved form of both, the trustee canât verify your identity and the meeting cannot go forward. You should also bring a copy of your bankruptcy forms to the meeting, along with your last 60 days of pay stubs, your recent bank statements, and any other documents that your trustee has asked for. ââ

Also Check: Bankruptcy And Insolvency Act

Who Qualifies For Chapter 13 Bankruptcy

The requirements for Chapter 13 bankruptcy differ from the requirements for Chapter 7 bankruptcy. Here are some of them.

- You must have sufficient income to make the monthly debt payments outlined in your bankruptcy plan.

- Your unsecured debts must be less than $419,275, and your secured debts must be less than $1,257,850. These dollar amounts are in effect until April 2022. Debt limits change every three years.

- If you attempted to file for Chapter 7 or 13 bankruptcy but your case was tossed out, you must wait 181 days or more before refiling.

- You must provide proof that you filed federal and state income tax returns for the past four years.

- You typically must finish an individual or group credit counseling course offered by an approved credit counseling agency within 180 days before you file for bankruptcy.

What Debts Cannot Be Discharged In Bankruptcy

The following debts cannot be discharged in either a Chapter 7 or a Chapter 13 bankruptcy case. If you file Chapter 7, you will still owe these debts after your case is over. If you file Chapter 13, these debts will either be paid in full during your plan, or the balance will remain at the end of your case.

Nondischargeable debts include:

- Unlisted debts, unless the creditor had knowledge of your bankruptcy filing.

- Recent income tax debt and other tax debt.

- Fines imposed for violating the law.

- Student loans, unless you can show that it will cause a hardship for you to repay them.

- Debts you owe under a divorce decree or settlement.

In a Chapter 7 and 13 case, a creditor may object, and a judge may agree, to theseadditional debts being discharged:

- Debts incurred by embezzlement, fraud, or larceny.

- Certain credit purchases made within 90 days or cash advances made within 70 days of filing.

- Restitution or damages awarded in a civil action for willful or malicious injury to a person.

Read Also: What Is Epiq Bankruptcy Solutions Llc

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

To Qualify For Chapter 7 Bankruptcy Your Disposable Income Must Be Low Enough To Pass The Means Test

By Baran Bulkat, Attorney

Chapter 7 bankruptcy provides relief from debt bywiping out most unsecured debtand giving the debtor a fresh start. But not everyone qualifies for Chapter 7 bankruptcy. To prevent consumers from abusing the system, filers must meet eligibility requirements before receiving a debt discharge in a Chapter 7 case. In this article, you’ll learn about the main requirements you’ll need to meet before qualifying for Chapter 7 Bankruptcy relief.

Recommended Reading: Which Statement Regarding Bankruptcy Is Not True

Role Of The Case Trustee

When a chapter 7 petition is filed, the U.S. trustee appoints an impartial case trustee to administer the case and liquidate the debtor’s nonexempt assets. 11 U.S.C. §§ 701, 704. If all the debtor’s assets are exempt or subject to valid liens, the trustee will normally file a “no asset” report with the court, and there will be no distribution to unsecured creditors. Most chapter 7 cases involving individual debtors are no asset cases. But if the case appears to be an “asset” case at the outset, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. Fed. R. Bankr. P. 3002. A governmental unit, however, has 180 days from the date the case is filed to file a claim. 11 U.S.C. § 502. In the typical no asset chapter 7 case, there is no need for creditors to file proofs of claim because there will be no distribution. If the trustee later recovers assets for distribution to unsecured creditors, the Bankruptcy Court will provide notice to creditors and will allow additional time to file proofs of claim. Although a secured creditor does not need to file a proof of claim in a chapter 7 case to preserve its security interest or lien, there may be other reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor’s property should consult an attorney for advice.

Documents You’ll Need To Complete Chapter 7 Forms

The average Chapter 7 bankruptcy petition is approximately 50 pages in length, so it shouldn’t come as a surprise that you’ll need a lot of information to complete the required forms. Being organized will help you complete the bankruptcy forms efficiently.

Here are some of the documents you’ll need to get started:

- six months of paycheck stubs

- six months of bank statements

- tax returns

- current investment and retirement statements

- current mortgage and car loan statements

- home and car valuations

- property list with values

- repair estimates for damaged property

- a current credit report

- your Driver’s license and Social Security card

- a

If you plan to hire a Chapter 7 bankruptcy attorney, bring copies to the initial consultation. Not only will doing so help the lawyer assess your case but getting documents from clients can be challenging. Showing up prepared will make you a more desirable client.

You’ll find a list of the required official bankruptcy forms and instructions for finding them in Free Bankruptcy forms.

Recommended Reading: How Many Times Did Trump Claim Bankruptcy

How Does Bankruptcy Affect Your Credit Score

While bankruptcy may alleviate some of your financial commitments, it will have a long-lasting effect on your credit report.

Bankruptcy is a unique legal process that allows you to restructure or discharge your debt, depending on your financial state. Bankruptcy may be beneficial if financial obligations overburden you, but it may also harm your credit. Generally, a bankruptcy will remain on your credit reports for up to ten years from the date of filing.

The marvelous thing is that if you take the proper actions, your credit may progressively improve.

The Benefits Of Hiring A Bankruptcy Lawyer

While the USC states that you may represent yourself when declaring bankruptcy, there are benefits to hiring a bankruptcy lawyer. Those benefits may include a lawyers ability to:

- Weigh the benefits and limitations of filing bankruptcy

- Recommend the best bankruptcy chapter for your financial situation

- Provide information on dischargeable and nondischargeable debt

- Review the bankruptcy consequences for your vehicle, home, and other property

- Define the effect filing bankruptcy might have on your taxes

If you opt to hire a bankruptcy lawyer, they will help you complete, and file necessary forms, advise you about continuing to pay debts, and familiarize you with relevant laws and procedures. A bankruptcy lawyer will also represent you at the Chapter 7 meeting of creditors and at any court hearing held in your case.

You May Like: Kentuckydebtrelief.org Reviews

Losing Paperwork In A Natural Disaster

Filing for bankruptcy after a natural disaster is common. But not only are jobs and property lost, but the paperwork required to file for bankruptcy can end up missing, too. Fortunately, provisions are made for such emergencies. When a bankruptcy debtor loses financial paperwork in a natural disaster, the bankruptcy trustee must:

- avoid taking action against a debtor who can’t produce documents

- grant reasonable requests to ease filing requirements, and

- take into account a decrease in income or increase in expenses.

Should I File For Chapter 7 Bankruptcy

- Read this in:

Learn about the pros and cons of filing for bankruptcy and what types of debts you can discharge. #0103EN

- Contents

What is bankruptcy?

It is a legal process to help people who are unable to pay their outstanding debts.

How are Chapter 7 and Chapter 13 bankruptcies different?

Chapter 7: the court cancels your debt. Your bills vanish. You are no longer responsible for them. You get a clean slate and a chance to start over with no debt.

Chapter 13: the court puts you on a 3- to 5-year payment plan to repay your debts. This can help you try to avoid foreclosure of your home or to pay off other debts, such as traffic tickets or legal financial obligations , that you cannot discharge.

My wages are being garnished. Can a bankruptcy help?

Probably. The day you file for bankruptcy, the court issues a stay. This means all collection action, including garnishment, must stop immediately.

Which bills can I discharge in a Chapter 7?

You can discharge most bills, including credit card debt, hospital and medical debt, debt owed to a former landlord, and debt owed due to the repossession of a vehicle.

You cannot discharge:

-

Traffic tickets and fines . Read My Drivers License was Suspended. Can I Get it Back? to learn more.

When should I think about Chapter 7 bankruptcy?

You can only file for bankruptcy once every 8 years. Before filing for Chapter 7, at least 1 of these should be true:

If you are a homeowner:

When do I not need bankruptcy?

Recommended Reading: Did Trump File Bankruptcy

The Benefits Of Filing Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy may allow you to erase overwhelming debt and get a fresh start managing your finances. Chapter 7 bankruptcy can relieve you of the responsibility to repay your creditors and eliminate most or all of your current debt. The USC Bankruptcy defines it as giving debtors a clean financial slate.

An important benefit of filing bankruptcy is that all debt collection efforts must stop as soon as you file. This benefit can provide relief from demanding letters and phone calls that add stress to an already challenging financial situation. Another advantage of Chapter 7 bankruptcy is that it does not require you to file a repayment plan. Instead, you are allowed to retain your assets, and all of your qualifying debts will be discharged.