What Are The Differences Between The Various Chapters Of Bankruptcy

In Title 11 of the United States Code , there are four bankruptcy filings:

- Chapter 7 – Liquidation

- Chapter 12 – Adjustment of Debts of a Family Farmer with Regular Annual Income

- Chapter 13 – Adjustment of Debts of an Individual with Regular Income

The filing generally depends on the person’s financial situation. Reportedly, the most common filing is Chapter 7. Companies, married couples and individuals are allowed to file Chapter 7.

A debtor filing Chapter 7 is essentially scrapping everything and starting over, hoping for a clean financial slate. Basically what happens is that once the filing is underway, an administrator or trustee is appointed to maneuver the sale of the debtor’s assets. This does not necessarily mean that everything the person owns is sold. Both federal and state laws allow for certain exemptions, meaning that the debtor might get to keep some property, such as his or her primary residence or personal items like clothing. Once the debtor’s assets are liquidated, the trustee pays certain a portion of the money raised. Obviously, not all of the creditors receive money from the proceeds, so many of those financial obligations are “forgiven,” or discharged. Once someone has filed for bankruptcy under Chapter 7, he or she cannot file again for seven years, and debts that were not forgiven in a previous filing will not be discharged in the next filing.

For more information on bankruptcy and debt, check out the links on the next page.

The Differences Between Chapter 7 And Chapter 13 Bankruptcy In Colorado

This blog post will outline the differences between these two bankruptcy options. It is in no way a complete analysis, but rather a short overview. If you are confused and want further explanation of these options, feel free to call me, Peter Milwid, at and I would happy to talk it over with you.

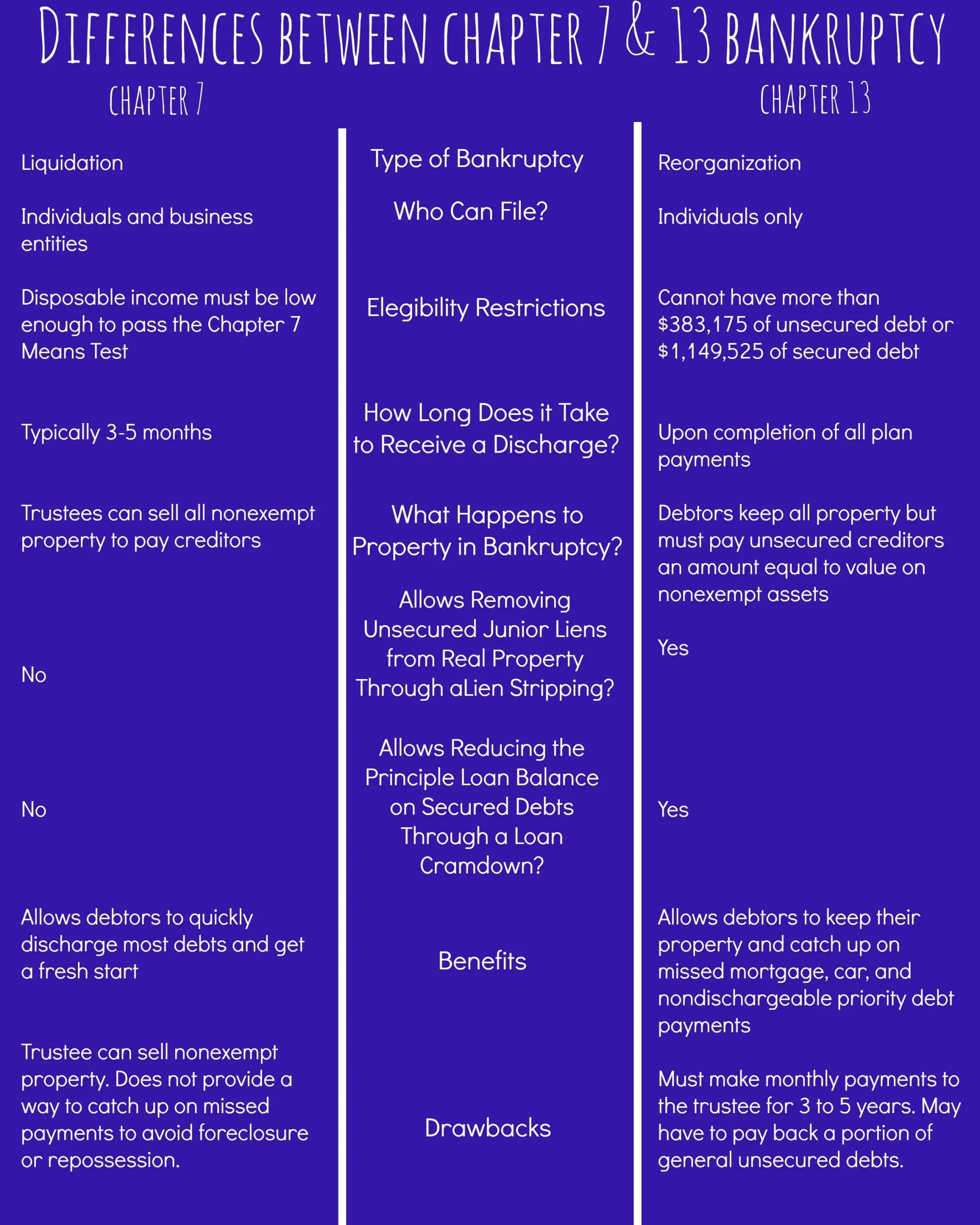

In short, a Chapter 7 bankruptcy cancels most debts with a simple procedure that takes about four months to complete, and Chapter 13 is a payment plan bankruptcy with monthly payments based on your disposable income over a period of three to five years.

In my view, the consideration begins with Chapter 7, which is cheaper and faster, and then to Chapter 13 if the problems involved require a reorganization as opposed to simple debt cancellation provide by Chapter 7.

The question becomes: why would someone choose a Chapter 13 if Chapter 7 is easier and cheaper?

There are several reasons, but the answer is that they are really two different tools to solve different types of debt problems.

In Chapter 7, in rare instances, property might be required to be liquidated to pay debts if it is not protected by exemption laws. Chapter 13 may be used to protect such assets if necessary for an effective reorganization.

Either option begins with the issuance by the Court of an order, the automatic stay, which stops all creditor activity and gives you protection to solve your debt problems while the case is processed.

Defining Insolvency And Bankruptcy For Uk Businesses

Insolvency and bankruptcy are often confused as being one and the same. When you add terms like administration and voluntary liquidation into the mix, it can all get a little confusing. Here we go through the main differences between insolvency and bankruptcy and when each one applies, specifically in the United Kingdom.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Liquidation Vs Bankruptcy Whats The Difference

While the words bankruptcy and liquidation are often used interchangeably, they are actually two different occurrences. Because they are both so frequently associated with business failure, it is easy to see why one may think they are the same thing. The truth of the matter, however, is that they are not interchangeable and they both serve two very different purposes.

It is important to know the difference as a business owner because if the day ever comes where the business begins to fail, youll need to know what your options are. Knowing that you can declare bankruptcy without necessarily having to liquidate, or that you can liquidate without having declared bankruptcy, can help you to make informed decisions regarding the future of your business.

Bankruptcy

Insolvency, another word for bankruptcy, occurs when an individual or a business accumulates so much debt that they are unable to repay their creditors.

- Bankruptcy is often a last resort after every effort has been made to work with a debt counselor and creditors to pay off all or part of the debt.

- Bankruptcy can be voluntary or court ordered.

- In order to declare bankruptcy an individual or business must legally file and apply to court.

- Certain criteria must be met in order to qualify for bankruptcy.

- One of the stipulations of a business bankruptcy may be to liquidate company assets in order to repay part or all of its debt.

Liquidation

Dont Miss: How To Claim Bankruptcy In Massachusetts

How Do You Know If You Are Insolvent

Below are some indicators of insolvency:

- You owe more money than you can repay.

- You are constantly behind on all of your debt payments.

- At the end of each month, you dont have enough cash to meet your reasonable living expenses and have to incur more debt.

- Your debt total exceeds the value of your assets

It is important to note that being delinquent on your loans and credit card bills is not the same as being insolvent.

For example, if you lose your job and miss your mortgage payments for two months, you are not automatically insolvent, although that could eventually result if you fail to find new employment.

Read Also: Epiq Bankruptcy

What Is The Difference Between Default And Bankruptcy

Defaulting on a loan means that youve violated the promissory or cardholder agreement with the lender to make payments on time. Each lender has its own requirements on how many missed payments you can have before it considers you in default. In some cases, that may be as little as one missed payment or as many as nine missed payments.

Filing for bankruptcy is a legal process that involves listing out your debts and assets and finding a way to resolve those debts. A judge will decide if any of your debts can be discharged and if your assets will be used to pay off the outstanding balance. The judge will also decide which assets youre allowed to keep and which can be taken from you.

Default and bankruptcy usually go hand in hand. Many borrowers default on their loans and then subsequently file for bankruptcy.

The Difference Between Bankruptcy And Insolvency

I was with a friend recently who was telling me about a family member whose finances were circling the drain.

Shes got no savings, her credit cards are maxxed, shes getting calls from creditors all day longshes bankrupt.

Im sorry to hear that, I said with some sympathy. Now that shes filed though, the calls should stop.

My friend looked at me, aghast. Oh no, shes not bankrupt bankrupt. I meant shes broke.

I didnt press the point, but people frequently use the word bankrupt to describe a situation where a person or company no longer has money to pay off debts and obligations. That situation is called insolvency. Being bankrupt and being insolvent are actually two different financial statesor straits.

Bankruptcy is a legal process for liquidating what property and assets a debtor owns to pay off their debts. Insolvency is a financial state in which a persons debts exceed their assets. Someone whos bankrupt is insolvent, but someone whos insolvent isnt necessarily bankrupt.

For example, my friends family memberIm sure there are many attorneys whod add up her assets and liabilities, see that shes insolvent, and advise her to file for bankruptcy. Sometimes thats the only way out of a bad financial situation. But she wouldnt be bankrupt unless she filed a case in court.

Also Check: How Many Times Trump Declared Bankruptcy

Contact A Skilled And Experienced Bankruptcy Lawyer Today

The bankruptcy attorneys at Bunch & Brock have helped countless clients just like you reestablish their financial footing and step into a brighter outlook. Whether you are seeking a personal or business bankruptcy, our experienced Lexington, Kentucky, bankruptcy lawyers will ensure that you receive full protection under the law, put an end to harassing creditor phone calls and letters, and prevent legal mistakes that can prove costly. Our years of experience mean we know how to utilize federal bankruptcy laws to your benefit and prevent any unintended consequences. We will answer all your questions and stand beside you through every step of the process. For an initial consultation about your case, call us at 254-5522. Its the first step toward a better future.

You Must Repay Creditors

A Chapter 13 bankruptcy requires repayment to creditors using a three- or five-year repayment plan.

This means you must have enough income to pay creditors every month. You must:

- Repay priority debts and secured creditors in full

- Repay unsecured creditors an amount equal to what those creditors would have received if your trustee sold your nonexempt property in a Chapter 7 bankruptcy

Also Check: Buying Cars After Bankruptcy

Is A Proposal Better Than Bankruptcy

If you can pay for at least 20% of your debts, a consumer proposal may be the best option. However, if you cannot afford to pay for any or almost any of your debt, you might have to file for bankruptcy. The rule is that the more debt you have, the worse it is. This is because a consumer proposal is the best option in terms of credit impact and other deals. However, you need to be able to pay for some of your debt and in monthly payments.

Therefore, those who need to file for bankruptcy have this as their only option left. So, if you have a bit less debt and want to make a repayment plan, a consumer proposal may be best. However, we recommend that you always look for a Licensed Insolvency Trustee to help you analyze your finances and see which is the best option for you.

The Role Of Bankruptcy Lawyers

Practicing lawyers are unable to become bankruptcy trustees. Bankruptcy lawyers specialize in insolvency law. In Canada, bankruptcy lawyers are usually engaged on business files or to provide individuals advice in complicated situations. In our legal system, lawyers for each side present their clients side of an argument, and the Court makes the decision based on these arguments. Lawyers are not needed in the majority of personal bankruptcy cases, as usually there is no legal argument over the debts you owe or the assets you possess.

If your trustee deems there are contentious issues with your debts or assets, your trustee will suggest you to seek legal advice.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Whats Worse Credit Rating Impact Of A Bankruptcy Vs Consumer Proposal

Impact of Personal Bankruptcy: If you claim bankruptcy in Canada, you will receive an R9 credit rating, which is the worst rating you can have. Depending on your circumstances, it will remain on your credit report for 7 to 14 years.

Impact of Proposal: If you make a consumer credit proposal through a consumer proposal, an R7 credit rating will appear on your report to indicate that you have made a settlement with your creditors. It will remain for the shorter of 3 years after you complete your payments or 6 years after you file.

We do not recommend that you choose a bankruptcy or consumer proposal based on the impact on your credit score. The decision to file a consumer proposal or bankruptcy should be based on whether you need relief from your debts and comparing the cost and impact of each option on your budget and assets.

Whats The Difference Between Chapter 7 And Chapter 13 Bankruptcy

The major difference is time Chapter 7 takes 4-6 months Chapter 13 takes 3-5 years and money. You can have most, or all your unsecured debt discharged in Chapter 7 bankruptcy. In Chapter 13, some of your debt is forgiven, but only if you meet the conditions approved by the trustee and bankruptcy judge.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

Business Use Of Chapter 11 And Chapter 7

Businesses frequently use both types of these bankruptcies. Choosing between these two chapters comes down to what business owners hope to achieve with their business in the long run. If the business is not profitable or worth keeping, Chapter 7 bankruptcy is a reasonable choice. If the business is profitable, Chapter 11 may be a good option. It is worth noting, however, that few small businesses survive the costs of Chapter 11 bankruptcy.

Who Controls The Business In A Chapter 7 Vs Chapter 11 Filing

In a Chapter 11 filing, the owners of the business continue to operate the business. The debtor is considered the âdebtor in possessionâ because generally no trustee is involved. The debtor in possession has the exclusive right to propose a bankruptcy plan of reorganization for a certain period of time.

Unsecured creditors may form a creditors’ committee to ensure the bankruptcy plan meets their best interests under the bankruptcy laws. After a certain period of time, creditors are able to file a competing plan. The debtor’s bankruptcy plan can propose different treatment for creditors’ claims and even cram down secured creditors by changing the terms of the repayment, including the interest rate.

Ultimately, the court determines what’s in the best interest of creditors and approves a bankruptcy plan and related disclosure statements following a confirmation hearing.

In a Chapter 7 case the trustee takes over to close down the business. This typically involves selling off all of the debtorâs assets for the benefit of unsecured creditors. The trustee has a duty to act in the best interest of the unsecured creditors while administering the case. The trustee may operate the business for a short time if that generates more money for the creditors.

Also Check: How Many Bankrupcies Has Trump Had

Difference Between Insolvency And Bankruptcy

You may often hear the terms insolvency and bankruptcy being used interchangeably, but they have different meanings. Insolvency is a financial state where a person cannot meet debt payments on time. Bankruptcy is a legal process that happens when the individual declares he or she can no longer pay back his or her debts to creditors.

What Is The Difference Between Bankruptcy And Debt Consolidation

Debt consolidation is a financial relief offered to borrowers who make a number of debt repayments to a number of institutions at varying interest rate levels. A debt consolidation strategy allows the borrower to make one payment possibly at a negotiated lower interest rate instead of making payments to a number of firms. Bankruptcy also offers financial relief where the borrower can either restructure their payments in a manageable manner or eliminate certain types of debts completely. The main difference between bankruptcy and debt consolidation is that debt consolidation is privately managed whereas bankruptcy is made public through public record. Debt consolidation does not affect your credit score, whereas bankruptcy can affect your credit rating and make it very difficult to obtain loans.

Summary:

Recommended Reading: Bankruptcy Software For Petition Preparers

Summary Of Differences Between Liquidation And Bankruptcy

Both liquidation and bankruptcy occur as an option of last resort. They can be voluntary or imposed by the court, but the end result is an attempt to manage assets to pay off debts where possible.

However, the two are different states, as follows:

-

Bankruptcy is an insolvency situation for individuals, while liquidation can occur due to insolvency or another reason, such as ceasing operations.

-

Bankruptcy affects only one individual, whereas liquidation impacts many people, including the directors, shareholders, and employees, who will be affected by debt recovery or employment termination. Both situations influence creditors who are unable to recover their debt.

-

With bankruptcy, the individual will be given relief from paying most debts. Liquidation, on the other hand, means that the company will be shut down in an orderly manner as the liquidator attempts to dispose of any assets to repay company debts.

-

As a result, once a company is shut down from liquidation, it ceases to exist. The company structure is dismantled, and assets are sold off, so it will never return to operations. The legal state of bankruptcy, on the other hand, will only last for several years, after which it wont show in your credit history.

Also Check: Will Filing Bankruptcy Clear A Judgement

Key Differences Between Bankruptcy And Liquidation

The points given below are substantial so far as the difference between bankruptcy and liquidation:

Read Also: Has Mark Cuban Ever Filed For Bankruptcy

Difference Between Insolvency And Liquidation

Insolvency is a monetary state. A company can be insolvent, but not yet liquidated. If the commerce liabilities exceed the assets, then the business is insolvent. But, if it is still capable of servicing debts when due, then the business is not cash-flow insolvent. If it is unable to pay debts when due and the liabilities exceed the assets, then it is insolvent.

Liquidation is the winding up of the business estate. However, a company does not have to be insolvent for the entity to be liquidated. If the business is dormant, therefore not operating, and the owner wishes to close it, the best route to prevent creditor claims against the entity in future is to liquidate the entity.