Health Care And Bankruptcy

According to an article at www.thebalance.com I was reading yesterday, health care costs are the #1 cause of bankruptcy for Americas families. Now, this is not news to me as I frequently counsel with individuals and families who are facing substantial medical and other debt. But what caught my attention was the magnitude of the problem. According to the article, 56 million people struggle with medical debt each year. About 8.9% of these people could not afford to pay anything towards these medical debts. Eleven million of these people ran up high interest credit card debt to pay their medical debts. Think about that for a moment. These people did not have the income to pay their medical debts so they took out a high interest loan to do so. So, for example, if such a person owed $1,000.00 in medical debt and charged it to their credit card at say 28% interest, how much more money that they dont have will they need to finally pay the medical bill? Where is that money going to come from? How do you break out of that cycle?

Health Care Bill Bankruptcies

Q:What is the percentage of total personal bankruptcies caused by health care bills?

A: A Harvard study published in 2005 found that about half of those who filed for bankruptcy said health care expenses, illness or related job-loss led them to do so. Twenty-seven percent cited uncovered medical bills specifically, and 2 percent said they had mortgaged their home to pay what they owed.

FULL ANSWER

Its worth noting, though, that the figure from the Harvard study includes those who lost their jobs or significant income due to illness even if they didnt cite mounting health care bills as a direct cause of their bankruptcy. That makes Daschles specific mention of “medical bills” not quite correct, though several newspaper headlines characterized the findings that way, too. The study, published in the Feb. 2, 2005, issue of the journal Health Affairs, based its findings on surveys completed by 1,771 Americans in bankruptcy courts in 2001, financial information available in public court records and follow-up interviews with 931 of the respondents. It determined that 46.2 percent of bankruptcies were attributable to a major medical reason. Debtors cited at least one of the following specific causes: illness or injury , uncovered medical bills exceeding $1,000 in the past two years , loss of at least two weeks of work-related income because of illness , or mortgaging a home to pay medical bills .

The Only Cause?

Lori Robertson

- Categories

What Are Alternatives To Bankruptcy For Eliminating Medical Debt

- Medical creditors are typically much easier to work with than creditors or collectors of other forms of debt.

If medical debt is the primary reason youre considering a bankruptcy filing, there are alternatives you may want to consider first. Unlike other forms of debt, medical creditors are usually more willing to work with you on repayment, possibly even accepting a lower amount. Many medical offices and hospitals will hold the bill as long as possible within their own billing departments before sending it off to a collector, if at all. Since medical creditors rarely belong to credit reporting agencies, medical debt is less likely to hurt your credit score than other types of debt. As such, there is substantial incentive to contact your care provider or hospital to negotiate a plan of repayment. Being saddled with medical debt can be onerous. It may be beneficial to speak with a bankruptcy lawyer so you can have a better understanding of all your options.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Medical Products Research And Development

As in most other countries, the manufacture and production of pharmaceuticals and medical devices is carried out by private companies. The research and development of medical devices and pharmaceuticals is supported by both public and private sources of funding. In 2003, research and development expenditures were approximately $95 billion with $40 billion coming from public sources and $55 billion coming from private sources. These investments into medical research have made the United States the leader in medical innovation, measured either in terms of revenue or the number of new drugs and devices introduced. In 2016 the research and development spending by pharmaceutical companies in the U.S. was estimated to be around 59 billion dollars. In 2006, the United States accounted for three quarters of the world’s biotechnology revenues and 82% of world R& D spending in biotechnology. According to multiple international pharmaceutical trade groups, the high cost of patented drugs in the U.S. has encouraged substantial reinvestment in such research and development. Though the Affordable Care Act will force industry to sell medicine at a cheaper price. Due to this, it is possible budget cuts will be made on research and development of human health and medicine in America.

The Cost Of Malnutrition To Society

Although not all healthcare spending can be attributed to malnutrition, trends in the cost of healthcare nevertheless illustrate the major trends, and its clear from those trends that we are not on the right track. Health expenditures as a percentage of GDP in the US are more than three times greater than they were sixty years ago, and remain significantly higher than the healthcare spending in other high-income countries.

The CDCs Health and Economic Costs of Chronic Diseases web page illustrates the problem very well. Here are a few highlights cited on that webpage, from various reports that you can find listed in their references:

- chronic conditions account for 90% of the nations $3.5 trillion in annual health care expenditures

- heart disease and stroke cost our health care system $199 billion per year not including lost productivity

- in 2013, more than $300 billion in cost was attributed to arthritis

- nearly $150 billion in cost is attributed to obesity each year

- $327 billion in medical costs and lost productivity were attributed to diabetes in 2017

- and the cost of cancer care continues to rise and is expected to reach almost $174 billion .

How will we begin to address malnutrition if even our trusted institutions cannot admit that it exists?

Don’t Miss: How Do I File Bankruptcy In Ohio

The Effects Of Rising Healthcare Costs

It comes as no surprise that people in the US spend a lot of money on healthcare every year. But what you might not know is that they even go overseas to seek medical care for a better deal. The US healthcare facts uncover the amount of money people need for medical expenses during retirement and how often Americans declare bankruptcy because of the high medical bills.

The American Healthcare Industry Was Worth $247 Billion In 1960 It Is Now Worth $38 Trillion

Healthcare industry growth rate statistics affirm that the United States healthcare industry has seen significant growth over the last six decades. To clarify, it was worth $24.7 billion in 1960, whereas now it is worth $3.8 trillion. All things considered, this can be attributed to rising healthcare costs and a population that has become a lot more health-conscious.

Recommended Reading: How Many Times Has Donald Trump Bankrupt

Speak To An Experienced Bankruptcy Attorney Today

This article is intended to be helpful and informative. But even common legal matters can become complex and stressful. A qualified bankruptcy lawyer can address your particular legal needs, explain the law, and represent you in court. Take the first step now and contact a local bankruptcy attorney to discuss your specific legal situation.

The Cost Of Malnutrition To Individuals

Though the financial costs of managing diseases caused by malnutrition may seem more profane than the lives lost, these costs are nevertheless significant. Take, for example, the two leading causes of death listed above: heart disease and cancer. According to a paper published in the American Journal of Managed Care , patients with established cardiovascular disease paid nearly $19,000 annually in direct costs for medical treatment, an economic burden substantially greater than current American Heart Association estimates. Meanwhile, for cancer, the average cost of one round of chemotherapy ranges from $20,000 to $26,000 .

Most Americans cannot deal with these costs. In fact, sixty-three percent of Americans cannot afford an unexpected bill of even 500 dollars. A bad diagnosis is, for the vast majority, not only a threat to their lives, but also a financial death sentence. For a poignant illustration of the resulting desperation, we need only look at the flood of fundraisers asking for assistance with medical bills. On GoFundMe alone, this category of fundraisers makes up over 250,000 campaigns per year, more than twice as many as exist for education, memorial, or natural disaster emergency fundraisers.

You May Like: Do It Yourself Bankruptcy Software

Number Of Bankruptcy Filings

The number of bankruptcy filings in the United States has steadily increased over the last century, and especially so from 1980 to 2005.

Bankruptcy filings hit an all-time high in 2005, when more than 2 million cases were started. In that year, one out of every 55 households filed for bankruptcy.

The following year, bankruptcy filings dipped to about 600,000, the lowest point in 20 years.

The vast majority of bankruptcies are now filed by consumers and not by businesses. In 1980, businesses accounted for 13 percent of bankruptcies. Today, they account for about 3 percent.

Percentage Bankruptcy Medical Expenses

As you devour this piece, remember that the remainder of it contains useful info related to percentage bankruptcy medical expenses and in some shape related to filing medical bankruptcy debtors,free public records search, david ramsey ornew bankruptcy law requires hurricane katrina victims to pay for your reading pleasure.

I?d counsel all of them to file only when you have exhausted all of your available avenues like chatting with your medical loan representative about the varied options you?ve got to explore.You should also look for every aspect which is available for u.If none of these options worked, and your medical debt surpasses your yearly salary,then it?s time to talk with an insolvency medical barrister.

Medical bills can total up to a giant amount of cash and if you suddenly become jobless then you could be incapable of finding the cash to repay unexpected medical bills.In many countries, many of those who have gone bankrupt have done so solely due to hospital bills. Before rushing into insolvency, you might want to think about taking on the aid of a debt control company and looking into other solutions, which are less severe.

Read Also: How Often Can You File Bankruptcy In Ohio

The Variables Of The Reports

Researchers disagree on the evidence for medical bills causing bankruptcies. The biggest problem in answering this question is that those filing for bankruptcy aren’t required to state the reason.

As a result, estimates are based on surveys. Therefore, the answer will depend on how researchers phrase their questions, and how the survey respondents define the cause of their bankruptcy.

A variety of factors cause bankruptcies. Many people with medical debt have other debts as well. They may also have a lower income, little savings, or have lost a job.

Medical debts are generally unexpectedmany Americans live paycheck to paycheck due to the cost of living, low wages, or living beyond their means. A sudden medical bill causes havoc in the financial lives of struggling people.

Almost a third of the respondents surveyed by KFF claimed they weren’t aware that a particular hospital or service wasn’t part of their plan. One-in-four found that their insurance denied their claims.

Many insured people are not aware that their policies have limits. High deductibles and co-payments can cause high debts, and annual/lifetime limits can cause an insurance plan to run out. Some insurance policies and companies will deny claims or cancel the insurance policy.

The Us Spends More On Healthcare As A Share Of The Economy

Namely, it spends twice as much as the average OECD country. As a side note, OECD stands for the Organization for Economic Cooperation and Development. This organization, founded in 1961, aims to accelerate world trade and ensure economic progress.

Now, back to the US healthcare statistics. Even though the country recorded one of the highest expenditures on healthcare, it has the highest suicide rates and the lowest life expectancy relative to ten high-income nations .

You May Like: Find My Bankruptcy Discharge Date

Can Medical Debt Be Discharged Through Bankruptcy

- Yes, medical debt is a form of debt dischargeable through the bankruptcy process.

Bankruptcy law classifies medical debt as unsecure debt. Unsecure debt simply means it is debt that is not tied or attached to any property or assets that you own. Bankruptcy is frequently used as a method for discharging unsecure debts like credit card debt, medical debt, etc.

Secure debts, meanwhile, are debts tied to assets which can be repossessed by the creditor if the debt is not paid. A home mortgage is an example of a secure debt if you fail to pay your mortgage, the bank may foreclose on your home. A discharge of your medical debt through bankruptcy means that you are no longer liable to repay this debt. The hospital, doctors office, or collection agency can no longer send you notices or call you to collect on a medical bill once that debt has been discharged.

Interesting Medical Bankruptcy Statistics

Lets look at some curious facts about medical bills.

27. There are 250,000+ medical GoFundMe medical campaigns per year.

Every year more than 250,000 Americans resort to crowdfunding on GoFundMe to help them with medical bill payments. That makes for 1 in 3 campaigns.

Considering the fact that 90% of GoFundMe campaigns fail to reach their goal, theres no wonder why the percentage of bankruptcies due to medical bills is so high.

28. 39% of Americans are more worried about medical bills than Covid-19.

Undoubtedly, medical bills are a source of stress for Americans. The current pandemic has just revealed the extent of this issue.

Most alarming is the fact that 1 in 3 Americans would not seek coronavirus treatment to avoid expenses.

Not just the associated costs make people nervous, though. A separate survey shows that 48% of Americans have already delayed or steered clear of getting medical care due to fear of the new virus. Some 11% of them report their condition worsened because of that.

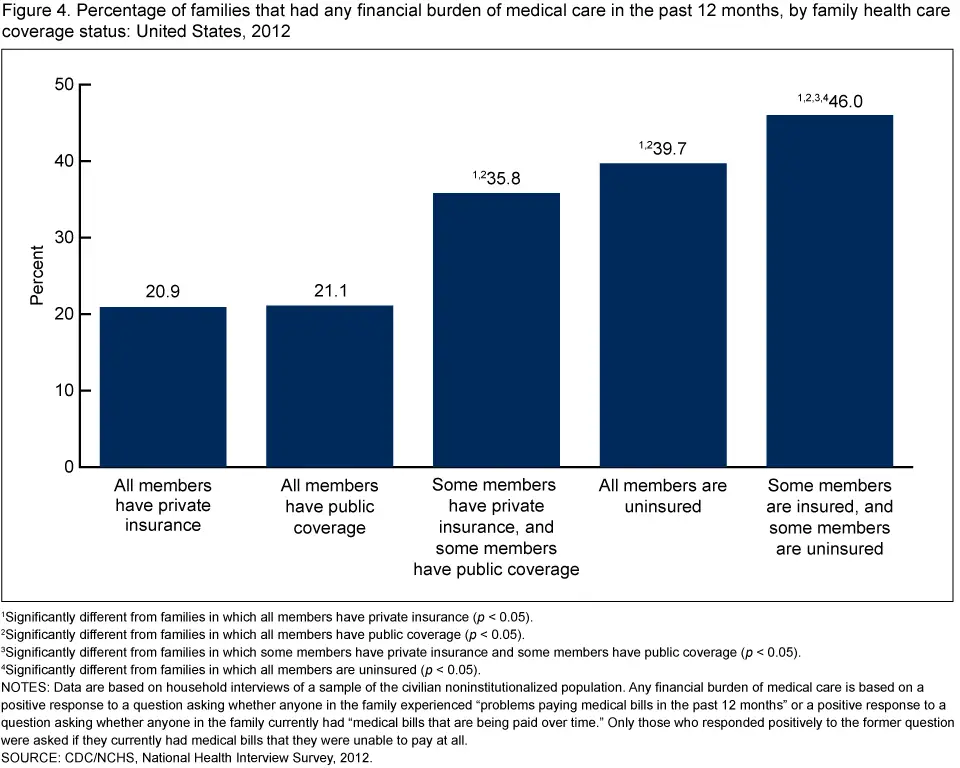

29. 39% of those who have issues with medical bill payments already have employer insurance.

Medical debt bankruptcy statistics show that the majority of those reporting issues with their medical bills already have some form of insurance. The majority of them, or 32%, have employer insurance, 16% have public coverage, and 7% are privately insured.

30. Short-term hospital stays is what causes issues with medical bills in 66% of the cases.

You May Like: When Did Donald Trump Declare Bankruptcy

Per Capita The Us Spends More Per Person On Health Care Than Any Other Country

The United States spends more than $9,000 per person on health care. While this might initially sound like a good thing, its not despite its high spending, our country doesnt have the best health outcomes. For instance, the U.S. ranks 12th in life expectancy among the 12 wealthiest industrialized countries.

See also:Household Debt Near Great Recession Level: What Does it Mean?

The No 1 Source Of Debt Collections

Published today in The Journal of the American Medical Association, Mahoney’s study is based on the largest-ever dataset of medical debt in the United States and examines all outstanding payments over time. It finds substantial variation across the country and by income, with debt loads hitting the poor and the South the hardest.

This is a classic case of the rich getting richer and the poor getting poorer, says Mahoney, an economics professor in the Stanford School of Humanities and Sciences, and the George P. Shultz Fellow at the Stanford Institute for Economic Policy Research .

While the overall amount of unpaid medical bills has declined nationwide since the Great Recession, the decline in total debt has been much smaller in the South. He also finds that the rate at which Southerners have been acquiring medical debt from one year to the next has been rising, most notably within low-income communities.

The reason, according to Mahoneys research, appears to tie into the decision by many states in the South to not expand Medicaid as allowed under the Affordable Care Act . By comparison, in states that chose to broaden their public health insurance for low-income individuals, total medical debt fell significantly more, and the rates at which their residents including those who live in the lowest-income areas accumulated new debt from one year to the next also declined.

Recommended Reading: How Many Times Has Trump Filed Bankrupsy

Healthcare As A Percentage Of Gdp In The Us Has Increased From 5% In 1960 To 18% In 2020

Healthcare spending in the United States is on its way up. As a matter of fact, it grew by 4.6% in 2019, reaching $11,582 per person that year. Then, healthcare statistics affirm that, as a part of the countrys Gross Domestic Product, health spending summed up to 18% in 2020. To point out, that is a striking difference from 1960, when it was only 5%.

How Are Hospitals Addressing The Medical Expense Issue

In an effort to collect more money for services, many hospitals are offering discounts for medical care when it is paid for in advance or at the time of service. Many hospitals have financial advisors who meet with patients as they are being discharged to set up payment plans.

Because of the time and expense spent collecting and filing paperwork with the bankruptcy courts, many medical providers and hospitals are selling off debts or using medical factoring companies. Even though they lose a lot of money on these kinds of transactions, they do at least get some cash in return.

In addition, some hospitals and health systems are actually being sold or entering partnerships with larger medical groups in order to stay afloat. As an example, the non-profit Mercy Health Partners Tennessee sold its facilities to a for-profit organization, Tennova Healthcare.

Originally the hospital network was the merger of Baptist Health System and St. Maryâs Health System, who merged to form Mercy Health in efforts to financially stay afloat. About a year after the merger, the system was sold as financial troubles continued to plague the operations.

Many community hospitals, which are operated by local municipalities, have actually been forced to close their doors. As the economy slowly shows progress, hopefully the healthcare market will see more debts paid and more systems will remain intact.

Also Check: How To Declare Bankruptcy In Canada