Dividend Payments To Creditors

Money paid to creditors is usually called a dividend and is expressed as the number of pence in the pound paid in respect of each creditor’s claim. If a creditor has not submitted a claim form and proof of the debt they will not be included in this process.

When the trustee has collected enough money to pay a dividend, they will write to all creditors telling them how much to expect. The trustee should make every effort to ensure that the dividend is paid, there is no statutory requirement for the trustee to obtain a Form of Receipt from a creditor prior to payment of a dividend. In cases where the trustee is unable to pay the dividend to the creditors, he will lodge the funds with the Accountant in Bankruptcy in a special bank account called a consignation account. If you wish to claim any money in the consignation account, you must write to the Accountant in Bankruptcy. A charge is made for dealing with consigned money.

Limitations Of Bankruptcy Discharge

Contrary to what some consumers may believe, bankruptcy is not always the best option in a financial crisis, and a bankruptcy discharge may not relieve them from the obligation of paying off all their debts. Simply put, there are some debts that just cant be discharged.

According to the Federal Judiciary, there are 19 different types of debt that are not eligible for discharge. The most common are spousal child support, alimony payments, and debts for willful and malicious injuries to person or property.

For certain kinds of bankruptcies, condo fees, debts owed to some tax-advantaged retirement plans, debts from DUIs, and student loans are also among them. And any debt not listed on the bankruptcy cannot be discharged. In addition, valid liens on specific property to secure payment of debts that have not been discharged will remain in effect after the discharge, and a secured creditor has the right to enforce the liens to recover such property.

As mentioned above, creditors listed on the discharge are not permitted to contact the debtor or pursue collection activity, and a debtor may file a report with the court if a creditor violates the discharge order. The court may sanction the creditor with civil contempt, which also may be accompanied by a fine.

Bankruptcy Discharge Certificate Canada: How Long Does My Credit Score Take To Recover From Bankruptcy

Your bankruptcy will stay on your for 6 years from the date your bankruptcy discharge certificate Canada is issued. If you have actually been bankrupt more than once, then it might be reported for approximately 14 years from the date of your discharge.

Having actually removed your financial obligation problems by getting your bankruptcy discharge certificate Canada, most individuals see they now have the ability to construct a more powerful financial future. Unless you urgently need to purchase a house for the very first time or buy an auto, you need not also bother with getting approved credit to take on debt right away. Many find they have the ability to live without credit considering that they have a more powerful cash flow than prior to bankruptcy. They are now able to start saving.

While you remain in bankruptcy, you are learning to live your life without credit. You are living essentially on a cash basis. You are not spending more than you make. Your Trustee is advising you to do so on an after-tax basis so that you will not have a nasty surprise when tax time comes.

You May Like: How Many Bankruptcies Has Donald Trump

Phase : 341 Meeting Date Of Discharge

Remember how the date of the 341 meeting determines a lot of deadlines for the rest of the case? Here is how it works:

341 meeting + 30 days = Deadline for the trustee to object to an exemption you claimed. This deadline starts when the 341 meeting is âconcludedâ which can be delayed if the trustee schedules a follow up meeting.

341 meeting + 60 days = Deadline for creditors to object to having their debt discharged. are not very common in typical Chapter 7 cases, but they do happen.

341 meeting + 45 days = Deadline to deal with secured debts, like car loans .

Once the deadline to object to the discharge has passed, the court will enter the discharge order.

Can the discharge date be delayed?

Yes. If you donât take your financial management course after filing and submit a certificate of completion, the bankruptcy court canât grant your discharge. If too much time passes, the court can close your case.

Other Things That Can Delay The Entry Of The Discharge

What Happens To Debts

Once a debtor is discharged they no longer have a personal liability to repay the debts they had before they were made bankrupt, although there are exceptions to this.

A debtor is still personally responsible for:

- student loans

- fines, penalties, compensation and forfeiture orders imposed by any sheriff

- any liability incurred as a result of fraud or breach of trust on the debtors part

- any liability to forfeiture of bail

- any obligation to pay aliment

- any periodical payment ordered by the sheriff to the ex-spouse of the debtor

The pre-bankruptcy creditors, except those above, will not be able to take any legal action against the debtor to recover their debts. However, the debts still exist and the debtor is still responsible for paying any contributions agreed with the trustee.

A creditor can still take action against anyone else, for example the debtors spouse, who had a joint liability for the debt.

A debtor is also still responsible for making payments to any secured creditor, for example, for the mortgage on their house.

A debtor is also responsible for repaying any debts which they have run up after they were made bankrupt along with any ongoing liabilities such as rent, council tax, gas, electricity and telephone bills.

Don’t Miss: Has United Airlines Filed For Bankruptcy

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

Discharge And Your Business

After discharge you can carry on a business without the restrictions that applied during your bankruptcy.

You can act as a director of a limited company or be involved in its management .

You will be able to obtain credit without having to mention your bankruptcy but you will want to ensure that you can repay it.

Read Also: How Much Is Bankruptcy Chapter 7 In Ohio

Disadvantages Of A Bankruptcy Discharge

Your bankruptcy protection doesn’t extend to joint account holders or cosigners on any of your debt obligations. Your personal liability for the debt is removed when you receive your bankruptcy discharge, but your cosigner remains on the hook for the entire balance of the debt. Creditors can still collect fromor even suecosigners and joint account holders for discharged debts.

You can voluntarily make payments on a debt to ensure that it’s paid in full.

Your bankruptcy discharge will additional appear on your and affect your credit score for seven years after you file for Chapter 13 protection, and for 10 years from the date you file for Chapter 7 bankruptcy.

Accounts associated with your bankruptcy might be deleted from your credit report if the date of delinquency preceded your bankruptcy filing.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Order Of Conditional Discharge

The court may rule that, as a bankrupt, you need to satisfy one or more conditions before you can be released from your debts. The condition might be to make certain additional payments over a specified time frame, or complete some duties you did not finish.

While absolute and conditional discharges have their differences, they aim to achieve the same result. The goal is to relieve the individual of bankruptcy and help them begin a new debt-free start.

While an absolute discharge produces that outcome immediately, a conditional discharge postpones that result until specific terms are met.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Is A Judgment A Dischargeable Debt In Bankruptcy

The manner in which a judgment is obtained has no bearing on whether bankruptcy can eliminate it. What matters is if the debt or obligation underlying the judgment is subject to discharge through bankruptcy.

- Overdue rent or bill payments

- Private debts to friends or family members

The attachment of a judgment to a debt does not change the debt’s eligibility for discharge through bankruptcy, and judgments associated with debts such as these are typically eliminated in the bankruptcy process.

Debts are discharged in a Chapter 7 proceeding following the debtor’s forfeiture of assets . Debts are discharged in a Chapter 13 bankruptcy after the debtor completes the repayment plan imposed by the bankruptcy court.

Neither Chapter 7 nor Chapter 13 bankruptcy can discharge all debts, however. Obligations that cannot be eliminated through bankruptcy include:

- Child support and alimony

- Mortgages

- Obligations incurred through negligence, fraud or other criminal acts

In addition

- Chapter 7 bankruptcy cannot discharge car loans, obligations to pay court costs or fees, or debts secured by liens .

- Chapter 13 specifically cannot discharge certain tax debts.

Signing A Bankruptcy Petition

To file for bankruptcy protection, you sign various bankruptcy forms, including an Assignment and a Statement of Affairs. In your bankruptcy assignment, you state that you are handing over your property to the Licensed Insolvency Trustee for the benefit of your creditors. The statement of affairs is a list of all your assets and liabilities.

You will also be required to answer several questions about your situation including details about your family, work, and disposition of assets before bankruptcy. It is an offence under the Bankruptcy & Insolvency Act to sell or hide assets from your creditors when you know you intend to go bankrupt.

With the advent of COVID-19 and the required social distancing, it is now possible to file bankruptcy online by video-conference and electronic signature. However, you must still file with a trustee in the province where you live or where most of your assets are if you live outside of Canada.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

When To Expect The Discharge

If your bankruptcy chapter proceeds as plannedyou satisfied all requirements and no one successfully objects to your filingyou’ll receive the discharge at the end of your matter after you’ve done the following:

- filed the official petition, schedules, and required local forms

- provided the court with accurate documentation of your debts, assets, income, and financial dealings

- attended the meeting of creditors

- participated in a session with a credit counselor and taken a financial management course, and

- if filing under Chapter 13, made all of your payments under your repayment plan.

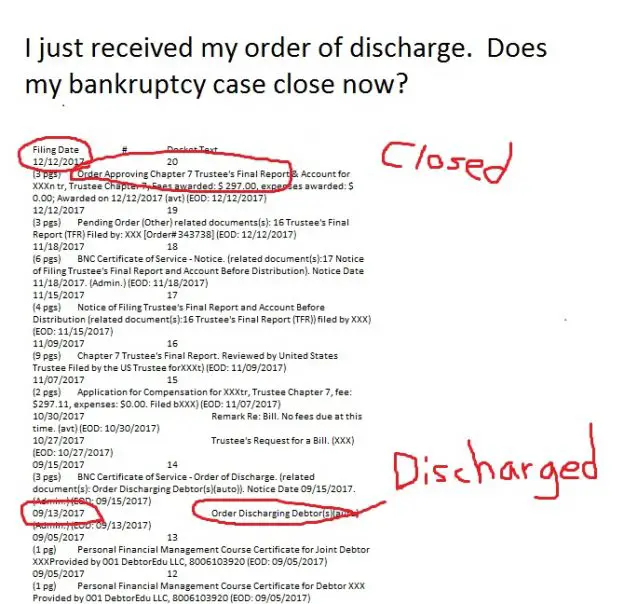

The court will notify you by mailing out a document called an “order of discharge.” The order won’t close your case, however. The case will remain open until the bankruptcy trusteethe official who manages your matterdisperses available money to creditors, or until any outstanding bankruptcy litigation ends.

Timewise, in a Chapter 7 case, the court sends out the order approximately three to four months after filing. In a Chapter 13 bankruptcy, the discharge comes after completing the three- to five-year repayment plan. It will wipe out any remaining dischargeable debt balances at that time.

Contact The Clerk Of The Court

The first place to check when you need a copy of your bankruptcy discharge papers is with the Clerk of the Court where your case was filed. Some courts will allow you to search the record online for free, while others charge a fee for searches. If you need copies of the document, there will be a fee as well. Copies of the document are often a charge per page. If it has been many years, the case may have been archived, so additional fees may apply.

You May Like: Can A Person File Bankruptcy Twice

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

What Happens In Every Bankruptcy Case

When you file a bankruptcy case, you’ll have to complete certain requirements before you can qualify to have your debts discharged . At a minimum, you’re required to:

- fill out bankruptcy paperwork with details about your financial situation, including your assets, debts, income, and expenses

- pay a filing fee

- provide 521 financial documentation to the bankruptcy trustee

- complete .

You’ll have to wait 60 days after your meeting of creditors before the court will issue your discharge order. If all of your property is exemptmeaning that you’re allowed to keep itthe court won’t have to take any further action in your case and will most likely close it.

Don’t Miss: How Many Times Has Trump Declared Bankruptcy

Order Of Absolute Discharge

If a court hearing is required, and if you satisfy the court that all duties are completed, the court will issue an Order of Absolute Discharge. After an absolute discharge, you are no longer bankrupt.

There are certain situations where the court will not grant an Absolute Discharge Order.

If this is your third bankruptcy, you dont complete your duties, or if your creditor opposes the bankruptcy discharge you will have to attend a court discharge hearing, and the court will then decide on the type of Discharge Order to grant.

At the court hearing, your trustee will let the court know about any relevant details about your bankruptcy. These details can include information about the creditors opposition or the duties that you didnt complete.

The court will take many factors into account when issuing an order of discharge, including:

- your conduct during your bankruptcy

- your income and bankruptcy payments

- how you got into debt in the first place

- even the education and age of the bankrupt

The court may still grant you an Order of Absolute Discharge, or they can issue an order with conditions, suspend your discharge for a period of time, or refuse your release from bankruptcy outright.

How Long Does Bankruptcy Last In Canada

Not forever, fortunately. Bankruptcy is a legal process that is intended to provide a new financial start, without being unnecessarily punitive.

Your bankruptcy ends when you receive a discharge, the event that actually cancels your debts.

Several factors affect the length of personal bankruptcies in Canada.

How Long Does Bankruptcy Last In Canada?

First-time bankrupts who make very little income are often eligible for discharge after the legislated minimum period of nine months. However, your bankruptcy will last for more than nine months if you make surplus income, or if this is not your first bankruptcy.

You May Like: How To File For Bankruptcy In Indiana Without A Lawyer

Fans Of Nbcs The Office May Remember An Episode In Which Michael Scott Yells To His Office I Declare Bankruptcy Unfortunately Theres A Lot More To Fixing A Heap Of Debt Than Making A Loud Proclamation Filing For Bankruptcy Is A Complex Legal Process That Might Save You Money But It Also Comes With Serious Consequences Youll Want To Consider

The first step in determining whether a bankruptcy is right for you is defining what it is. Here are a couple important terms to know:

- Bankruptcy is a legal means by which someone with a large burden of debt can get out from under it. In a 1934 case , the U.S. Supreme Court defined the purpose of bankruptcy as giving a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of preexisting debt. In other words, its an opportunity for a financial do-over.

- If bankruptcy is the end goal, a bankruptcy discharge is a tool used to accomplish it. A bankruptcy discharge is a court order that releases a debtor from personal liability for specific debts. It legally prohibits a lender or creditor from taking any action to collect the debt in question.

Sound too good to be true? In several important ways, it is. For one, the bankruptcy shows up on your credit reports for seven to 10 years, depending on the type of bankruptcy you file, and will almost surely harm your credit scores. It also only applies to certain specific types of debts, so its not a catch-all remedy.

Follow along to learn more about discharged debt and whether a Chapter 7 or Chapter 13 bankruptcy might make sense for you. If in doubt, work with a qualified or bankruptcy lawyer to ensure you make the best decision for your needs.

Do you really need to talk to a credit counselor if youre considering bankruptcy?