Here’s How Bankruptcies Impact Your Credit Score

While bankruptcies on your credit report will always get factored into your credit score for as long as they are on there, the impact on your score lessens with each year that passes. So, you may see a dramatic drop in your score in the first month immediately following your bankruptcy filing, but by the end of the first year it could have less weight, and certainly less in later years compared to year one.

Your own credit profile will also play a part in how much your credit score is affected when you declare bankruptcy. Similar to how having a higher credit score can ding your more points if you miss a credit card payment, so, too, is the case if you file for bankruptcy. According to FICO, someone with good credit may experience a bigger drop in their score when a bankruptcy appears on their report than someone with an already poor credit score.

Estimates we found online from places like Debt.org show how people with different credit scores would be impacted by a bankruptcy filing. Someone with a credit score of 780 or above would be dinged between 200 and 240 points, while someone with a 680 score would lose 130 to 150 points.

Whatever the case, no one really benefits from filing for bankruptcy. It’s an option of last resort that sometimes even those with good credit find themselves making.

When Can I Get A Bankruptcy Off My Credit Report

Article updated by Mia Taylor May 21, 2018

Filing for bankruptcy in order to deal with overwhelming debts can be a frightening and confusing prospect.

But if youre among those who have opted to use this approach in order to turn a troublesome financial picture around, youre probably wondering what the next step should be. And more importantly, how long it takes to get that bankruptcy removed from your credit reports.

The good news is, bankruptcy filings dont mean the end of obtaining credit and in fact you can try to speed up the removal process, while also rebuilding your financial profile quite successfully.

How Bankruptcy Is Removed From A Credit Report

Oct 7, 2021Bankruptcy

When people file Chapter 7 and 13 bankruptcies, theyre usually focused on filling out all of the necessary paperwork and after all is said and done, on rebuilding their credit. They rarely think much about when and how the bankruptcy falls off their credit report. Its been almost 10 years since I filed Chapter 7. What do I need to do to get it removed from my credit on the 10-year anniversary?

In the above situation, usually the debtor doesnt need to do anything to have their Chapter 7 bankruptcy removed from their credit report. Why? Because, Chapter 7 and 13 bankruptcies and all of the included or discharged debts are deleted automatically after a specified period of time passes.

Also Check: How Many Times Has Trump Filed For Bankrupsy

Equifax And Transunion Credit Reports

Both Equifax and TransUnion maintain a bankruptcy record on your credit report for a period from the date of your discharge or last payment.

For first-time bankrupts, TransUnion maintains the information for the maximum length of time permitted by provincial law , while Equifax retains the information for 6 years for every province.

A Fresh Start After Bankruptcy

Mei Ling and Matt are a married couple who rent a flat in Gosford NSW. Both worked full time until two years ago when Matt lost his job. Mei Ling now works part time earning less than $40,000 per year.

For two years they tried to survive on Mei Lings wage, struggling to make repayments on their overdue credit cards and loans. They ended up with unsecured debts of over $65,000.

The only assets they owned were a car worth $5,000 and general household goods .

The pressure from their creditors became too much to handle. Debt collectors and process servers were constantly calling on them. Their electricity was turned off a few times and they stopped answering phone calls because it always seemed to be bad news. Matts health was also suffering and he was treated for depression. Most nights Mei Ling would end up in tears thinking about their situation.

They finally decided to see a financial counsellor. There was no charge for this service. The financial counsellor looked through their finances and suggested they consider filing for bankruptcy.

Matt and Mei Ling went home and looked in detail at the AFSA website. They read all about their options and the consequences of bankruptcy. The AFSA website showed that they would be able to keep their car because it was worth less than the set amount. They read they could also keep their household goods. In the end, they decided that bankruptcy would be the best option for them.

Read Also: How Does A Bankruptcy Trustee Find Hidden Assets

Chapter 7 And Chapter 13 Bankruptcy

A Chapter 7 bankruptcy is a type of bankruptcy that liquidates most of your assets. This liquidation process serves to pay a portion of your outstanding debts to your debtors. This is in accordance with the provisions of the Bankruptcy Code.

Simply put, with a Chapter 7 bankruptcy, you can stop making payments on your accounts. However, you will need to include those accounts in the bankruptcy filing. To that end, Chapter 7 bankruptcy records will remain on your report for up to 10 years. The reason is: You are not repaying all of your debts.

On the other hand, a Chapter 13 bankruptcy is an adjustment of the debt plan. In contrast to a Chapter 7 bankruptcy, your debts will not be discharged. In addition, the repayment plan typically lasts around three to five years. Fortunately, Chapter 13 bankruptcy records fall off much sooner at seven years.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: How Many Bankruptcies Has Donald Trump Filed For

Can You Get A Credit Card After Filing For Bankruptcy

Yes, you can get a credit card after filing for bankruptcy. That said, a bankruptcy will make it very difficult for you to get a regular unsecured credit card, however, you can apply for an unsecured credit and build good credit history for that account. The only difference between a regular credit card and a secured credit card is that to get a secured credit, you need to pay a security deposit and the deposit that you pay will be your credit limit.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How To File Bankruptcy Yourself In Va

How Long Does Bankruptcy Affect My Credit Report

There are two main credit reporting agencies in Ontario: Equifax and Trans Union. Information about your bankruptcy or consumer proposal is reported to these agencies by the Office of The Superintendent of Bankruptcy , not your trustee. The OSB will advise these agencies when you file a bankruptcy or proposal and when you receive your discharge.

If you file ANY of a bankruptcy, consumer proposal, debt management plan or do a debt settlement, a not will appear on your credit report that can negatively impact your credit. In general:

- a first bankruptcy will remain on your credit report for six years or seven years after you are discharged

- a consumer proposal (or debt management or debt settlement plan will remain on your credit report for three years after all of your payments are completed.

Bankruptcy does not mean you cannot borrow for six or seven years. This just means that the note will remain on your report, however there are many other factors that affect your ability to get credit.

If you have a job, and if you have a down payment or security deposit, it is possible to repair your credit sooner. Many people are able to buy a car or a house in less than seven years after their bankruptcy ends, if they are able to save money and begin repairing their credit. Here are some ways you can improve your credit after filing for bankruptcy:

How Much Will Credit Score Increase After Bankruptcy Falls Off

Your credit score will increase by 50 to 150 points after a bankruptcy is removed from your credit report. The removal of bankruptcy can dramatically increase your credit score because bankruptcy is the most negative item that can appear on your credit report. The amount of points your credit score will increase depends on other items you have on your credit report.

If you have other negative items bringing down your credit score, you might not see a huge increase. But if nothing else is affecting your credit score, the removal of bankruptcy will likely result in a huge increase in your credit score.

If, after filing for bankruptcy, you open new accounts, make all of your payments on time, you should see a substantial increase in your credit score once the bankruptcy is removed from your credit report.

Many people have reported that their credit score has increased by 50 to 150 points after the bankruptcy fell of their credit report. That said, some saw a 50 point increase, others saw a 91 point increase, and others experienced a 150 point increase. So, your point increase will vary depending on the information in your credit report.

If, after filing for bankruptcy, you opened new credit cards, racked up a lot of new debt, and missed payments on your account, you will be hurting your credit score and the removal of a bankruptcy would have little to no impact on your credit score because the new derogatory information will drag your credit score down.

Don’t Miss: Can I Rent After Bankruptcy

Turning Your Financial Picture Around

Before you start thinking about when you might be able to get that next or line of credit again, its important to make sure you correct whatever behaviors got you into trouble in the first place.

First and foremost, and most people dont realize this, before getting back into the credit game or applying for anything, make sure your financial habits are fixed, said Exantus. Whatever you did that required filing bankruptcies, you now need to establish good financial habits. That includes things like paying yourself first, saving money, creating an emergency fund. All of these things are so directly tied to credit and the ability to manage credit and money.

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.

Don’t Miss: How To File For Bankruptcy In Massachusetts

How Does Bankruptcy Affect Your Credit Score

Unfortunately, bankruptcy is considered a seriously negative event by scoring models like FICO and VantageScore. As such, if a bankruptcy is added to your credit report, it can have a severe negative impact on your .

According to myFICO, someone with a score in the mid-600s or 700s could expect their score to fall by 100 points or more even 200+. Also, the more accounts that are included in your bankruptcy, the heavier an impact it’s likely to have on your score.

Thankfully, the negative impact of a bankruptcy on your credit report will diminish over time. So even though a bankruptcy will still be on your credit report five years down the road, its impact on your score will be much less than it was in the year that you filed.

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

Also Check: Did Donald Trump File For Bankruptcy

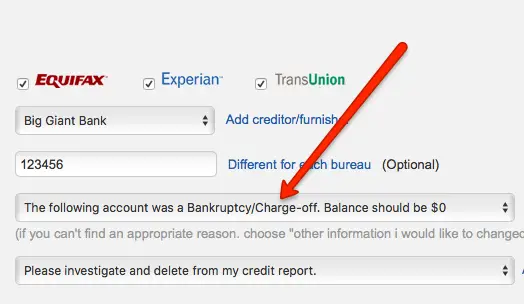

Dispute Inaccurate Bankruptcy Entries With A Credit Dispute Letter

If you were able to find some inaccurate information within the credit report, then your next step will be to dispute the inaccurate entries with each of the credit bureaus using a .

The best-case scenario is that theyll be unable to verify the bankruptcy and remove it from your credit report. This is unlikely if its a recent bankruptcy. The older the bankruptcy, the better chances you have of getting it removed from your credit report this way. Nonetheless, if it happens, then great, you can skip the other steps.

If the bankruptcy is verified by the credit bureaus, continue to the next step.

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

Don’t Miss: How Many Bankruptcies Did Trump File

Chapter 13 Bankruptcy Early Removal

The one I know most about applies to getting your chapter 13 bankruptcy removed early. There are several seemingly legitimate reports of individuals successfully having their bankruptcies removed before the seven year mark.

They all mention an early exclusion request to the three major credit bureaus. But heres the catch, if you are successful in getting an early exclusion you may not get it with all three credit bureaus. Furthermore, youre unlikely to get it much sooner than your chapter 13 bankruptcy would fall off anyway.

All reports Ive seen indicate that their chapter 13 bankruptcy was removed via early exclusion between 1-6 months early. Now, if youve waited 6.5 years for your bankruptcy to fall off, that next six months generally isnt a big deal.

But if youre planning to buy a home, car, etc. it can make a big difference in your ability to borrow at a more competitive rate. Take a look at how much my . You can bet my interest rates are far more favorable with an 800+ credit score!