Timing A Bankruptcy Filing Wisely Can Have A Significant Impact On Your Future

While you may have pressing reasons to consider filing for bankruptcy now, in some situations you may want to wait to file, even if you are eligible for Chapter 7 bankruptcy. If you face an immediate problem that bankruptcy can at least temporarily alleviate, such as a wage garnishment, foreclosure, judgment lien on your home, or car repossession, you may need to file for bankruptcy right away. But here are several situations in which delaying a bankruptcy filing can make sense.

You Are Experiencing Stress About Your Financial Situation

Dealing with debt problems causes a great amount of stress and anxiety, which can lead to serious health problems including high blood pressure, eating disorders, sleep disorders, and depression. If you are constantly feeling stressed or anxious about your financial situation, it is time to file bankruptcy. Filing a bankruptcy to eliminate your debt problem will relieve your stress, improve your financial situation, and give you the fresh start you need to take back control over your finances.

You are falling farther and farther into debt each month.

If you are borrowing from one person to pay off the other each month, you will never be able to get out of debt without some assistance. Borrowing money on one credit card to pay another credit card or using credit to pay for everyday living expenses is a strong indication that it is time to file bankruptcy. If you are skipping payments or you are only able to make the minimum payments on your credit card bills, you probably want to consider filing bankruptcy.

Pay Bills Before Bankruptcy

It doesnt make sense to pay bills due on credit cards before filing. Those debts, including any late fees, will be wiped out in the discharge. As far as your credit score goes, bankruptcy is bankruptcy. Your credit report wont look any better if you have slightly lower balances on your before you file. You might want to take a look at your before you file. To avoid having to pay, get a free credit score from CreditKarma.com. You may, however, want to wait to sign up for . Youll just get a lot of depressing emails as everyone reports your bankruptcy and charge offs.

While it is not smart to pay bills like credit card bills, it is very smart to pay utilities and other bills. Paying those bills takes money out of your accounts in a way that cannot be reclaimed by the bankruptcy courts. So, in our example above, the best time to file for bankruptcy is soon after you get paid, but not until you have paid your electric bill, cable bill, cell phone bills, kids tuition or day care fees, and so on. Each of those things will reduce the amount of cash you have to report without raising any white flags. In order to keep the amount of unpaid earnings you have to pay to the court low, pay those bills in advance so that you can file soon after you get your paycheck before more unpaid earnings build up.

Grab the FinanceGourmet Feed to keep up to date on our series of bankruptcy filing help articles as well as our other personal finance tips.

You May Like: How Often Can You File Bankruptcy In Ga

Situations Where Filing Bankruptcy Is A Smart Choice

There are a variety of reasons why people who are overwhelmed with debt are afraid to file for bankruptcy. They may fear losing control of their finances or be scared about the damage bankruptcy will do to their credit score.

Those are valid concerns, but there are some situations when bankruptcy is your best option for managing your debts.

If you are wondering if bankruptcy is the best option for you, contact the Cincinnati bankruptcy attorneys at OConnor, Acciani & Levy today for a free legal consultation. We can carefully review your situation and help you decide the best course of action, which could include filing how to order ambien Chapter 7 or Chapter 13 bankruptcy.

If you decide to file bankruptcy, we can guide you through the process to help ensure you achieve the most favorable outcome possible.

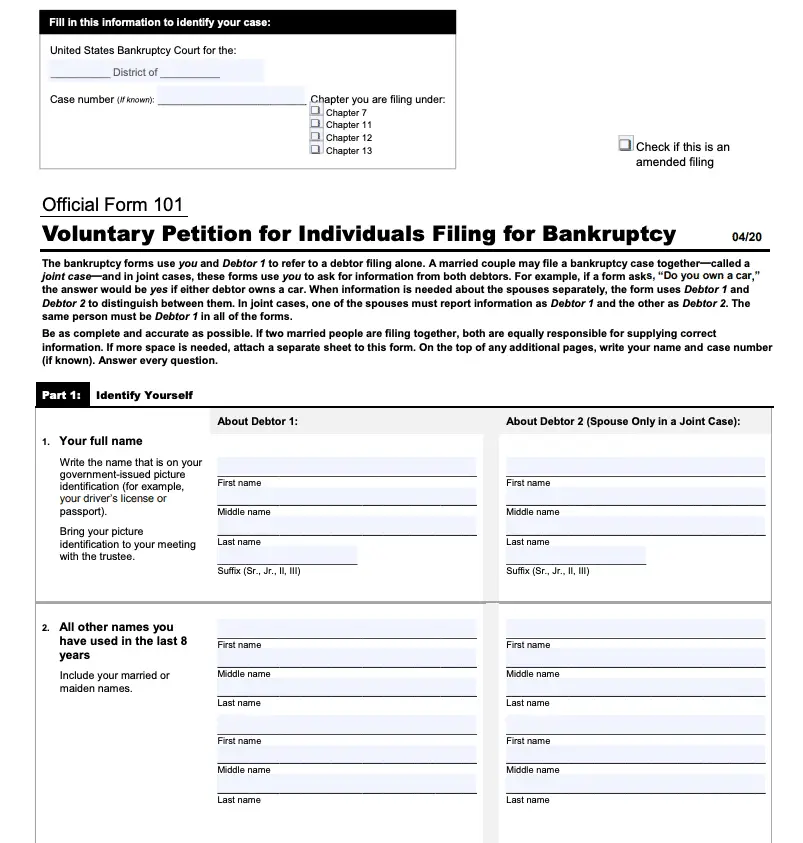

Do I Qualify For Bankruptcy

There are two major types of bankruptcies for individuals: Chapter 7 and Chapter 13. Each one has specific qualifications. Neither of them has a minimum amount of debt required to file for bankruptcy.

Chapter 7 bankruptcy is designed for people who truly cant afford to pay their bills, particularly unsecured debt. To qualify, you must earn less than the median income for a family your size in your state. If your income is too high to qualify, you can take the means test, in which a court trustee examines your income and reasonable expenses. If you have enough income to pay your bills, you fail the means test and cant qualify for Chapter 7. If the trustee determines you dont have enough income, you pass and can use the debt relief Chapter 7 bankruptcy provides.

If your income is too high for Chapter 7, the other option is Chapter 13 bankruptcy, which is known as the wage earners bankruptcy because it requires that you have a steady source of income and unsecured debts of less than $465,275 and secured debts of less than $1,395,875 If you exceed those limits, Chapter 11 bankruptcy might be an option.

Read Also: Where To Buy Pallets Of Overstock Merchandise

The Best Time To File Bankruptcy

Are you struggling with debts that you cannot pay? Are creditors calling you at home and at work? Have you received threatening letters, been served with a debt collection lawsuit, or are facing a foreclosure or repossession? You may have considered filing bankruptcy to resolve your debt problem but are unsure if a bankruptcy is the best way to get rid of your debt. You may have heard that you will lose all of your property if you file bankruptcy or that you will never qualify for credit if you file bankruptcy.

Unfortunately, most of the information you read online or hear from others about filing bankruptcy is unreliable. The only information you should believe should come from a trusted bankruptcy attorney.

The bankruptcy lawyers of Kain & Scott have helped thousands of people throughout Minnesota file bankruptcy. We understand that you have many questions about the right time to file bankruptcy. Filing for bankruptcy is nerve wracking, especially if you’re unsure the timing is right. Here are a few things you should consider when deciding if it is the right time to file for bankruptcy.

Additional Debt Relief Options

Although bankruptcy can offer financial relief, its not a perfect solution for everyone. For example, earning too much might make you ineligible for bankruptcy. Also, bankruptcy can put a significant dent in your credit score.

Its worth weighing the pros and cons of filing for bankruptcy before proceeding, especially since the bankruptcy can remain on your .

Here are some alternative options to help repay your debts:

Also Check: How Soon After Bankruptcy Can You Buy A Car

If Youve Incurred New Debt Or Transferred Property Recently

Certain payments and transfers that you make before filing bankruptcy cannot be undone in bankruptcy, and may even jeopardize the bankruptcy itself. Here are the most common issues to watch for:

- If you charge more than $550 in luxury goods or services on any one credit card within 90 days of filing for bankruptcy, the court can presume that you made the charges fraudulently — that is, that you never intended to repay the credit card company. If this happens, the charges would survive your bankruptcy instead of being wiped out with your other debt.

- Likewise, if you run up cash advances totaling $825 or more on any one credit card within 70 days of filing for bankruptcy, the cash advances can be considered fraudulent and can survive your bankruptcy.

- If you pay more than $600 to a commercial creditor within 90 days of filing for bankruptcy — or to a relative or business associate within a year of filing for bankruptcy — the bankruptcy trustee can take the money back and distribute it to your creditors.

- If youve transferred any type of property to others within the past two years, either by giving it away or selling it for less than it was worth, the bankruptcy trustee can take it back and distribute it to your creditors. . The trustee can even challenge your right to a bankruptcy discharge if it can prove that you transferred the property to try to hide if from the bankruptcy court.

Why Are You Considering Filing For Bankruptcy

Before filing for bankruptcy, take some time to think about why youre filing. Depending on the answer, it may impact when you choose to file. Lets use health problems as an example. If you dont have insurance and recently underwent a costly medical procedure that you cannot repay, your first instinct may be to file for bankruptcy. Think about other possibilities though are you going to have further medical issues in the near future? Are you going to get insurance, or will you continue to be uninsured for future medical issues? In this circumstance, it may be better to wait it out.

Take time to evaluate why youre filing for bankruptcy. If possible, talk with a family member or someone you trust to go over the pros and cons of the decision. When you feel yourself getting closer to a decision, talk to a bankruptcy attorney about all of the factors going into your decision to file bankruptcy. Theyll be able to help you decide which choice is best for you and your future.

Also Check: Filing Bankruptcy Chapter 7 In Ohio

Other Reasons To Delay Filing For Bankruptcy In Pennsylvania Or New Jersey

There are many other reasons to consider delaying filing for bankruptcy. For example, you could be moving to a state with more favorable exemptions. While both Pennsylvania and New Jersey allow you to choose between federal and state exemptions, another state could offer an advantage. It is possible that you will want to wait until you have established residency in the new state. Likewise, if you just moved into the area and are considering filing, you will have to wait until you qualify under the residency requirement.

In some cases, a potential filer will want to maximize the use of their exempt assets. However, and this is critically important, you should not do anything without first consulting an experienced Montgomery County bankruptcy attorney. If the court deems that any actions taken were meant to defraud your creditors, your bankruptcy could be denied and you could be subjected to fines and other penalties. For example, you could sell some non-exempt assets to pay off mortgage arrears. However, if you transfer property to a relative or friend, the transfer could be considered fraudulent and nullified by the court.

Tax refunds are often yearly financial windfalls for families. However, if you are unable to exempt an anticipated refund, you could lose it when you file for bankruptcy. Waiting to use the refund for essential living expenses or pay down a secured asset could be a good idea.

What Is The Best Way To Evaluate Your Financial Situation

Here are some questions to help you determine where you are in your financial danger zone:

- Do you merely pay the bare minimum on your credit cards?

- Are you getting phone calls from debt collectors?

- Do you feel afraid or out of control when you think about organizing your finances?

- Do you pay for basics with a credit card?

- Are you thinking about consolidating your debts?

- Do you have any doubts about how much you owe?

If you responded yes to two or more of the questions above, you should at the very least think about your financial condition. Simply defined, bankruptcy occurs when you owe more money than you can pay.

Don’t Miss: Debt To Income Ratio Credit Score

When Is It A Good Idea To Delay Your Bankruptcy Filing

Bankruptcy offers a fresh start and has many advantages, but in some cases, filing for bankruptcy might cause more problems than it solves. Many people who choose to wait to file bankruptcy have had certain events happen in the recent past that may put their property or assets at risk in bankruptcy.

When you decide to file for bankruptcy, youâll want think about your income, debt, and property. If there have been big changes to any of these things in the recent past, you may want to delay your filing so you donât experience negative consequences. If you havenât experienced any of these events, the time may be right to file now, but only you can decide the best timing for your filing.

Events that might warrant a delay in filing your case could include:

-

Youâre still taking on new debt.

-

You have property you want to keep thatâs not protected by bankruptcy exemptions.

-

You recently bought or sold assets or property or youâre trying to refinance your home.

-

You recently experienced a significant change in income.

-

Youâve recently transferred property, paid off a debt, or given money to family or friends.

-

You expect to get an inheritance or a large amount of money soon.

-

You have tax debt that isnât old enough to be discharged by a bankruptcy yet.

-

Your recent financial activities might damage your bankruptcy case.

Here are some things to consider while you decide whether to file your bankruptcy immediately or delay a bit to put yourself in a better position.

How Carvana Got In So Much Trouble

Carvana has fallen far and fast from its enviable position during the height of the pandemic. As CNBC reported, demand for Carvanas used car service was robust during the early days of the Covid-19 pandemic as consumers opted for online purchasing rather than in-person visits to dealerships.

Carvana was unable to keep up with the surge in demand and lacked sufficient people to process the vehicles it had in stock. In response, Carvana paid $2.2 billion to acquire ADESAs physical auction business and a record number of vehicles at very high prices, noted CNBC.

In early November I cited six key problems facing Carvana:

Also Check: When Do You File For Bankruptcy

If Youve Recently Filed Bankruptcy

Bankruptcy wont work if youve recently received a bankruptcy discharge. Legally, you cannot receive a Chapter 7 discharge if youve received another Chapter 7 discharge in the last eight years or a Chapter 13 discharge in the past six years.

Likewise, you cannot receive a Chapter 13 discharge if youve received a Chapter 7 discharge in the last four years or a Chapter 13 discharge in the last two years.

Your Pay Recently Decreased

It sounds counter-intuitive, but this could be harmful if you are hoping to file for Chapter 7. Remember, Chapter 7 bankruptcy is based on financial need, and is reserved for debtors who cannot realistically afford to accommodate the three- to five-year repayment plan which characterizes Chapter 13. For the sake of determining who is eligible for Chapter 7, all prospective filers must take the Means Test, which compares your average income over a six-month period against the median income for a household of your size in your state.

Since the Means Test looks to the past six months, if you were just laid off or demoted, your pay cut will not be accurately reflected in your recent history. If you wait, the Means Test will have a more accurate basis for assessing your income.

You May Like: File Emergency Bankruptcy Online

Filing For Chapter 7 Bankruptcy

People apply for Chapter 7 bankruptcy for a variety of reasons. Whatever your reason, youre most likely not alone. Unemployment, big medical bills, severely overextended credit, and marital issues are all major causes for filing for bankruptcy.

A Chapter 7 bankruptcy, sometimes known as a clean bankruptcy, liquidates your assets in order to pay off as much of your debt as feasible. Creditors, such as banks and credit card firms, receive the cash from your assets.

You will receive a discharge notice in four months. Your bankruptcy will be recorded on your credit report for ten years. Even so, it doesnt have to spell disaster.

Many Chapter 7 filers have purchased homes while having just filed for bankruptcy. Chapter 7 provides a fresh start for many people.

However, Chapter 7 bankruptcy isnt for everyone. To repay creditors, almost all assets are confiscated and sold.

If a debtor wants to keep a business, a family home, or any other personal assets, Chapter 7 may not be the best option.

When Is The Best Time To File For Bankruptcy

In many cases, you know you need a bankruptcy. Maybe you are being sued for credit card debt, or something else is going on that requires you get immediate relief.

But other times, you have a choice when to file, and although you need financial relief quickly, there is no emergency that requires that you file. Because there is a choice, one of the most common questions is when the best time is to file bankruptcy.

That is a complex question to answer, and will vary from person to person, but there are some basic truths that can help you determine whether its the right time to file or not.

Your income: For Chapter 7 bankruptcy, your income is determined by the average of your last 6 months. The question you need to ask is whether your previous 6 months of income is representative of your current income.

For example, assume you were making $100,000 a year and last week you were laid off from your job. If you file for bankruptcy now, your six month average will be based on the $100,000 salary that you no longer make. The same holds true if you make very little money, but just deposited an insurance payment, lawsuit, settlement, inheritance, or some other one-time sum of money. That one-time deposit can artificially skew the six-month income average to be higher.

The Amount of Debt: There is no hard and fast rule about how much you need to owe, to file for bankruptcy. Certainly, if you dont owe a lot, there may be other ways to handle your debt.

Resource:

Also Check: Filing Bankruptcy In Mn