What Are The Downsides To Filing An Emergency Bankruptcy

The biggest drawback to filing an emergency case is having such a limited time to prepare your bankruptcy forms. The forms are complex. Youâll need to gather documents, such as tax returns, bank statements, and paycheck stubs. Another drawback is that, while completing your other forms, you may encounter unexpected issues with your case, such as property thatâs not covered by exemptions. If you run into a problem, you donât have much time to figure out a solution.

Also, while an emergency bankruptcy provides you some relief, in some situations itâs just a temporary solution. In Chapter 7, for example, if you want to keep your house or car, you must bring the payments current right away. In Chapter 13, you have more time to catch up on your payments. If you filed bankruptcy to stop an eviction, you only have 30 days to bring your payments current, no matter which chapter you file.

File For Skeleton Bankruptcy To Seek An Automatic Stay

Under ordinary circumstances, thebankruptcy process takes time for petition composition, extensive financial information, cross-checking, and attention to detail in order to avoid a dismissal of your case. However, in some cases, you may need to file an emergency bankruptcy.

This may be necessary when facing:

- Garnishment of your wages

- Or sudden lawsuits

With an emergency filing, you will be seeking the protection of the courts automatic stay that stops or delays the actions of your creditors.

Need to file an emergency bankruptcy?Contact Morrison & Associates online or at 928-3038.

Work With A Bankruptcy Lawyer Online

More than almost anyone else, experienced bankruptcy lawyers know how stressful it is for people who are preparing to file bankruptcy. Thats why the best bankruptcy lawyers often have no problem meeting with their clients online via a video or audio call.

Online, you and your lawyer can do virtually everything you would do in an in-person meeting. And when your attorney has completed your bankruptcy petition, they can file it online for you.

Don’t Miss: Can You File Bankruptcy After A Judgement

How Much Does Chapter 7 Bankruptcy Cost

If you dont hire an attorney, the total cost for filing Chapter 7 is $338, broken down this way:

- $245 filing fee, the cost for the court to handle your paperwork and case after you take it to the bankruptcy court and file it in person.

- $78 administrative fee. Somebody has to pay the clerks and other court employees.

- $15 trustee surcharge. Its the government, right?

The good news: Those who qualify may file for free, with all bankruptcy filing fees waived. The bad news: Qualifying means not only are you in debt, your income is really low.

Those whose household income is less than 150% of the federal poverty level qualify to have fees waived. To become eligible for the fee waiver, you must file Form 103B Application to Have the Chapter 7 Filing Fee Waived and its wise to include it when you file bankruptcy. This form requires you to certify your income, and that you cannot even afford to make installment payments. Filing the form along with your bankruptcy filing takes care of everything at once.

Fees for the two required courses one before filing on pre-bankruptcy credit counseling and the other, after filing, focused on financial management are not high. The courses are run by agencies outside the court, many of which are nonprofit typically the cost for both should never be more than $50. But if you cant afford even that, you can ask the agency or organization for a waiver of the fees.

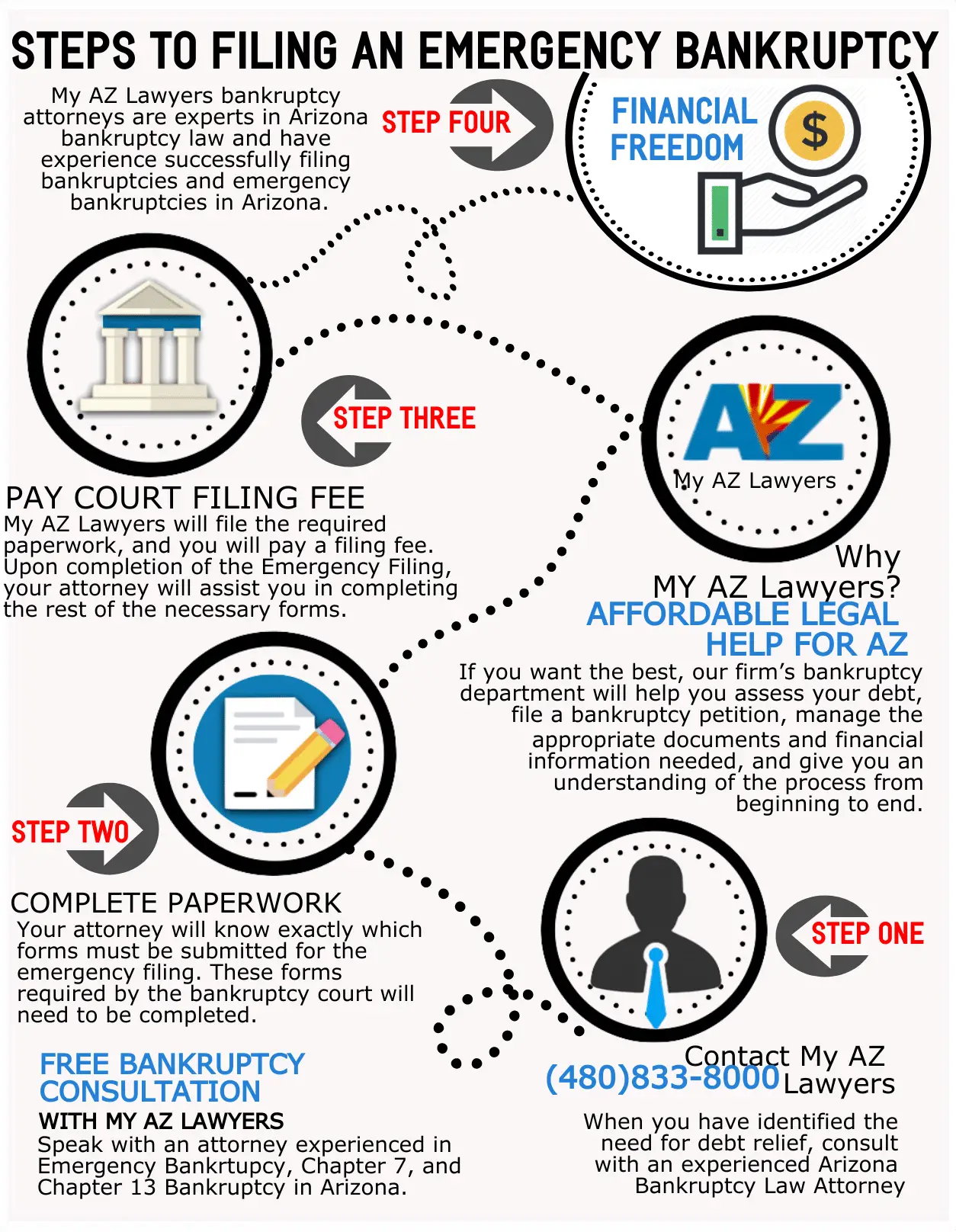

Whats Needed For An Emergency Filing

First, you need to make sure that you actually qualify for Chapter 7 bankruptcy. To qualify for Chapter 7, you must pass the means test, which requires your income to be under the median income for a household of similar size in your state. If your income is above the state median, you can still qualify if you show that you cannot cover your monthly expenses with your current income. In other words, you need to show that your debts leave you with little to no disposable income each month.

If you qualify, the emergency petition needs to include Form 101, your creditor matrix, Form 121, payment for a filing fee, and certificate of credit counseling. Form 101 is titled Voluntary Petition for Individuals Filing for Bankruptcy, and it asks for your personal information, including your name, address, type of bankruptcy, number of creditors, the total value of your assets, and your total debt. It also asks you about your credit counseling class and a few other basic questions. Your creditor matrix is your list of creditors along with their addresses. Form 121 is titled Statement About Your Social Security Number, and it asks for your full name, your social security number, and any Taxpayer Identification Numbers you have used in the past. You also must complete your pre-bankruptcy credit counseling course within six months before filing for bankruptcy. A typical credit counseling course lasts about 45-60 minutes, and usually takes place on the phone or online.

Also Check: When To Stop Using Credit Cards Before Bankruptcy

Forms Necessary For Filing An Emergency Bankruptcy Petition

The first thing that you should do is double-check with the courts to make sure you have all the necessary forms you need to file your emergency bankruptcy petition. The forms required are Form 1 , a Form 21 , Form 201B , and a Verification of Creditor Matrix and Creditor Matrix. In some cases, an Order Dismissing Chapter 7 Case will also be required.

According to U.S. Bankruptcy Court, Western District of Texas, for an emergency Chapter 13 filing, a filing fee of $281 is also required, or an application for the fee to be paid in installments, or an application for a fee waiver. For an emergency Chapter 7 filing, the fee is $306. You will also need to file a certification of credit counseling. If you have not received credit counseling, you will have to file a motion either exempting you from credit counseling or explaining why you did not receive it.

How Quickly Can I File A Bankruptcy Case

How long will it take to file Bankruptcy or how quickly can I stop a garnishment?

Provided you have completed your credit counseling session, we can file a bankruptcy on your initial visit with our office by filing an Emergency Bankruptcy Petition. Immediately, we will fax notice to your employer to stop the Tax Levy or Garnishment. If your pay period has already ended for your next pay check, then you may have one more check garnished. The rest of the documents that must be filed will take around two weeks to complete and must be completed timely so your case will not be dismissed.

At that first appointment, we will go over your assets to make sure that you will not lose anything that you want to keep if you file bankruptcy. We will also try to help you determine if a chapter 7 or a chapter 13 case will be the most helpful to you and help you determine if you qualify for a chapter 7 and how much your plan payment will be if you file a chapter 13 case. Once we have covered all of these things, we can file the emergency petition to stop a foreclosure, a garnishment or and IRS levy if that is what you need.

You May Like: Can You Buy A Home After Bankruptcy

Pay The Bankruptcy Fees

In most cases, you have to pay a fee to file bankruptcy. Depending on your situation, its sometimes possible to waive this fee or break it into installments, but its not possible to waive the in-person or by-mail payment requirement.

Even in the very few districts that allow bankruptcy filers to submit their petitions online, they still require offline payment. Of course, the workaround is to work with an attorney who allows online payments. If your attorney handles the bankruptcy fee as part of their services, you may be able to pay your lawyer for it online.

Should I Hire A Lawyer To File An Emergency Bankruptcy

Technically, you can file an emergency bankruptcy on your own. However, it is typically not recommended. It can help to contact a bankruptcy lawyer in your area if you are thinking about an emergency filing.

Your lawyer will help you to determine eligibility, assist you through the entire process, attend hearings on your behalf, and offer alternatives if necessary. Generally, the more complicated your case, the more necessary it is to hire an attorney.

You May Like: How To File Bankruptcy Chapter 7 Online

Filing For Emergency Bankruptcy

To start an emergency bankruptcy filing, some basic documents need to be filed with the court. A voluntary bankruptcy petition containing the Debtors contact information and chapter designation is prepared and signed. The Debtor need to complete the required credit counseling session. Additionally, you need to include a creditor matrix, which lists all of your creditors and their addresses. A credit report pull will likely provide the bulk of that information. Finally, you need to submit form B121, which confirms your Social Security number.

If you fail to complete the balance of your schedules in the coming 14 days or so, the court can dismiss your case, and attempting to file again will be more difficult. If you attempt to file again within the same year of your initial filing, youll only be granted an automatic stay, the injunction protecting you from creditors, for 30 days unless the court extends it. Youll need to file a motion to extend your automatic stay beyond 30 days, and youll need to explain the reason for the extension in court.

In addition to submitting these necessary forms, youll also need to pay some fees and costs.

Stopping Foreclosure Eviction Repossession And Debt Harassment With An Automatic Stay Bankruptcy

Filing for an emergency bankruptcy may help stop foreclosure, eviction, repossession, and debt collection harassment in some situations. Bankruptcy may be able to help if you need to act fast to stop creditors from taking certain assets or possessions.

Financial struggles can be an overwhelming situation that can leave you feeling lost and helpless. Although filing for bankruptcy can take time, filing for bankruptcy quickly may be able to stop creditors from taking further action against you. If you need to act quickly to stop foreclosure, repossession or eviction, an emergency bankruptcy filing may be able to offer you solutions.

Having an attorney on your side may help you file more quickly and choose the best strategy to protect assets. John Dunlap is an experienced attorney who has worked with many bankruptcy cases to help stop repossession, foreclosure, and eviction. Contact us today for a free 30 minute session and learn how we may be able to help.

Read Also: Can You Keep A Credit Card If You File Bankruptcy

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Contact Us Today To Speak With An Unbundled Bankruptcy Lawyer

Most lawyers wont start working on your bankruptcy case until their fees are paid in full. Our bankruptcy lawyers offer affordable and flexible payment plans that allow them to quickly start on your case.

We also provide virtual consultations so you wont have to worry about leaving the comfort and safety of your home to begin the bankruptcy process.

You May Like: Do Married Couples Have To File Bankruptcy Together

Contact The Pope Firms Bankruptcy Lawyer Today

Dont hesitate to contact the competent legal team at The Pope Firm if youre facing repossession or wage garnishment, and you think the professionals can help you with your online bankruptcy case or a bankruptcy discharge. Our professionals offer all clients a free evaluation where you can meet our representatives and ask any questions you need to know about your case. We wont initiate an attorney-client relationship until youre ready, so you wont have to pay attorney fees to our law firm until you accept us as your official representation.

The Pope Firms goal is to help all our clients navigate bankruptcy with as little fanfare as possible, whether it is from our offices in Kingsport, Knoxville, or Johnson City, TN. Call us today to start the process.

Summary Of Emergency Bankruptcy

If you want to file a bankruptcy petition there are a number of forms that you are required to file with the bankruptcy court. If you are facing an emergency, such as a wage garnishment or home foreclosure, you can file just a few of those forms to get the case started this is often referred to as an emergency bankruptcy filing.

When you file for bankruptcy, the automatic stay kicks in. When you file the minimum forms required in an emergency bankruptcy, the automatic stay kicks in right away. If you have not filed the remaining forms after 14 days, you can file a request for more time with the bankruptcy court.

Read Also: How Does Declaring Bankruptcy Affect Your Mortgage

Gather Most Of Your Financial Documents

To file for bankruptcy, you need to have access to a lot of your financial information. The following is just a sampling of what you might need in order to file for bankruptcy:

- Your recent pay stubs

- Your bank statement

- A list of your outstanding debts

In most cases, you should be able to get your hands on all of those financial documents online.

Make Sure You Are Eligible

There are qualifying standards that must be met before you can file for either Chapter 7 or Chapter 13 bankruptcy and it makes sense to do research to see what form of bankruptcy you are eligible for.

To be eligible for Chapter 7 bankruptcy, an individual must pass a means test that determines if their income is at or below the median income for their state. If not, they may have to file additional paperwork or switch to Chapter 13 bankruptcy.

To be eligible for Chapter 13 bankruptcy, an individuals unsecured debt must be less than $419,275 and secured debts of less than $1,257,850.

Recommended Reading: Are Medical Bills Dischargeable In Bankruptcy

Find A Bankruptcy Lawyer In Jacksonville Fl

If youre filing for bankruptcy in northeast Florida, finding a bankruptcy in Jacksonville, FL must be a top priority. With a trusted bankruptcy lawyer on your side, you can be confident that your case will be handled properly. If you would like to discuss your financial options with an expert, contact Parker & DuFresne today.

To set up a free bankruptcy consultation in Jacksonville, Florida, contact Parker & DuFresne.

If you have any other questions about the process of filing for bankruptcy, be sure to contact an attorney or credit counseling service for more information.

What Happens After Filing For Emergency Bankruptcy

After you file, all methods of debt collection must stop. However, the court may take longer to notify your creditors, so we would recommend having your emergency bankruptcy lawyer notify them on your behalf. If you choose to do this on your own, be sure to have the name of the court, your case number, and the date you filed attached to your notification.

Once this step is complete, you must then work to complete the rest of the necessary paperwork to complete the filing within 14 days. Failure to do so can lead to your case being dismissed which would allow debt collection proceedings to begin again.

Don’t Miss: Where To Buy A Car After Bankruptcy

Hiring A Bankruptcy Lawyer To Submit Your Forms Online

Bankruptcy attorneys are required to use the U.S. Courtsâ electronic filing system, so theyâre able to submit your bankruptcy forms to the court online. You may be able to use an online questionnaire to provide your lawyerâs customer support team with the information theyâll need to prepare your bankruptcy petition. Depending on the law firm, you may also be able to pay your attorney fees through an online portal. As with the filing fees paid to the bankruptcy court, make sure not to use a credit card.

The Different Types Of Bankruptcy

Depending on your situation, there are different types, officially known as chapters of bankruptcy, that you can file for. These different chapters of bankruptcy provide different results for different cases, and its important to have some knowledge on these chapters before filing for bankruptcy.

You May Like: Will Filing Bankruptcy Affect My Car Loan

Complete And File Your Remaining Bankruptcy Forms

After you file your emergency paperwork, you only have 14 days to file the rest of the bankruptcy forms. Fourteen days can go by quickly, so donât put this off. Like the emergency forms, the remaining forms and instructions are available online. Upsolve also has a free filing guide for each state.

Within a few days after filing your emergency case, youâll receive a deficiency notice from the bankruptcy court. This doesnât mean thereâs something wrong with what you already filed. It just means you havenât filed all the required forms yet. Your deficiency notice will contain a checklist of the remaining forms you must file and the deadline for filing them. File your remaining forms in person to be sure theyâre received by the deadline.

If you donât file all the remaining bankruptcy forms by the deadline, the court can dismiss your case. A dismissal ends the automatic stay, which means your creditors can proceed with collection actions. If you need more time to file your remaining forms, you can file a motion asking the court for an extension. Courts are often reluctant to grant these extensions, so donât ask for more time unless you truly need it.