Why Are My Credit Scores So Low

Many consumers cannot figure out why their credit scores are so low when they have no derogatory tradelines in the past several years.

- One of the biggest and main reasons why consumers have lower credit scores is due to not having any active revolving credit accounts

- Every consumer should have at least three credit cards with at least $500 credit balances

- Those with lower credit scores and prior bad credit should get three secured credit cards as soon as possible

- Each secured credit card can boost ones credit scores by 30 or more points

As the secured credit card ages, consumer credit profiles will strengthen and their credit scores will go up further. Eventually, the secured credit card company will offer a higher credit limit increase without asking for an additional deposit.

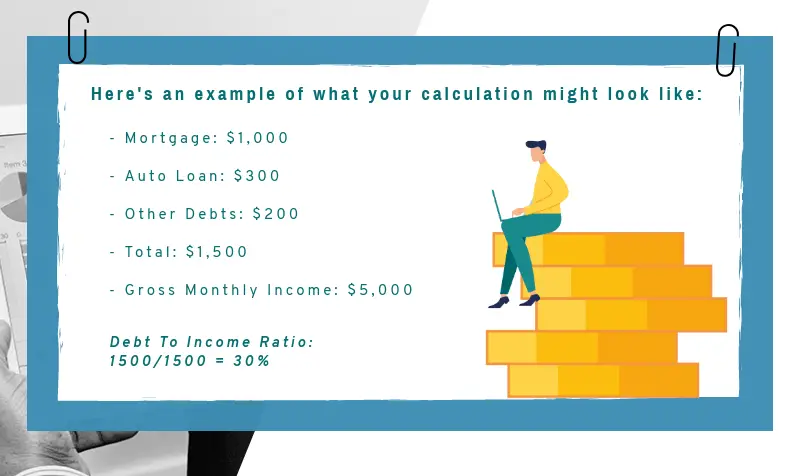

Divide Monthly Debt By Monthly Income

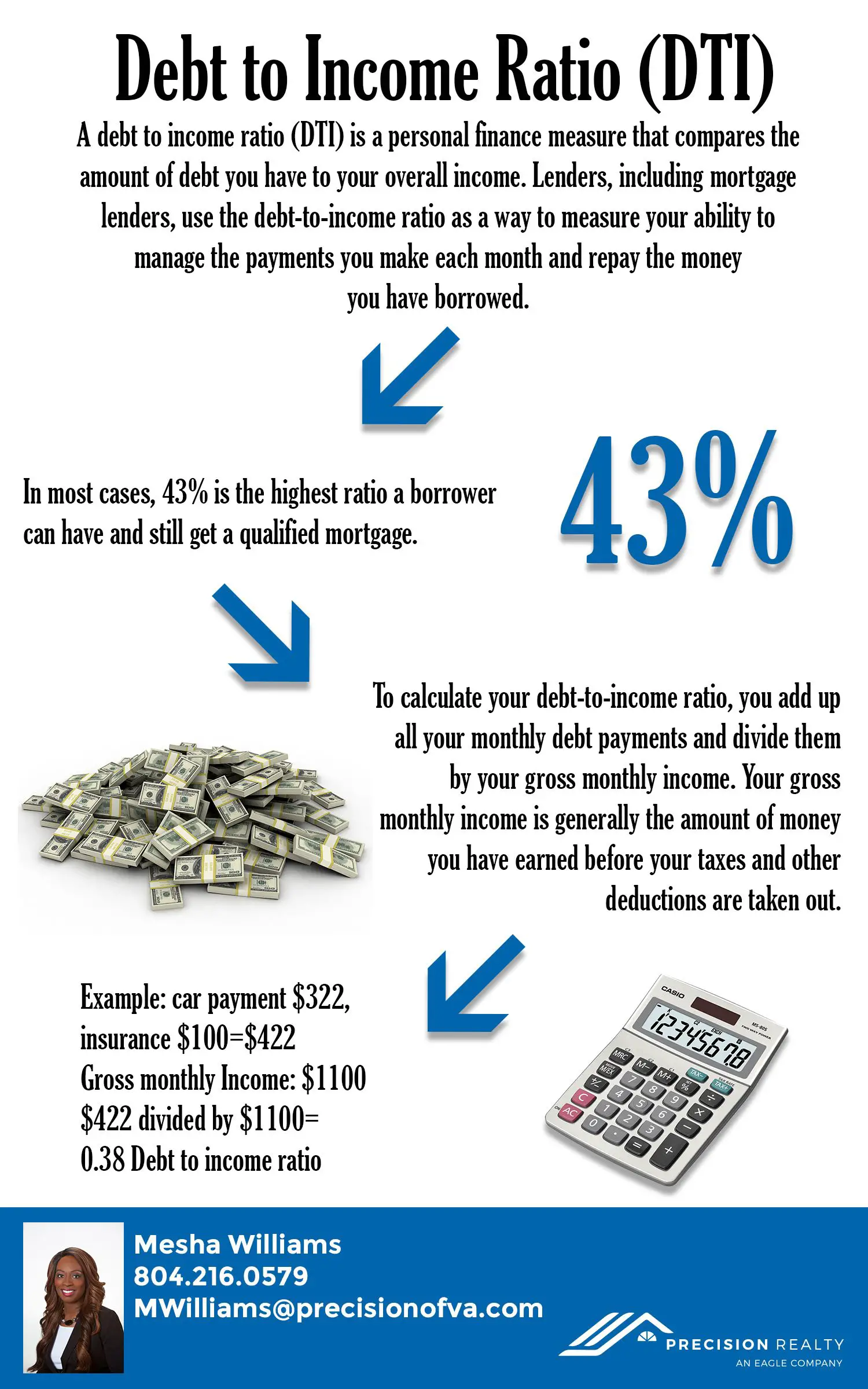

When you divide all monthly debt payments by gross monthly income, you have a decimal. Move the decimal point two places to the right and you have your percentage, or DTI ratio.

For example, let’s say Amelia wants to buy a home for the first time. Her gross monthly income is $5,000 and her monthly debt payments include a $300 car loan, $100 minimum credit-card payments, and $400 student loan payments. Amelia’s debt-to-income ratio would be 16% . With such a low debt-to-income ratio, she’d likely be favorable to mortgage lenders.

While DTI ratio isn’t connected to your and therefore doesn’t affect your credit report the two have a fairly symbiotic relationship.

The two most important factors the credit-scoring agencies use to determine a credit score are payment history and current debt balances they make up 65% of your credit score. While credit-scoring agencies don’t have access to a person’s income, they’re still able to consider past behavior to evaluate the likelihood of on-time payments.

Mortgage lenders typically have the strictest debt-to-income ratio requirements. Generally, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Some mortgage lenders, both large and small, can still approve a borrower who has a debt-to-income ratio above 43%, according to the Consumer Financial Protection Bureau, but they would have to make a “reasonable, good-faith effort” to determine repayment ability.

What Is Debt To Income Ratio

The debt to income ratio determines the proportion of debt you have to the amount of income you bring in before taxes. It is an indicator to lenders of whether you can easily meet your monthly debt payments based on your income. Lenders and creditors use this ratio to understand if your income can afford to take on more debt, to ensure that you can repay the debt.

Don’t Miss: How To Declare Bankruptcy In Maryland

How To Lower Your Dti Ratio

If you have a high DTI ratio, you’re probably putting a large chunk of your monthly income toward debt payments. Lowering your DTI ratio can help you shift your focus to building wealth for the future.

Here are a few steps you can take to help lower your DTI ratio:

- Increase the amount you pay each month toward your existing debt. You can do this by paying more than the minimum monthly payments for your credit card accounts, for example. This can help lower your overall debt quickly and effectively.

- Avoid increasing your overall debt. If you feel it’s necessary to apply for additional loans, first aim to reduce the amount of your existing debt.

- Postpone large purchases. Prioritize lowering your DTI ratio before making significant purchases that could lead to additional debt.

- Track your DTI ratio. Monitoring your DTI ratio and seeing the percentage fall as a direct result of your efforts may motivate you to continue reducing your DTI ratio, which can help you better manage your debt in the long run.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Don’t Miss: How To Get Copy Of Bankruptcy Filing

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

How To Calculate Debt To Income Ratio

You can calculate your debt to income ratio in one of two ways. You can divide your total monthly debt payments by your monthly gross income . You can also divide your total amount of existing debts by your total annual income before taxes.

When adding up your income , dont forget other sources in addition to salary and wages. Some of these sources could include pension and retirement benefits, government assistance or child support. On the debt side, youll want to include all loan payments, mortgage and property tax payments, and car payments, as well as your monthly rent, and credit card payments.

You May Like: Do You Have To Report Bankruptcy After 10 Years

Dont Borrow More Than You Can Afford

Your lender is of course aware that you have other expenses, but they wont take those into account when calculating your DTI. Other monthly bills and financial obligations include things like:

- Income and other internal revenue taxes

- Utilities such as water, electricity, gas, cable, internet, and phone service

- Life and health insurance premiums

- Healthcare expenses

- Private school costs

- Groceries and household goods

If you have other significant monthly costs your lender doesnt know about, they could offer you a loan with monthly payments that may put pressure on your budget even if your DTI seems within acceptable parameters. Qualifying for a $250,000 mortgage doesnt automatically mean you can afford the monthly mortgage payments.

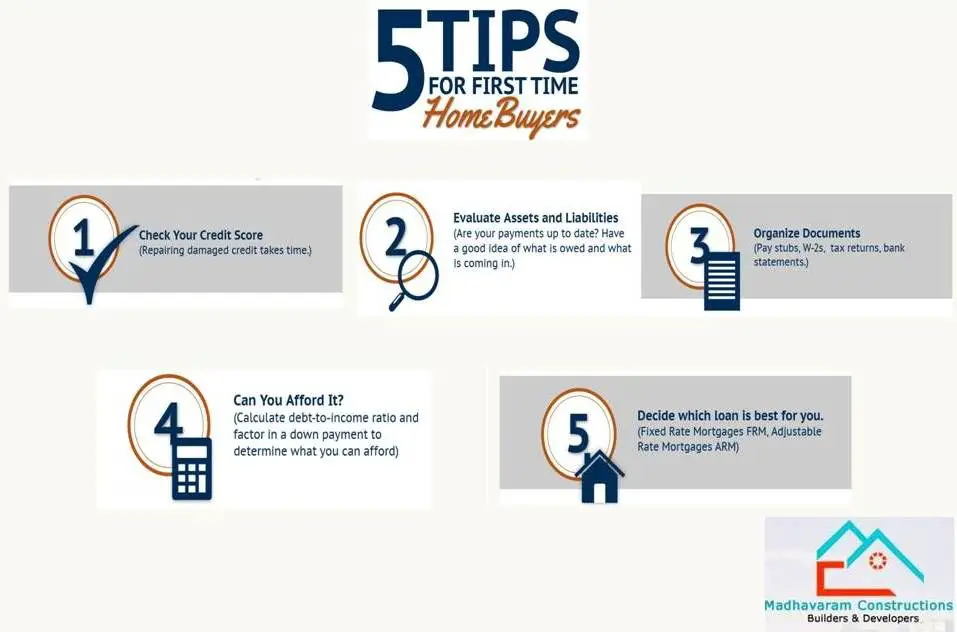

What Is A Good Credit Score To Buy A House 2020

While you don’t need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Don’t Miss: Is Bankruptcy State Or Federal Law

It Works In Tandem With Your Credit Score

Though your DTI does not directly impact your credit score, it is closely associated with your credit utilization. If your DTI ratio and your ratio are both low, youll have a better chance of being approved for loans. Keep in mind: most lenders do not advertise maximum debt-to-income ratios, but instead provide guidelines that offer some flexibility. For example, a common guideline is the 28/36 rule used by some lenders to assess borrowing capacity. According to this rule, a household should only spend 27% of its gross monthly income on housing expenses, and no more than 36% on debt expenseslike car payments and credit cards.

What If My Debt

What happens if my debt-to-income ratio is too high? Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan.

Don’t Miss: Can You File Bankruptcy Twice In Ohio

What Is Considered A Good Dti Ratio

What counts as a good DTI will depend on what type of loan you want. Some lenders allow a higher DTI, while others require a lower cut-off.

In general, lenders prefer that your back-end ratio not exceed 36%. That means if you earn $5,000 in monthly gross income, your total debt obligations should be $1,800 or less. However, some lenders might make an exception if you have excellent credit. In fact, its possible to qualify for a loan with up to a 50% DTI as long as youre an otherwise highly qualified borrower.

Mortgage lenders, in particular, tend to have more hard-and-fast rules. They typically prefer a front-end DTI of 28% or less. That means your mortgage payments cant be any higher than 28% of your gross monthly income. So if you take home $5,000 per month, your mortgage payments shouldnt be any higher than $1,400.

On the other hand, conventional mortgage lenders, as well as FHA and USDA lenders, will typically allow a back-end DTI of up to 43%, giving your budget a little more wiggle room. VA loans usually require a back-end DTI of 41% or less.

Knowing your front-end and back-end DTI can help you figure out how much house you can afford. If you apply for a mortgage and the payments would cause you to exceed either of these DTI requirements, you may have to go with a smaller loan or could be denied a loan altogether.

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Read Also: What Happens If You Claim Bankruptcy In Uk

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

What Is An Acceptabel Debt

Generally, the lower a debt-to-income ratio is, the better your financial condition. Following are examples of the different percentages. Note: This example assumes a loan applicant’s FICO score is above 700.

10% or less: Shouldn’t have trouble getting loans. May qualify for lower rates.

11% to 20%: Again, shouldn’t have trouble getting loans. Time to scale back on spending.

21% to 35%: Although you may not have trouble getting new credit cards, you are spending too much of your monthly income on debt repayment.

36% to 50%: You may still qualify for certain loans, however it will be at higher rates. It is time to develop a plan to get out of debt.

More than 50%: Very difficult to qualify for financing.

Note: All answers are providing the consumers FICO score is above 700.

You can avoid going into debt by staying aware of your debt-to-income ratio. Knowing your debt-to-income ratio will help you to make sound decisions about making purchases on credit or taking out loans.

Also Check: Can You File Bankruptcy On Student Loans In Michigan

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

What Is The Minimum Credit Score For A Conventional Loan

Conventional Loans A conventional loan is a mortgage that’s not insured by a government agency. Most conventional loans are backed by mortgage companies Fannie Mae and Freddie Mac. Fannie Mae says that conventional loans typically require a minimum credit score of 620. But lenders can raise their own requirements.

Recommended Reading: What Happens When Someone Files For Bankruptcy

Why Do Lenders Care About My Debt

When a lender considers whether or not to let you borrow money, it wants information about how you handle your finances both past and present. So lenders will look at different factors like your , and debt-to-income ratio to get an idea of your financial picture.

When lenders see a healthy debt-to-income ratio, it can help them feel more confident that youll be able to make your loan payments. This might help you qualify for financing.

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

You May Like: How Much Money Can You Have When Filing Bankruptcy

Dti Calculator: Try Our Debt

- Copied link to Clipboard!

If youre hoping to get a home loan, auto loan or debt consolidation loan, theres one important number lenders will want to take a close look at. That number is your debt-to-income ratio Even if your credit report is squeaky clean, your DTI is a good indicator of whether or not youre overextended and might have trouble with additional monthly debt payments like house or car loans.

LESSON CONTENTS

Your DTI ratio has several components:

The front end ratio is generally composed of housing expenses and includes:

- Mortgage or rent payment

- Private mortgage insurance

- Property taxes

The back end ratio is composed of the above housing costs plus all other monthly expenses and debt payments including:

- Minimum payments for credit card debt

- Auto loan payments

- Monthly alimony or child support payments

- Payments that show on your credit report for other debt

- The loan payment you are applying for

Both ratios are calculated by dividing your monthly expenses by your monthly gross income.

For example, if your monthly income is $6,000, and you have a housing payment of $1,500, your front-end ratio is 25%. If your other monthly debts total $1,000, the back-end ratio is 41%. You can use our debt-to-income calculator below to arrive at your own DTI.

Lenders use your DTI to determine how well you manage your monthly obligations. The higher your DTI is, the higher the risk lenders feel they are taking on when they loan you money.

Learn More About The Avant Credit Card

Improve your creditworthiness with the Avant credit card. Transparent and easy-to-use with zero fraud liability for unauthorized purchases and zero deposit required, the Avant credit card is a responsible choice for building strong credit. Checking your eligibility online does not affect your credit score responsible use of the Avant credit card can help improve your credit score by establishing a track record of on-time payments.

Avant branded credit products are issued by WebBank.

Don’t Miss: What Does Foreclose Mean

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.