Phase : Notice Of Default

A notice of default is sent after the fourth month of missed payments . This public notice gives the borrower 30 days to remedy past due payments before formally starting the foreclosure process.

Most lenders will not send a notice of default until the borrower is 90 days past due . Thus, many times a borrower can fall behind a month or two without facing foreclosure.

Generally, federal law prohibits a lender from starting foreclosure until the borrower is more than 120 days past due.

Real Signs For Future Red Flags

Mortgage delinquencies are the most telling sign for the rise or fall of future foreclosure filings. Right now, there is no reason to believe foreclosure starts will jump dramatically, given the national delinquency rate is sitting at a low 3.3% as of January 2022. Employment remains strong and the housing market is on fire, putting home equity levels at all-time highs. This means that the roughly 2 million delinquent households today have solid alternatives to avoid foreclosure.

But just because today’s numbers remain low doesn’t mean things can’t change. Inflation is a growing concern for Americans, as the cost of basic necessities like fuel, groceries, electricity, and property taxes quickly becomes more expensive. Budgets surely will tighten as a result, and it’s very possible we could see delinquencies increase in coming years.

There is also a notable backlog of loans that were previously in forbearance that haven’t been addressed. These are loans that are in some type of active loss mitigation or completed loss mitigation efforts but still remain past due, and the ultimate outcome of the loans, either foreclosure, repayment of debt, or a long-term loss mitigation solution like a modification, isn’t known.

Liz Brumer-Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Foreclosurecom Delivers The Best Real Estate Deals First Well Before They Hit The Mass Market

As you know, perfect timing not just “location, location, location” is critical when it comes to purchasing a new home and/or investment property at the right price. That’s because competition drives prices up. At Foreclosure.com, we target low-priced distressed deals bank-owned homes, government foreclosures preforeclosure listings, real estate owned properties and foreclosure auctions, among others and pass them onto smart homebuyers .

Don’t Miss: How Long Does Filing Bankruptcies Take

Where Can I Find Help If Im Facing A Foreclosure Proceeding

If youre facing a judicial foreclosure, note that the US Department of Justice maintains a list of free or low-cost legal service providers. Despite the fact that judicial foreclosures are a public court proceeding, there wont be an attorney assigned to help you.

Depending on your situation, defending a foreclosure to keep your home isnt always the best option. If you have a genuine defense, however, hiring a lawyer might be crucial. For those who choose to advocate for themselves, the National Consumer Law Center also offers advice on how best to proceed.

Mounting Debt Linked To Increased Risk Of Foreclosure

As household debt in Canada continues to grow, homeowners are finding it increasingly difficult to juggle all of their monthly bills, including their mortgages. With interest rates hovering near historic lows, stable inflation, and an increase in housing demand, our countrys level household debt only seems to keep climbing. The more debt being held by the average homeowner, the higher the odds of them defaulting on payments become.

Also Check: Las Vegas Bankruptcy Lawyers

After The Moratorium Expiration Foreclosures Jumped 7x Is This The First Sign That The Housing Market Is In Trouble

Editor’s Note: A previous version of this article incorrectly referenced the 700% increase in foreclosure starts as a year-over-year increase. It is, in fact, a 702% increase month-over-month, from December 2021 to January 2022. The same report lists the January 2022 YOY increase as 457.63%.

January 2022 saw a massive jump in the number of foreclosure starts, with ATTOM Data solutions reporting 23,204 foreclosure filings, a 700% increase from December 2021 to January 2022, according to Black Knight. Rising foreclosure rates aren’t great news for the housing market because they could be an indicator of distress. As foreclosures steadily rise, could this be the first red flag for a housing market correction?

Image source: Getty Images.

Cfpb Finalizes A Rule Restricting Mortgage Foreclosures Until 2022

While federal law already prohibits a servicer from beginning a foreclosure until the borrower is more than 120 days delinquent, a CFPB rule provides even more protection to borrowers affected by the COVID-19 pandemic. From August 31, 2021 through December 31, 2021, unless an exception applies, a loan servicer may start a foreclosure only if the borrower is over 120 days behind on their mortgage payments and:

- the borrower has abandoned the property

- the borrower hasn’t responded to the servicer’s outreach attempts for 90 days, or

- the borrower submitted a complete loss mitigation application, remained delinquent at all times since applying, and has been evaluated for all loss mitigation options, but noalternatives to foreclosureare available.

But the rule doesn’t apply to non-primary residences or to small mortgage servicers. The protections also don’t apply if the borrower was more than 120 days delinquent before March 1, 2020, or the applicablestatute of limitationswill expire before January 1, 2022.

Recommended Reading: What Does Bankruptcy Chapter 13 Mean

Foreclosure Process Step : Auction

The home will be sold at a public auction to the highest bidder, who will have to pay the full amount of the bid immediately. This buyer will receive a trustees deed once the sale is complete, at which point he becomes the official owner.

From there, the homes new owner must serve any remaining occupant of the home with a three-day written notice to quit .

If the occupant does not move out in the three days, the bidder must go through the formal eviction process in court in order to get possession of the home, Zuetel notes.

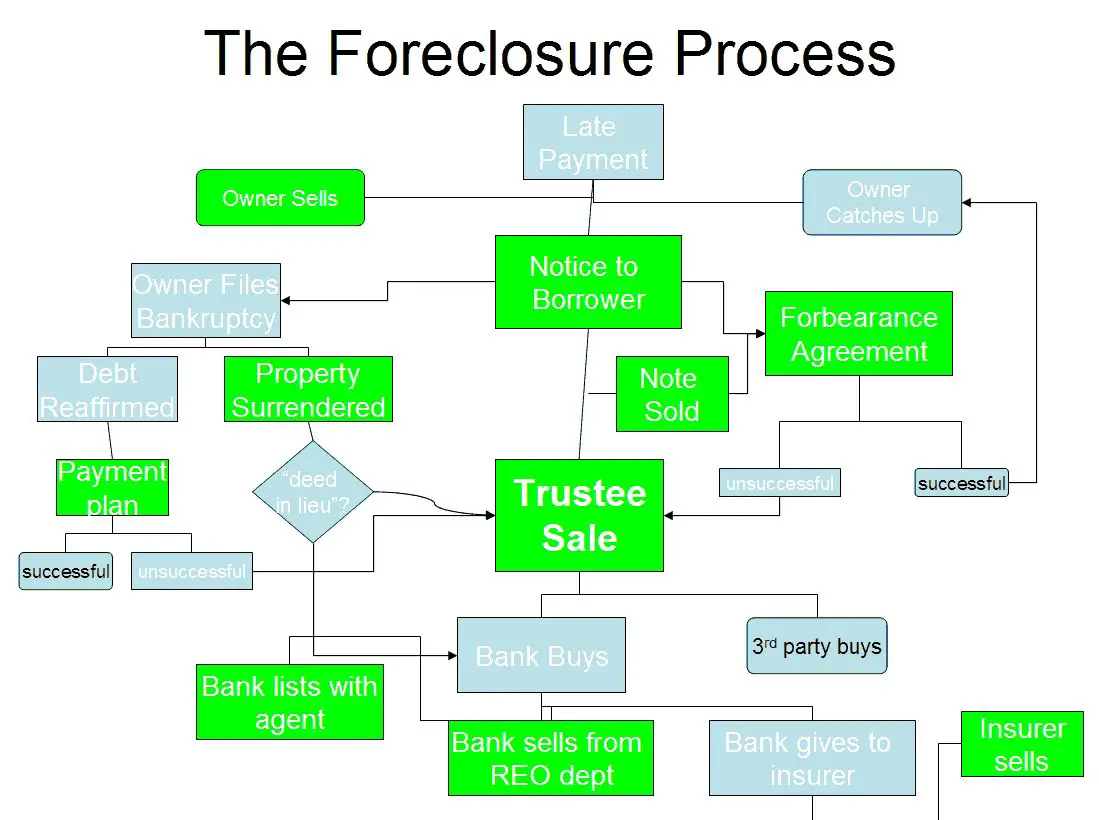

The Process Of Foreclosure

If you live outside of Ontario, Newfoundland, New Brunswick, and PEI and your lender is unable to go through Power of Sale, you risk facing foreclosure right from the get-go. This process starts off much like a typical lawsuit in which you become the Defendant and your lender is the Plaintiff. A Statement of Claim document will be filed by the lender with the court, a copy of which will be served to you.

After receiving a copy of this document, you have 20 days to file your reply in the form of a Statement of Defence or a Demand for Notice. If you fail to reply, the lender can inform the court that youre in default regarding the court action .

Failing to reply will communicate to the court that youve chosen not to fight the foreclosure process. At this point, you have no other avenues to take to defend yourself. Your lender will eventually apply for a remedy with the court as a means of getting back the money they loaned out to you to finance your home.

At this point, the court will likely issue a Redemption Order, which gives you a certain amount of time to bring your mortgage up to snuff or pay it off completely. If you can come up with enough money, you can effectively stop the foreclosure process at this point.

However, if the court has reason to believe that you dont have the funds, it can go straight to issuing an Order for Foreclosure without even bothering with a Redemption Order. In this case, the property will be directly transferred to the lender.

Don’t Miss: Illinois Northern District Bankruptcy

What Is The First Notice Or Filing In A Nonjudicial Foreclosure

In a nonjudicial foreclosure, the servicer cant initiate a foreclosure by recording or publishing the first notice until after the 120th day of delinquency. If your states foreclosure laws dont require any document to be recorded or published as part of the foreclosure process, the first notice is the earliest document that establishes, sets, or schedules a date for a foreclosure sale.

Foreclosure Practices May Differ By Lender

Foreclosure practices can differ from one lender to another. If your lender has a large portfolio of low-risk loans, it may be more lenient regarding missed payments or might make allowances for individual borrowers. Often, such a lender will forgive the occasional missed payment and may not pursue foreclosure unless you continue to miss more payments.

On the other hand, if the lender has a portfolio of high-risk loans, foreclosure proceedings might begin after as little as two missed payments. Even if you are a low-risk borrower, the proceedings could be triggered by standards relating to the overall default risk of the mortgage pool owned by the lender.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report with the Consumer Financial Protection Bureau or the U.S. Department of Housing and Urban Development.

Don’t Miss: Can You File Bankruptcy On Hospital Bills

Applicability Of The 120

The 120-day rule applies to mortgages that are secured by a property, which is the borrower’s principal residence. . But whether a property is deemed a borrower’s principal residence depends on a number of factors. Sometimes, a vacant property can be considered a borrowers principal residence, like if a military servicemember moves out due to a permanent change of station orders and was living at the property as a principal residence immediately prior to leaving, intends to return to the property at some point in the future, and doesn’t own any other residential property.

Small servicers, which are exempt from some of the other requirements under federal mortgage servicing laws, must comply with the 120-day rule, assuming the property and loan meet the other criteria. The rule applies to both first lien and subordinate lien federally related mortgage loans, although it expressly doesn’t apply to open-end lines of credit , or certain other types of exempt loans. .

The 120-day delay on starting a foreclosure also generally applies in the case of a non-monetary breach of the loan contract.

Where Foreclosures Are Headed

There are roughly 2.73 million mortgages either in forbearance or past due, according to the Federal Reserve Bank of Philadelphiaâs latest report released Jan. 14. Among those mortgages, nearly 800,000 are in the Coronavirus Aid, Relief and Economic Security Actâs forbearance measure, with 89% of those set to expire in the first half of this year.

âWith the expiration of additional safeguards against foreclosures provided by the Consumer Financial Protection Bureau by year-end 2021, unless mortgage servicers can successfully execute home-retention options, many borrowers face the prospect of selling their homes or losing them to foreclosure,â the report said.

The temporary CFPB rule required mortgage servicers to make every effort to ensure struggling borrowers clearly knew what they could do to avoid foreclosure, including modification and alternative payment options. Without this rule in place, housing experts are urging lenders to continue to educate borrowers on their options and make them readily available. Otherwise, foreclosures could begin to climb later in 2022, says Faith Schwartz, CEO of housing advisory practice Housing Finance Strategies.

Schwartz also noted the federally sponsored Homeowner Assistance Fund program that provides nearly $10 billion to states in order to help homeowners with past-due and current bills. These funds are distributed at the state level.

Also Check: What Percentage Of All Bankruptcies Are Attributed To Medical Expenses

There’s More To The Numbers Than Seen At First Glance

A 7x jump sounds massive, but even a small uptick in foreclosures would have been a notable increase when compared to recent levels. Moratorium protections that prohibited lenders from initiating foreclosures during the pandemic in 2020 and 2021 resulted in the lowest number of foreclosure filings since this data has been tracked on a national level.

Today’s foreclosure starts, while much higher than recent past, are still below pre-pandemic levels — by a lot. In 2021, there were a total of 151,153 foreclosure filings for the entire year, which was 69% less than pre-pandemic levels in 2019. For the month of January, there were 56,251 foreclosures filed in 2019, 58% more than the number filed in January 2022.

Foreclosure filings are continuing to rise month over month, with February 2022 seeing 25,833 new foreclosures, an 11% increase from January 2022, which is welcome news for distressed real estate investors. But the numbers aren’t necessarily a red flag for the housing market.

Image source: Getty Images.

Eviction From The Home

Once the redemption period has ended, you can be evicted from the home. The new owner can file a Summons and Complaint to evict you from the property. You will get a notice of this, including a time for a hearing or notification that you must respond in writing. To learn about the eviction process read the articles Eviction: What Is It and How Does It Start? and Eviction to Recover Possession of Property.

Unless there was something wrong with the foreclosure, this kind of eviction is difficult to defend. If you think there was a problem with the foreclosure, you may want to contact a lawyer. Use the Guide to Legal Help to find lawyers and legal services in your area.

If the court orders the eviction, you usually have 10 days to leave the home. You can ask the new owner for more time if you have special circumstances. If you stay, the court will order the sheriff to evict you and remove your belongings from the home.

You May Like: How Fast Can I File Bankruptcy

Foreclosure Process Step : Default

A bank cant just start the foreclose process on a home whenever it wants. Homeowners have to first default on their mortgage, failing to pay their required monthly payments. And its rare for lenders to begin the foreclosure process after just one late mortgage payment.

They will usually give the borrower a grace period because they recognize the reality that people face temporary financial hardship at some point in their lives, explains Lisa Blake, a real estate broker and owner of The Blake Team in Aurora, CO.

That said, banks want their money, so borrowers can expect an influx of emails, letters, and phone calls from their lender or bank trying to collect.

Lenders usually offer alternatives during this period, including different payment plans to help the homeowner get back on track, keep their home, and keep paying their monthly mortgage bill. This is partly because its in a lenders best interest to make things workafter all, the lender wants its money. But its also the law in many states, says real estate attorney and broker Bryan Zuetel of Esquire Real Estate in Irvine, CA.

In many states, a lender or servicer cannot file a notice of default until 30 days after contacting the homeowner to assess the homeowners financial situation and explore options to avoid foreclosure, Zuetel explains.

Termed a foreclosure avoidance assessment, this period might include requests for a payment adjustment, interest adjustment, deferral, or other accommodations.

Learn How To Stop Power Of Sale In Canada Today

Its definitely one of the most stressful situations you could be dealing with: the bank has sent you a letter and they are saying they want to foreclose on your home. We know it hasnt been easy lately, and we know this is not helping, but thousands of families across Canada are in a similar situation.

Bank foreclosures in Canada arent uncommon, but they are stressful

Read Also: How To File Bankruptcy In Louisiana

Should I Consider Buying A Foreclosed Property

Anyone looking to buy a property should consider a foreclosure, as long as you ensure that your Real Estate agent is fully aware of how to protect you.

The Mel Star Team Can Help!

The Mel Star team has successfully marketed thousands of Calgary foreclosures. Our experienced and knowledgeable team can professionally guide you through the whole process to ensure you have the best chance of success at purchasing your dream home.

Why Choose The Mel Star Team: 40 Plus Years of Real Estate Experience

The Mel Star team has sold thousands of foreclosures. In the 40 plus years of business, weve encountered many different scenarios while dealing with both sellers and buyers in the foreclosure market. In addition, our team:

- Is experienced in all sorts of different markets.

- Will provide you with expert knowledge and advice to ensure you make the right decision.

- Is made up of expert negotiators who can help you achieve the best deal possible.

Over the years, we have built up a vast network of connections and we are proud to be a one-stop shop for all your Real Estate needs.If you would like to take advantage of our expert knowledge and advice, please contact us at or fill out our contact form.

In January There Was A Seven

- Email icon

- Print icon

- Resize icon

The foreclosure uptick indicates that the economic and especially employment recovery is not complete, an expert says.

In January there was a seven-fold increase in foreclosure starts as compared to December, with roughly 33,000 loans referred to foreclosure, according to a report from mortgage data and analytics company Black Knight. Whats more, data from real estate data analytics firm ATTOM Data Solutions revealed that lenders repossessed 2,634 U.S. properties through completed foreclosures in February 2022, which is an increase of 70% from last year .

What do these foreclosures say about the housing market?

Realtor.com senior economist George Ratiu says the uptick in foreclosures during January is an early signal that many of the regulatory protections implemented during the pandemic to help Amercans stay in their homes are starting to wear off. Indeed, millions of people got mortgage forbearances during the pandemic that put their mortgage payments on hold. Most of them got back on their feet and ended their forbearances in 2020 and 2021, pros say.

The foreclosure uptick also indicates that the economic, and especially employment recovery, is not complete. We lost 20.2 million jobs in April 2020 alone as the government imposed wide-ranging lockdowns and since then, the economy has added 18.8 million jobs back, but were still short of the pre-pandemic level, says Ratiu.

Should I buy a foreclosure?

You May Like: What Cannot Be Discharged In Chapter 7 Bankruptcy