Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when theyre considering your application. Take a look at the guidelines we use:

35% or less: Looking Good Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Types Of Mortgage Loans

In addition to your mortgage-to-income ratio, its also important to research different kinds of mortgages. There are many types of mortgage loans you can choose from, such as conventional mortgage loans, adjustable rate mortgages and affordable home loan programs, to name a few. Research the best loans interest rates, length and terms for you.

What Should Your Mortgage To Income Ratio Be

September 2, 2019 By JMcHood

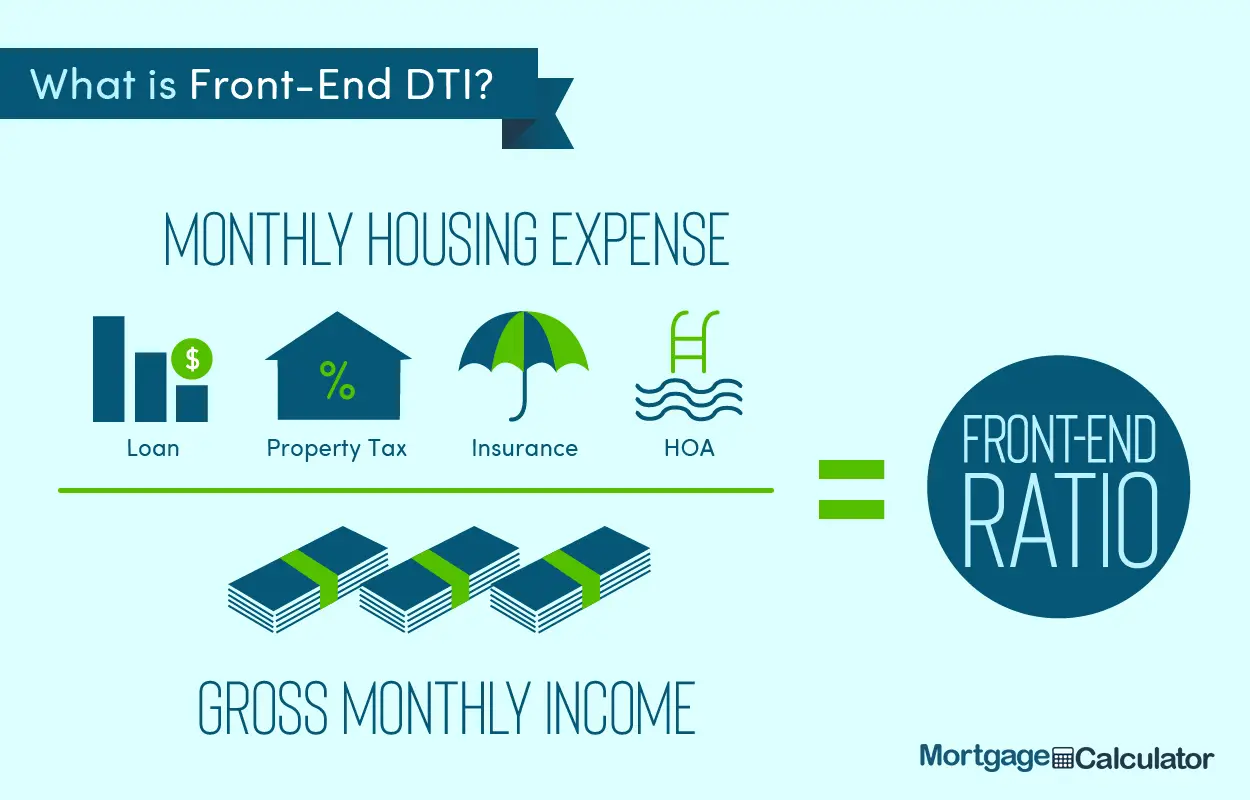

When you apply for a mortgage, you have to meet the mortgage program guidelines, including the mortgage to income ratio. The debt ratio, or front-end ratio, compares your mortgage payment to your gross monthly income. Its the percentage of your gross monthly income that your mortgage payment takes up. Each loan program has a maximum front-end ratio, but you should have your own maximum in mind as well.

Recommended Reading: How Does Bankruptcy Affect Student Loans

Finding The Right Lender

One place to start is with Credible, a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

Credible Operations, Inc. NMLS# 1681276, Credible. Not available in all states. www.nmlsconsumeraccess.org.

Fiona is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford:

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

Read Also: How Many Months Bank Statements For Bankruptcy

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

What Is The Maximum Debt To Income Ratio For A Conventional Mortgage

Conventional loan debt-to-income ratios

loan

Then, what is the maximum debt to income ratio for a mortgage?

The maximum debt-to-income ratio will vary by mortgage lender, loan program, and investor, but the number generally ranges between 40-50%. Update: Thanks to the new Qualified Mortgage rule, most mortgages have a maximum back-end DTI ratio of 43%.

Additionally, what is an acceptable debt to income ratio? Most lenders do not have maximum debt-to-income ratios per se, but rather guidelines that offer some flexibility. In general, lenders want to see monthly housing debt of no more than 28% to 33% of your income and total debt of no more than 38% of your income.

People also ask, can I get a mortgage with high debt to income ratio?

There are ways to get approved for a mortgage, even with a high debt-to-income ratio: Try a more forgiving program, such as an FHA, USDA, or VA loan. Restructure your debts to lower your interest rates and payments. Lenders usually drop that payment from your ratios at this point.

What credit score do you need for a conventional loan?

620-640

Donât Miss: Can You Get A Reverse Mortgage On A Mobile Home

Also Check: What Is Needed To File Chapter 7 Bankruptcy

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

How Do I Lower My Debt

Is your debt-to-income ratio over 50%? This may be a sign that youre living above your means.

To make getting a mortgage loan easier, you could figure out how topay off your debt. Here are a few things you could do:

Make a budget: Having an overview of your monthly income and expenses will allow you to determine how much money you can put towards paying off your debt, even if youre only paying off a little at a time. To put the odds in your favour, review your budget regularly, spend reasonably, and consider whether a major expense that will increase your debt load is really something you need. Prioritize your debts: List the totals of all your debts, as well as their interest rates. Pay off debts with a high interest rate first, as these are usually the most expensive. You can also prioritize paying off bad debt, meaning loans taken out to make purchases that will quickly lose value, rather than good debt, which is considered an investment, or debts whose interest is tax deductible, such as student loans. Consolidate your debt: To make payments easier and potentially get a lower interest rate, you could ask the bank for a loan in order to consolidate all your debt. On top of having only one monthly payment to make, this could also have a positive impact on your budget and borrowing capacity. Talk it over with an advisor.

Also Check: New Foreclosure Law In California

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

What Factors Make Up A Dti Ratio

There are two components mortgage lenders use for a DTI ratio: a front-end ratio and back-end ratio. Heres a closer look at each and how they are calculated:

- Front-end ratio, also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Recommended Reading: How Long Before You Can Claim Bankruptcy Again

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

How To Use The Usda Mortgage Calculator

To use this calculator, youâll need to input values for some basic information including your estimated home price, down payment, loan term and interest rate.

USDA loans typically donât require a down payment, but you can enter an amount to see how much less your monthly payments might be if you chose to put money down.

Read Also: How To Restore Credit After Bankruptcy

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

How To Lower Your Dti

If your DTI is not within the recommended range, you can attempt to lower your DTI through a number of techniques. The preferred option is to pay off as much of your debt as you can manage, but you can also try restructuring your loans. Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options. Look into loan forgiveness programs that may help to eliminate some of your debt entirely.

If youre unable to refinance your loans, focus on paying off the high-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

If you can, seek out an additional source of income. This additional stream of income will help to improve your DTI ratio.

You May Like: What Does It Mean If Bankruptcy Is Discharged

What Are Tds Gds And Ltv Ratios

As you can see, Linda and Bill are below the GDS standard, but their TDS is a little bit higher than lenders like to see. Both of Eds ratios are too high according to industry standards. What if my ratios are higher than the industry standard? The first thing to remember is that these ratio percentages are simply industry guidelines and vary from lender to lender, both within the same category of lender as well as across different types of lenders . Therefore, they are not set in stone. Some lenders will emphasize other factors when determining the validity of an applicant. For instance, the loan-to-value ratio is much more important to B lenders, as they are lending based on equity and income can simply be stated to alter the TDS/GDS ratios. The LTV is a simpler calculation its the ratio of the size of the loan to the value of the property.

What Is The Maximum Debt

On the low end, lenders prefer a maximum 36% debt-to-income ratio, but some lenders will go as high as 43%. These are just guidelines set by the government agencies investing or backing the loans. Each lender can make its own decision on a case-by-case basis, allowing them to accept higher DTI ratios if borrowers have compensating factors, such as a high credit score or a large amount of savings on hand.

In the United States, many lenders mandate a maximum 43% debt ratio because thats the highest ratio allowed for a loan to be considered a Qualified Mortgage. A QM is a loan the lender did its due diligence on to ensure you could easily afford it and wont be subject to financial distress.

In Canada, some lenders can accept DTI ratios up to 44%, which is the highest debt ratio allowed for CMHCs Homeowner Mortgage Loan Insurance. This insurance is what allows borrowers to secure financing with less than a 20% down payment.

Whether youre in the US or Canada, the debt-to-income ratio requirements will vary based on your other qualifying factors including the amount of money you put down on the home and your credit score. For example, Fannie Mae allows a DTI ratio up to 45% if you have at least a 660 credit score and 25% or higher for a down payment. In short, the better your other factors are, the higher the DTI ratio a lender can accept.

You May Like: Can You File Bankruptcy On The Irs

Conventional Loan Lending Guidelines

Conventional loan programs have higher credit standards than FHA insured mortgage programs:

- To qualify for a 3.5% down payment FHA insured mortgage loan, the minimum credit score required is 580

- However, to qualify for a conventional loan, the loan applicant needs a minimum credit score of at least a 620

- However, a 620 credit score is normally considered a poor credit score for a conventional loan

- Those with a low credit score will most likely pay a much higher mortgage rate on a conventional loan

- With FHA loans, as long as borrowers have a 640 or higher credit score, borrowers will most likely get the best FHA mortgage rate

- For a conventional loan applicant to get the best available conventional mortgage rate, they would need a credit score higher than 740

Due to the government guarantee, lenders have less risk with FHA and VA Loans. Lenders are able to offer lower mortgage rates on government loans.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Also Check: Southern District Of California Bankruptcy

How Much Can I Borrow For A Mortgage

The amount of money you can borrow depends on a number of factors:

- The deposit youâve saved

- The amount that you earn

- Your outgoings

- Future changes which might affect your earnings, such as redundancy, having a baby or switchingjobs

There are several mortgage calculators available onlinewhich will let you see at a glance how much you could potentially borrow.

You can also work out how much deposit youâll need if youhavenât started saving yet â or if youâve found a property and you want to know if you have enoughdeposit to get a good deal on a mortgage.

Next Step: Understand The Total Cost Of Borrowing

When considering a new loan or restructuring your current debts, remember to consider your borrowing costs. Extending the term of your loan may lower your monthly payment, but you may pay more in interest over the life of the loan, increasing your total payments.

Only one qualifying relationship discount may be applied per application. All loans are subject to qualification. To learn which checking accounts qualify, please consult a Wells Fargo banker.

Personal Loans: To qualify for a customer relationship discount, you must maintain a qualifying Wells Fargo consumer checking account and make automatic payments from a Wells Fargo deposit account. If automatic payments are not selected at account opening, or are canceled for any reason at any time after account opening, the interest rate and the corresponding monthly payment may increase.

Home Equity: To qualify for a customer relationship interest rate discount, you must maintain a qualifying Wells Fargo consumer checking account or mortgage relationship and make automatic payments from a qualified consumer deposit account.

Wells Fargo Bank, N.A. Member FDIC.

Dont Miss: Do Married Couples Have To File Bankruptcy Together

Also Check: Bankrupt Houses For Sale