What About My Credit Report

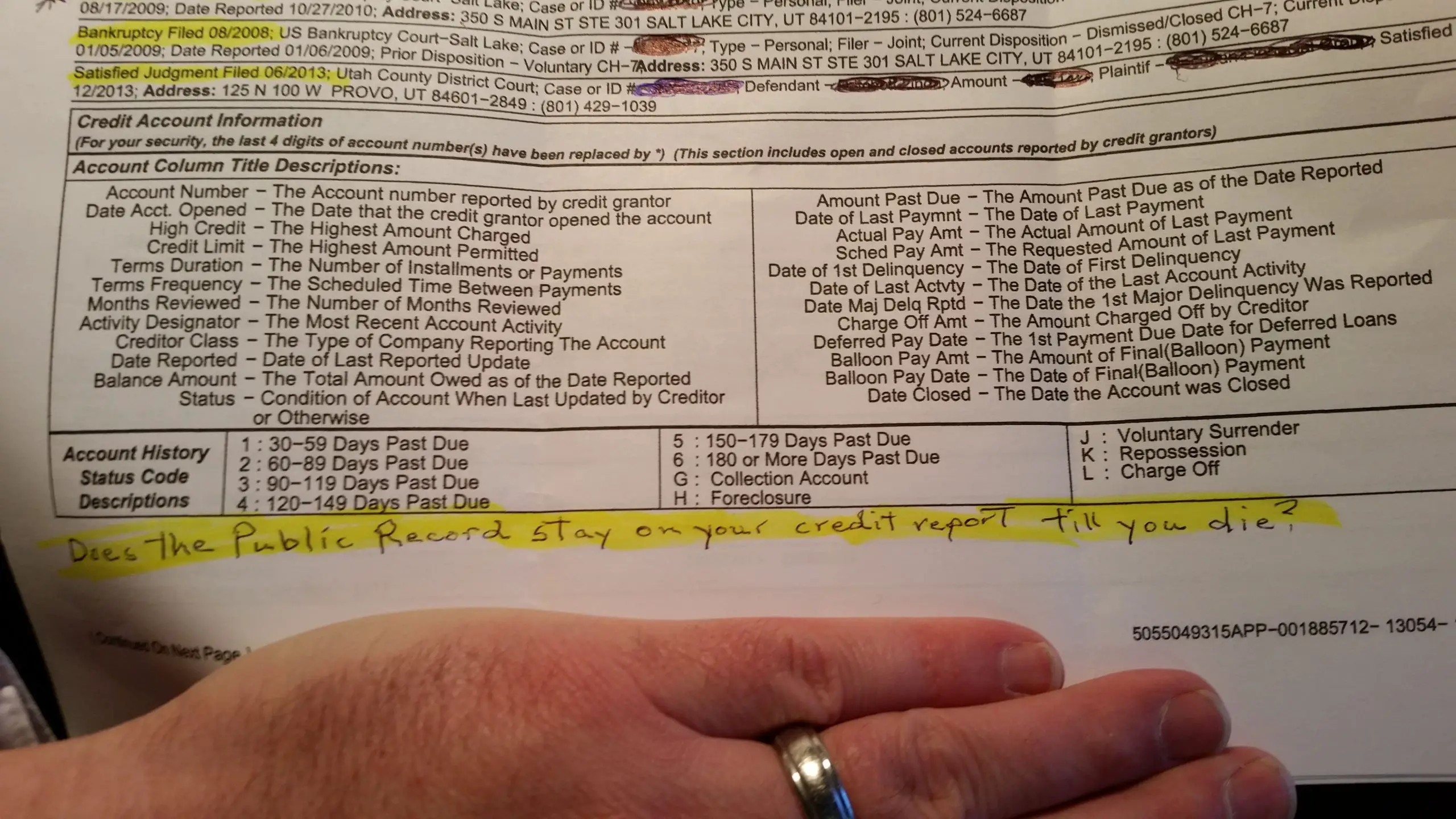

Your credit report is not part of the public record. The credit report is private and is only viewable by those you authorize to view it. Your bankruptcy will remain on your credit report for up to ten years from the date of filing. In most cases, when you apply for a loan, you authorize the lender to view your credit report.

Personal Bankruptcy Is Technically Public

The fact is that filing a personal bankruptcy case is public record. However, the fact you filed is not something that is easy to obtain by the general public. There is a public access system known as;PACER which contains information regarding bankruptcy filings throughout the country. To gain access to that system you must register and pay per page of each document you obtain. For this reason, the general public typically doesnt obtain a pacer account. Pacer is more or less used for bankruptcy professionals, lenders, and others who have a direct need to look up prior bankruptcy cases in detail.

The fact that you filed personal bankruptcy will appear on a credit report for up to 10 years. Thus, if you go to apply for a job, a rental apartment, or credit, those individuals obtaining your credit report with your consent are going to be made aware of your bankruptcy filing. Additionally, in certain applications there may be questions concerning whether or not you have ever filed a bankruptcy before in any capacity. This is another way where your personal bankruptcy can become public.

Will My Bankruptcy Filing Show Up In Public Records

The bottom line is that, once you file a bankruptcy petition with the court, it will become a public record. However, the chance that a friend, neighbor, or coworker will find out about your bankruptcy filing is slight.

Thats because bankruptcy filings and all federal court documents are uploaded to a system called Pacer. Pacer enables those who have accounts to search for court documents. Someone could look up your name, for example, and find your bankruptcy filing. In order to do that, though, the person would need to register for a Pacer account and know enough to try and find your petition.

Recommended Reading: How To Be A Bankruptcy Lawyer

How To Access Public Bankruptcy Records In The Newspaper

Another way to access a bankruptcy filing in Georgia is through the local newspaper. Publishing bankruptcies in the newspaper used to be a common practice. Papers would print an announcement in the Legal Notices section when an individual, local business, or larger corporation filed for bankruptcy or appeared in bankruptcy court. However, with corporate bankruptcies becoming more common, newspapers are now less likely to report on bankruptcy filings unless the filing would also significantly impact jobs or the economy. Bankruptcy notices do occasionally happen, however. For example, newspapers in Blue Ridge, Rome, and Augusta do still print legal notices, including bankruptcies.

Is My Bankruptcy Filing Public Will Everyone I Know Find Out

Bankruptcy can carry with it a certain stigma, despite how useful it can be in helping people dig themselves out of their financial struggles. And when considering bankruptcy, you might wonder: will other people be able to find out that you filed? Are bankruptcy filings public?

Yes, actually. Most court records, including bankruptcy filings, are public. But, that does not mean that just anyone can access all of your personal information. Typically speaking, your friends, family and acquaintances are not going to find out about your bankruptcy filing unless you tell them yourself. There is a public access system known as PACER that contains information about bankruptcy filings throughout the U.S. But to access this system, you are required to register and pay per page of documents you obtain. As such, the average citizen will not be able to see your bankruptcy filing.

However, your creditors and co-debtors will find out quickly. Once you file for bankruptcy, creditors and co-debtors will receive a direct notice. Major credit bureaus will also be notified of your bankruptcy, and the bankruptcy will show up on your credit report for ten years Because your bankruptcy will show up on your credit reports, any company that is running a credit check on you will find out about your bankruptcy. That means that if you apply for a job, a rental apartment or any kind of credit, whoever you are applying to will be able to see your bankruptcy filing.

Read Also: What To Expect At A Bankruptcy Hearing

How Public Is A Bankruptcy Filing

February 22, 2017 by Jeanne Moralesno comments

Interviewer: I didnt even realize the job hopping would even show up on your credit. I think one thing people are concerned about and maybe you can clarify this part is some court proceedings are obviously made public. How public will my bankruptcy be? Will my friends or my job going to find out and is that something I need to worry about as well?

A Bankruptcy Filing Is Public Record But Is Not a Publicized Proceeding

Jeanne:;Thats going to be region specific. Bankruptcy, just like any other court proceedings are public record but the bankruptcy court doesnt go around advertising it. Now, I do know that there are some areas in Texas where the local newspaper goes out of their way to list events that happen at the courthouse, such as births that are registered, death records, new business filings and bankruptcies. Thats not a product of the bankruptcy system. Thats just some regional newspaper does that.

Bankruptcy Filing Was Created by the Government to Offer People a Second Chance at a Financially Secure Future and Has Been Used by Many People

Jeanne:;Quite frankly, the people who are most worried about it would be shocked to know who around them has filed bankruptcy.

Interviewer: That was going to be my next question actually. Its probably something that your neighbor down the street has done.

Your Creditors And Your Bankruptcy

You are required to list all of your creditors and send them a notice that states you are filing bankruptcy at the beginning of your filing. That means that if you owe money to individuals or entities in the community, they will become aware when you file bankruptcy just because you owe them money.

This notice requirement is really for your benefit, however. The automatic stay is only useful if the creditor knows you have filed bankruptcy. That is, a creditor can only be punished for continuing collection activities if it knows that you filed bankruptcy. As a result, it is vital that all of your creditors be made aware that you have filed.

Read Also: How Long Does Bankruptcy Stay On Record

Is This Rule The Same For Both Chapter 7 Bankruptcy And Chapter 13 Bankruptcy Cases

The law is the same for both Chapter 7 and Chapter 13 bankruptcies. These are the two different types of bankruptcy specifically for consumers. They can both stay on your credit report for up to ten years. This ten-year period starts from the filing date of your most recent bankruptcy. The three major credit bureaus are Experian, Equifax, and Transunion. All three major credit bureaus show a Chapter 7 bankruptcy on your credit report for the ten years the law allows. But, all three major credit bureaus follow a rule that they will only note a Chapter 13 bankruptcy on your credit report for seven years. In a Chapter 13 that uses a five-year plan, the bankruptcy notation would fall off your credit report only two years after getting your discharge.

How Can I Check Whether Someone Has Been Bankrupt

You can pay a fee to the Office of the Superintendent of Bankruptcy for them to search for any record of a specific Canadian individuals having being bankrupt. To do this on the Internet:

- Go to the OSBs Insolvency Name Search.

- Establish an account for searching.

- Specify criteria for your search. These can include names and age of the person, and place of filing.

- Each search costs $8.00, whether successful or not. If the search finds more than ten matches to your search criteria, it will cost a further $8.00 to view each ten or fewer after the first ten.

The search tool does not allow random searches. The person searching must know in advance whose record they are seeking, or the search may become prohibitively expensive.

Recommended Reading: What Is A Bankruptcy Petition Preparer

How Does This Affect My Credit Score

Bankruptcy stays on your credit report for up to ten years. This negative information will impact your credit score, sometimes called your FICO score, less over time. In most cases, a personâs credit score is better within two years after the bankruptcy filing date, than it was the day before they filed bankruptcy. This is because the most important factors in a credit score involve your financial situation. If youâre overwhelmed with debt, you will have a difficult time paying your bills. Bankruptcy fixes this problem. If you take the necessary steps to build credit after your bankruptcy, such as getting a secured credit card, the bankruptcy notation on the credit report will have little impact in most cases. The notation will let lenders know that you canât file another bankruptcy for a period of time. This actually lowers the risk to the bank considering giving new loans to you. Still, the bankruptcy notation can be a factor when you apply for a mortgage anytime within the first four years after filing. This depends on what type of mortgage you apply for and what type of bankruptcy you filed. Under certain circumstances, a lender will approve a mortgage for you while you’re still in bankruptcy.

Will Bankruptcies Appear In Background Checks

Bankruptcies do not normally appear in results of criminal background checks, and under the Fair Credit Reporting Act , bankruptcy filings cannot be reported in pre-employment screenings once they are ten years old. This rule may vary slightly from state to state, so it is always best to ask your bankruptcy attorney specific questions.

The bankruptcy laws in Massachusetts are numerous and complex. Your case may seem like a simple one, but it is always unique. Bankruptcy attorneys helping clients obtain financial freedom, are the only ones, besides yourself, that know all the facts about the intricacies of your finances. They alone, in discussion with you and your family, will guide you to the best outcome possible.

Also Check: Is It Better To Settle Debt Or File Bankruptcy

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Who Is Required To Be Informed Of Your Bankruptcy

The most obvious party that will be informed of your bankruptcy is your creditors.

When filing bankruptcy, you will compile a list of creditors who will be informed as they need to put an automatic stay on your debt, which;means that all creditors are required to stop their debt collecting activity.

Your lawyer is required to list everyone you owe money to.

Surprisingly enough, you have to tell companies that have nondischargeable debts too.

For example, you must tell student loan companies that you are filing bankruptcy, even though the student loans dont go away in bankruptcy.

Child support recipients and any co-signers or codebtors must also must be told about it.

You May Like: Can You File Bankruptcy On Business Taxes

Is Bankruptcy Public Record

While theres a huge stigma attached to bankruptcy, the following content may prove you otherwise or side with you. Read further to understand better!;

One may feel too overwhelmed at sharing a piece of information as sensitive as this with his friends or colleagues. What if they never find out? Its a common myth that people might find out about bankruptcy cases on their own; however, this is not the case. No one would know unless you choose to tell them in good faith. It is undoubtedly true that bankruptcy is listed on a public database for people to access.;

Still, theres not even a bleak possibility that your family might stumble upon; its mostly your creditors that are actively searching for details of you, your last transaction, and various other things.;;

The likeability of a local newspaper publishing about bankruptcy is relatively low; however, a financial paper might. For an average person/your neighbor/recent contacts, obtaining this kind of bankruptcy information is quite hard. The only people who will know it are the people involved in the process, including your attorneys and financial institutions. You will find all your filings with the federal court where you have filed. Such intimate information can only be found out through;PACER, where you will have to create an account and pay for obtaining such records.;

Can You Be Evicted While In Chapter 13

A tenant could easily stop an eviction by filing for a Chapter 7 or Chapter 13 bankruptcy. The landlord can now evict a tenant, regardless of an automatic stay, if the landlord had a court-ordered judgment for possession prior to the tenant filing for bankruptcy. The landlord, therefore, can ignore the automatic stay.

Don’t Miss: How To Get A Credit Card After Filing Bankruptcy

Past Bankruptcies Appear On Your Credit Report And In Applications

Most of the time, companies will learn about your bankruptcy after it is over. Lenders, creditors, and leasing companies review your credit report to decide whether to lend you money or rent you an apartment. You may also consent to a credit history search while looking for a job or as part of a background check. When that search is done, your bankruptcy will be included in the report.

A bankruptcy appears on your credit report for years after the discharge has been entered. A Chapter 7 bankruptcy will appear for 10 years. A Chapter 13 bankruptcy itself stays on your credit report for 7 years, but because those debts are paid off over time, they may continue to appear a few years later. While the bankruptcy is included in your credit report, it could cause creditors to decline loans or charge higher interest rates than they would to someone with a similar credit history that avoided filing for bankruptcy.

It is true that a bankruptcy will negatively affect your credit score. However, in most cases, by the time you decide bankruptcy is right for you, your credit score may already be quite low. The work you do to cancel delinquencies and pay off or discharge past-due balances may mean that your total credit score will be higher at the end than it was when you started the bankruptcy process.

What Happens If I Declare Personal Bankruptcy

What happens when you file. When you file for bankruptcy, you get an automatic stay, which puts a block on your debt. Such stays prevent creditors and collections agencies from pursuing debtors for amounts owed. While the stay is in place, your wages cant be garnished and creditors cant go after any secured assets.

You May Like: Did The Nra Filed For Bankruptcy

Notice To The Creditors

When you fill out your bankruptcy petition, you will list everyone that you owe money to. The court will then notify your creditors of the filing. Some creditors may, then, attend your Meeting of the Creditors.

The Meeting of the Creditors is held between you, your bankruptcy attorney, and your creditors. At this meeting, your creditors will have a chance to interface with you in person over the details of your filing and provide any objections. This meeting can be attended by the public, though no invitations or postings are sent out.

Bankruptcy Is Public Record

While only your creditors and potentially your employer will need to be notified specifically that you filed bankruptcy, the fact that you did file is saved on a website called Public Access to Court Electronic Records .

Searching PACER is hard, however, so only lawyers do it.

In order to search if someone has filed bankruptcy on PACER, the searcher has to pay money and make a user name and password.

The good news is that, if we are honest, most people dont care.

If you are a prominent member of the community, it could be an issue that you wish to prevent.

In these cases, you may be able to file in another district, but that sort of subterfuge can be just as damaging, if not more so.

Some very small papers may seek to take advantage of it. However, most newspapers find there are too many bankruptcy filings in their town.

And their readers? Well, they just dont care.

It is more newsworthy and interesting to see business bankruptcies in the paper as it will affect a larger part of the community, but your personal bankruptcy is unlikely to show up in the newspaper.

Read Also: Why Do Companies File For Bankruptcy

Most Family And Friends Dont Need To Know About Your Bankruptcy Court Records

In most cases, the emotional resistance to filing for bankruptcy doesnt come from creditors knowing about your money trouble, but from family and friends. A bankruptcy is often the most financially prudent option for individuals and families facing excessive debt or an unexpected loss of income. But some people have a false perception that filing for bankruptcy means you have somehow failed.

The good news is that, unless you owe them money, your friends and family dont need to know about your bankruptcy. Relatives and close friends may receive notices to creditors if you owe them money at the time you file the petition. However, if you dont want someone to know about your money trouble, you probably have not borrowed money from them, so they will not receive notice. Since most people are not paying to search PACER to discover family secrets, you should rest assured that your closest relatives wont be informed of your bankruptcy, even though it is technically a public record.

At John A. Steinberger & Associates, P.C., we are a full-service bankruptcy law firm in Southeast MI. We help debtors and families in Southfield, throughout Metro Detroit, and in the surrounding communities see their Chapter 7 or Chapter 13 bankruptcy through from start to finish. If you think a bankruptcy might be the best financial decision for you, call us toll-free at 690-2140 or contact us online to schedule a free initial consultation.