Does China Own The United States

For its part, China owned 191,000 acres worth $1.9 billion as of 2019. … Indeed, there has been a tenfold expansion of Chinese ownership of farmland in the United States in less than a decade. Six states Hawaii, Iowa, Minnesota, Mississippi, North Dakota and Oklahoma currently ban foreign ownership of farmland.

Top 10 Countries The Us Owes Money To

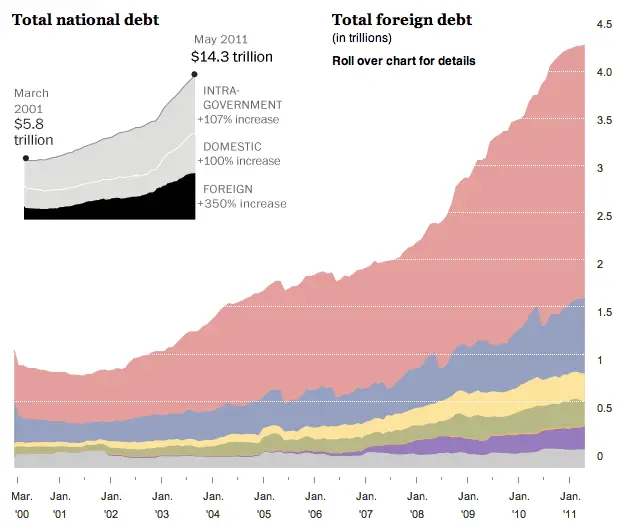

In 1989, New York real estate investor Seymour Durst spent $120,000 to erect a “National Debt Clock” in Times Square to track the exact amount of money that the U.S. federal government was borrowing to pay its bills. At the time, the country had run up a $2.7 trillion tab, but that figure seems almost quaint today. In 2008, the clock briefly ran out of available digits when the debt topped $10 trillion. By June 2021, the upgraded clock which can now display up to a quadrillion dollars registered more than $28 trillion .

Now, it’s important to understand that U.S. doesn’t owe that entire $28 trillion to its creditors, which include individuals, businesses and foreign governments who purchased U.S. Treasury bonds and securities. More than 20 percent of the national debt, or $6.2 trillion, is incurred for intragovernmental holdings, which are funds the U.S. government owes itself, mainly for the Social Security and Medicare trust funds . In June 2021, these two trust funds alone accounted for some $2.4 trillion of the national debt.

But the question we want to answer today is, who owns the bulk of that $28 trillion in public debt? You can find out by perusing our global parade of America’s biggest sugar daddies, according to the U.S. Department of the Treasury.

Contents

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.

Don’t Miss: Foreclosed Lots For Sale

Top Countries The Us Owes Money To

If there’s one thing the good old U.S.A. has a lot of, it’s debt. In an almost embarrassingly short time frame , the United States has gone from having a budget surplus

If there’s one thing the good old U.S.A. has a lot of, it’s debt. In an almost embarrassingly short time frame , the United States has gone from having a budget surplus to being the most indebted nation in the world, racking up an estimated $16 trillion in debt, the burden of which works out to roughly $148,000 per taxpaying citizen. So who do we owe all this money to? Below are the top 10 countries the U.S. owes money to.

What We Learned About Chinas Overseas Lending

Our data show that almost all of Chinas lending is undertaken by the government and various state-owned entities, such as public enterprises and public banks. Chinas overseas lending boom is unique in comparison to capital outflows from the United States or Europe, which are largely privately driven. We also show that China tends to lend at market terms, meaning at interest rates that are close to those in private capital markets. Other official entities, such as the World Bank, typically lend at concessional, below-market interest rates, and longer maturities. In addition, many Chinese loans are backed by collateral, meaning that debt repayments are secured by revenues, such as those coming from commodity exports.

The Peoples Republic has always been an active international lender. In the 1950s and 1960s, when it lent money to other Communist states, China accounted for a small share of world GDP, so the lending had little or no impact on the pattern of global capital flows. Today, Chinese lending is substantial across the globe. The last comparable surge in state-driven capital outflows was the U.S. lending to war-ravaged Europe in the aftermath of World War II, including programs such as the Marshall Plan. But even then, about 90% of the $100 billion spent in Europe comprised grants and aid. Very little came at market terms and with strings attached such as collateral.

Don’t Miss: Do Medical Bills Go Away With Bankruptcy

Does The Us Owe China Money

Breaking Down Ownership of US DebtChina owns about $1.1 trillion in U.S. debt, or a bit more than the amount Japan owns. Whether you’re an American retiree or a Chinese bank, American debt is considered a sound investment. The Chinese yuan, like the currencies of many nations, is tied to the U.S. dollar.

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

You May Like: Why Did Forever 21 File Bankruptcy

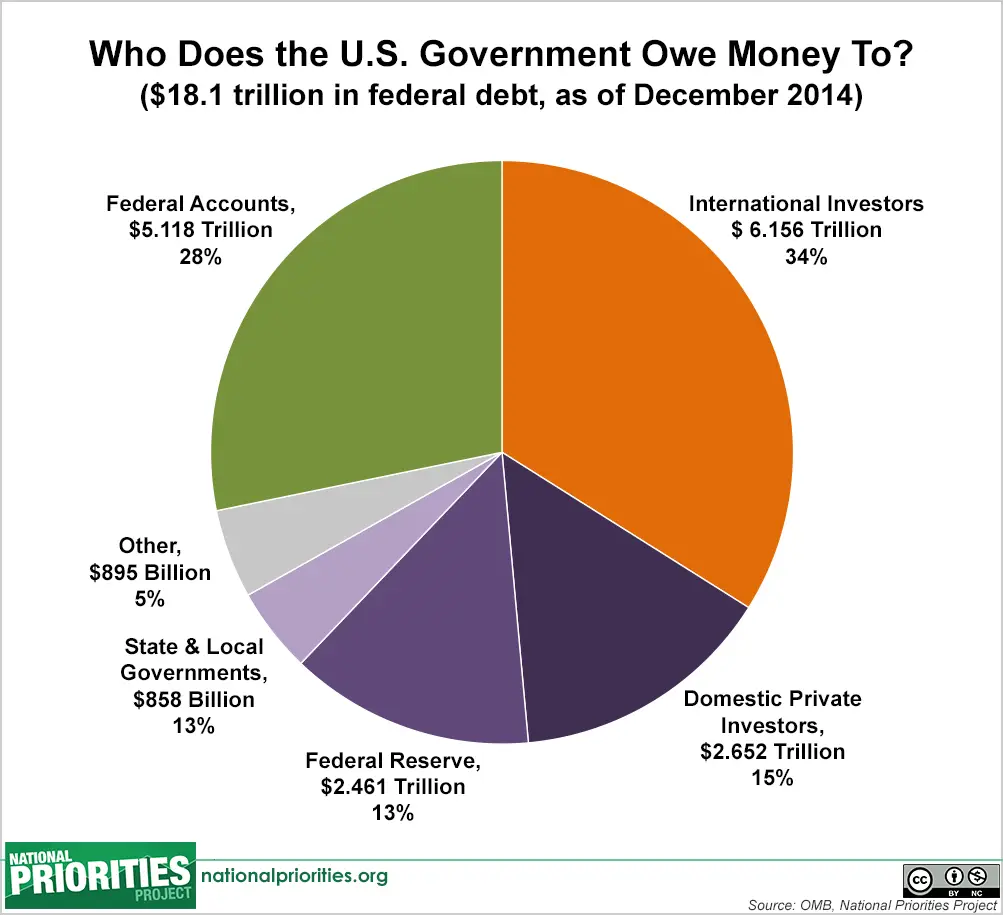

Who Owns This Debt

The public owes 74 percent of the current federal debt. Intragovernmental debt accounts for 26 percent or $5.9 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt. Individual investors and banks represent 15 percent of the debt.

The Federal Reserve is holding 12 percent of the treasuries issued. The Federal Reserve has been purchasing these bonds to keep interest rates low after the 2008 Financial Crisis. States and local governments hold 5 percent of the debt.

Foreign governments who have purchased U.S. treasuries include China, Japan, Brazil, Ireland, the U.K. and others. China represents 29 percent of all treasuries issued to other countries, which corresponds to $1.18 trillion. Japan holds the equivalent of $1.03 trillion in treasuries.

Investing in U.S. treasuries is a deliberate strategy for foreign countries. China has been using these bonds to keep the Yuan weaker than the U.S. dollar and benefit from low import prices. Intragovernmental debt encompasses different funds and holdings.

Some agencies take in revenues and use this money to purchase treasury bonds. This makes the revenues usable by other agencies, and these bonds can be redeemed in the future when these funds and holdings need money.

What Country Owes The Us The Most Money

What is the richest government in the world?United States. 2019 Nominal GDP in Current U.S. Dollars: $21.43 trillion3 China. 2019 Nominal GDP in Current U.S. Dollars: $14.34 trillion3 Japan. 2019 Nominal GDP in Current U.S. Dollars: $5.08 trillion3 Germany. 2019 Nominal GDP in Current U.S. Dollars: $3.86 trillion3 India. United Kingdom. France. Italy.

Don’t Miss: Foreclosed Homes With Acreage

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

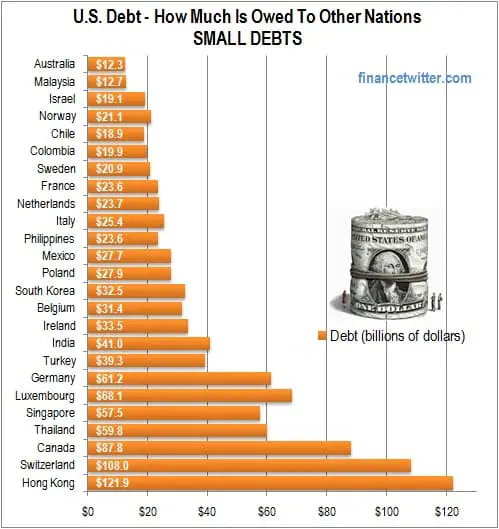

Current Foreign Ownership Of Us Debt

Japan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Read Also: How Do You File For Bankruptcy In Ct

Does It Matter That The National Debt Is Going Up

Yes – though opinions differ about how much it matters.

The total amount the government owes is called the national debt. The latest figures show it is £2.4tn – nearly as much as the value of all the goods and services produced in the UK in a year.

Many experts and politicians fear that the government’s borrowing is too great, and too costly in the long term.

Others argue additional borrowing will help the economy grow faster – generating more tax revenue in the long run.

However, the larger the national debt gets, the more interest the government has to pay on the money it has borrowed.

Until recently, the government was able to borrow very cheaply, at rates of less than one per cent.

But investors, worried by the scale of borrowing, are asking for higher interest rates.

After the tax cut announcement, interest rates on government debt soared to over 4%

The government is expected to spend over £100bn this year and next on debt interest payments – more than it spends on education.

And that’s without taking into account the tax cuts announced on 23 September, which is expected to increase that figure even further.

Why Do Countries Accumulate Foreign Exchange Reserves

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a countrys central bank. First, sovereign debt frequently comprises part of other countries foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

Read Also: Can You File Bankruptcy On Medical Bills Only

Who Owns The Us Debt

The short answer: A big chunk of it is held by the US government itself. The rest is held by private investors and foreign governments. Foreign governments hold about 30% of US public debt.

The following data was taken from a US Treasury Department website. It shows the ownership of Americas national debt, in billions of dollars, at the end of 2018:

- Federal reserve and government accounts – 8,095

- Total privately held – 13,879

- State and local governments – 689

- Private pension funds – 646

- State and local government pension funds – 283

- Insurance companies – 229

- US savings bonds – 156

- Other investors – 2,794

What is public debt and how is it accrued? Why is debt split into two categories? Do foreign governments that hold debt pose a threat to the US economy?

Keep reading to find out.

How Does The Federal Debt Work

The government finances the operation of the different federal agencies by issuing treasuries. The Treasury Department is in charge of issuing enough savings bonds, Treasury bonds, and Treasury inflation-protected securities to finance the government’s current budget.

Revenues generated by taxes are used to pay the bonds that come to maturity. Investors, including banks, foreign governments and individuals, can cash in on these bonds when they reach maturity. The debt ceiling is the cap that is set on what the Treasury Department can issue.

Congress keeps raising the debt ceiling to finance government spending. A deficit occurs when spending increases faster than revenues.

Recommended Reading: How To Decide To File Bankruptcy

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

How Does China Buy Us Treasurys

The Chinese government uses U.S. dollars it has on hand to buy Treasurys. It receives these dollars from Chinese companies that receive them as payments for their exports.

Chinas demand for Treasurys helps keep U.S. interest rates low. It allows the U.S. Treasury to borrow more at low rates. Congress can then increase the federal spending that spurs U.S. economic growth.

Owning U.S. Treasury notes helps China’s economy grow. Demand for dollar-denominated bonds raises the dollar value compared to that of the yuan. That makes Chinese exports cheaper than American-made goods, increasing sales. U.S. consumers benefit from low consumer prices.

Recommended Reading: How To Get A Credit Card After Filing Bankruptcy

Search For Money From Banking And Investments

- Bank Failures Search for unclaimed funds from failed financial institutions. The Federal Deposit Insurance Corporation lists them.

- Find unclaimed deposits from credit unions.

- SEC Claims Funds The Securities and Exchange Commission lists enforcement cases in which a company or person owes investors money.

- Savings Bonds Use TreasuryHunt.gov to find matured savings bonds that have stopped earning interest. You can also learn how to replace a lost or destroyed savings bond.

What Country Has The Most External Debt

Turkey Debt StatsExternal debt: 453 Billion USDlast updated date: 30 September 2019Debt Per capita: 2,983 USD% of GDP: 34%

How is the public debt calculated? By cumulating the annual difference between tax revenues and government spending over the years. Crowding out is a decrease in private investment caused by: Increased borrowing by the government. The goal of expansionary fiscal policy is to rein in inflation.

Also Check: Can You File Bankruptcy Twice In Florida

Who Does The Us Owe Money To

READ: From my piggy bank to you: Boy sends Christmas card, cash to Florida police Channel 9 can help you find out if you think a past employer owes you money. You can click here to find out. READ: Boxed out: Mystery alum donates $180K to City College

www.thebalance.comThe majority of the national debt is debt held by the public. The remaining portion is intragovernmental debt. The interest on the national debt is how much the federal government must pay on outstanding public debt each year. More items

Content

Why Does The Government Have To Borrow

The new government, led by Prime Minister Liz Truss, plans to borrow money to fund a £45bn tax cut.

In addition, the scheme to limit energy bill increases is expected to cost about £60bn over the next six months.

Cutting taxes means the government receives less money. To make up the difference, government borrowing is expected to rise to £190bn this year according to the Institute for Fiscal Studies think tank – and about £100bn a year for the next four years.

The money governments borrow has to be paid back eventually with interest – which is also increasing. This means taxpayers ultimately pay.

The scale of the tax cuts announced in the mini-budget and its implications for borrowing spooked investors, which caused the pound to lose value.

Don’t Miss: When To File Bankruptcy On Credit Cards