Who Is The Owner Of The Us National Debt

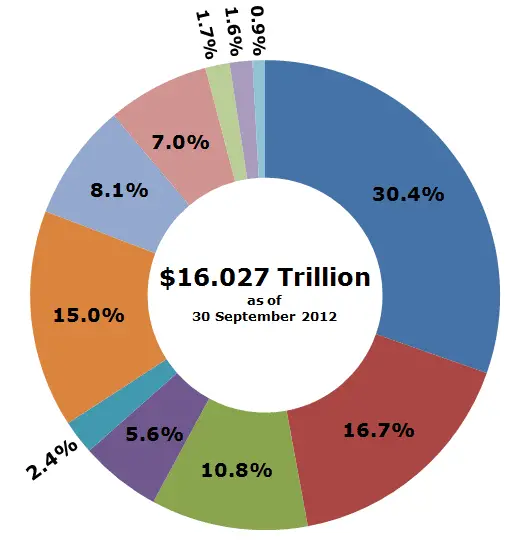

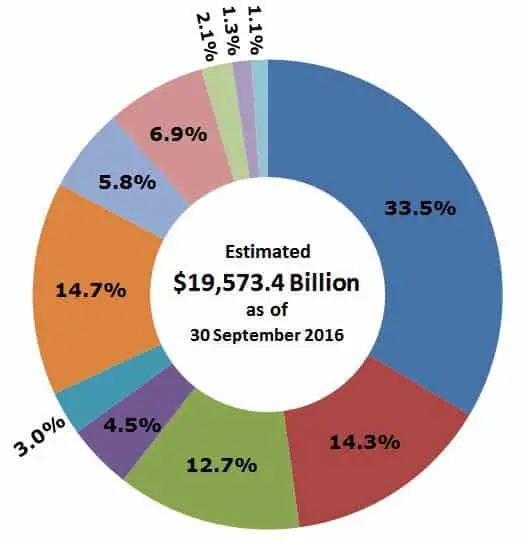

It shows the ownership of Americas national debt, in billions of dollars, at the end of 2018:Federal reserve and government accounts 8,095Total privately held 13,879Foreign and international 6,626Mutual funds 2,059Depository institutions 771State and local governments 689Private pension funds 646State and local government pension funds 283Insurance companies 229US savings bonds 156More items

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

How Much Of The National Debt Is Owned By The Public

As of August 31, 2020 federal debt held by the public was $20.83 trillion and intragovernmental holdings were $5.88 trillion, for a total national debt of $26.70 trillion. At the end of 2019, debt held by the public was approximately 79.2% of GDP, and approximately 37% of the debt held by the public was owned by foreigners.

You May Like: Overstock Returns Customer Service

Who Is Really Responsible For The National Debt

Reagan actually by percentage increased the national debt more than any other president since then.GWB finagled the books so he didnt pay about $1.3 trillion in the cost of wars that Obama ended up absorbing.Revenue largely comes from a tax base. As the baton was handed to Obama, the red emergency lights were flashing.

How Can The United States Reduce Its Debt

The only way the United States will reduce its debt is if the American people are ready to tighten their belts and accept austerity measures. The most painless time to do so is when the economy is expanding. Thats when GDP growth rates are greater than 3 percent and unemployment is less than 5 percent.

Don’t Miss: What Can You File Bankruptcy On

Who Is To Blame When There Is A Deficit

Who is to Blame? The president, any president, deserves neither as much blame they get when there is a deficit or as much credit as they get when there is a surplus. Our Constitution gives Congress the power to tax, spend, and pay or not pay the federal governments debts.The president can propose a budget, but Congress has to pass it.

What Country Owns The Most Us Debt

Current Foreign Ownership of U.S. Debt In January 2021, Japan owned $1.28 trillion in U.S. Treasuries, making it the largest foreign holder. The second-largest holder is China, which owns $1.10 trillion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their currencies.

Recommended Reading: When Does A Bankruptcy Come Off Credit

Does The Issuance Of Debt Promote Economic Growth

From a public policy standpoint, the issuance of debt is typically accepted by the public, so long as the proceeds are used to stimulate the growth of the economy in a manner that will lead to the countrys long-term prosperity. However, when debt is raised simply to fund public consumption, the use of debt loses a significant amount of support.

Cost Of Servicing The Debt

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2012, the annual cost of servicing the public debt amounted to around £43bn, or roughly 3% of GDP.

In 2012, the British population numbered around 64 million, and the debt therefore amounted to a little over £15,000 for each individual Briton, or around £33,000 per person in employment. Each household in Britain pays an average of around £2,000 per year in taxes to finance the interest.

Like other sovereign debt, the British national debt is rated by various ratings agencies. On 23 February 2013, it was reported that Moody’s had downgraded UK debt from Aaa to Aa1, the first time since 1978 that the country has not had an AAA credit rating.

This was described as a “humiliating blow” by Shadow Chancellor Ed Balls. George Osborne, the Chancellor, said that it was “a stark reminder of the debt problems facing our country”, adding that “we will go on delivering the plan that has cut the deficit by a quarter”. France and the United States of America had each lost their AAA credit status in 2012.

The agency Fitch also downgraded its credit rating for British government debt from AAA to AA+ in April 2013.

Recommended Reading: How Soon After Bankruptcy Can You Get A Car Loan

Current Foreign Ownership Of Us Debt

Japan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

What Country Owes The Us The Most Money

What is the richest government in the world?United States. 2019 Nominal GDP in Current U.S. Dollars: $21.43 trillion3 China. 2019 Nominal GDP in Current U.S. Dollars: $14.34 trillion3 Japan. 2019 Nominal GDP in Current U.S. Dollars: $5.08 trillion3 Germany. 2019 Nominal GDP in Current U.S. Dollars: $3.86 trillion3 India. United Kingdom. France. Italy.

Also Check: How Much To File For Bankruptcy In Michigan

Public Debt And Intragovernmental Holdings

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The Social Security Trust Fund owns a significant portion of U.S. national debt, but how does that work and what does it mean? Below, we’ll dive into who actually owns the U.S. national debt and how that impacts you.

Foreign Holders Of Federal Debt

Foreign ownership of U.S. debt, which includes both governments and private investors, is much higher now than it was 50 years ago. In 1970, total foreign holdings accounted for $4.9 billion, or just 5 percent, of DHBP. As of December 2021, such holdings made up $7.7 trillion, or one-third, of public debt. Of that amount, 54 percent was held by foreign governments while private investors held the remaining 46 percent. Because Treasury securities are backed by the full faith and credit of the U.S. government, creditors including foreign investors often view lending to the United States as a safe investment.

In recent years, however, the foreign of DHBP has declined due to the rapid growth in purchases by the Federal Reserve in response to the economic effects of the COVID-19 pandemic. Foreign holdings peaked at 48.5 percent of DHBP in 2011, but dropped to 33.0 percent at the end of 2021.

Japan and China hold significant shares of U.S. public debt. Together, as of December 2021, they accounted for $2.4 trillion, or about 10 percent of DHBP. While Chinas holdings of U.S. debt have declined over the past decade, recently falling below $1 trillion for the first time since 2010, Japan has slightly increased their purchases of U.S. Treasury securities. Investors in many other countries including the United Kingdom, Switzerland, and Ireland have increased their holdings of U.S. debt as well.

You May Like: Can Bankruptcy Take Your Income Tax Refund

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

So Who Owns Americas National Debt

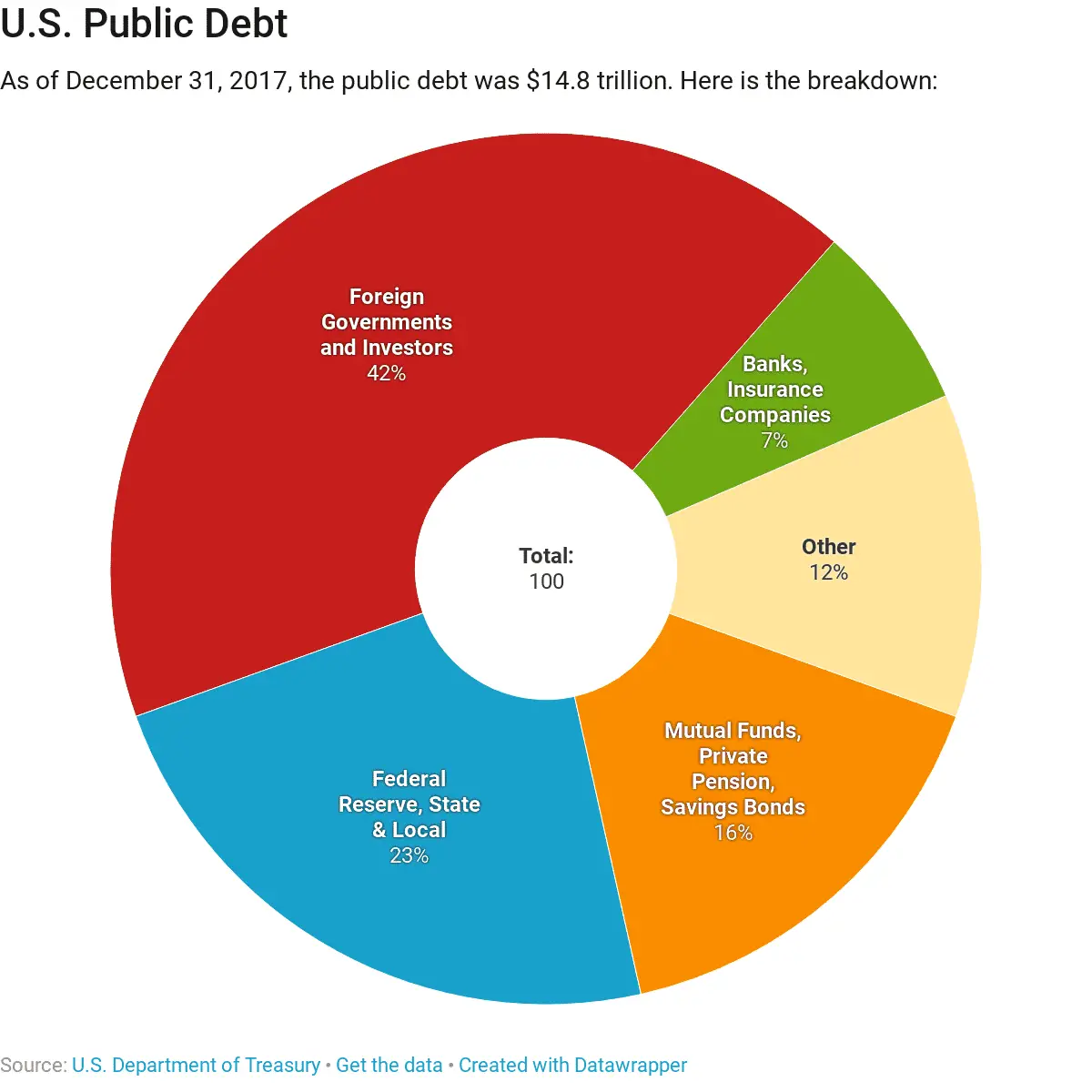

There are different kinds of national debt. Think about it like having a credit card, a mortgage and a car payment all debt, but different. The U.S. Department of the Treasury manages the national debt, which is split between what one government agency owes to another and debts that are held by the public.

Intragovernmental debt accounts for about $6.5 trillion of the debt.

The much bigger piece of the debt is held by the public. Right now, thats about $24 trillion.

Foreign governments as well as banks and private investors, state and local governments and the Federal Reserve own most of this debt, and its held in Treasury securities, bills and bonds.

Foreign governments and private investors are one of the biggest holders of the public debt, owning around $7.7 trillion. Domestically, the Federal Reserve holds the largest share of the public debt, at about 40%.

You May Like: What Happens When An Llc Files Bankruptcy

What Is The Debt Held By Government Accounts

Debt held by government accounts or intragovernmental debt are non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings,

Intragovernmental Holdings are mostly made up of the Government Account Series held by government trust funds, revolving funds, and special funds. Debt Held by the Public includes all federal debt held by individuals, corporations, state and local governments, foreign governments, and GAS deposit funds, such as the Thrift Savings Plan.

Governments, however, rarely do. Borrowing more money, raising spending, and cutting taxes are three surefire ways to dig deeper into the hole that is the US federal debt. And, these are three shovels that the US government continues to use. So, what are the appropriate ways to relieve the debt burden?

Who Is Responsible For The Growth Of The National Debt

The bottom line is both Democrats and Republicans are responsible for growth of the national debt. The debt grew by $7.8 trillion during the Trump years, in part because of bipartisan votes on COVID-19 relief and other spending, but also because of measures like the Tax Cut and Jobs Act, which was backed only by Republicans.

You May Like: Can You File Bankruptcy Alone When Married

Who Does The United States Owe The National Debt To

The truth is, most of it is owed to Social Security and pension funds. This means U.S. citizens, through their retirement money, own most of the national debt. U.S. national debt is the sum of these two federal debt categories: Public debt, held by other countries, the Federal Reserve, mutual funds, and other entities and individuals

What Is The $28 Trillion Gross Federal Debt

The $28 trillion gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself. Learn more about different ways to measure our national debt.

It consists of two types of debt. The first is debt held by the public. The government owes this to buyers of its bonds. Those buyers are the countrys citizens, international investors, and foreign governments. The second type is intragovernmental debt. The federal government owes this to other government departments.

President Andrew Jackson Paid Off The Entire National Debt There was a time, believe it or not, when the United States had zero debt. On January 8th, 1835, President Andrew Jackson paid off the national debt. This was an impressive feat for the country.

Also Check: What Happens To Your House When You File Bankruptcy

Who Owns The Us Debt

The short answer: A big chunk of it is held by the US government itself. The rest is held by private investors and foreign governments. Foreign governments hold about 30% of US public debt.

The following data was taken from a US Treasury Department website. It shows the ownership of Americas national debt, in billions of dollars, at the end of 2018:

- Federal reserve and government accounts – 8,095

- Total privately held – 13,879

- State and local governments – 689

- Private pension funds – 646

- State and local government pension funds – 283

- Insurance companies – 229

- US savings bonds – 156

- Other investors – 2,794

What is public debt and how is it accrued? Why is debt split into two categories? Do foreign governments that hold debt pose a threat to the US economy?

Keep reading to find out.

How Do Current Debt Levels Compare Historically

Both gross and public debt are at all-time highs in nominal dollars, which is perhaps not surprising since the federal government has been running deficits for each of the past 20 fiscal years. As a percent of GDP, both are high by historical standards. Debt held by the public is currently around 98 percent of GDP, which is higher than any time in history other than in fiscal years 1945, 1946, and 2020, when unprecedented borrowing occurred to finance the World War II effort and to fight COVID-19. Even during those two periods, the record for debt was 106 percent of GDP in 1946 and 100 percent in 2020, both of which the federal government will surpass by 2031.

Gross debt currently amounts to 125 percent of GDP, which is the second-highest total in history, just short of the all-time record of 128 percent of GDP in 2020. By 2031, public debt will be at its highest level in history as a share of GDP, while gross debt will be slightly below todays level.

You May Like: How To Find Foreclosure Records

What To Read Next

- Mitt Romney says a billionaire tax will trigger demand for these two physical assets get in now before the super-rich swarm

- House Democrats have officially drafted a bill that bans politicians, judges, their spouses and children from trading stocks but here’s what they’re still allowed to own and do

- Biggest crash in world history’: Robert Kiyosaki issues another dire warning and now avoids anything that can be printed here are 3 hard assets he likes instead

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

What Countries Have The Biggest Debt

Countries With The Biggest Public Debt. Japan, Sudan, and Greece have the highest levels of national debt worldwide compared to their GDP, landing them in a somewhat risky economic position. In 2019, the US ranked 13th globally for its public debt compared to its GDP, owing $22,773 billion USD, but that is predicted to rise to almost $30,000

Also Check: Where To Buy Overstock Pallets

Debt Held By The Public

Debt held by the public is the amount that the Treasury has borrowed from outside lenders through financial markets to support government activities. Economists view DHBP as the most meaningful measure of debt high levels of such debt, typically measured as a percentage of gross domestic product , can crowd out private investments in the economy, make it more difficult to respond to economic crises, and generate other concerns.

As of December 2021, DHBP was $23.1 trillion, or 96 percent of GDP. That borrowing came from both domestic and foreign creditors, with the former holding about two-thirds of it.

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

Also Check: How To File Bankruptcy Online Free