Chapter 11 Vs Chapter 13

Chapter 13 involves the appointment of a trustee; with Chapter 11 this is optional and not usually done. The trustees role includes reviewing the bankruptcy proposal, making recommendations to the court, and the collection and distribution of creditor payments.

If a debtor meets all the requirements, theres no limit to a Chapter 11 plans duration, though typical plans are structured for three to five years. The court can extend the time frame of the plan for debtors who need more time to make the required payments.

The approval process for a Chapter 13 bankruptcy is generally much more expedient. Theres a set commitment period, however, of three to five years, during which a debtor must relinquish essentially all disposable income to the appointed trustee for distribution among creditors. The commitment period can be shortened but never extended .

Chapter 11 And Chapter 12

Chapter 11 and Chapter 12 are similar to Chapter 13 repayment bankruptcy but designed for specific debtors.

Chapter 11 bankruptcy is another form of reorganization bankruptcy that is most often used by large businesses and corporations. Individuals can use Chapter 11 too, but it rarely makes sense for them to do so.

Chapter 12 bankruptcy is designed for farmers and fishermen. Chapter 12 repayment plans can be more flexible in Chapter 13. In addition, Chapter 12 has higher debt limits and more options for lien stripping and cramdowns on unsecured portions of secured loans.

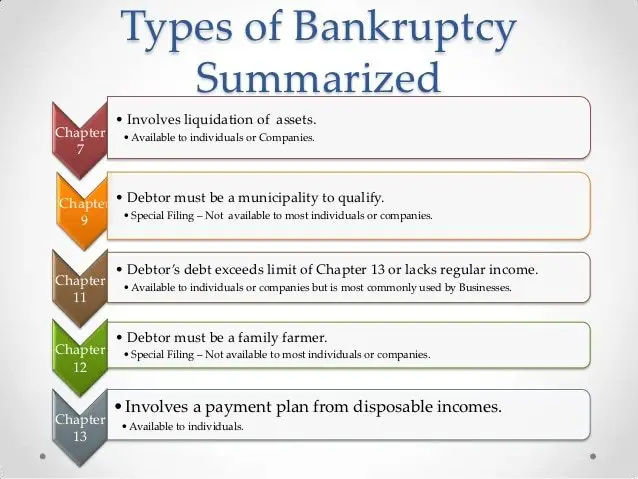

The Different Chapters Of Bankruptcy Explained

Most people in the United States are familiar with the term bankruptcy.

Bankruptcy, handled in the federal courts, can help a person get rid of any debt they have or make a plan to repay it.

However, can you tell the differences between each of the different chapters of bankruptcy? There are six chapters of bankruptcy in the United States, Chapter 7, Chapter 9, Chapter 11, Chapter 12, Chapter 13 and Chapter 15, with Chapter 7 and Chapter 13 bankruptcy being the most common forms filed.

Below is an overview of the details of each of the different chapters of bankruptcy.

Chapter 7

Chapter 7 bankruptcy, sometimes referred to as liquidation bankruptcy, is the most common type of bankruptcy in the U.S., and the most basic form of bankruptcy. Chapter 7 provides liquidation of an individuals property and then distributes it to creditors. Individuals are allowed to keep exempt property.

The courts may provide businesses that file chapter 7 with a trustee that operates the business for a period of time. In general, the trustee will take charge of asset liquidations and proceeds.

Chapter 9

Chapter 9 bankruptcy is a bankruptcy for municipalities cities, towns, counties and school districts, for example. Municipalities that file chapter 9 earn protection from creditors while they develop a plan for adjusting their debts. In 2013, the city of Detroit filed chapter 9, becoming the biggest city in the history of the U.S. to file for bankruptcy.

Chapter 11

Chapter 12

Chapter 13

Don’t Miss: What Is Bankruptcy Code In India

If You’re Thinking About Bankruptcy You’ll Need To Consider Which Type Is Right For You Here Are The Highlights

By Cara O’Neill, Attorney

Once you’ve decided that bankruptcy is the right solution for your financial situation, you will need to decide which type of bankruptcy is most beneficial.

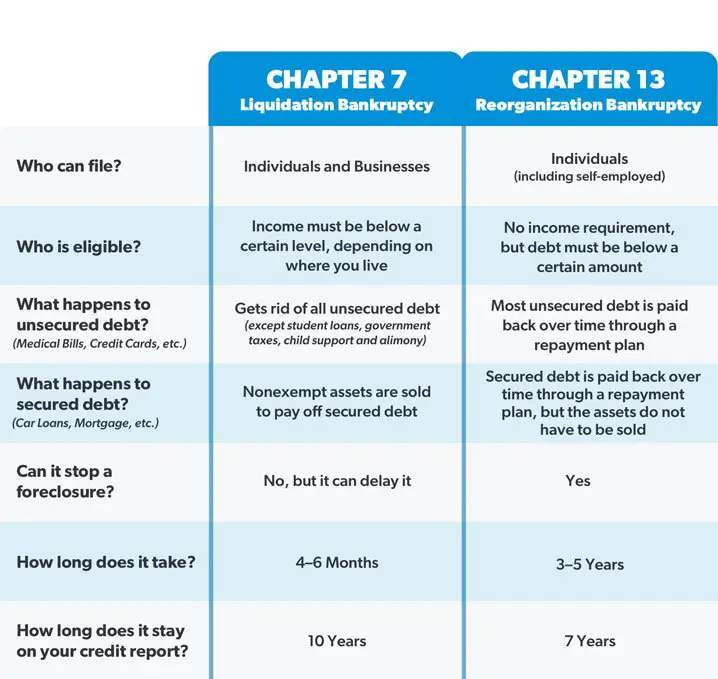

If you are an individual or a small business owner, then your most obvious choices are Chapter 7 “liquidation” bankruptcy or Chapter 13 “wage earners” or “reorganization” bankruptcy.

We’ll go over the pros and cons of each, the eligibility rules, and give you some information to help decide which would be best for you in your financial situation.

There are a select few other types of bankruptcies that are available under certain circumstances, and we will touch on those as well.

Is There More Than One Kind Of Bankruptcy

Yes. For individuals, there are two main types of bankruptcies that can be filed: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Chapter 7 cases are also referred to as “liquidation” cases, while Chapter 13 cases are commonly referred to as “debt adjustment” or “wage earner” cases. Individuals may also be eligible for a Chapter 11 bankruptcy, which allows the debtor to propose a plan for reorganization to pay creditors overtime, but Chapter 11 is normally used to reorganize a business. Farmers and fisherman can also file a separate type of bankruptcy available only to farmers under Chapter 12. The word “Chapter” is simply a reference to a chapter number in the Bankruptcy Code.

You May Like: Does Declaring Bankruptcy Affect Your Spouse

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Do Unsecured Debt Get Paid In Chapter 13

Heres how your unsecured debt, like credit cards and medical debt, is treated in Chapter 13 bankruptcy. Most Chapter 13 filers dont pay much toward unsecured debt, such as credit card balances, medical bills, cellphone bills, utility balances, and personal loans. Find out more about Chapter 13 Bankruptcy.

Recommended Reading: What Is A Bankruptcy Petition Preparer

Chapter 9: Reorganization For Municipalities

A Chapter 9 bankruptcy is available only to municipalities. Chapter 9 is a form of reorganization, not liquidation. Notable examples of municipal bankruptcies include that of Orange County, California and the bankruptcy of the city of Detroit, Michigan in 2013.

Different Chapters Of Bankruptcy

While the phrase “filing for bankruptcy” is often used as blanket term for individuals andbusinesses, the fact is that there are several different types of bankruptcy.Before determining that declaring bankruptcy is the best course of action, adebtor must consider which type of bankruptcy will benefit him most.

Recommended Reading: How To Claim Bankruptcy Without A Lawyer

Eligibility To File A Chapter 7 Bankruptcy Case

In order to be eligible for a Chapter 7 case, you must receive credit counseling from an approved agency within 180 days prior to filing. When you file, you are required to provide the court with a certificate from the agency describing the services you received along with a copy of any debt repayment plan you and the agency may have developed. After you file, you will also have to complete an instructional course concerning personal financial management in order receive a discharge. Classes are run by independent agencies and require additional costs. A list of accredited credit counselors can be found at the United States Trustee’s website, .

All About The Different Types Of Bankruptcy Part 2

Bankruptcy is no joke! We’re going to walk you through the nitty-gritty of the different types of bankruptcy, as well as a way to keep away from it!

If you’ve reached this article, you should have already read all about bankruptcy and what exactly it is. If you haven’t, you can find it Part 1 HERE. Go read it and we’ll wait patiently for you to come back!

Alright, now that you’ve got the background on that Let’s go over the different types of bankruptcy, what they are, and what they mean. Time to go into a little more detail about it!

You May Like: How Long Does Bankruptcy Stay On Credit Report

Bankruptcy Alternatives And Debt Relief

Medical bills, job loss, divorce, separation and consumer debt are the leading causes of personal bankruptcy. Unexpected expenses have lasting financial consequences. With the increasing cost of living, it is difficult to support a family without relying on high-interest loans and credit cards. Americans owe a recording-breaking amount to credit card companies,;banks;and lenders. Mounting debt can quickly become an uncomfortable burden. Thats when bankruptcy can help.

Bankruptcy;may be;a last;resort for severe financial problems, so its important to examine alternatives. Debt consolidation and debt settlement may offer similar advantages in a shorter amount of time. In fact, you might be required to undergo credit counseling before you file for bankruptcy. If your creditors are threatening to take your car or repossess your house, bankruptcy can protect you while you get back on track. The right option often depends on the type of debt you owe.

Get Help From An Experienced Bankruptcy Lawyer Lake County Florida

The type of bankruptcy you file, however, can make a difference in what you get to keep or give up.

Bankruptcy is an umbrella term for a legal process used to solve debt, either through:

The Liquidation of Assets;and/or;Asset Protection

There are several ways one can file bankruptcy, and a lawyer who specializes in this niche is the best person to review your case, to determine if its best to file:

- Chapter 7 Bankruptcy

Though all bankruptcy filings share the common goal of dissolving debt, there are different eligibility requirements for each.

Additionally, each bankruptcy type has various pros and cons.

In this post, Campione & Hackney briefly describes the main differences between three main types of bankruptcy:

In Chapter 7 Bankruptcy, unsecured debts are resolved by selling the debtors nonexempt assets. Whatever monies are made is redirected to creditors. In these cases, a court-appointed executor handles the sale of assets and repayment activities.

Eligibility Requirements Limited or No Disposable Income

To determine eligibility, a Chapter 7 Means Test is completed. Chapter 7 Bankruptcy can also be filed by both individuals and businesses.

Cons

Read Also: How To Get A Credit Card After Filing Bankruptcy

Modern Law And Debt Restructuring

The principal focus of modern insolvency legislation and business debt restructuring practices no longer rests on the elimination of insolvent entities, but on the remodeling of the financial and organizational structure of debtors experiencing financial distress so as to permit the rehabilitation and continuation of the business.

For private households, some argue that it is insufficient to merely dismiss debts after a certain period. It is important to assess the underlying problems and to minimize the risk of financial distress to re-occur. It has been stressed that debt advice, a supervised rehabilitation period, financial education and social help to find sources of income and to improve the management of household expenditures must be equally provided during this period of rehabilitation . In most EU Member States, debt discharge is conditioned by a partial payment obligation and by a number of requirements concerning the debtor’s behavior. In the United States , discharge is conditioned to a lesser extent. The spectrum is broad in the EU, with the UK coming closest to the US system . The Other Member States do not provide the option of a debt discharge. Spain, for example, passed a bankruptcy law in 2003 which provides for debt settlement plans that can result in a reduction of the debt or an extension of the payment period of maximally five years , but it does not foresee debt discharge.

Chapter 7 Bankruptcy Vs Chapter 11

Chapter 7 bankruptcy, also known as liquidation, is what most people think of when it comes to bankruptcy. It involves selling assets and using the proceeds to pay debts. For a business, however, selling assets often results in ceasing operations. Unless a business owner plans to shut down, Chapter 11 is often the better choice for businesses that can continue to generate income to pay off their debts.

| Chapter 7 Bankruptcy |

|---|

| Higher fees |

Don’t Miss: How To Be A Bankruptcy Lawyer

Bankruptcy Basics: What Is Personal Bankruptcy

Personal bankruptcy refers to a bankruptcy case filed by an individual or married couple. If a married couple files bankruptcy together, itâs called a joint bankruptcy filing. But, thereâs nothing that says you have to file with your spouse. Sometimes it makes sense not to.Â;

Chapter 7 and Chapter 13 are the most common types of personal bankruptcy. Even though a bankruptcy can stay on your credit report for up to 10 years, many filers see a noticeable increase in their credit score within 2 years of filing their case. Personal bankruptcies can also be filed under Chapter 11 of the Bankruptcy Code, but thatâs pretty rare.Â;

Do I Need A Lawyer To Represent Me If I File A Bankruptcy Case

You can represent yourself in a bankruptcy proceeding if you choose, but you do so at your own risk. It is crucial that bankruptcy cases be filed and handled correctly, and you must comply with all of the rules, which are highly technical. Bankruptcy courts in Illinois generally require that all bankruptcy materials be filed electronically and not through written papers, but if you are representing yourself, the courts will typically allow you to file your documents in paper form with the clerk’s office. In every bankruptcy case, each individual is required to prepare and submit to the court detailed forms concerning his or her property, debts, and financial affairs, which are difficult to complete without the help of an attorney. Additionally, options available to each individual, such as property claiming exemptions, filing jointly with a spouse, and what type of bankruptcy to file, probably cannot be properly assessed without the assistance of an experienced attorney.

This pamphlet is prepared and published by the Illinois State Bar Association as a public service. Every effort has been made to provide accurate information at the time of publication.

For the most current information, please consult your lawyer. If you need a lawyer and do not have one, call Illinois Lawyer Finder at 922-8757 or online www.IllinoisLawyerFinder.com

Read Also: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Employed Homeowners Facing Mortgage Delinquency Or Foreclosure Chapter 13

For homeowners who have fallen behind on mortgage payments, Chapter 13 offers a way to catch up or “cure” past due mortgage payments while simultaneously eliminating some portion of dischargeable debt. Filers can save the home from foreclosure and get rid of a lot of credit card debt, medical debt, and possibly even second and third mortgages or HELOCs. Chapter 7 bankruptcy does not provide a way for homeowners to make up mortgage arrears, so it’s not a good choice for delinquent homeowners who want to keep a home.

How Does Filing Bankruptcy Impact Credit

Your credit may not be in tip-top shape by the time you consider filing for bankruptcy, since high balances and missed payments are the top factors affecting your credit score. Still, the presence of a bankruptcy on your credit report will severely impact your credit scores and creditworthiness the entire time it is on your report. That impact will lessen as time passes, however. Chapter 7 bankruptcy remains on your report for up to 10 years, and Chapter 13 stays there for up to seven years.

It’s not an ideal credit situation, of course, but you can use the time to manage your debts wisely and make consistent on-time payments. Like with any damage to your creditworthiness, it’s possible to rebuild your credit with some focus and patiencealong with using the debt relief provided by the bankruptcy to get back on track financially.

You May Like: What Can They Take In Bankruptcy

Types Of Bankruptcy Discharge In Canada

When you complete your bankruptcy, whether personal or business, you will also receive a different type of bankruptcy discharge, depending on certain factors.

There are four types of bankruptcy discharge of your debts that you might receive:

Absolute Discharge This is the type of discharge from bankruptcy you want to receive, which happens automatically in most bankruptcies.

When you receive an absolute bankruptcy discharge you will be released from any legal obligation to repay the debts that existed at the time you filed bankruptcy, with certain types of debts not being discharged in bankruptcy .

Conditional bankruptcy discharge If you receive a conditional discharge from your bankruptcy you will have to complete certain conditions before you can receive your absolute discharge.

Suspended discharge If you receive a suspended bankruptcy discharge you will receive your absolute discharge at a future date.

Discharge refused In very rare cases the court has the right to refuse a discharge and you will have to work with your trustee to find out how to receive your discharge.

You might also need the assistance of an insolvency lawyer.

Entities That Cannot Be Debtors

The section of the Bankruptcy code that governs which entities are permitted to file a bankruptcy petition is 11Â;U.S.C.Â;§Â;109. Banks and other deposit institutions, insurance companies, railroads, and certain other financial institutions and entities regulated by the federal and state governments, and Private and Personal Trusts, except Statutory Business Trusts, as permitted by some States, cannot be a debtor under the Bankruptcy Code. Instead, special state and federal laws govern the liquidation or reorganization of these companies. In the U.S. context at least, it is incorrect to refer to a bank or insurer as being “bankrupt”. The terms “insolvent”, “in liquidation”, or “in receivership” would be appropriate under some circumstances.

Also Check: How Many Times Can You File Bankruptcy In A Year

Should You File An Individual Or Joint Bankruptcy

If you are married, you can choose to file for bankruptcy jointly with your spouse or individually. In general, filing for bankruptcy together makes sense if you have a lot of joint debts and your state allows you to double your bankruptcy exemptions in a joint filing.

However, individual bankruptcy might be in your best interest if:

- only one spouse has debt

- one spouse has nonexempt separate property that may be at risk in bankruptcy , or

- your state doesn’t allow married couples to double their exemptions in a joint case.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information