The Pandemics Continuing Impact On American Finances

The COVID-19 pandemic has affected Americans finances in multiple ways. One such way is the relief and stimulus programs available over the past almost two years.

According to our survey, more than three-quarters of Americans reported that they had received some form of pandemic relief since March 2020. Close to two-thirds of Americans say they received stimulus payments, and some Americans received extended/supplemental federal unemployment benefits , the expanded child tax credit and automatic forbearance on federal student loans , among other things.

Of Americans who received pandemic relief, 43% say they used the extra money to pay for necessities, and another 43% say they saved some or all of the money. Close to 2 in 5 Americans who received pandemic relief repaid debt with this money.

Some Americans took big steps over the past 12 months that will affect their finances in the long term, for better or worse. More than 1 in 10 Americans say they purchased a home over the past year, and the same proportion say they enrolled in college courses or continuing education during that time. Around 1 in 12 Americans say they quit their job in the past 12 months, with Gen Zers and millennials more likely to say this than Gen Xers and baby boomers . Those saying they quit a job include 16% of Gen Zers, 11% of millennials, 6% of Xers, and 3% of boomers.

The Average Debt For Those 75+

Seniors age 75 and older have by far the lowest average debt. Among those who carry debt, the average debt level is just $57,500. Seniors in this age group had some advantages over other age groups. Of course, theyve had more years to earn money and pay down their mortgages. But they also benefited from a time when real wages were higher. They may even have pensions from their old jobs. And their wages probably werent affected by the 2008 recession.

How Much Debt Is The Average Millennial In

Consumer debt in the United States currently stands at about $ 14.88 trillion, representing an average individual debt of nearly $ 93,000, according to data from consumer debt analysis.

How much credit card debt does the average millennial have?

The millennial average is over $ 4,000 in credit card debtâ some generations are extra.

How much debt does the average Gen Z have?

Gen Zers, aged between 18 and 23, holds an average of $ 16,043 in debt, according to data from consumer credit analysis.

Read Also: Can You File Bankruptcy On Debt Consolidation

American Credit Card Usage Statistics

How many credit cards are in American wallets?

U.S. cardholders are using a small portion of their available credit

Despite Cost Americans Still Opt For Higher Education

Higher education has long been considered the ticket to affluence and job satisfaction. The earnings premium for degree holders has grown steadily over the past several decades, and college graduates are more likely to become homeowners, according to the Federal Reserve Bank of New York. Among all Americans aged 25 and older, 58.9% have spent at least some time in college, and about 32.5% have earned a bachelors degree or higher. Younger Americans are more likely to prioritize going to college than previous generations. Among people aged 65 and older part of the baby boomer and silent generations 50% have spent some time in college, and 27% have a bachelors degree or higher. Among those aged 25 to 34 who would be considered millennials 65% have spent some time in college, and 36% have a bachelors degree or higher.

Don’t Miss: How Does A Bankruptcy Trustee Find Hidden Assets

Complete Your Profile To Continue Reading And Get Free Access To Benefitsprocom Part Of Your Alm Digital Membership

Your access to unlimited BenefitsPRO.com content isnt changing.Once you are an ALM digital member, youll receive:

- Critical BenefitsPRO.com information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events.

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account?

Average American Debt By Type Of Debt

Here’s a breakdown of the total amount, according to the Federal Reserve Bank of New York’s Household Debt and Credit report from the first quarter of 2021.

| Debt type | |

| Home equity lines of credit | $1,210 |

| Other debt | $1,490 |

Mortgage debt is most Americans’ largest debt, exceeding other types by far. Student loans are the next biggest type of debt among those listed in the data.

Read Also: How To Claim Bankruptcy In Washington State

How To Get Out Of Credit Card Debt

As we’ve seen from these statistics, owing money to your credit card issuer is common. Many American credit card holders have expensive balances that are costing them interest charges every month.

If you’re in this situation, here are some methods to consider that can help you get out of credit card debt:

Average Credit Card Debt Statistics

Numerous American households are burdened with credit card debt. That comes as no surprise as the cost for many necessities cant be covered with one or more monthly salaries.

1. In August 2020, the average percentage rate on credit card accounts accruing interests amounted to 16.43%.

2. According to credit card debt statistics, an average of $1,539 in annual credit card interest will fall upon self-employed American residents.

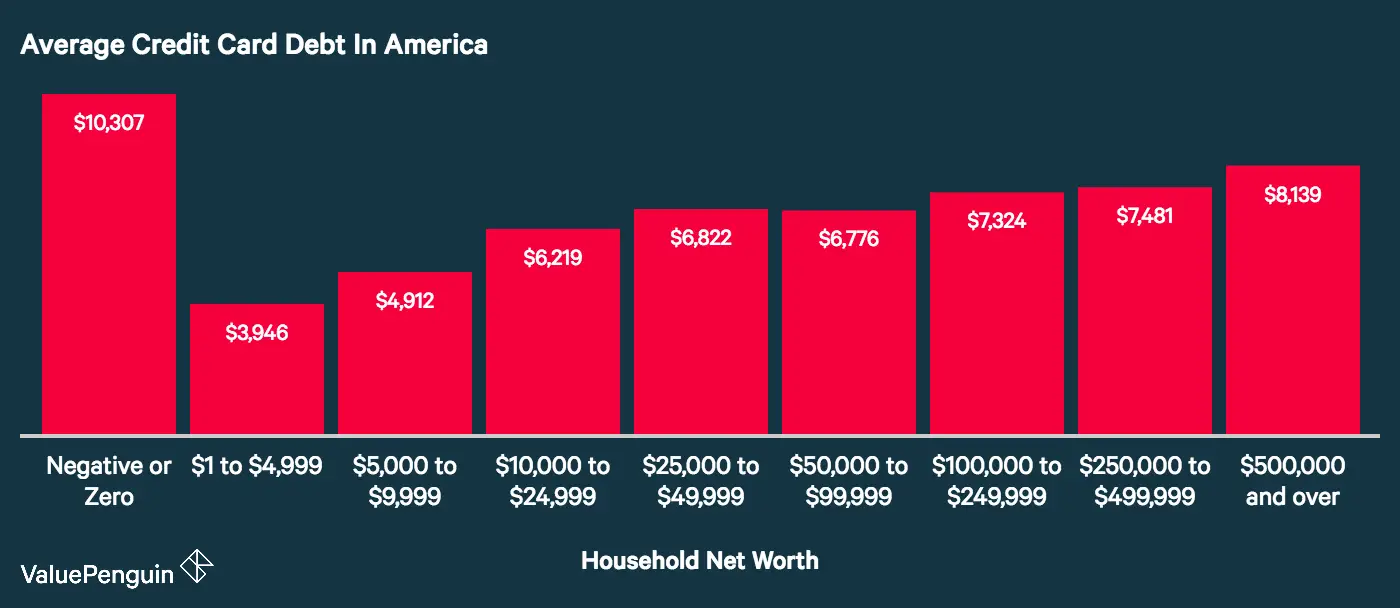

3. Households with the lowest net worth have an average of $4,830 in credit card debt.

4. US households that carry credit card debt are liable to paying average interest charges of up to $1,155.

5. Credit debt statistics show that 45.4% of US families are burdened with some type of credit card debt.

6. The average is around $5,315, down from $6,194 since last year.

Heres a breakdown of the average household debt:

7. 70% of adults have accrued personal debt, of which 39% have a credit card debt, 25% a mortgage debt, 23% a car loan debt, and 16% a student loan debt.

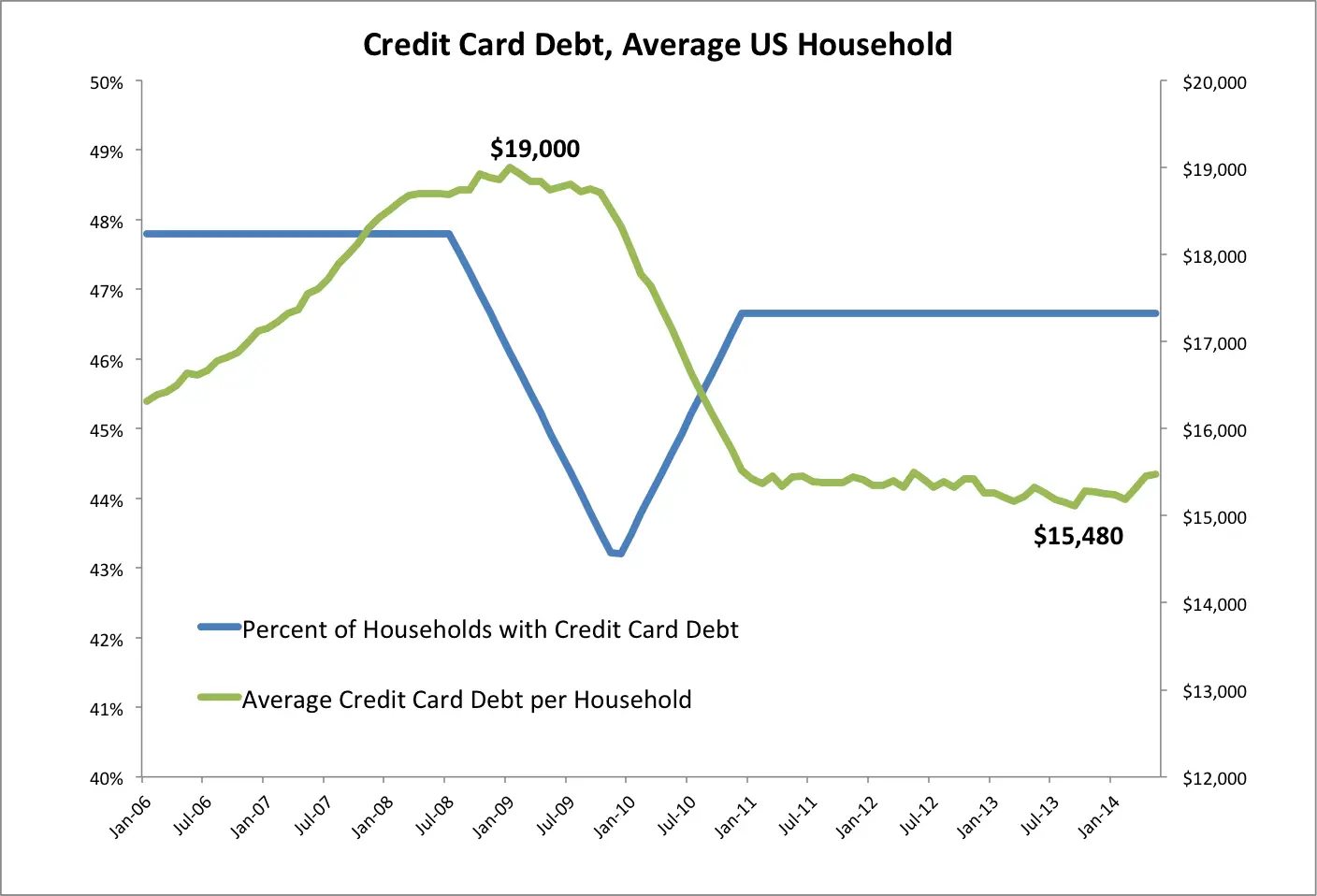

8. The average household credit card debt owed by an average US household amounts to $6,270, whereas the total consumer debt spikes to $14.56 trillion.

The total debt includes any kind of debt ranging from mortgages, credit lines, student loans, auto loans, fast loans, and other household debt.

9. A regular US family has accrued a $190,595 mortgage debt, and the total mortgage debt is $9.86 trillion.

Don’t Miss: Can You Buy A House With Bankruptcies

Lets Learn About: The Average Credit Card Debt In America

- The number of adults in America that find it difficult to minimize debt or who have debt in collections has increased over time.

- Making a late payment or missing payments will likely have a negative impact on your credit score.

- If youre facing seemingly insurmountable debt, speak with your creditors about setting up a payment plan to rebuild your credit.

When it comes to personal finance, Americans are most concerned with retiring without having enough money set aside, and also having insufficient rainy day savings, according to a recent survey by the National Foundation for Credit Counseling® .

Just prior to the COVID-19 outbreak in the United States, the NFCC® conducted its 2020 Financial Literacy Survey, sponsored by Discover Financial Services, and the results offer a snapshot of the state of financial health in the U.S.

The 2020 Financial Literacy Survey was conducted online within the United States by Harris Poll on behalf of the NFCC® and Discover Financial Services between March 9th and March 13th, 2020 among 2,004 U.S. adults ages 18+. See the 2020 Financial Literacy Survey and the associated survey data linked for details.

In addition to those larger, long-term financial goals, some more immediate, everyday personal finance issues continue to be top of mind for Americans. For example, nearly 7 in 10 of respondents find it difficult to minimize their debt, primarily due to unexpected financial emergencies or reduction of income.

Why Should You Trust Elitepersonalfinance

With accuracy and accountability in mind, we pride ourselves on presenting you with the latest information from the most reliable sources. We carefully select data from the largest credit reporting agencies â like FICO, Equifax, Experian, and TransUnion. In addition, we augment our studies with relevant data from the U.S. government, the U.S. Federal Reserve , the Consumer Financial Protection Bureau , and other reputable research institutions.

Moreover, our editorial team carefully vets all of the findings, and sources are present throughout the study.

You May Like: Do You Have To File For Bankruptcy After A Foreclosure

How Much Credit Card Debt Does The Average American Have

Lets continue:

11. American people aged 45-54 have an average credit card debt of $7,670, with 51.7% of those indebted, which is the highest proportion of the age groups.

Median credit card debt is the highest for Americans aged 45-54 at $3,200. Americans younger than 35, on the other hand, have the lowest median credit card debt at $1,900.

In the table below, you can find the median and average debt by age in the US:

| Age | |

| $8,080 | 28% |

12. Americans aged 75 or older have the highest average credit card debt of $8,080, but only 28% of them are charged with credit card debt.

The credit card debt of Americans aged 75 or older rose to 28% in 2019 from 10% in 1989. Over the same period, the median amount owed escalated from $400 to $2,700.

13. Around 34% of people aged 1829 have student loans. Borrowers under 24 owe an average of $16,500.

People aged 35 have the highest average American student loan debt at $42,600 per borrower. The end balance is 287%, which is higher than the value of their original loan.

Student borrowers aged 30-44 owe 49% of the national student loan debt balance, which means $823.2 billion.

14. Even though women have a lower income, they have higher student loan payments than men .

This also shows that men have a lower percentage of the average American student loan debt per person than women. Out of the total national student loan debt, $929 billion belongs to women. The most common reason for this debt is the persistent gender wage gap.

What Is The Biggest Debt In America

The biggest debt in America is mortgage debt with the average American household mortgage debt being $189,586 with the total of $9.44 trillion owed in the US. The next biggest debt is student loans, with the average amount per American household is $46,822. The average auto loan debt is $27,804 and the average per household is $5135.

A study done on budgeting done by the Bureau of Labor Statistics reflects that mortgages & housing are our biggest expense. The most recent numbers from their study show that 33% of our monthly income is going toward housing – which includes mortgage repayment, utilities & bills, repairs & furnishings. However, the largest debt you have can vary by age group and stage of life. For example, people who are younger than 35 have, on average, about $67,400 of debt. The majority of their debt is made up of credit card debt and student loans. But as we look at age groups as they get old and consider their stage of life, it makes sense that mortgage debt would be the main source of debt for households 35-44, as many people buy houses and start families.

Recommended Reading: Can You File Bankruptcy For Free

What Percentage Of Debt Should You Have

What is the right-of-way ratio? Lenders usually say that the average interest rate should not exceed 28 percent, and the interest rate, including all payments, should be 36 percent or less.

What is a good amount of debt to have?

Most lenders say DTI of 36% is acceptable, but they want to give you money so they are willing to cut any damage. Most financial advisers say DTI above 35% means you are heavily indebted.

How much debt is safe to carry?

Rule 28/36 And homes should not spend more than an average of 36% on total loan service, ie mortgage and other loans, such as car loans and credit cards.

Which Generation Has The Most Debt

While we love to point our fingers at one generation, with baby boomers often ridiculously pitted against millennials like high school rivals, its actually Gen-Xers who have racked up the most debt out of modern generations.

If you take a closer look at average debt by age, those in the younger part of Generation X, between the ages of 35 and 44, had $93,700 of debt, with the older half of this generation close to that at $89,900. Studying average American debt by age tells us that those under 35 and over 65 tend to have the lowest amounts of debt, often because theyve not accumulated much debt or have paid it off already, respectively.

Read Also: How Long Does Bankruptcy Affect My Credit Rating

Average Credit Card Debt By Race

People who identified as white reported their families carried an average of $6,940 in credit debt the highest amount of any racial group.

They were followed by “other” which includes Asians, American Indians and people who identify as multi-racial with an average credit card debt of $6,320. Black households carried the least debt with an average of $3,940, which is 37% lower than the nationwide average.

Average Credit Card Debt Statistics Editors Choice

- The average household credit card debt in the US peaked at $7,027.

- A regular US family has accrued a $190,595 mortgage debt.

- Around 6 out of 10 Americans have a FICO score of at least 700.

- from the previous quarter.

- 45.4% of US families are burdened with some type of credit card debt.

- On average, women have 4.5 active credit cards while men have 3.6.

- There are 511.4 million credit cards in circulation in the US.

- The average credit card borrower in Alaska carries the highest credit card debt hitting $6,617.

Don’t Miss: How To Write A Letter Of Explanation For Bankruptcy

Which Are The Most

Levels of educational attainment vary widely across the country. The states with the most bachelors degree recipients age 25 or older are Massachusetts , Maryland , Colorado , and Connecticut . The states with the fewest bachelors degree holders are West Virginia , Mississippi , Arkansas , and Kentucky .

Consider A Personal Loan To Consolidate Credit Card Debt

Consolidating your credit card debt into a personal loan may help you pay your debt off faster. With a debt consolidation personal loan, you make a single payment each month, and your interest rate is fixed, meaning it wont change based on an index. Another benefit: Interest rates on personal loans tend to be lower than credit card rates. This can help lower your overall monthly payment and/or allow you to pay down your debt more quicky.

Take note that personal loans may come with fees, such as an origination fee or paperwork processing fee. Consider these fees when determining whether you might be able to save money with debt consolidation.

Also Check: How Do You File Bankruptcy In Missouri

Americans Added Consumer Debt While Paying Down Credit Card Debt

The average American accumulated $1,700 in additional consumer debt during the pandemic. Also known as personal debt, consumer debt is debt available to everyday people and includes mortgage, credit card, student loan and auto loan debt.

This uptick in consumer debt was primarily caused by increased mortgage debt mortgages as home-buying took off during the pandemic.

Interestingly, this increase in mortgage debt was offset by lower debt. Thirty-six percent of respondents to MoneyGeeks recent financial stress survey reported paying down their credit card balances over the previous six months. In total, Americans paid down $110 billion in credit card debt since the first quarter of 2020, an average of $2,049 per household.

Consider Consolidating Or Refinancing While Interest Rates Are Low

For borrowers with credit card debt and other relatively small debts with high interest rates, consolidating your debts could make them more manageable. Debt consolidation loans roll all of your existing debts into one debt, with one monthly payment and one balance. You could pay less in interest on a debt consolidation loan than you would on a credit card, especially while interest rates are low.

Refinancing could be a smart move for people with larger debts, like mortgages, private student loans, and car loans. Refinancing replaces your current loan with a new loan, and can often help to bring down the interest rate. With interest rates currently much lower than they have been in the past, refinancing could be a smart move to lower your interest costs and make headway on your debt.

Also Check: How To File For Bankruptcy In Indiana Without A Lawyer