Can You Buy A House After Bankruptcy

Yes, itâs possible to buy a house after a bankruptcyâbut having it in your past puts up a major red flag to lenders, said Matt Metcalf, a Denver-based real estate agent and financial expert. Bankruptcies can remain on your credit reports for up to 10 years, so lenders will see the negative mark when pulling your credit during the application process.

The process of qualifying for a mortgage after bankruptcy varies, depending on two major factors.

Letter Of Explanation Due To Bankruptcy And Foreclosure

You will not be denied a home mortgage due to bankruptcy, foreclosure, deed in lieu of foreclosure, short sale. However, mortgage underwriters need a brief explanation for the reason why you filed bankruptcy and/or had a prior housing event. It can be just a few sentences and does not have to be lengthy. There is no right and/or wrong answer. Mortgage underwriters want to just document the reason. Mortgage underwriters are more concerned about rebuilt and reestablished credit after bankruptcy and/or a housing event.

Some common reasons why people filed bankruptcy or had housing event was due to the following:

- periods of unemployment

How To Write Letter Of Explanation To Mortgage Underwriters

When homebuyers apply for a mortgage with prior questionable items on the credit report, mortgage underwriters may need clarification. If underwriters need clarification on the items below, they need a letter of explanation:

- derogatory credit

- judgments

- charged-off accounts

- other items that an underwriter may need clarification, letter of explanation to mortgage underwriters will need to be provided

Don’t Miss: How Many Bankruptcies Has Trump Had

Your Credit Since The Bankruptcy Will Either Support Your Claim Or Deny It

This is another critical point. Even if your bankruptcy explanation letter makes clear that the cause was an extenuating circumstance, and that its in your past, the state of your credit since the bankruptcy will provide the proof.

If you filed for bankruptcy in the recent past , and your credit has been clean since, the lender is much more likely to look upon your application favorably.

But if you have a steady pattern of late payments and collections since the discharge, your credit report will invalidate your bankruptcy explanation letter.

Also, be aware that your overall financial situation will weigh heavily in the lenders decision.

For example, if your bankruptcy was due to income instability, your income documentation pay stubs, W-2s, tax returns, etc. will need to reflect a stable earnings pattern since the bankruptcy.

And one of the best pieces of evidence of recovery from a bankruptcy is a healthy bank account balance. It indicates youve mastered the art of living beneath your means, and theres extra room in your budget to accommodate the new loan payment.

Put another way, while your well-written bankruptcy explanation letter will certainly help your loan application, the substance of your financial profile will be at least as important.

Inconsistency In Mailing Address

Address discrepancies within a loan file are considered high-level red flags for mortgage fraud, Fannie Mae warns.

The lender will need a letter of explanation if it finds any inconsistencies in your identifying documents, such as a different address given in your credit report than on your bank statements and tax returns.

Learn More:

Read Also: Paying Off Chapter 13 Early

Cover Letters Allow You Expose Your Individuality And Also Develop Relationship

A return to has the tendency to be fact-based as well as rather official, yet a cover letter could be instilled with individuality. Don t be scared to infuse personal notes about interests or viewpoints that might aid employers identify if you will certainly suit their society, says Roleta Fowler Vasquez, specialist resume writer and also proprietor of Wordbusters in Fillmore, The golden state. To boost the wow variable of their cover letters, she urges candidates to include a few standout success that put on t appear on the resume.

Laila Atallah, a Seattle occupation counselor and proprietor of Career Counseling with a Twist, concurs that a cover letter can be extra revealing than a resume. The very best cover letters are instilled with energy, character as well as details about the applicant s skills and also success, she says. I get a sense of the person and what they ve accomplished, and it s much easier for me to visualize them in their following task.

Work seekers often make the blunder of sending out a resume without a cover letter, says Ann Baehr, president of Best Resumes of New York in East Islip, New York. This is a missed possibility to establish connection with companies as well as give a sense of that they are past their work experience, she claims.

Whats A Letter Of Explanation

First, let’s go over what exactly underwriting is. During the underwriting stage of a mortgage, the mortgage company decides whether you qualify for a loan by reviewing the financial documents you submitted with your application. Mortgage companies use finance professionals called underwriters to oversee underwriting. An underwriters job is to assess your risk and decide whether youre a good candidate for a home loan.

The information the underwriter sees doesn’t always tell your entire financial story. An underwriter may request a letter of explanation from you if theyre unsure about something they see. A letter of explanation is a brief document you can use to explain anything in your financial or employment documents that might make an underwriter pause. For example, you may need to write a letter of explanation if you have unusual or sudden activity in your credit report or banking statements.

Dont assume your lender wont be able to give you a loan if they need one of these letters. The opposite is often true. They might simply need clarification or more information about your credit report or bank statement.

Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. The Federal Housing Administration , Department of Veterans Affairs and Fannie Mae or Freddie Mac impose such underwriting standards on lenders. Furthermore, lenders that offer jumbo loans may have additional qualification standards.

You May Like: Filing Bankruptcy In Wisconsin

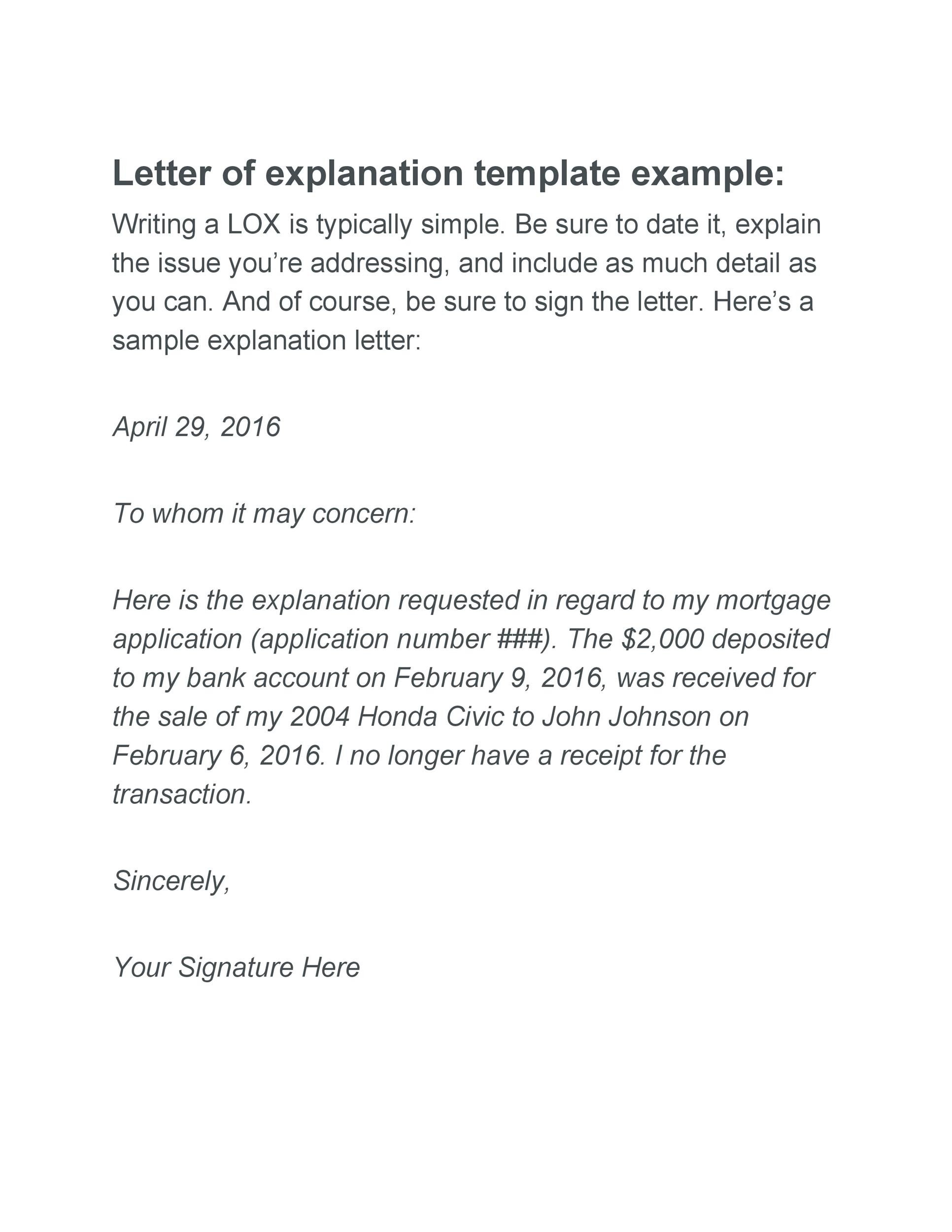

Letter Of Explanation Template

The content of your letter will, of course, depend on your specific circumstances. You can use the following sample letter and replace the details in brackets with your own information and explanation:

Dear Loan Specialist:

Im writing in response to the underwriters request for information regarding from . The reason for my absence from work was .

In support of my explanation, Ive enclosed the following documentation:

If you have any additional questions, please do not hesitate to contact me.

Sincerely,

A Guide To Writing A Letter Of Explanation

6-minute read

May 11, 2021

Your lender might ask you for a letter of explanation during the underwriting process. A letter of explanation consists of short descriptions you can use to fill in the gaps in your paperwork for your underwriter. Letters of explanation might sound like a pain to write, but the truth is that they can actually help you get a loan more easily.

Well explain what letters of explanation are and why you might need to write one. Well also give you a sample template you can use to draft your own.

Don’t Miss: What Is A Bankruptcy Petition Preparer

Debts You’ll Still Have To Pay

These include:

- magistrates court fines

- any payments a court has ordered you to make under a confiscation order, for example, for drug trafficking

- maintenance payments and child support payments, including any lump sum orders and costs that have arisen from family proceedings, although you may be able to ask the court to order that you don’t have to pay this debt

- student loans from the Student Loans Company

- debts you owe because of the personal injury or death of another person, although you might be able to ask the court to order that you don’t have to pay this debt

- social fund loans

Getting A Mortgage After Bankruptcy: The Letter That May Make The Difference

Since filing for bankruptcy protection may shave more than 200 points off your credit score , it stands to reason that you may not be the picture of a good risk when applying for a mortgage. However, that doesnt mean you cant get a loan approved; a good letter of explanation about why you filed for bankruptcy can an important first step in the process.

If you have to write a hardship letter explaining to the prospective lender why you filed, dont panic. You didnt make the decision to file for bankruptcy quickly or easily but there were good reasons to pull the trigger. Now you just have to explain them in a way that assures the lender that you arent planning on doing it again anytime soon.

Now, you are going to have to write a letter that truly explains what happened. A couple of sentences about irreconcilable differences or credit card debt and especially a woe is me, I lost my job story wont be enough to prove your current credibility to a lender. You need to be specific and be able to show documents proving your story is true.

Dont forget to explain to the lender about your efforts to pull yourself out of a bad financial situation. If you filed for Chapter 13, for example, and stuck to the payment plan, share that information. If you got a second job so you could pay back more of what you owed, thats surely a sign of good faith.

You May Like: Renting An Apartment After Bankruptcy

Start The Conversation With A Lender

Whether youre hoping to buy a home in a few months or a few years, know that its worth the wait. This is especially true for those who have filed for bankruptcy in the past and may need to pause their home buying journey as a result.

Interested in learning more about qualifying for a home loan? Contact one of our dedicated mortgage consultants today.

How To Explain A Bankruptcy When Applying For A Mortgage

It’s possible to take out a new mortgage after a bankruptcy, but it’s often difficult. Bankruptcy can cut credit score by 200 points or more. You may have to wait a couple of years after bankruptcy before you can get a good interest rate. Most lenders will also want to know why you filed bankruptcy and if you’re likely to do it again.

Recommended Reading: Dave Ramsey Bankruptcy

The Type Of Bankruptcy You Filed

With Chapter 13 bankruptcy, the debtor creates a plan to pay back some or all of their debts over a period of three-to-five years. On the other hand, consumers who file Chapter 7 bankruptcy discharge their unsecured debts, such as credit cards and medical bills, so the balances go unpaid.

With both types of bankruptcies, youâll need to honor a waiting period, called âseasoning,â after the bankruptcy court closes your case. Because consumers who file a Chapter 13 bankruptcy eventually repay their debts, mortgage lenders tend to look more favorably on themâand they generally donât have to wait as long to apply for a mortgage.

Buying A House After Bankruptcy With Fha Usda And Va Loans

With a bankruptcy on your credit reports, government-backed mortgage programs might appeal to you over conventional loans. These programs tend to âhave much more flexible requirements for credit scores and down payments,â Metcalf said. Plus, you donât have to wait as long to apply once the bankruptcy court discharges your case.

Recommended Reading: Dave Ramsey Engagement Ring Cost

Why You Went Bankrupt

Bank employees and loan officers have seen it all when it comes to personal finance. So while conducting business with a bankruptcy hanging over the proceedings may seem novel to you, it will not be for them. Banks live in the real world, too, and they are managed much like a business. They know financial misfortune can strike everyone, even the most vigilant and thrifty spender.

This letter is your opportunity to lay out the specifics of your case. If it was a medical situation that gutted your bank account, be honest. Without going into any sensitive specifics , its important to be clear. Was it an insurance problem? Did a misdiagnosis lead you to spend money on treatment for something you never had?

Again, the loan officer is going to do their job, but theyre also humans. Chances are they or someone close to them has experienced financial hardship due to a medical emergency. Its a sad statistic, but the fact is hundreds of thousands of Americans declare bankruptcy each year due to medical bills. If thats you, rest assured youre not even close to being alone.

Or if much of your personal wealth is tied to the stock market , even the slightest ripple in the stock market can have a huge impact on your bank account. Banks learned this lesson in 2008, so a clear explanation of your investments and financial strategies will go a long way in their decision.

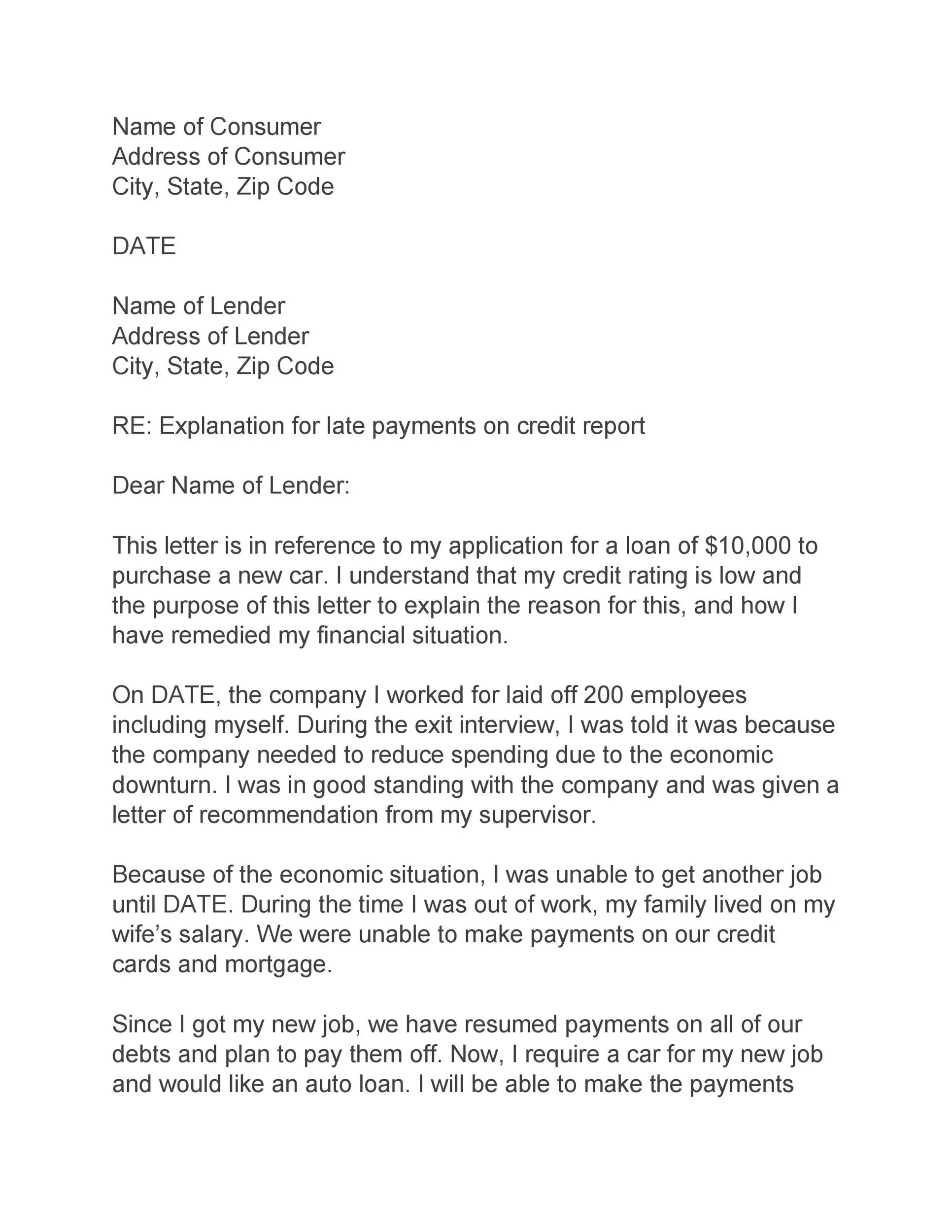

How To Write A Letter Of Explanation

Letters of explanation are a fairly common part of the mortgage application process. Make sure your letter of explanation includes:

- The current date

- The name of your lender

- Your lenders complete mailing address and phone number

- A subject line that begins with RE: and includes your name, application number or other identifying information

- One or more paragraphs that provide information the lender asked for. Be as detailed as possible and include dates, dollar amounts, account numbers, etc.

- Any identifying documentation that backs up your claims

- Your full legal name as it appears on your mortgage application, signed and printed

- Your spouse or partners name if theyre on the loan application with you

- Your full mailing address and 10-digit phone number

- A polite closing

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didnt ask. Be polite but not overfriendly and dont use emotional language.

After you finish writing the letter, edit for typos or grammatical errors. Send the letter in a timely manner to keep your mortgage application on track.

Read Also: Bankruptcy Renting Apartment

Letter Explaining Reasons For Bankruptcy

Somebody who has been forced into bankruptcy may be forgiven for thinking that itâs the end of the world but with more people than ever facing debt problems these days, itâs inevitable that this will also be reflected in the increased number of bankruptcies. However, whilst this will inevitably be poorly reflected upon your credit history at the time, at some stage when you have been discharged from bankruptcy, you may wish to re-apply for a mortgage or some other form of loan or credit and, these days, there are many companies who are willing to lend money to those who have had a bankruptcy order placed upon them in the past. The good news is that a well constructed letter explaining the reasons for the bankruptcy is always liable to go in your favour.

How to Write it

Here is an example of the type of letter you could use to explain the reasons for your bankruptcy.

In response to your letter regarding the reasons for my bankruptcy from which I was discharged 18 months ago, this is in regard to my recent application for a loan with your company.

I have also included supporting documents of evidence to back up the explanation contained within this letter and if you require any further clarification or information, please do not hesitate to get in touch.

Yours faithfully,

Mortgages And Debts Secured On Your Home

Youll need to keep paying your mortgage and any other debts secured on your home – for example, debts secured with a charging order. If you fall behind with the payments, bankruptcy won’t stop your mortgage lender from taking steps to repossess your home.

If you have an income payment agreement or income payment order , tell the official receiver you need to keep paying a secured debt. Ask them if you can pay less under the IPA or IPO so you can keep paying the secured debt as well.

If your home is repossessed and sold, but doesn’t raise enough money to pay off your outstanding mortgage or any other debt secured on it, the remaining debt known as ‘mortgage shortfall’ will no longer be secured. This means you’ll be released from it at the end of your bankruptcy. You’ll also be released from a mortgage shortfall if your home is sold at any time, even after your bankruptcy has ended.

Recommended Reading: Renting After Chapter 7

Loan Officers Will Help Borrowers With Lox

Borrowers going through the mortgage approval process;will oftentimes get requests for letter of explanations by mortgage underwriters. Loan officers will normally write the letter of explanations ; for borrowers. Unfortunately, there are some loan officers that will just ask borrowers to write the letter. My team and I often get calls and inquiries from borrowers on how to write letter of explanations to mortgage underwriters.

Just What To Do Prior To Putting On A Task

While we could debate the relevance of cover letters, there’s no getting around the fact that your resume is still most likely to be the very first point of contact between you and also an employer. There’s no doubt that it should be as solid as feasible in order to encourage a hiring manager to seriously consider you for the position.

Also Check: Kentuckydebtrelief.org Reviews