Check Your Credit Reports

Until April 2021, you can check your reports weekly for free on AnnualCreditReport.com. Your credit scores are calculated using information in your , so any inaccurate negative information can make it even harder for you to dig out of debt. If you find mistakes, dispute credit report errors and get them corrected.

Of course, there will be negative information that is accurate. Bankruptcy wipes out or reorganizes debts, but it doesnt wipe your credit reports clean. Your reports will show a Chapter 7 bankruptcy for 10 years, or a Chapter 13 for 7 years. Late payments and debts that go to collection also remain on the reports until seven years after the delinquencies. You’ll just need to wait for that information to age off of your reports.

Find Out How Bankruptcy Initially Hurts Your Credit Score But Might Help You Rebuild Credit Over The Long

Updated By Amy Loftsgordon, Attorney

Bankruptcy laws were enacted to provide you with relief from your creditors by giving you a fresh start. This fresh start usually comes with a high price, namely, a major hit to your credit. But there are ways that bankruptcy can actually help your credit in the short and long term. This will depend on your , financial circumstances, and other factors.

Can You Get Credit After Bankruptcy

Although it may be harder to find a lender willing to offer you a competitive product, there are still ways to get credit after bankruptcy. Some types of credit you could receive include:

- Car financing. Chern says that its possible for a Chapter 7 debtor to finance a car the day after filing. Additionally, a Chapter 13 debtor may be able to finance a car while the repayment plan is still in effect, although the trustees permission is required after showing that the car is necessary to complete the debt repayment.

- Conventional mortgage. Most experts say that it will take 18 to 24 months before a consumer with re-established good credit can secure a mortgage loan after personal bankruptcy discharge. Credit-impaired borrowers should prepare to pay interest rates that are 2 points to 3 points over conventional rates.

- FHA-insured mortgage. Chapter 13 filers can get an FHA-insured mortgage if theyve made timely payments for one year and the debtor has received the courts permission. Debtors with a Chapter 7 bankruptcy discharge must wait at least two years after discharge and establish a history of good credit.

You May Like: Nortel Epiq

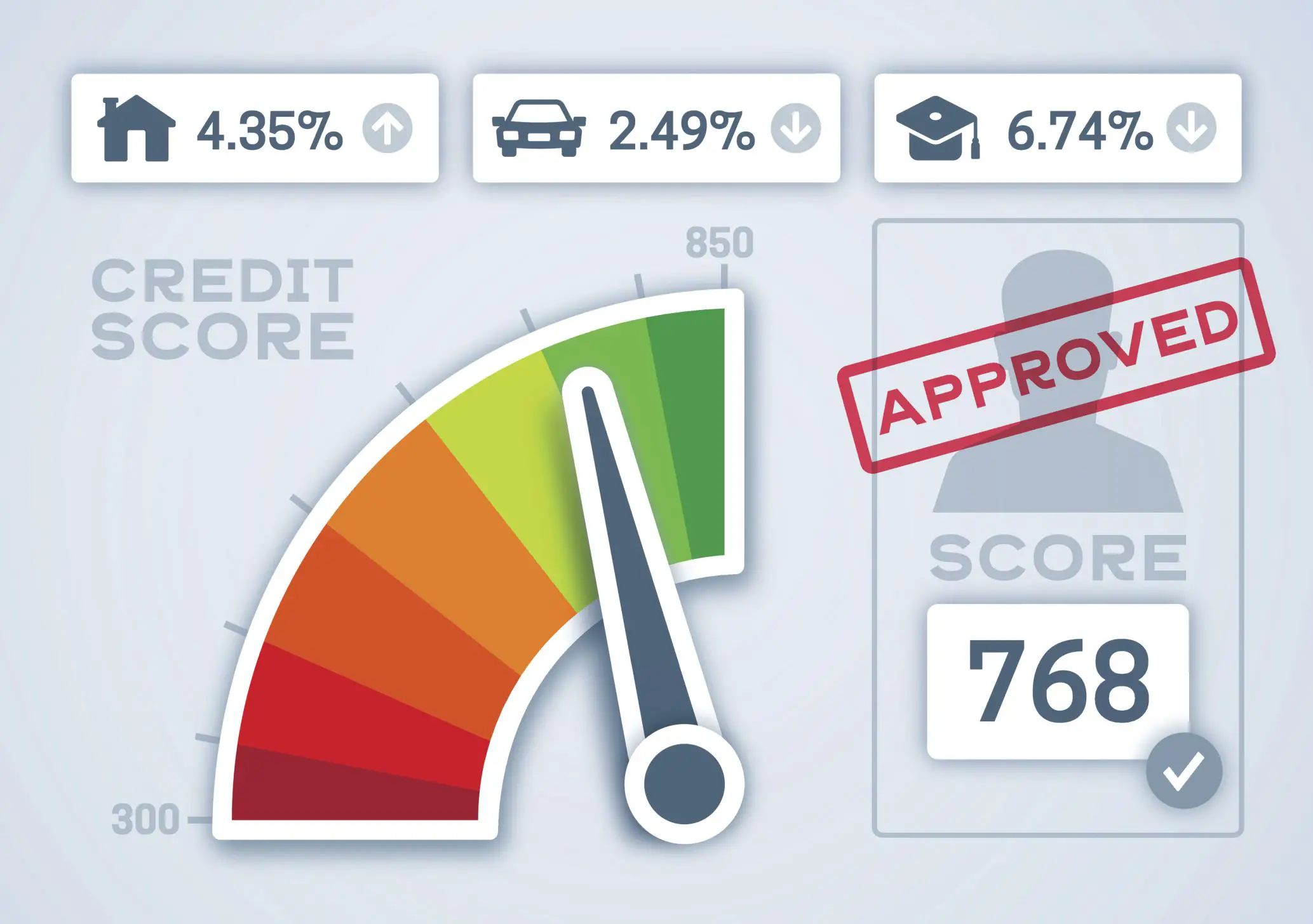

What Is A Credit Rating

Your credit rating is derived from your credit file, which contains information about your credit balances, limits, and payment history , as well as personal details such as your occupation and employment history.

Canada’s largest credit bureau, Equifax, uses a simplified scale of R1 to R9R1 being a perfect scorewhile TransUnion measures credit scores on a scale of 300 to 900, with 650 generally considered to be the dividing line between good credit and poor credit. Declaring bankruptcy will likely reduce your credit rating to the lowest level.

Think Twice About Working With Credit Repair Agencies

Instead of paying a credit repair agency, consider using that money to increase your emergency fund and savings. Focus your efforts on the habits and circumstances that led to your bankruptcy and how you can change them.

There are many unscrupulous agencies out there that will claim they can remove a bankruptcy or fix a credit report, says Samah Haggag, a senior marketing manager for Experian. There is nothing a credit repair organization can do that you cannot do yourself.

Why this matters: Credit repair agencies take the heavy lifting out of credit-building, but they charge fees. If youre willing to put in the work of checking your credit reports and disputing errors, you can save that money and use it to continue paying down existing debt.

How to get started: Take a look at your budget and request copies of your credit report yourself before looking into credit repair agencies.

Don’t Miss: How Many Times Has Trump Claimed Bankruptcy

Can I Apply For A Credit Card Before My Bankruptcy Is Discharged

Technically, yes, you can apply whenever you want to. But we don’t recommend it for the reasons outlined above. You’re unlikely to qualify for most cards before your bankruptcy is discharged, and each check could damage your score.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

How We Calculate Rewards: ValuePenguin calculates the value of rewards by estimating the dollar value of any points, miles or bonuses earned using the card less any associated annual fees. These estimates here are ValuePenguin’s alone, not those of the card issuer, and have not been reviewed, approved or otherwise endorsed by the credit card issuer.

Keep Up Payments With New Credit Cards

Payment history is the most important factor that impacts your credit score. Its crucial, especially after bankruptcy, to make timely payments once you have new credit.

You can stay on top of your payments by:

- Enrolling in autopay

- Paying off your card multiple times a month

- Setting reminders to make payments

- Arranging your personal finances to help you pay off the full balance each month

Read Also: How To Claim Bankruptcy In Massachusetts

Updating Bankruptcy To Show Discharged

Once discharged, the bankruptcy filing listed on your credit report will be . Any accounts that were included in the bankruptcy will also be updated by your lenders to show they have been discharged and the balance owed is now zero.

Although you will no longer be responsible for paying those balances, the history of the accounts will remain, including any late payments made on the account.

How Much Will A Credit Score Go Up After Bankruptcy Comes Off

ByJennifer Quilter | Submitted On November 25, 2009

Yes, your credit score will go up after a bankruptcy comes off your report, but how much it will go up is largely dependent on what you’ve done since you initially had your debts discharged.

Your rating will likely go up somewhere between seventy five and one hundred and fifty points, but again, this is largely dependent on what’s happened in your recent financial history. Shortly after your discharge is complete it’s important to start working on rebuilding your finances. You can start off with a secured credit card at your bank, work up to small secured or unsecured loans, and over the years graduate to unsecured cards and other endeavors, always making sure to make your payments on time and in full.

If you’ve done all of this over the years then your rating has probably already improved a great deal, and you probably have a good rating already. Once your bankruptcy comes off your credit score you are likely to go up to a great score, and have very few financial problems in the future.

On top of raising your rating seventy five to a hundred and fifty points, having this off your report will greatly help you when you go to apply for loans, insurance, or employment. When people look into your financial background a discharge on your report stands out as a giant black mark, which you will no longer have with you.

Don’t Miss: How Many Times Has Trump Filed Chapter 11

Get A Secured Credit Card

Reducing your dependence on credit cards can be an important step toward rebuilding credit after bankruptcy. However, the strategic use of secured credit cards can also help you begin to repair your trustworthiness in the eyes of lenders.

Taking out a secured credit card requires making a refundable security deposit and then borrowing against it. While these cards tend to come with high interest rates, if they report to all three credit bureaus, theyre a great option to show responsible credit behavior until youre better qualified for a traditional card with more competitive terms.

Some secured cards even allow you to graduate to an unsecured card after consistent on-time payments. This is a benefit since you wont have to apply for a new, unsecured card when your credit improves,

Keep in mind, however, that applying for a secured card doesnt guarantee acceptance, so take time to research the providers requirements before applying. If possible, choose a provider that offers prequalification so you can see whether youre likely to qualify before agreeing to a hard credit check that can further damage your score.

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Also Check: How To File Bankruptcy In Wisconsin

Myths That May Stop You From Getting To The 800 Club

1st Myth: Bankruptcy will ruin your credit forever and ever.

The truth is you can see a 800 credit score after bk. Bankruptcy will hurt your credit in the short term. In general cases, a BK7 can be on your report for about 10 years.

But this does not mean you cant rebuild credit, fix current inaccuracies and continue to practice good financial habits.

If the BK itself cant be removed, you still can take actions elsewhere to counteract the negative effect its having on your credit report.

And, if you get ahead of it, you can speak to an attorney about what a bankruptcy will do to your credit so as to minimize any damage.

Related: Nolo helps consumers and small businesses find answers to everyday legal questions. Visit Nolo.com today for your legal needs

2nd Myth: ALL Bankruptcy info will stay on your credit report for ten years

Actually, only the public record of a BK7 lasts for ten years. Other bankruptcy references stay on your report for seven years, like:

- Trade lines that state account included on bankruptcy

- Third-party collection debts, judgments and tax liens discharged through BK

- Chapter 13 public record items

3rd Myth: You will have poor credit as long as the bankruptcy information stays on your CR

Actually, you can expect a lower score after your bankruptcy. But you can rebuild your credit with proper management and smart tactics.

You can make moves to 800 credit score after bankruptcy. It may take 2-4 years depending on your situation, still, it can be done.

Ideas Pertain If You Decide Tove Experienced Bankruptcy Proceeding

Notice our actions below to discover how to request a Vanquis card after case of bankruptcy.

When you apply, you should use a qualifications examiner, that will furnish you with an indication of whether your application could be acknowledged.

This willnt impair your credit score.

Were going to show your supply from the help and advice were required to assist you in deciding.

Condividi questa storia, scegli tu dove!

Recommended Reading: Chapter 13 And Apartment Lease

What Should You Do To Improve Your Credit Score After A Bankruptcy

After you have filed for bankruptcy, it will be very difficult for you to be approved for any type of credit, including regular unsecured credit cards. So, you should ease back into borrowing money by applying for a secured credit card. A secured card is just as good for your credit as is an unsecured credit card, but there is a difference. With a secured credit card, your credit limit is determined by a security deposit that you give the issuer.

For example, if you want a $500 credit limit, the card issuer will ask you for a $500 deposit. The security deposit is kept by the bank as collateral in the event that you fail to repay your credit card. Usually, if you use the credit card and make all of your payments on time, the card issuer will return the security deposit to you within 12 to 18 months.

Dont be discouraged from applying for a secured credit card after your debt has been discharged. Its one of the greatest ways to build a good credit history after bankruptcy. That said, make sure to make all of your payments on time and dont fall back into the bad habits that cause you to file for bankruptcy the first time.

Here are some quick tips on improving your credit score:

So How Can A Bankruptcy Filing Possibly Help My Credit Rating

Think of your credit report like a timeline that dips down when negative information is reported and steadily goes up with every on-time payment you make. After a while, the bankruptcy filing will be nothing more than a blip in your timeline.

Remember, your credit history is ⦠well ⦠history. What you do to improve your personal finances today matters more than what you did last year! Letâs take a look at some of the things you can do to build good credit after a bankruptcy filing.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Buying A Car Or House After Chapter 7 Bankruptcy

Many people are surprised to learn that filing bankruptcy won’t derail a car purchase or homeownership for long. If the bankruptcy helps clean up your credit faster than you’d be able to do on your ownas it does for many without the means to pay off outstanding debtsyour dream might be closer than you imagine. Specifically, if you take steps to rebuild your credit, it’s possible to get relatively reasonable interest rates when buying a new car within one to two years after bankruptcy. Securing a home loan within four years is well within reachand some people start the home purchasing process in as few as two.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Rebuilding Your Credit Score

Your ability to borrow is dependent on more than just one item on your credit report. A past bankruptcy is one factor, but a potential lender will review other factors including your income, work history, living situation, and other credit you have re-established.

If you want to rebuild your credit rating after bankruptcy, it is recommended that you do the following:

Don’t Miss: Can Bankruptcy Stop A Judgement

Filing Bankruptcy After Defaulting On Your Accounts

Most people who file for bankruptcy have already defaulted on making payments on their credit cards and/or loans and so they have already caused significant damage to their credit.

If you file for bankruptcy after defaulting on several of your accounts, you will notice a smaller drop in your credit score because your credit score has already taken a hit from your previous defaults. The lower your credit score, the less damage a bankruptcy will do to your credit because youve already tanked it.

On the other hand, if you file for bankruptcy prior to defaulting on your loans and missing payments on your credit cards, you will likely experience a much larger drop in your credit score when you file for bankruptcy. So, the higher your credit score, the bigger the drop in your credit score when you file for bankruptcy.

How Long Does Bankruptcy Stay On Your Credit Report

According to Equifax, Canadas largest credit reporting agency, a first time bankruptcy will appear on your credit report for six years after your date of discharge. This means if you are bankrupt for the minimum period of nine months, your bankruptcy will appear on your credit report for nine months plus six years, or almost seven years in total.

A second bankruptcy appears on your credit report for 14 years.

Read Also: Epiq Bankruptcy Solutions Llc Scam

Bankruptcy May Help Relieve Your Debt Obligations But It Will Impact Your Credit For Years

Bankruptcy is a special legal proceeding you can use to reorganize or get rid of your debt, depending on your financial situation. Bankruptcy can be helpful if youre overwhelmed with financial commitments, but it could also negatively affect your credit. A bankruptcy will generally stay on your reports for up to 10 years from the date you file.

I refer to bankruptcy as kind of Armageddon on someones , says Freddie Huynh, vice president of data optimization for Freedom Debt Relief.

The good news is your credit can gradually heal if you take the right steps. Heres what can happen to your credit reports when you file for bankruptcy.

Seek A Credit Product For Your Situation

Your pre-bankruptcy payment history will make you look like an extremely risky borrower to lenders. You can fix that problem by providing extra assurances that they wont lose money by lending to you.

Here are some credit products designed to do that as well as other ways to improve your financial profile:

Get a secured loan or credit-builder loan: This comes in two varieties, and most often is offered by credit unions or community banks. One kind of secured loan involves borrowing against money you already have on deposit. You wont be able to access that money while youre paying off your loan. The other kind can be made without cash upfront, though the money loaned to you is placed in a savings account and released to you only after you have made the necessary payments. In return, the financial institution agrees to send a report about your payment history to the credit bureaus.

Get a secured credit card: This kind of card is backed by a deposit you pay, and the credit limit typically is the amount you have on deposit. A secured card often has annual fees and may carry high interest rates, but you shouldnt need it for the long term. It can be used to mend your credit until you become eligible for a better, unsecured card.

This route wont lift a score by nearly as much as the other methods, because authorized users dont have ultimate responsibility for repaying debt. But this path wont hurt, so you may want to pursue it.

Don’t Miss: What Is A Good Bankruptcy Score