Types Of Bankruptcy Discharges

Individual debtors can file for Chapter 7 or Chapter 13 bankruptcy protection. The trustee will liquidate your nonexempt assets and divide the proceeds among your creditors in a Chapter 7 bankruptcy. Any debt that remains will be discharged or erased.

You’ll enter into a payment plan over three to five years that repays all or most of your debts if you file for Chapter 13 protection. Any debt that remains at the end of your repayment plan will be discharged.

A Chapter 13 bankruptcy allows some debts to be discharged that can’t be discharged in Chapter 7 proceedings. These include marital debts created in a divorce agreement , as well as court fees, certain tax-related debts, condo and homeowners’ association fees, debts for retirement loans, and debts that couldn’t be discharged in a previous bankruptcy.

Maximizing The Benefits Of Bankruptcy

Ultimately, what you can expect to happen next will all depend on you. Your decisions will dictate how quickly you recover from bankruptcy and how easily you can avoid common pitfalls.

To maximize both the short-term and long-term benefits of this financial fresh start, we recommend the following steps:

Bankruptcy has a clear beginning and end. However, just like you need to prepare for bankruptcy, you must also plan for life after bankruptcy. With thoughtful preparation and intentional financial decisions, you can slowly build solid financial foundations that clear the way toward a prosperous future.

Chapter 7 Bankruptcy Exemptions In North Or South Carolina

Here is a list of the property you can generally protect from creditors when filing for Chapter 7 bankruptcy in North or South Carolina:

- Property used as your residence

- Your car

- Your pension and retirement accounts

- Your life insurance

- Public benefits

- Your personal property

Our bankruptcy team can represent you and protect your assets when filing for Chapter 7 bankruptcy.

For a legal consultation, call

Also Check: When Can You File Bankruptcy Again

Which Debts Are Dischargeable

Below is a list of commonly discharged debts.

- collection agency accounts

- social security overpayments, and

- veterans assistance loans and overpayments.

Note about fraud and utility deposits. Any debt-related misconduct or fraud can render an otherwise dischargeable obligation nondischargeable. Also, a utility provider cannot refuse to provide service because of a bankruptcy filing however, the provider can charge a reasonable deposit to ensure future payment. Find out about utility shut-offs and Chapter 7 bankruptcy.

Also Check: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Va Loan After A Chapter 7 Bankruptcy

Below are some of the basic requirements to get a VA loan after a chapter 7 bankruptcy discharge:

- The mandatory waiting period to get a VA loan after a chapter 7 bankruptcy is 2 years.

- VA loans do not have a minimum credit score requirement. It will depend on the lenders minimum credit score requirement, which often is around 620.

- VA loans to not require a down payment.

- In order to be eligible for a VA loan, you must be a veteran, or active duty military.

Would you like to see if you qualify for a VA loan? We can match you with a mortgage lender that offers VA loans in your location.

Recommended Reading: How To Get A Credit Card With Bankruptcy

Which Is Better Chapter 7 Or Chapter 13

Most people prefer Chapter 7 bankruptcy because, unlike Chapter 13 bankruptcy, it doesn’t require you to repay a portion of your debt to creditors. In Chapter 13 bankruptcy, you must pay all of your disposable incomethe amount remaining after allowed monthly expensesto your creditors for three to five years.

Let Donotpay Help You With Excellent Legal Advice When Filing For Chapter :

DoNotPay works diligently to streamline the Chapter 7 discharge timeline. As the premier robotic lawyer, we possess the legal knowledge to move you forward in the process reasonably and efficiently.

Just follow these five simple steps:

And that’s it! Once done, the court will give you:

- The bankruptcy case number

- Your bankruptcy trustee’s name

- The location and date and time of your meeting with your trustee

- At this point, you’ve completed the filing of your case. At this point, the automatic stay will protect you from all debt collectors, and you may breathe a sigh of relief.

Your trustee will then contact you for further financial documents you will need to provide. Make sure to attend your meeting and complete the post-filing bankruptcy debtor’s course!

Recommended Reading: How To Tell If Someone Filed Bankruptcy

How Do I Keep My Car In Chapter 7

Keeping a Car in Chapter 7 Bankruptcy By Reaffirming the Car Loan. Many lenders will let you keep a car after bankruptcy as long as you’re current on the payment and continue to make the payment after the case ends. The lender will give you the title when you pay the amount due under the discharged contract.

How Do I File For Chapter 7 Bankruptcy On My Own

Filing for Chapter 7 bankruptcy requires a few steps on behalf of the filer.

This includes:

Read Also: What Is Epiq Bankruptcy Solutions Llc

Can A Debtor Receive A Second Discharge In A Later Chapter 7 Case

The court will deny a discharge in a later chapter 7 case if the debtor received a discharge under chapter 7 or chapter 11 in a case filed within eight years before the second petition is filed. The court will also deny a chapter 7 discharge if the debtor previously received a discharge in a chapter 12 or chapter 13 case filed within six years before the date of the filing of the second case unless the debtor paid all “allowed unsecured” claims in the earlier case in full, or the debtor made payments under the plan in the earlier case totaling at least 70 percent of the allowed unsecured claims and the debtor’s plan was proposed in good faith and the payments represented the debtor’s best effort. A debtor is ineligible for discharge under chapter 13 if he or she received a prior discharge in a chapter 7, 11, or 12 case filed four years before the current case or in a chapter 13 case filed two years before the current case.

Should I File For Chapter 13 After Filing For Chapter 7

If you file Chapter 13 at least four years after filing Chapter 7, you can have a very low monthly Chapter 13 payment plan and receive a full discharge of all remaining balances after you complete the three- to five-year plan. For example, you could pay as little as $100 a month for three years inside of Chapter 13, paying very little to your creditors and yet still discharging the remaining balances owed.

This may be a good option for people who have student loan debt, certain types of income tax debt and child support payments to make, says Sean Fox, president of Freedom Debt Relief. These things cannot get discharged in a Chapter 7 bankruptcy.

Also Check: Does Bankruptcy Clear Tax Debt In Canada

What Happens If I Have Property I Can’t Keep

If you have assets that are not exempt, you’re required to turn those over to the trustee assigned to your case. The trustee’s job is to gather the nonexempt assets, sell them, and distribute the proceeds to your creditors who filed valid proof of claims. If your case is complicated, it can take the trustee months, or in rare cases, even years to track down the property and liquidate it.

The trustee may need your help in gathering the property. You have a duty that continues throughout the case to cooperate with the trustee and the court, or you risk the court revoking your discharge. Failing to cooperate means that you’ll likely experience the worst possible outcome: to lose your nonexempt property and lose almost any benefit that you would gain from the bankruptcy discharge.

Debt Discharge Comes After Selling Off Assets

Chapter 7 bankruptcy often involves the liquidation of assets in order to pay past debts. Only after this process is completed can you have qualifying debts discharged. Some property is protected from liquidation by federal or state bankruptcy exemptions. In fact, many people who file for Chapter 7 can keep a majority of their property. It will be up to your attorney and bankruptcy trustee to decide what you can keep, what deals you can make with the creditor, and what you need to give up in your bankruptcy case.

Once assets are liquidated, the courts tend to discharge debts right away. In the whole Chapter 7 bankruptcy process, this happens about four months after you first file in bankruptcy court. Keep in mind you need to complete educational classes on debt management in between filing and receiving the discharge, or the judge may dent your debt discharge.

Also Check: How To Declare Bankruptcy In Victoria Australia

Navigating Your Bankruptcy Case

Bankruptcy is essentially a qualification process. The laws provide instructions for completing a 50- to 60-page bankruptcy petition, and because the rules apply to every case, you can’t skip a step. We want to help.

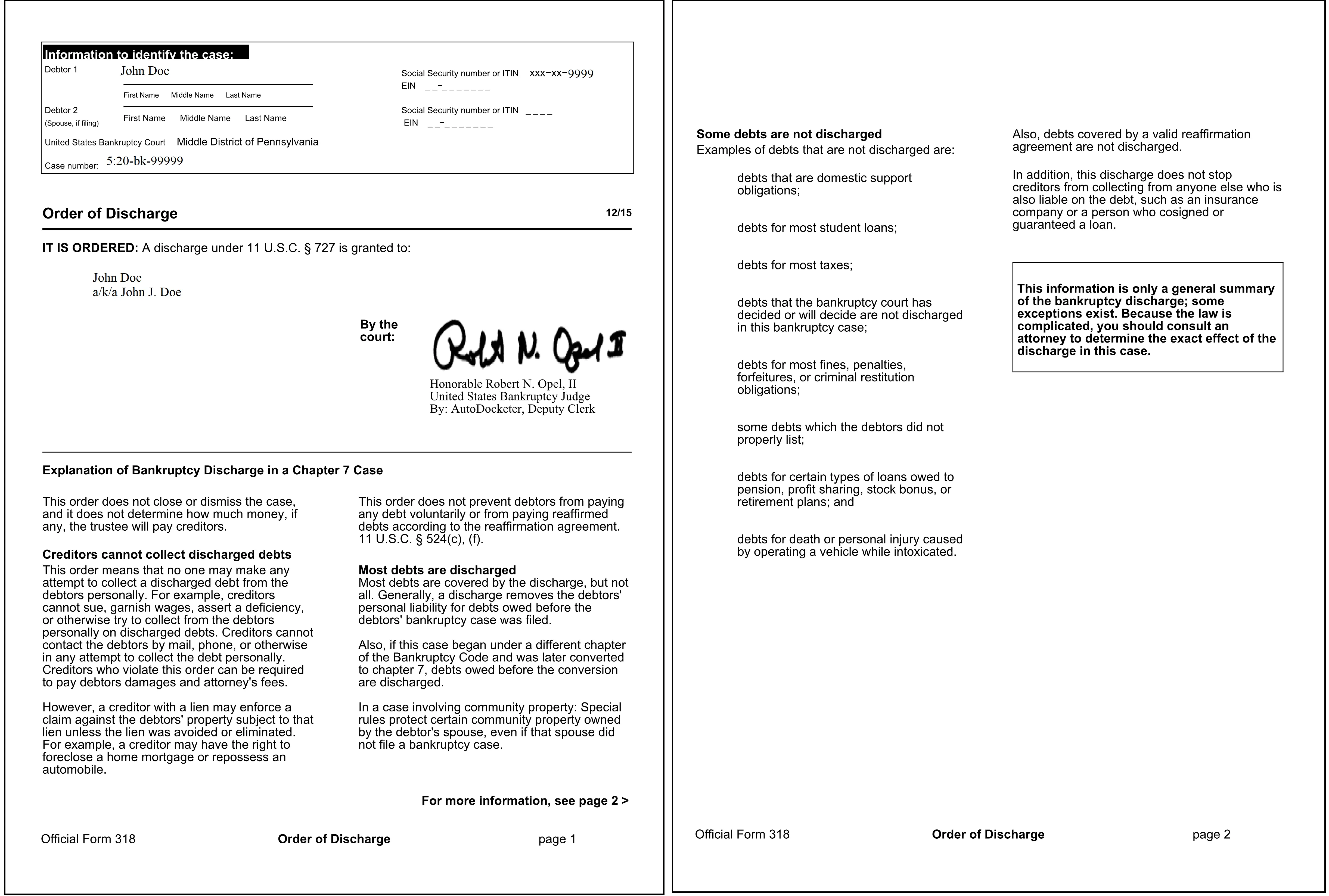

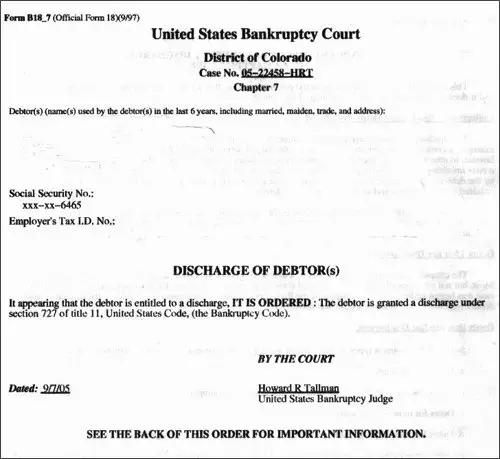

Below is the bankruptcy form for this topic and other resources we think you’ll enjoy. For more easy-to-understand articles, go to TheBankruptcySite.

|

More Bankruptcy Information |

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Asset Chapter 7 Cases Take Longer

If the case involves assets the trustee needs to sell, the case could go on for months or years after the discharge. The amount of time will depend on whether the Chapter 7 trustee needs to file lawsuits against creditors or others or sell assets like real estate, vehicles, or businesses.

Once the trustee has a pool of funds, the court will ask the for what the debtor owes. The trustee will file objections with the court to any claim that is deficient or improper, and the court will hold hearings on them. The trustee mails checks to those creditors with allowed claims and will file a report after distributing funds. Only then will the court close the case.

Also Check: Can You Get A Mortgage Loan After Bankruptcy

Your Bankruptcy Discharge Date

5 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so well never ask you for a credit card.Explore our free tool

In a Nutshell

Obtaining a bankruptcy discharge is the primary goal of every individual who files bankruptcy. The discharge date is the most important date in a personal bankruptcy, second only to the date the case was initially filed. Letâs take a look at 4 things you should know about your bankruptcy discharge, when your discharge will be granted by the bankruptcy court, and how to figure out the date of your discharge even if you canât find your paperwork anymore.

Obtaining a bankruptcy discharge is the primary goal of every individual who files bankruptcy. The discharge date is the most important date in a personal bankruptcy, second only to the date the case was initially filed. Letâs take a look at 4 things you should know about your bankruptcy discharge, when your discharge will be granted by the bankruptcy court, and how to figure out the date of your discharge even if you canât find your paperwork anymore.

What Our Past Bankruptcy Clients Have To Say About Us

Our team is passionate about helping our bankruptcy clients get back on track. Here are just a few Google reviews reflecting our dedication and commitment to our clients:

Simply put, Caleb did everything that I could possibly have expected and more. Even in the years following the bankruptcy, Caleb and Sandie went way above and beyond to help us with every aspect of the process. You will not find better people. John

Informativethere when I emailed. Understanding without judgment.

I am very satisfied with Mr. Farmer and his pleasant staffMrs. Ann Doty never let me down5 stars. Sharon

Don’t Miss: What Is A Cram Down In Bankruptcy

Pros And Cons Of Chapter 7 Bankruptcy

Filing for bankruptcy is serious business, so its important that you understand the benefits and risks before beginning the process.

| Pros | Cons |

|---|---|

|

Can offer a fresh financial start and your credit score may start to go up after your debt is discharged You may be able to keep certain exempt assets Collection efforts by your creditors must stop as soon as you file |

May impact your ability to get credit, buy a home or car and rent an apartment for some time Can remain on your credit report for up to 10 years You may lose some of your assets, such as vehicles, jewelry and real estate |

In order to file Chapter 7, you must be able to pass a means test, which is designed to determine whether you have the means to repay a portion of your debts. The process requires you to provide information about your income, expenses and debt, and if you dont pass, your case may be converted to Chapter 13 or be dismissed altogether. Additional information on means testing is available through the U.S. Department of Justice.

But just because youre eligible doesnt mean filing for bankruptcy is the right choice for your financial situation. Chapter 7 bankruptcy may make sense for people who:

Bankruptcy: Can My Chapter 7 Discharge Be Revoked

Most debtors believe that once they receive a discharge in bankruptcy and their case is closed they can put their troubles behind them. While thats true almost all the time the bankruptcy code does leave the door open for creditors to complain that the discharge was obtained as a result of fraud. Like many other provisions of the bankruptcy code the timeframe for bringing these actions is somewhat compressed.

The procedure for debtors obtaining a discharge in bankruptcy is fairly straightforward. At the beginning of the bankruptcy case the debtor submits schedules of assets and liabilities and a statement of financial affairs. These documents attempt to accurately and completely portray the debtors financial condition. The debtor signs these documents under penalty of perjury and they become open to the public.

Approximately 30 to 40 days after filing a case the debtor meets with a Chapter 7 trustee. Creditors and the trustee then have 60 days after the first meeting of creditors to complain to the bankruptcy court that the debtor should not receive a discharge or that individual claims should not be discharged and should survive the bankruptcy case. This 60 day period is strictly enforced and if no complaints are filed during that time the bankruptcy court will promptly award the debtor a discharge.

Posted

Recommended Reading: What Does Bankruptcy Do To Student Loans

When To Declare Bankruptcy: 8 Questions To Ask Yourself

Most people take their financial obligations seriously and want to pay their debts in full, but knowing when to file bankruptcy and when to negotiate or use another strategy can help put you on the road to financial health.

Here are a list of questions that can help you assess your financial health and give you insight into whether bankruptcy may be right for you. You should also discuss these questions with an attorney.

What Debts Can’t Be Discharged

Depending on which type of bankruptcy is filed, there are certain types of debts that cannot be discharged. The following types of debt are not dischargeable under the specific chapters listed below.

- Debt secured by a lien

- Court costs

- Debts that result from you maliciously or willfully injuring another person or entity

- Debt that results from death or personal injury while driving under the influence

- Mortgages

- Debt that results from death or personal injury while driving under the influence

- Criminal fines

The following debts can be discharged, but the discharge may be stopped if a creditor files a motion in court requesting that the debt be declared non-dischargeable.

- Debt that was a result of fraud

- Civil court judgements

Don’t Miss: Can Bankruptcy Prevent You From Getting A Job