Apply After Reducing Your Debt

If youre hesitant to apply for a loan with a high DTI, it may be worth it to simply take time to pay down your debt and prepare to apply for a mortgage in the future. If youd rather avoid the risks of non-conforming loans, this is your safest and most economical option. There are plenty of ways to go about this, including paying off your highest interest debts first, extending loan terms and even looking into loan forgiveness.

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

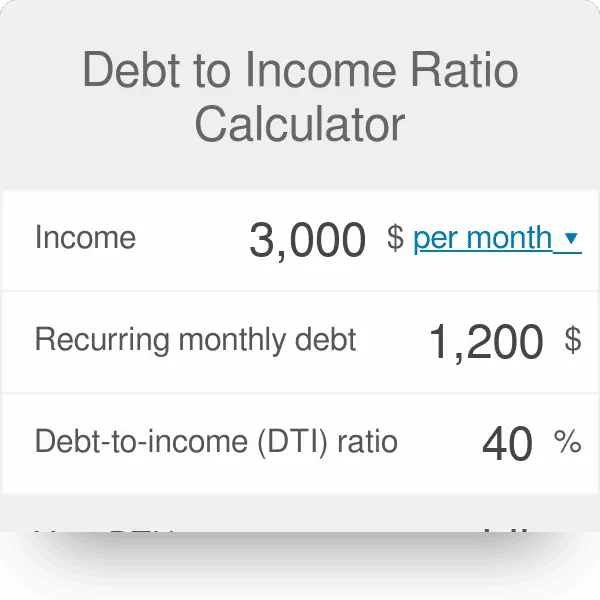

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Don’t Miss: How To File Bankruptcy Chapter 7 Yourself In Indiana

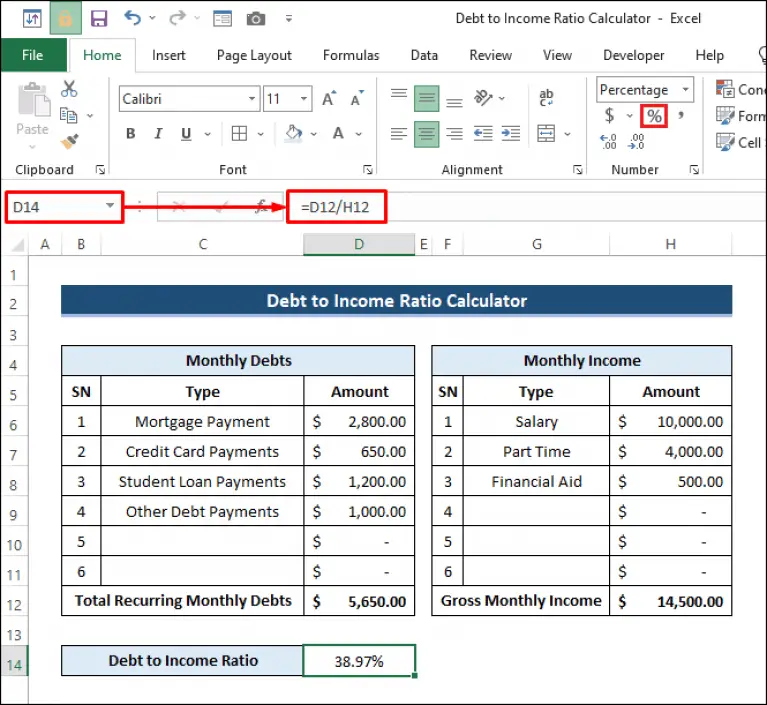

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Read Also: What Is The Chapter 13 Bankruptcy

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Read Also: What Happens If You File Bankruptcy On Your Home

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowners income and the typical local home value.

You May Like: How To File Bankruptcy On Credit Cards Only

What Is Included In Your Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, , and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like rent, health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

What is your front-end ratio?

The front-end-DTI ratio, also called the housing ratio, only looks at how much of an applicants gross income is spent on housing costs, including principal, interest, taxes and insurance.

What is your back-end ratio?

The back-end-DTI ratio considers what portion of your income is needed to cover your monthly debt obligations, including future mortgage payments and housing expenses. This is the number most lenders focus on, as it gives a broad picture of an applicants monthly spending and the relationship between income and overall debt.

A general rule would be to work towards a back-end ratio of 36% or lower, with a front-end ratio that does not exceed 28%.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Recommended Reading: Remove Bankruptcy From Public Record

The Bottom Line: Dti Is An Important Gauge Of Your Ability To Repay And Is Important To Your Prospective Lenders

DTI is an important measure of a credit applicants financial health and sustainability and can make or break whether you qualify for a loan. While having a high DTI ratio isnt the end of the world, lowering it can help you qualify for better loans and lower interest rates.

To learn more about improving your financial stability, check out our guide to building excellent credit.

How Is The Debt

Also Check: What Is A Bankruptcy Restrictions Order

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Monitor Your Dti And Your Credit For Better Access To Credit

Even if you don’t anticipate needing to apply for credit anytime soon, it’s a good idea to keep an eye on your DTI and your credit score to make sure you’re ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian’s free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You’ll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Read Also: Homes For Sale Near Em

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

Recommended Reading: What Is The National Debt Of Usa

Pay Off Your Most Expensive Loan First

Your most expensive loan is the loan with the highest interest rate. By paying it off first, youre reducing the overall amount of interest you pay and decreasing your overall debt. Then, continue paying down debts with the next highest interest rates to save on your overall cost. This is sometimes referred to as the avalanche method of paying down debt.

Its Important To Have A Healthy Debt To Credit Ratio

Debt to credit ratio is one of the most critical factors used to determine your credit score. By using the formula provided in this article, you can quickly and easily calculate your credit utilization rate and use this information to adjust your spending practices as needed.

At Camino Financial, we operate on the motto, No Business Left Behind. Thats why we offer small business loans with lenient requirements, competitive rates, and excellent terms. Our loans will help you reach success.

Want to learn more?

You May Like: How Often Can You File Bankruptcy In Indiana

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

Recommended Reading: Liquidation Pallets New Hampshire

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Don’t Miss: What Is A 341 Meeting In Bankruptcy

Example Of A Dti Calculation

Here’s a look at an example of a debt-to-income ratio calculation.

- $1,000 mortgage

- $200 minimum credit card payments

- $400 other monthly debt obligations

She has the following gross monthly income:

- $4,000 salary from her primary job

- $2,000 from her secondary job

Debt-to-income ratio = $2,300 / $6,000 = 0.38

Now multiply by 100 to express it as a percentage:

0.38 X 100 = 38%

Less debt or a higher income would give Mary a lower, and therefore better, debt-to-income ratio. Say she manages to pay off her student and auto loans, but her income stays the same. In that case the calculation would be:

Total recurring monthly debt = $1,600

Gross monthly income = $6,000

Consumer Financial Protection Bureau. “Debt-to-Income Calculator,” Pages 1-3.

The Carr Report: Calculating Your Debt

- Courier Newsroom

When it comes to purchasing real estate, the most important 3 factors in determining desirability and homes value is location, location, location. Most people know that. However, many people dont know this. Whats the next most important factor when determining desirability and value of real estate? That would be square footage. Size does matter!

When it comes to qualifying for a mortgage to purchase a property, what are the most important three factors in determining eligibility? Some would say credit, credit, credit. Credit is a measure that lenders use to evaluate a persons willingness to repay.

Thin credit or bad credit is the biggest stumbling block to people being approved for a mortgage. Credit aside, what do you think is the second biggest reason people fail to qualify for a mortgage? Based on the title of this article, Im sure you got it right: Debt-to-income ratio. The second most important factor in determining ones eligibility for a mortgage is what lenders refer to as ability to repay. Two things are being evaluated when determining ability to repay: 1. Source and Stability of income. 2. Debt-to-income ratio.

Debts that are included in your DTI:

- Mortgage principal, interest, taxes and insurance

- Personal Care, etc.

Don’t Miss: Does Bankruptcy Save Your Home From Foreclosure