Chapter 11 Bankruptcy For Businesses

Chapter 11 of the bankruptcy code states that businesses and individuals can protect their property and assets by restructuring their finances. This type of bankruptcy is costly and time-consuming. Its used by businesses and individuals who have too much debt or income.

You can file the bankruptcy petition voluntarily, or your creditors can file it on your behalf. After submitting the petition, the lenders must agree to your repayment strategy. Creditors might lower your interest rate or temporarily reduce or suspend your payments until your finances improve.

Alternatives To Filing For Bankruptcy

Bankruptcy should be the last option that you choose due to its long-lasting ramifications. Even, if you feel that you have no other choices, depending on the type of debt that you hold, bankruptcy might not even be able to save you from repaying it.

Having debt that cant be discharged by the courts, such as past-due income tax , student loans, alimony, and child support, may not make bankruptcy a viable option. Its also best to remember that filing for bankruptcy in the first place isnt free. The fee will depend on the state in which you reside.

Regardless of how dire your financial situation may be, there are always avenues you can take to avoid bankruptcy. If you have debt that is piling up, you should first turn to debt settlement. To make the process as easy as possible, you should seek the advice of an expert debt consultant. To learn more about your options when it comes to debt relief, contact CreditAssociates for a free consultation at 1-844-432-6978 or via our online form. We also recommend reading our guide to debt relief vs bankruptcy.

Categories

What Are The Different Types Of Bankruptcy

Too long to read? Enter your email to download this post as a PDF.We will also send you our best business tips every 2 weeks in our newsletter.You can unsubscribe anytime.

Bankruptcy is a stressful process that no one would ever do if they didnt have to, and many different elements enhance that. One thing that people have to worry about is what kind of bankruptcies there are, and what types are right for their situation. Most people know of Chapter 7 and Chapter 13 bankruptcy, but the other types are much less well known. In order to help you figure that out, we will examine the various options available for you.

You May Like: Filing For Bankruptcy In Texas Without A Lawyer

Other Types Of Bankruptcy

Chapter 7 and Chapter 13 are your two choices when filing for personal bankruptcy. But there are a few other types of bankruptcy you might hear about in passing as you explore your options.

Chapter 9

Chapter 9 applies to municipalities — cities, states, and other public entities like school districts are eligible for it when they can no longer keep up with their financial obligations. Chapter 9 debtors reorganize their debts in an attempt to pay creditors to the greatest extent possible, and the extent to which creditors are made whole depends on the level of assets and revenue the filer in question has.

Chapter 11

Chapter 11 is a corporate bankruptcy that allows companies to reorganize their debts, similar to a Chapter 13. Under Chapter 11, a company puts together a plan of reorganization that dictates how its existing debts will be paid. The purpose of Chapter 11 is to allow the company in question to keep operating. By contrast, Chapter 7 liquidations are available to corporations, too, only in that case, the filing company doesn’t attempt to stay in operation, but rather, winds down its business and pays creditors off to the greatest extent possible.

Chapter 12

Chapter 12 is an option specifically for farmers and fishermen to reorganize their debts. It works much like a Chapter 13 bankruptcy, only to be eligible, you must be engaged in a commercial farming or fishing operation.

Chapter 15

The Bottom Line On Bankruptcy

The U.S. Bankruptcy Code exists for a reason — to protect individuals who get in over their heads on the debt front and need relief. Filing for bankruptcy could be the best solution for dealing with your outstanding debt, or it could end up being a mistake you regret. If youre even considering filing for bankruptcy, consulting with a bankruptcy attorney is a good idea because a lawyer can walk you through your options and help you weigh the pros and cons involved.

Don’t Miss: Online Bankruptcy Preparation Services

Types Of Business Bankruptcies

Business bankruptcies typically fall into one of three categories. Two Chapter 7 and Chapter 13 are variations on the personal bankruptcy theme. Chapter 11 bankruptcy is generally for businesses that have hit a bad patch and might be able to survive if their operations, along with their debt, can be reorganized.

Business bankruptcies involve legal entities ranging from sole proprietorships and LLCs to partnerships, professional associations, and corporations.

What Are The Different Types Of Bankruptcies

11 Minute Read | September 03, 2021

Youre sitting at the kitchen table, staring down collection notices and wondering how youre going to make things work. Maybe youve recently lost your job and the debt is piling up to an overwhelming amount. And then you think itthat word you never thought youd have to consider: bankruptcy.

Sometimes your situation seems so hopeless that bankruptcy looks like your only option. We know you might feel scared and backed into a corner, but bankruptcy isnt a decision to make lightly. Its important to know exactly what bankruptcy is and what the different types of bankruptcies are so you can make the best decision for your situation.

Recommended Reading: Bankruptcy Form Software

Consumer Bankruptcy Differences: Chapter 7 Vs Chapter 13

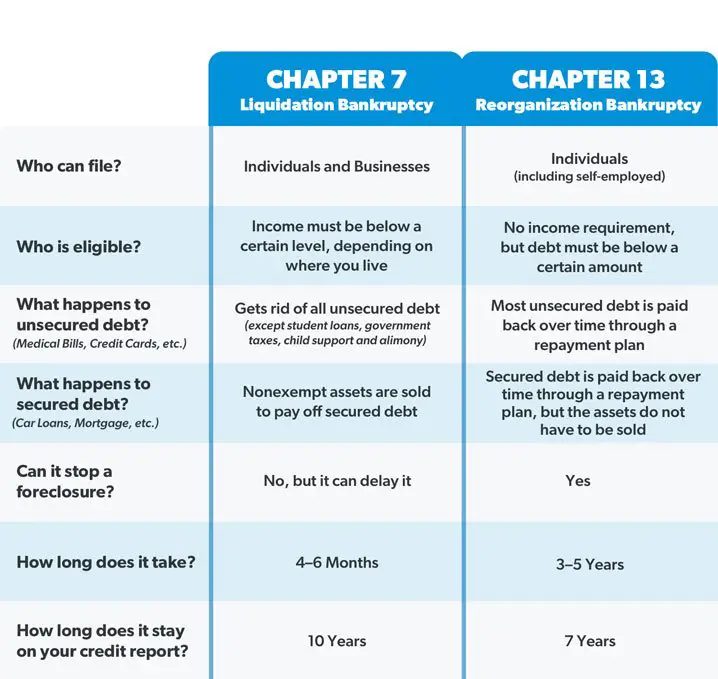

Most consumer bankruptcy cases are filed as either a chapter 7 or chapter 13 case. Depending on your circumstances, one may be a better fit for you than the other. Here are just a few of the differences in the common consumer bankruptcy cases filed under chapter 7 vs chapter 13.

- Debt Limits: In a chapter 7 bankruptcy proceeding, there are no debt limits. A person can file for bankruptcy relief whether they have $1,000 in debt, or if its $1,000,000 in debt. The chapter 13 bankruptcy process, however, is subject to debt limits. There is a debt limit for both unsecured debt as well as secured debt in a chapter 13 case. A debtor filing bankruptcy under chapter 13 must pass BOTH debt limits. If not, either the bankruptcy court, the bankruptcy trustee, or a creditor may file a motion to dismiss your case.

- Repayment Plan: The biggest difference between chapter 7 and chapter 13 is that in chapter 7 there is no expectation that you will pay any of the debt back , while the premise of a chapter 13 case is that you will propose a repayment plan where you agree to make a monthly payment to the chapter 13 trustee to go towards your debts.

- Time for Bankruptcy Discharge: Chapter 7 bankruptcy proceedings are much faster than chapter 13 bankruptcy proceedings. The chapter 7 bankruptcy process is usually over about 90 120 days after the petition is filed.

Chapter 7 Bankruptcy: Liquidation

Chapter 7 Bankruptcy is also referred to as complete bankruptcy, or straight bankruptcy, or liquidation, which is believed to be the most frequent form of bankruptcy being filed among persons. Chapter 7 basically enables the defaulter to start fresh.

Under the successful reporting of Chapter 7 case, a representative gathers the nonexempt assets of the debtorDebtorA debtor is a person or entity that owes money to the other party in a transaction. The receiver is referred to as the creditor, and the payment terms vary for each transaction based on the terms and conditions agreed upon by the parties.read more, which are later converted to cash, subsequently, cash distributions are started to all the creditors as per the bankruptcy law.

In several cases of Chapter 7, the debtor gets a release discharging the individual from personal obligation for some known dischargeable debts. One must consider filing for a Chapter 7 while there exists no expectation of any successful debt repayments by the debtor, there exist no cosigners in the case, or else court action by creditors become pending. Further, companies that demand liquidation of their assets while discontinuing their business could even file for bankruptcy under Chapter 7.

Chapter 7 Bankruptcy Eligibility:

Chapter 7 Bankruptcy Example

Therefore, the company was asked to pay off all their debt that exceeded USD$100 million by liquidating each of its valuable assets and settle the payment for all its creditors.

Read Also: Can An Employer Fire You For Filing Bankruptcy

Being Discharged From Bankruptcy

When a debtor receives a discharge order, they are no longer legally required to pay the debts specified in the order. What’s more, any creditor listed on the discharge order cannot legally undertake any type of collection activity against the debtor once the discharge order is in force.

However, not all debts qualify to be discharged. Some of these include tax claims, anything that was not listed by the debtor, child support or alimony payments, personal injury debts, and debts to the government. In addition, any secured creditor can still enforce a lien against property owned by the debtor, provided that the lien is still valid.

Debtors do not necessarily have the right to a discharge. When a petition for bankruptcy has been filed in court, creditors receive a notice and can object if they choose to do so. If they do, they will need to file a complaint in the court before the deadline. This leads to the filing of an adversary proceeding to recover money owed or enforce a lien.

The discharge from Chapter 7 is usually granted about four months after the debtor files to petition for bankruptcy. For any other type of bankruptcy, the discharge can occur when it becomes practical.

When Should A Business File For Bankruptcy

Instead of thinking about how successfulor notyour business is, when considering bankruptcies, think most about your debts and your ability to repay them.

The truth is, if your business is consistently unable to keep up with your debts and expenses, its already bankruptor on a very short trajectory towards it, explains Meredith Wood inAllBusiness. Filing for bankruptcy protection is meant to help you get out of this untenable situation and keep many of your personal assets. You may be able to keep your business open while you pay off debt by reorganizing, consolidating, and/or negotiating terms.

Filing for bankruptcy canlead to the closure of your business, but it can also be used to save your company by allowing you to renegotiate your debt situation. Either way, it doesnt foreclose your ability tostart another business in the future.

While filing for bankruptcy does take recovery time, it isnt the all-time credit-wrecker you may think, Wood continues. Typically, after 10 years, it is removed from your credit history, and youll likely be able to get financing several years before that.

If you feel like your debt and business expenses are overwhelming your small businesss ability to continue, you should think about bankruptcy. The next step is to determine what type of bankruptcy represents the best way to move forward.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

What Are The Six Different Types Of Bankruptcy

The federal Bankruptcy Code provides for multiple different types of bankruptcy for debtors. The different types, or chapters, are available to different debtors depending on the nature and the means of the debtor as well as the type and amount of debt involved. Read on to learn about the types of bankruptcies and their uses, and call a dedicated and understanding Poughkeepsie bankruptcy lawyer to explore your options for debt relief.

Differences Between Chapter 7 And Chapter 13

The main difference between Chapter 7 and Chapter 13 bankruptcy points to their method. The primary factor to consider is whether or not the person has the means to repay the debt. In other words, the key lies in the debtors income level.

A second important difference between the two alternatives is the length of the process:

- Chapter 7: Commonly, cases take between 3 and 6 months to complete.

- Chapter 13: Under this regime, the payment plan lasts 3 to 5 years. This depends on the debtors income. At the end of the process, most unsecured debt balances will be discharged.

Are you unsure which chapter best fits your situation? Check here for a comparison between Chapters 7 and 13.

Also Check: Fizzics Company Worth

Chapter 1: For Family Farmers And Fishermen

Similar in design and intent to Chapter 13, Chapter 12 provides family farmers and family fishermen who meet certain criteria to propose a repayment plan lasting from three to five years.

However, anticipating the seasonal nature of many small farming and fishing operations, Chapter 12 allows more flexibility in structuring periodic payments.

Chapter 12 helps multigenerational families involved in the business in which the parents have guaranteed debt.

Family farmers or fishermen considering Chapter 12 should be aware of several changes that came about in 2019 regarding the sale of assets. Its a good idea to review these changes with an attorney or an accountant trained in bankruptcy law.

When Should I Declare Bankruptcy

You might consider filing for bankruptcy when your debts are such that you see no reasonable way to keep up with your payments. The purpose of bankruptcy is to give people a chance either to wipe out some of their financial obligations and start over with a clean slate, or to repay those obligations in a more affordable fashion.

However, to be clear, bankruptcy is not an option to consider if your debt is fairly new, or if you’re going through a temporary financial crisis that’s likely to improve . There are consequences associated with filing for bankruptcy, and it’s most certainly not a “get out of jail free” card. So you should really consider bankruptcy only as a last resort if you’ve tried paying off your debts but keep digging yourself deeper into a hole.

Recommended Reading: Fizzics Group Llc

Chapter 13 Bankruptcy: Modification Of An Individuals Debts As Per Regular Income

Chapter 13 Bankruptcy is made for persons who possess a steady income source and wish to pay off all their debts, however at present is incapable of doing so. The Bankruptcy Chapter 13 might be desirable to Chapter 7 since Chapter 13 typically lets the debtor hold on to a precious asset, for example, an individuals house. The debtor is empowered to place and suggest a key strategy in front of the court under Bankruptcy Chapter 13. The strategy describes the way debtor would reimburse creditors with time over a period ranging from three to five years. Finally, the Court should later approve of this strategy.

Suppose the Court accepts the strategy, the debtor would need to pay the creditors via a trustee. Hence, the debtor gets protected from all the actions taken by creditors that include an actual agreement with that debtor for the entire strategys life, wage garnishments, and lawsuits. Any outstanding debt would be discharged upon the successful plan completion.

Chapter 13 Bankruptcy Eligibility:

- Overall debt should not be extremely high.

- The Bankruptcy filing candidate must be current on his/her income tax reporting.

Chapter 13 Bankruptcy Example

Under this situation, since Josh is successfully meeting all the conditions of filing a Chapter 13 petition he subsequently decides to hire a lawyer and file a Chapter 13 Bankruptcy petition to get some financial respite.

What Type Of Bankruptcy To File

Now that you understand the differences between Chapter 7 and Chapter 13 bankruptcy, you may be wondering who decides which chapter a debtor files. You cant pick the one you prefer. There is an aspect of the bankruptcy law called the Means Test, which dictates the chapter of bankruptcy the debtor files. This can be a complicated area of the law, so it is always wise to get the help of an experienced bankruptcy attorney.

Don’t Miss: How Many Times Has Trump Filed Bankruptcy

How Does Filing Bankruptcy Impact Credit

Your credit may not be in tip-top shape by the time you consider filing for bankruptcy, since high balances and missed payments are the top factors affecting your credit score. Still, the presence of a bankruptcy on your credit report will severely impact your credit scores and creditworthiness the entire time it is on your report. That impact will lessen as time passes, however. Chapter 7 bankruptcy remains on your report for up to 10 years, and Chapter 13 stays there for up to seven years.

It’s not an ideal credit situation, of course, but you can use the time to manage your debts wisely and make consistent on-time payments. Like with any damage to your creditworthiness, it’s possible to rebuild your credit with some focus and patiencealong with using the debt relief provided by the bankruptcy to get back on track financially.

What Is Bankruptcy And How Does It Work

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

When you’re drowning in debt with no end in sight, you may start wondering if you should file for bankruptcy. There are both benefits and drawbacks to taking this drastic step, so it’s important to know what you’re signing up for. Here, we’ll discuss how bankruptcies work and help you decide if it’s the right route for you to take.

Also Check: Epiq Corporate Restructuring Llc

Advantages Of Chapter 7 Bankruptcy

Chapter 7 bankruptcy is an efficient way to get out of debt quickly, and most people would prefer to file this chapter, if possible. Here’s how it works:

- It’s relatively quick. A typical Chapter 7 bankruptcy case takes three to six months to complete.

- No payment plan. Unlike Chapter 13 bankruptcy, a filer doesn’t pay into a three- to five-year repayment plan.

- Many, but not all debts get wiped out. The person filing emerges debt-free except for particular types of debts, such as student loans, recent taxes, and unpaid child support.

- You can protect property. Although you can lose property in Chapter 7 bankruptcy, many filers can keep everything that they own. Bankruptcy lets you keep most necessities, and, if you don’t have much in the way of luxury goods, the chances are that you’ll be able to exempt all or most of your property.

- You can keep a house or car in some situations. You can also keep your house or car as long as you’re current on the payments, can continue making payments after the bankruptcy case, and can exempt the amount of equity you have in the property.