Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. Youll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

Building Credit After Chapter 7 Bankruptcy

Most can rebuild their credit rating and have a better score than ever within 1 – 2 years after they file Chapter 7 bankruptcy. But, you canât take this for granted. To get the full benefit of your bankruptcy filing, youâll have to make an effort to improve your credit score.

Getting new credit after filing bankruptcy – itâs easier than you might think!

One of the biggest surprises for many bankruptcy filers is the amount of car loan and credit card offers they receive – often within a couple of weeks of filing their case. Itâs a lot! Why?

Filing Chapter 7 bankruptcy makes you a low credit risk

The Bankruptcy Code limits how often someone can file a bankruptcy. Once you get a Chapter 7 bankruptcy discharge, youâre not able to get another one for 8 years. Banks, credit card issuers and other lenders know this.

They also know that, with the possible exception of your student loans, you have no unsecured debts and no monthly debt payment obligations. This tells them that you can use all of your disposable income to make monthly payments.

Beware of high interest rates

Pay close attention to the interest rates in the new credit offers you receive. Credit card companies and car loan lenders have the upper hand here. They know you want to build your credit rating back to an excellent FICO score. And they know that youâll be willing to pay a higher interest rate than someone with perfect credit and no bankruptcy on their record.

Shop around

You May Like: Can You Be Fired For Filing Bankruptcy

What Is The Average Credit Score After Chapter 7

What is the average credit score after chapter 7 discharge? Within 2-3 the months, the average credit score after chapter 7 discharge will suffer a 100 points initial jolt. It usually remains in the 500-550 range for the average debtor, unless he was already wallowing in the 450s, for default right and left.

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, JD | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Also Check: Can Restitution Be Discharged In Bankruptcy

How To Build Your Credit After Filing For Bankruptcy

If you are one of those people who want to swear off credit altogether, this is actually a bad idea. You want to rebuild your credit score after bankruptcy even if you dont have any immediate plans on making big purchases. This is because when you have a good credit score, it gives you access to better deals and savings. You dont have to pay deposits or high-interest rates when getting necessary services like utilities and cell phone plans.

So, how can you rebuild credit without going under debt again? Here are some practical tips.

Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

Recommended Reading: Bankruptcy Renting Apartment

Sign Up For A Secured Credit Card

Getting approved for a traditional credit card can be difficult after bankruptcy, but almost anyone can get approved for a secured credit card. This type of card requires a cash deposit as collateral and tends to come with low credit limits, but you can use a secured card to improve your credit score since your monthly payments will be reported to the three credit bureaus Experian, Equifax and TransUnion.

Let The Law Offices Of Kretzer And Volberding Pc Help You Navigate Bankruptcy

With an open mind and a skilled attorney guiding you every step of the way, bankruptcy does not have to represent financial hopelessness but instead can be about your empowerment and a chance at a fresh start. You will need a lawyer with specific experience on bankruptcy in Texas and who has the right knowledge and resources to help you.

Dont Miss: How Long Does Chapter 7 Bankruptcy Affect Your Credit Score

Don’t Miss: What Is A Bankruptcy Petition Preparer

How To Remove A Bankruptcy From Your Credit Report

Bankruptcy can be scary, but its important that you arm yourself with as much information as possible to navigate the process.

In this article, well walk you through some of the most commonly asked questions around bankruptcy, how it can affect your credit score, and how to get a bankruptcy removed.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Recommended Reading: How To File Bankruptcy In Wisconsin

Does Your Credit Score Increase After Filing For Bankruptcy

A bankruptcy does not increase your credit score. In fact, filing for bankruptcy almost always results in an immediate and significant decrease in your credit score. A bankruptcy can drop your credit score anywhere from 100 to 240 points depending on your credit score prior to filing for bankruptcy. Ironically, the higher your credit score pre-bankruptcy, the more it will drop.

That said, as the bankruptcy ages, its impact on your credit score will lessen. However, the biggest boost to your credit score will happen after the bankruptcy is removed from your credit report. So long as a bankruptcy remains on your credit report, it will decrease your credit score.

People often mistakenly believe that filing for bankruptcy will increase their credit score. However, this is completely wrong. The purpose of filing for bankruptcy is to provide you with relief by giving you a fresh start, not a better credit score. Filing for bankruptcy is the absolute worst thing that can happen for your credit score. That said, youll have a fresh start to begin building new credit.

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Also Check: What Is Epiq Bankruptcy Solutions Llc

Recommended Reading: Dave Ramsey Bankruptcy

Can You Still Get A Loan Even With A Bankruptcy On Your Credit Report

Many people think that just because they filed for bankruptcy, then this means that they will not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when you still had a stellar credit score. Thats why its important to be cautious and to not be blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit card. You dont want to end up in a more dreadful situation than you were in pre-bankruptcy.

So, what types of loans or credit are you still eligible for even after filing for bankruptcy? We listed down the credit options for you

Are Debts Discharged In Chapter 11

debtsdischargedChapter 11 dischargedischargeChapter 11debtsChapterStrategies to Remove Negative Credit Report Entries

Recommended Reading: When Does Chapter 7 Bankruptcy Fall Off Credit Report

How Does A Consumer Proposal Affect Your Credit

There are various ways a consumer proposal can affect your credit. That said, keep in mind that these implications are only temporary.

When your consumer proposal is filed and approved, the Office of the Superintendent of Bankruptcy will obtain it and inform the credit bureau. This action will result in several things.

- You will likely receive either an R7 credit rating . Bankruptcy, on the other hand, results in an R9 score.

- The proposal will show up on two sections of your credit rating for three years .

- Each creditor will indicate that your account was included in a proposal

- The date of the filing is recorded and then updated upon completion.

- On occasion, your creditors may indicate a bankruptcy on your credit report instead of a proposal. You can request an update to rectify this.

These implications are removed once your consumer proposal is completed, leaving you with a fresh slate to rebuild your credit and achieve financial wellness. The sooner you complete the proposal, the sooner you can start rebuilding.

Student Loan Delinquency Or Default

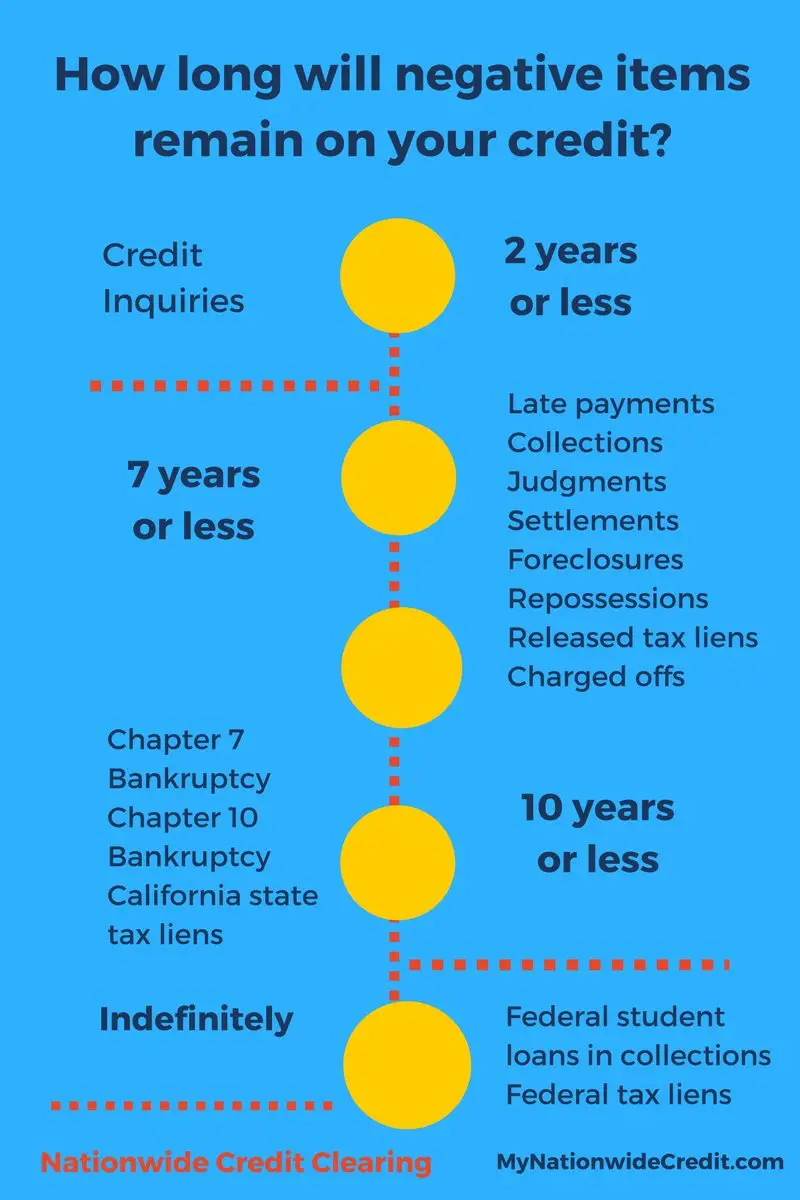

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

Also Check: Renting After Bankruptcy Discharge

Chapter 7 Vs Chapter 13

Chapter 7 and Chapter 13 bankruptcies are the two most common types of consumer bankruptcies. The process for each is different, as is the length of time they remain on your credit report.

In a Chapter 7 bankruptcy, also known as straight or liquidation bankruptcy, there is no repayment of debt. Because all your debts are wiped out, Chapter 7 has the most serious effect on your credit and will remain on your credit report for 10 years. The accounts included in the bankruptcy, however, are removed from the credit report earlier than that.

In a Chapter 13 bankruptcy, your debts are restructured and you typically pay a portion of them over three to five years. A Chapter 13 bankruptcy is deleted seven years from the filing date and has a lesser effect on your credit than Chapter 7.

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Read Also: Can You Rent An Apartment After Filing For Bankruptcy

How Long Until Bankruptcy Falls Off Your Credit Report

Talk to different bankruptcy attorneys and credit professionals, and youre sure to get just as many answers about the length of time the bankruptcy stays on your credit report before it is removed.

According to Experian, the credit reporting agency:

The bankruptcy record from the court is deleted either seven years or 10 years from the filing date of the bankruptcy depending on the chapter you declared.

Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe. Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid.

Individual accounts included in bankruptcy often are deleted from your credit history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts. Accounts are often seriously delinquent before the bankruptcy.

All delinquent accounts are deleted seven years from the original delinquency date, which is the date the account first became delinquent and was never again current. Declaring bankruptcy does not alter the original delinquency or extend the time the account remains on the credit report.

If the account was delinquent before being included in the bankruptcy, it will probably be deleted before the bankruptcy public record because the original delinquency date is typically earlier than the bankruptcy filing date.

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

Also Check: What Is Epiq Bankruptcy Solutions Llc

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note: