Why Repair Your Credit W/credit Glory Vs Diy

Removing inaccurate negative items helps improve your credit . DIY credit repair is a headache. Partnering w/Credit Glory is often a simpler alternative. Why?

- Easier – Making a mistake disputing DIY costs you. Credit Glory helps you build a strong case for disputing inaccurate collections .

- Saves you money – An unsuccessful dispute leaves you stuck with debt . Credit Glory helps you boost your score â which means saving money on loans .

- Top-class customer support – Credit Glory has best-in-class customer service to answer questions and keep you updated. Credit Glory even offers an industry-leading 100% money-back guarantee (if no errors are removed in the first

Checking Credit Report Accuracy After Bankruptcy

You’re entitled to get a free credit report from the three major credit reporting agencies each year. You can claim your reports by visiting www.annualcreditreport.com.

Instead of getting them all at once, a prudent approach is to claim one report three months after receiving your bankruptcy discharge. That should allow enough time for creditors to report the bankruptcy information.

Thoroughly review each listed debt for accuracy. Also watch out for unfamiliar creditor names or debts, as they might be discharged debts that were bought and sold to a third party, but are not accurately reflected as having been discharged. To make changes, follow the instructions under the “Correcting Misreported Discharged Debt” heading.

You’ll want to claim each of the remaining two credit reports at three-month intervals. Each time, check to see if the credit report reflects the previously requested changes, and, take steps to correct any remaining inaccurate information. This approach should allow you to clean up your credit report at no cost to you.

When Bankruptcies Are Dismissed

A dismissal could be at the request of the debtor when bankruptcy protection or a discharge is no longer needed.

Sometimes, we file a Chapter 13 to buy enough time to complete the sale of an endangered home. Once the sale is complete, there may be no further need for the automatic stay.

Generally a debtor cant voluntarily dismiss a Chapter 7 case. The debtor can convert the case to another chapter, but the debtor cant usually change his mind and escape bankruptcy.

More often, dismissal comes on the motion of the trustee or the court, often for failure to timely file a document or for abuse of the system.

But dismissed means that the case has been closed without a discharge.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Hire A Credit Repair Specialist To Deal With The Bankruptcy

This is obviously a lot of work, and it may seem a bit overwhelming. You may feel like its too much to handle with everything else going on in your life.

In that case, you may want to procure the services of a quality credit repair company. You could also hire a good bankruptcy attorney.

Granted, its never a good feeling when you pay out of pocket to fix something that wasnt your fault.

Taking it on by yourself can be a big challenge, though. It will cost you in terms of time and money.

Someday, fraud and cybercrime might be a thing of the past. But, for now, its a part of life that many of us have to deal with at one time or another.

What Are The Common Reasons For Dismissed Chapter 13 Cases

There are several reasons why a Chapter 13 case can be dismissed. Some are the same as for Chapter 7 cases. Things like not paying the court filing fee, not properly preparing for and attending the meeting of creditors, and not filing all required bankruptcy forms. Other reasons why a Chapter 13 bankruptcy case may be dismissed are:

-

Failing to pay the Chapter 13 payments

-

Failing to meet certain deadlines

-

Failing to propose a Chapter 13 plan that complies with bankruptcy law

-

Failing to submit the required documentation to the Chapter 13 trustee

-

Failing to file tax returns every year and submitting a copy to the trustee

As you can see, the reasons for a dismissed Chapter 13 usually involve the debtor failing to do something the debtor is required to do under the bankruptcy rules. However, sometimes, a dismissed Chapter 13 case is due to something beyond the debtorâs control.

For instance, if a debtor loses his or her job or becomes ill, the debtor may not have enough money to pay the Chapter 13 plan payments. If changing the plan payment or converting the case to a Chapter 7 case is not an option, there may be no choice but to let the Chapter 13 case be dismissed.

Don’t Miss: Fizzics Beer Net Worth

Will Your Credit Score Stay Poor Until Your Bankruptcy Is Removed From Your Credit Report

One common misconception is that your score will remain poor during the duration the bankruptcy is on your credit report. This is not true at all. In fact, you can start rebuilding your credit after your debt is discharged. According to bankruptcy experts, there is even a chance that your score will go above 700 after four to five years.

Converting To A Chapter 7 Case To Avoid A Dismissed Chapter 13 Case

Depending on why youâre at risk of having your Chapter 13 case dismissed, you may be able to convert it to a Chapter 7 case. Most bankruptcy courts allow you to do so by filing a simple ânoticeâ and paying a small conversion fee.

Whether conversion is an option depends on your situation. For example, if youâre unable to stay in the Chapter 13 payment plan because youâve lost your job and itâs not looking like youâll be able to get anything comparable anytime soon, you likely qualify for Chapter 7 relief even if you didnât when the case was first filed.

Of course, you want to make sure that you will not have any other problems when converting to a case under Chapter 7 to avoid a dismissed Chapter 13 case. If youâre behind on your mortgage payments or have property with non-exempt equity, you could face losing this property in a Chapter 7 case.

Also Check: How Many Times Has Donald Trump Filed For Bankrupcy

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

Consequences Of Bankruptcy Dismissal

Regardless of whether they are voluntary or involuntary, if a filer has more than three dismissals in a one-year period, any subsequent bankruptcy case refiling wonât benefit from an automatic stay. That means that regardless of your financial situation, you wonât be protected from collection activity, repossessions, garnishments, calls from credit card servicers, etc. Note also that if your case is dismissed for any reason, you wonât receive abankruptcy discharge of your debts.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed For

True And Accurate But Negative Entries Can Stay On A Credit Report

The guiding principle of FCRA is that entries on a persons credit report must be true and accurate. Many consumers hold to a prevalent misconception that negative, or derogatory, items can be removed from their credit reportbecause the item is negative. That is not true. Consumers have the right to remove only false and inaccurate information from their credit reports.

Causes Of Bankruptcy Dismissal

Here are some specific reasons your bankruptcy case might be dismissed:

- Failure to comply with court rules

- Procedural violations

- Fraud against creditors, lenders, or courts

- Failure to make court appearances or attend creditors meetings

- Failure to pay filing fees or installment payments

- Prior cases, prior dismissals, and prior discharges

- Failure to make timely plan payments in a Chapter 13 case

Also Check: Epiq Corporate Restructuring Llc Letter

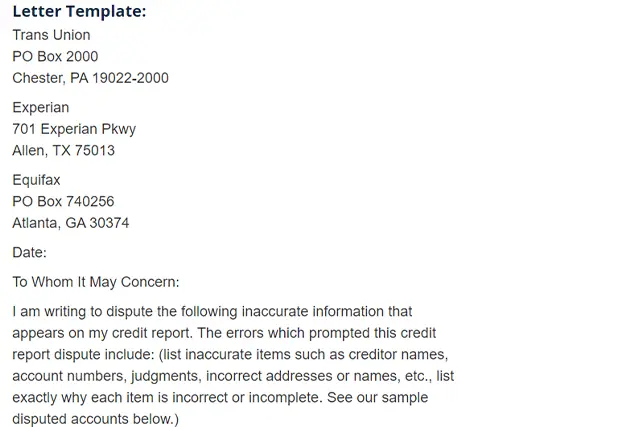

Send A Dispute Letter

Send a dispute letter and ask them to correct the mistake and remove the bankruptcy.

If you cant find any inaccuracies, you might try sending them a dispute letter anyway.

Ask them to verify how the bankruptcy came to be on the report.

They will likely respond that they received the information from the court, and provide the relevant information.

You can then follow the same process with the court. The hope is that one of these steps will expose some kind of problem or technicality that occurred during the process and will ultimately be grounds for removal.

Im a firm believer in the notion that nothing is impossible.

It may be highly unlikely that youll be able to remove a legitimate bankruptcy from your credit report early, but that doesnt mean it isnt worth trying.

Its definitely a long shot. However, many people who have taken the time to go through the process have had success with removing a Chapter 7 from their credit report before the 10 years were up .

Diy Vs Professional Credit Repair

![How to Remove a Bankruptcy from Your Credit Report [See Proof] How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

It can often feel like credit repair is a catch-22. You may not have a lot of expendable income to hire a professional credit repair company, but you likely dont have the know-how or emotional bandwidth to tackle it yourself either. We get it.

Bankruptcy is the negative item we most encourage our readers to get professional help with though. The steps weve outlined are advanced tactics that in most cases are best left to credit repair specialists. They are more familiar with the ins and outs of the credit bureaus and court systems, as well as the steps well be outlining.

Below are the credit repair companies we recommend.

Also Check: Epiq Bankruptcy

Bottom Line: Bankruptcy And Credit

I have personally seen the impact of the bankruptcy petition on some debtors five to seven years later and most are doing fine, says Arnold Hernandez, an attorney in Tustin, Calif., who handles bankruptcy cases. Bankruptcy is not forever.

How Long Can Bankruptcy Affect Your Credit Scores

Bankruptcy can affect your credit scores for as long as it remains on your credit reports. Thats because your scores are generated based on information thats found in your reports.

But the impact of bankruptcy on your credit scores can diminish over time. This means your credit scores could begin to recover even while the bankruptcy remains on your credit reports.

After the bankruptcy is removed from your credit reports, you may see your scores begin to improve even more, especially if you pay your bills in full and on time and use credit responsibly.

You May Like: Epiq Bankruptcy Solutions Llc

The Legal Process Of Removing Bankruptcy Errors

You can challenge any error you find on your credit history or bankruptcy filings. They must be removed if the credit bureau or reporting agency cannot prove they are legitimate.

To prove there is a mistake, you need to follow these steps:

Proving bankruptcy fraud can be drawn-out and time-consuming. A legal advocate can help reduce stress and save time throughout the process.

If Your Bankruptcy Is Dismissed Without Prejudice You Can Refile Immediately

Updated By Cara O’Neill, Attorney

Filing for bankruptcy relief doesn’t guarantee a dischargethe order that wipes out qualifying debt. If you don’t follow the bankruptcy laws or procedures in your jurisdiction, the court might dismiss your case. Luckily, most dismissals are without prejudice, and you can immediately refile your case.

Read on to learn what happens when the court dismisses a bankruptcy case without prejudice.

Read Also: Can You File Bankruptcy On A Title Loan

How Is A Chapter 13 Case Different

By contrast, those filing bankruptcy under bankruptcy Chapter 13 are required to submit completed schedules and a Chapter 13 repayment plan. Like Chapter 7 filers, they are required to be forthcoming when submitting information and documents to the court and the trustee assigned to their case, attend their meeting of creditors, and appear at certain mandatory bankruptcy court appearances. Additionally, they must make their Chapter 13 plan payments on time or risk the dismissal of their case.

Can You Legally Remove Bankruptcy From A Credit Report

By FindLaw Staff | Reviewed by Bridget Molitor, JD | Last updated June 30, 2021

It depends on the situation. You can remove bankruptcy from your credit report if it is untrue, misreported, disproved, or inaccurate.

You cannot legally remove bankruptcy on your credit report just because:

- You do not want it on your record

- You have a good credit score again

- Your debts are paid off

Legally, bankruptcy will stay on your record for 10 years if you filed for Chapter 7 bankruptcy or seven years if you filed for Chapter 13 bankruptcy. After that time, it should be automatically removed.

According to the Fair Credit Reporting Act , these timelines set the maximum time for a bankruptcy filing to stay on your credit report. In some cases it may be on your for less time.

You May Like: How Many Bankruptcies Has Trump Filed

Chapter 7 Bankruptcy Dismissed Credit Report

On occasion I will get a call from someone that filed their own bankruptcy without an attorney. For one reason or another, the bankruptcy case didnt fly and was dismissed by the court. The question is usually this: how do I remove the dismissed bankruptcy from my credit report?

The short answer is you cant. Credit report agencies will likely still report that you declared bankruptcy, including the filing date and also the disposition of the bankruptcy case. In my experience, whether the bankruptcy resulted in a discharge or a dismissal doesnt matter to the credit bureaus.

This is important. A bankruptcy filing will impact your ability to obtain credit in the short term. I usually advise my clients that the main impact on creditworthiness is during the first two years after filing Chapter 7 bankruptcy.

However, the results can be worse for a person with a dismissed bankruptcy. Not only do they get negative points for having a bankruptcy on their record, but they didnt receive any of the benefits of a bankruptcy discharge. In this way, they are a worse credit risk than a person that was successful in Chapter 7 bankruptcy and obtained a discharge.

Think about it this way: a bankruptcy discharge can in fact be a positive factor for a potential creditor. A discharge means that you do not have as many obligations for your monthly income. A person with a fresh start will be able to better handle any new debt extended to them after a bankruptcy.

Ask The Courts How The Bankruptcy Was Verified

![How to Remove a Bankruptcy from Your Credit Report [See Proof] How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Also Check: How Many Times Has Donald Trump Filed Bankruptcy

When Is Bankruptcy Removed From Your Credit Report

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date.

After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.

Can A Dismissed Chapter 13 Bankruptcy Be Removed From Credit Reports

Q: I am having trouble renting an apartment because of a dismissed Chapter 13 Bankruptcy. Can it be removed from credit reports since I did not continue with it and the debt has since been paid in full?

A: A discharged bankruptcy means you have satisfied the debts included in the Chapter 13 BK and that creditors will not further pursue you for payment. In addition, discharged debts listed on your credit report must be listed as discharged. This will either lower or eliminate your overall debt making you are better credit risk.

When a Chapter 13 has been dismissed, creditors can immediately pursue you for payment again in addition to initiate or continue with court litigation for payment which causes potential new creditors to deny you.

Even if you pay the debt, potential creditors are still going to look at a dismissed bankruptcy more negatively than a discharged bankruptcy. Unfortunately, when you attempt to get new credit with a dismissed bankruptcy it’s going to be more difficult.

Most creditors, lenders and rental companies want to see a discharged bankruptcy. Its great that you paid the debt but ironically theres no benefit to your credit profile for doing so.

Once a bankruptcy is filed it is almost impossible to un-ring the bell. But because a discharged Chapter 13 stays on your credit report for 7 years and dismissed Chapter 13 stays on your credit report for 10 years I suggest several strategies:

Read Also: How Many Times Donald Trump Filed For Bankruptcy