Contact A Chapter 13 Bankruptcy Lawyer

We are committed to helping our clients understand their rights and options under bankruptcy law and developing the debt relief solution that makes the most sense for each individual. We invite you to call 888-2188 or contact our Arizona office to schedule a free initial consultation with an experienced chapter 13 bankruptcy lawyer. Call us at 888-2188or contact us online to schedule an appointment to find out how we can help you and your Arizona business.

We are a debt relief agency. We help individuals and businesses file for bankruptcy relief under the Bankruptcy Code.

Using Chapter 13 Bankruptcy To Pay Off Your Debts In Arizona

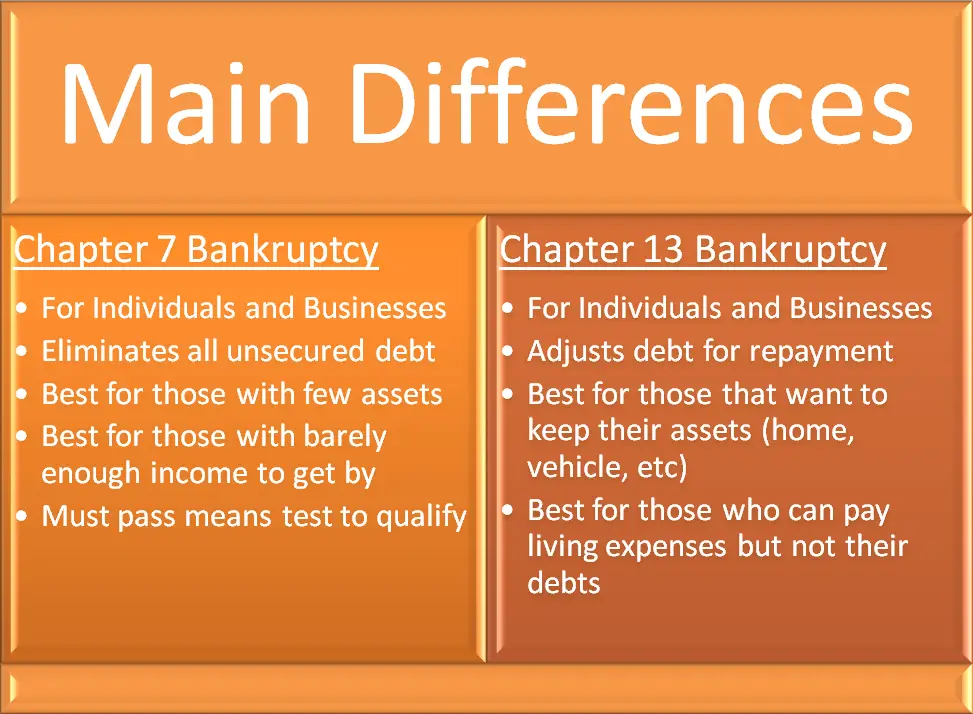

Filing for Chapter 7 bankruptcy protection is the fastest way to eliminate debts and get the fresh start you need, however, not everyone qualifies. Some people may have already filed for Chapter 7 while others do not qualify due to the results of the bankruptcy means test. If filing Chapter 7 bankruptcy is not a viable option to you, perhaps, an Arizona Chapter 13 bankruptcy can still allow you to eliminate your debts over time with zero interest. Contact an experienced Arizona Chapter 13 bankruptcy attorney or an experienced Chapter 13 bankruptcy lawyer from the My Arizona Lawyers and find out if which chapter of bankruptcy you may qualify.

Our Phoenix, Glendale, Tempe, Gilbert, Mesa, and Tucson, Arizona bankruptcy lawyers and debt relief specialist are committed to helping consumers in Arizona hit the RESET button and regain control over their finances. Many of our Arizona bankruptcy lawyers have extensive consumer bankruptcy experience and work closely with our clients, providing them with the personal service they need during a difficult time. We will guide you through every step of filing chapter 13 bankruptcy in Arizona.

Get more information about chapter 13 bankruptcy at a FREE bankruptcy consultation with one of our debt relief attorneys. Call 833-8000 or 306-8729 and schedule an appointment today!

Filing Chapter 13 Bankruptcy To Save Your Home From Foreclosure

If you are facing a foreclosure on your home in Phoenix, declaring bankruptcy may be the answer. One of Chapter 13 allows you to stop an effort to foreclose on your home. Filing a Chapter 13 petition suspends any current foreclosure proceedings and payment of any other debts owed. This buys time while the court considers the plan, but it does not eliminate the debt. Hopefully, the bankruptcy plan will free enough of your income that youll be able to make regular mortgage payments and keep your house.

How do I know if Bankruptcy Chapter 13 is the right option for me?

- If you need to prevent a foreclosure on your home, or a repossession of your vehicle

- Are you are getting wage garnishments & harassed by creditors

- Trying to eliminate a 2nd or 3rd mortgage and your home is valued below the 1st mortgage

- You have monthly income or wages, and you dont qualify for a Chapter 7

- If you have certain debts like unpaid income taxes, a student loan, or child support, all of which cannot be discharged in Chapter 7. Again, Chapter 13 allows you to pay these back over a 3 to 5 year period with no interest

- You have a co-debtor on a personal debt. If you file for Chapter 7 bankruptcy, your co-debtor will still be on the hook and your creditor will undoubtedly go after him/her for payment. If you file for Chapter 13 bankruptcy in Las Vegas, the creditor will leave your co-debtor alone as long as you keep up with your bankruptcy plan payments

Recommended Reading: How To File Bankruptcy Chapter 7 Yourself In Oregon

Means Testing In Arizona

As part of the bankruptcy process, you must complete the Arizona bankruptcy means test. The Means Test calculates your average monthly income , annual median income, and disposable income. Consequently, each of these figures is important for a Chapter 13 case.

Calculating Average Monthly Income

Your average monthly income is calculated using all household income received during the six months before filing a Chapter 13 case. Then, the total of all income over six months is divided by six to determine your AMI.

To calculate your annual median income, you multiple the AMI by 12. The annual median income is used in a Chapter 13 case to determine whether you are required to submit a 60-month bankruptcy plan.

If your median income exceeds the Arizona median income levels, you must submit a 60-month plan. Alternatively, if your median income is below the Arizona median income, you may qualify for a 36-month bankruptcy plan. Although, you may still choose to propose a 60-month plan based on your specific situation and needs.

The median income in Arizona for bankruptcy cases is based on information gathered by the United States Trustees Office. Also, the USTs office revises the data periodically to ensure it reflects the current income for each state. Furthermore, you can view the current median income figures used for Arizona Chapter 13 cases by clicking here.

The latest figures are for cases filed on or after May 15, 2022.

| # of People |

|---|

| $134,741 |

Debt Relief Through Consolidated Payments

Similar to a Chapter 7, a Chapter 13 often releases you from the obligation to pay back unsecured debt. This form of bankruptcy offers individuals with more assets, who do not qualify for a Chapter 7, the opportunity for a significant amount of debt relief by consolidating and discharging large amounts of debt. A court-approved repayment plan, or wage earner plan, is created as a means to repay debts through a series of consolidated payments. The amount is calculated by through a complex formula called a means test. At Ellett Law offices, our experienced professionals will maximize your means test deductions to keep your Chapter 13 payments as small as legally allowable.

Read Also: What Is Debt To Income Ratio For Conventional Mortgage

Locating A Chapter 13 Bankruptcy Attorney In Arizona

Even though you are not required to hire a bankruptcy lawyer, filing Chapter 13 bankruptcy without a lawyer is not recommended. Chapter 13 bankruptcy cases are very complex. Calculating a Chapter 13 plan requires a great deal of experience and knowledge. Someone who does not understand Chapter 13 bankruptcy law could pay much more than is necessary to get out of debt.

Also, the court expects you to understand and know the law the applies in your case if you represent yourself. The court will not explain bankruptcy law to you, and it will hold you accountable for the errors you make in your case. Therefore, it is best to have an experienced Chapter 13 bankruptcy lawyer handle your case.

What are the benefits of hiring a Chapter 13 bankruptcy attorney in Arizona?

- A trusted legal advocate who understands bankruptcy laws

- Reminds you of deadlines and hearings in your case

- Determines if you should file under Chapter 13 or Chapter 7

- Calculates the lowest Chapter 13 plan payment allowed by law

- Maximizes asset protection so you can keep all your property, including your home and vehicle

- Completes and files all required bankruptcy forms

- Guides you through the process by explaining each step and providing support at hearings

- Protects you from aggressive creditors who might want more money than they are entitled to receive

Having a Chapter 13 bankruptcy attorney handle your case means you have someone on your side who can help you avoid mistakes and errors that could hurt your case.

A Debtor Has The Ability Repay A Certain Amount To Unsecured Creditors

Non-priority, unsecured creditors may also be entitled to repayment. Because a debtor may keep the non-exempt property under Chapter 13 bankruptcy, a debtor must repay non-priority, unsecured creditors at least the amount equal in value to their non-exempt property over the life of the repayment plan. Non-exempt property typically includes household appliances and furniture, inexpensive jewelry, and a certain amount of equity in a home or motor vehicle.

Don’t Miss: How To File Personal Bankruptcy In Ny

Which Chapter Is Best For You

The choice of which type of bankruptcy to file depends on many factors that are specific to your situation, and this is one of the most important reasons to get good legal advice before filing. Which chapter is best for you depends on the nature of your debt and the nature and value of your assets. At Arentz Law Group, PLLC, their Phoenix, Arizona bankruptcy attorneys offer a free debt evaluation and want to help you to make the best decision.

Chapter 13 Bankruptcy Arizona: 7 Things You Need To Know

You may wonder whether filing Chapter 13 bankruptcy in Arizona is the best debt relief option. Bankruptcy is a common relief option. In fact, there were 11,646 bankruptcies that have been filed in Arizona by June 30th, 2021.

The purpose of this article is to provide what you need to know about Chapter 13 bankruptcy in Arizona. Heres what we will cover:

- Chapter 7 vs. Chapter 13 Bankruptcy in Arizona

- Calculating Chapter 13 Plan Payments in Arizona

- Filing for Chapter 13 Bankruptcy Arizona Process

- Arizona Bankruptcy Exemptions

- Bankruptcy Courts and Trustees for Arizona

- Arizona Chapter 13 Bankruptcy FAQs

- Alternatives to Filing Bankruptcy in Arizona

You May Like: How Long Does Chapter 13 Bankruptcy Stay On Your Credit

Advantages Of A Chapter 13 Bankruptcy

- Longer protection period from the Automatic Stay. The Automatic Stay becomes active when your petition is filed, and prevents your creditors from garnishing your wages, foreclosing on your home, repossessing your vehicle, and more. In a Chapter 7, the Automatic Stay will last up to 4-6 months. In a Chapter 13 bankruptcy filing, the Automatic Stay will last up to 3-5 years.

- You can discharge second mortgages in Chapter 13 if you owe more than your house is worth. This process, also known as lien stripping, is not available in Chapter 7 bankruptcy.

- The only way to stop a domestic obligation wage garnishment is by filing a Chapter 13 bankruptcy that arranges for full repayment of the balance in arrears. Chapter 7 has no impact on domestic obligation debts.

- A Chapter 13 bankruptcy remains on your credit for 7 years from the filing date, while a Chapter 7 bankruptcy remains on your credit for 10 years.

- Your plan will help you avoid missed payments, defaults, judgments, etc., which would damage your credit.

- Available to those whose income exceeds the strict income limits for Chapter 7 bankruptcy.

Our Tempe Bankruptcy Attorneys Discuss The The Pros & Cons Of Filing A Chapter 13

You may already know that bankruptcy is a good way to start over with a clean financial slate. You may even already know that you dont qualify for Chapter 7, and want to learn more about Chapter 13. Your Chapter 13 bankruptcy will last 3-5 years, so its crucial that you fully understand what youre getting yourself into before filing your petition. That way, you and your family can rest easy knowing that you are on the road to a financial fresh start.

Like every form of debt relief, Chapter 13 comes with its own advantages and disadvantages. While many bankruptcy attorneys may sell you on the numerous positive effects that will come from a Chapter 13 bankruptcy, they may neglect to tell you about the downsides. There may be factors that affect your case specifically, so be sure to bring up any of these during your bankruptcy consultations.

You May Like: How Long After Filing Bankruptcy Will Garnishment Stop

Chapter 13 At A Glance

In personal finance circles, Chapter 13 bankruptcy is known as the wage earners bankruptcy because youre proposing a repayment plan based upon your current and future income. On average, Chapter 13 payment plans run between 3-5 years. Chapter 13 allows you to in essence buy time to prevent home foreclosures, prevent interested from jacking up any tax debts, make good on any missed auto loan payment, and more. To qualify for Chapter 13, you must have a reliable stream of income as well as a bit of disposable income to put towards the payment plan.

Calculating Chapter 13 Plan Payments In Arizona

Your Chapter 13 plan payment in Arizona depends on your unique financial situation, which is why we built a Arizona Chapter 13 Plan Payment calculator below that you can use to estimate your Chapter 13 plan payment.

Factors used when calculating a Chapter 13 bankruptcy plan include, but are not limited to:

- Disposable Income The amount of income you have each month after subtracting allowable payroll deductions and allowable living expenses from your gross monthly income.

- Assets In some cases, the value of your assets could increase the amount of your Chapter 13 plan if your assets have large amounts of non-exempt equity. We discuss Arizona bankruptcy exemptions in more detail below and how exemptions impact your Chapter 13 plan.

- Debts Some debts must be paid in full through the Chapter 13 plan . Other creditors may receive partial payments, including unsecured debts, such as medical bills, credit card debt, and personal loans. Chapter 13 plans typically include back mortgage payments and car loan payments.

- Recent Financial Transactions Some recent financial transactions could impact your Chapter 13 plan.

Try the Chapter 13 calculator to estimate the amount of your Arizona Chapter 13 plan payment.

Also Check: How To Restore Credit After Bankruptcy

Benefits And Disadvantages Of Arizona Chapter 13 Bankruptcy

A Chapter 13 bankruptcy has many advantages for the right kind of debtor, and it has a few disadvantages compared to a Chapter 7. First, it is more complicated and costly than a Chapter 7. It requires the debtor to have some disposable income to pay into a Chapter 13 Plan. Disposable income is defined as income left over after paying for ones basic necessities, such as food and shelter. The Plan requires these payments to be made for 3 to 5 years. If a debtors monthly income is below the state average for a household of his/her size, or the debtor needs bankruptcy protection but has sufficient disposable income to pay all his unsecured creditors in 3 years, the Plan can be for 3 years. Absent these conditions, the length of the Plan is generally for 5 years. This is a long time compared to a Chapter 7, which is generally finished between 6 and 12 months.

However, a Chapter 13 bankruptcy allows the debtor to keep some or all of his or her non-exempt assets. For debtors who have disposable income and have worked had to accumulate non-exempt assets, this is a huge benefit. To keep non-exempt assets, the Plan must ensure that unsecured creditors receive as much under the Plan as they would in a Chapter 7 liquidation.

Another benefit of a Chapter 13 bankruptcy is that it will allow the debtor to catch up with mortgage payments or car payments through the Chapter 13 Plan if he or she has fallen behind in making these payments.

Start Your Chapter 13 Bankruptcy Case Today

Get A Free Consultation With The Majors Law Group

After youve found out how to qualify for Chapter 13 bankruptcy in Phoenix, Arizona, and decided its right for you, youll want an experienced law firm at your side. The Majors Law Group handles a variety of bankruptcy cases in Arizona including Chapter 13. We would be happy to offer you a free consultation to talk about your specific circumstances. To get started, call us at 892-1111 today!

Meet the Attorney:

Dominic Majors, who goes by Dom, is a strong legal advocate who is dedicated to helping those in need. Dom was born in Dallas, Texas, and was raised in Northern California on his Familys ranch in Clayton. Learn More

Recent Posts

Locations

- 4667 S. Lakeshore Dr. Suite 5Tempe, AZ 85282

- 8249 W. Thunderbird Rd. #160 Peoria, AZ 85381

- 333 N. Wilmont Rd. Suite 340 Tucson, AZ 85711

Don’t Miss: What Is Filing For Bankruptcy Mean

Filing For Chapter 13 Bankruptcy In Arizona Is No Small Matter

You may have experienced a financial hardship and are considering filing Chapter 13 bankruptcy in Arizona.

There are 3 extremely important things to consider when filing for bankruptcy in Arizona:

Chapter 7 bankruptcy is a legal debt relief option. Many got rid of debts and a fresh start with the help of the bankruptcy system.

Lets get started.

1) Chapter 13 Bankruptcy in Arizona

For those who make above the income limit for Chapter 7, debt relief can still come through filing a Chapter 13 bankruptcy in Arizona. A Chapter 13 Bankruptcy in Arizona case allows you to restructure your debts into an affordable monthly plan. By restructuring debts, many people can afford to keep their homes and vehicles under Chapter 13.

Chapter 13 stops foreclosures, repossessions, and wage garnishments. It also allows you to pay back mortgage payments, past-due car payments, and tax debt over three to five years through a bankruptcy plan. In addition, Arizona allows you to reduce unpaid child support and alimony. However, you must resume your normal domestic support payments to remain in Chapter 13.

In a Chapter 13 plan, some debtors can lower their car loan payments and erase second mortgages, if they meet certain requirements.

IMPORTANT: Chapter 13 Payment Estimate

2) Chapter 7 Bankruptcy in Arizona

a) Debt Settlement

Bankruptcy Courts And Districts In Arizona

- U.S. Bankruptcy Court < br> 230 N 1st Ave, Ste 101 < br> Phoenix, AZ 85003

- U.S. Bankruptcy Court < br> 38 S Scott Ave < br> Tucson, AZ 85701

- U.S. Bankruptcy Court < br> 98 W 1st St, 2nd Floor < br> Yuma, AZ 85364

- AWD Building < br> 123 N San Francisco St < br> Flagstaff, AZ 86001

- Superior Court < br> Courtroom R < br> 2225 Trane Road < br> Bullhead City, AZ 86442

In either case, the Chapter 13 bankruptcy process in Arizona is the same. You need to begin by deciding whether Chapter 13 is right for you, locate a Chapter 13 bankruptcy attorney, complete the bankruptcy forms, and attend your bankruptcy hearings.

Lets discuss the Chapter 13 bankruptcy process in Arizona in more detail.

Don’t Miss: Has Donald Trump Ever Filed Bankruptcy