Why The Bad Reputation

Filing for bankruptcy has a bad reputation in many circles due to the fact that it damages your credit and involves discharging debts that will likely never be repaid. Sure, Chapter 7 bankruptcy isnt great for your credit score and will appear as a public record for 10 years after filing. However, most consumers who file for bankruptcy have already had their credit damaged by a series of late payments.

Whether your bankruptcy filing can be labeled as bad is really a function of whether you intend to defraud the system or whether you have a moral obligation to pay debts that you plan to discharge in bankruptcy. There are many types of debts that are eliminated by filing for bankruptcy. For example, perhaps your primary debts are a $50,000 credit card balance and a $10,000 personal loan that you owe to your brother that he loaned to you while he was having financial problems of his own. If you file for bankruptcy, both the credit card debt as well as the debt to your brother will be eliminated. Filing bankruptcy to discharge credit card debt at 29% interest would not be considered bad by most people.

See also:How to Screw Up Your Bankruptcy Discharge

Will Filing For Bankruptcy Help Eliminate Your Debts

The big question is: Will bankruptcy eliminate all your debts? It is important to understand that there are different forms of debts and, under law, there are specific types of debts that cannot be discharged through bankruptcy.

These nondischargeable debts include some tax debts, domestic support obligations such as child support and alimony, debts incurred through fraudulent acts, debts arising from criminal behavior, like drunk driving, and student loans.

What Happens To Your Credit Rating After Filing Bankruptcy

It is true that filing for bankruptcy lowers your credit rating quite far.

Because credit rating is different for everyone, I cannot say by how many points a bankruptcy lowers your credit, but it goes down pretty far when you file for bankruptcy.

The more important question is:

- How quickly does it recover after filing for bankruptcy?

Based on my experience from filing tens of thousands of bankruptcies in Minnesota, people often have a 700 credit score about 2 years after filing bankruptcy, assuming that nothing bad happens in the meantime.

This observation is confirmed by this discussion on the MyFico website.

I know this because my clients often call me up and ask for their bankruptcy paperwork a few years after filing for bankruptcy. I make them a copy of the documents they need and send them on their way.

I know that the mortgage works because they never call back to say that everything fell through. I have also researched the FHA guidelines, and they say that you can get a mortgage only two years after filing for bankruptcy.

You can get car loans even more quickly than mortgages.

My clients tell me that they get pre-approved car loan offers within 1 month of filing bankruptcy.

- They get the offers even before their cases are finalized and before they have received their discharge orders.

- They tend to get better interest rates and terms than before the bankruptcy also

One recent client told me a story that stuck in my mind. she said that she was able to get a car

Read Also: What Is A Cram Down In Bankruptcy

When To Declare Bankruptcy: 8 Questions To Ask Yourself

Most people take their financial obligations seriously and want to pay their debts in full, but knowing when to file bankruptcy and when to negotiate or use another strategy can help put you on the road to financial health.

Here are a list of questions that can help you assess your financial health and give you insight into whether bankruptcy may be right for you. You should also discuss these questions with an attorney.

Is A Lawyer Necessary

Unlike corporations and partnerships, individuals can file for bankruptcy without an attorney. It’s called filling the case “pro se.” But because filing for bankruptcy is complex, and must be done correctly to succeed, it’s generally unwise to attempt it without the help of an attorney experienced in bankruptcy proceedings.

Even the Internal Revenue Service is sometimes willing to negotiate. You may be able to reduce the amount you owe in taxes or spread your payments out over time.

Also Check: How To Claim Bankruptcy In Illinois

Not Getting Legal Advice

Bankruptcy Can Be Complex To Understand And You Should Not Do It Without Legal Advice

Bankruptcy law is not easy to understand and trying to avoid the cost of an attorney will typically backfire on you and cost you a great deal more than the savings on legal fees. I understand that at the time you are considering bankruptcy it might not be the best time to pay out legal fees. What is most important when you are filing for bankruptcy is to get the best possible outcome, and an attorney can ensure that you are able to get the best possible deal.

We found some figures for 2017 and only 5% of those representing themselves in bankruptcy proceedings succeeded. The very first thing an attorney can do is advise you on the best form of bankruptcy to file, Chapter 7, or Chapter 13, as this will have a big impact on what you may lose.

I Owe Income Taxes So Bankruptcy Is Useless

I hate it when I hear this. Bankruptcy is one of the only ways to permanently get rid of income taxes.

Were living in an era when the IRS, in the Bay Area, will not settle your tax debt unless you are unemployed, on kidney dialysis, and on a heart-lung machine.

Income taxes are dischargeable in bankruptcy if they meet the tests under the Three Year Rule, The Two Year Rule, and the 240 Day Rule. Three special time periods have to run out.

There are complex rules for figuring out if they have run, and certain things the taxpayer may have done can keep these time periods from running out.

F& F attorneys dont have a clue about any of this. Thats why you need a specialist who knows what they CAN do in bankruptcy, how to do it and most importantly when. By the way, the same rules apply to the California Franchise Tax Board as well.

The corollary is that I Owe California Sale Taxes So Bankruptcy Is Useless

See the misconception immediately above. Not true.

The identical general set of discharge-ability rules applies to liability for California sales taxes. The State Board has admitted this in writing while commenting on a proposed piece of legislation.

See Staff Legislative Analysis 2008 for a proposed bill that would stop the accrual of interest on unpaid sales and use taxes for a small business during the pendency of a Chapter 7 Bankruptcy proceeding. Proposed Section 6593.7 for of the Revenue and Taxation Code.)

Don’t Miss: How Often Can I File Bankruptcy

Types Of Debt That Is Not Eliminated By Bankruptcy

You cannot discharge all debts in bankruptcy. Some of the most common debts that you cannot get rid of in bankruptcy are:

- Debts from child support or spousal support

- Most student loans

- Wages you owe people who worked for you

- Damages for personal injury you caused when driving while intoxicated

- Debts to government agencies for fines or penalties

Don’t File When You Are About To Receive Substantial Assets

You should reconsider filing bankruptcy if you are about to receive an inheritance , a significant income tax refund, a settlement from a lawsuit, or repayment of a loan you made to someone else. Why? Because once you receive the funds, you might not be bankruptespecially if you could use this money to settle with creditors and get out of debt on your own. If you find yourself in this situation, consult with a bankruptcy attorney to discuss your options.

Also Check: How Long Does A Bankruptcy Stay On My Credit Report

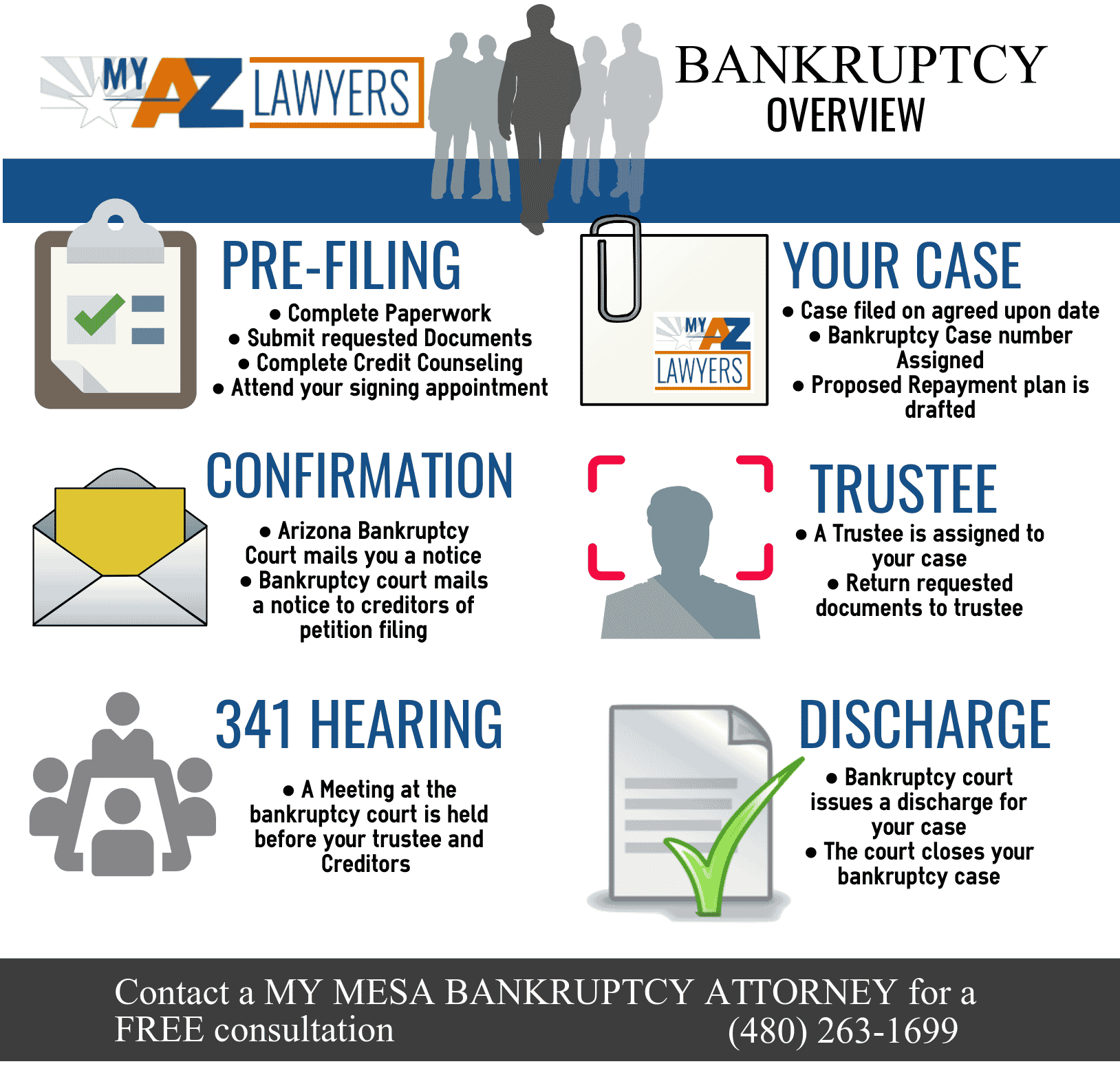

The Chapter 7 Discharge

A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor. Because a chapter 7 discharge is subject to many exceptions, debtors should consult competent legal counsel before filing to discuss the scope of the discharge. Generally, excluding cases that are dismissed or converted, individual debtors receive a discharge in more than 99 percent of chapter 7 cases. In most cases, unless a party in interest files a complaint objecting to the discharge or a motion to extend the time to object, the bankruptcy court will issue a discharge order relatively early in the case generally, 60 to 90 days after the date first set for the meeting of creditors. Fed. R. Bankr. P. 4004.

The grounds for denying an individual debtor a discharge in a chapter 7 case are narrow and are construed against the moving party. Among other reasons, the court may deny the debtor a discharge if it finds that the debtor: failed to keep or produce adequate books or financial records failed to explain satisfactorily any loss of assets committed a bankruptcy crime such as perjury failed to obey a lawful order of the bankruptcy court fraudulently transferred, concealed, or destroyed property that would have become property of the estate or failed to complete an approved instructional course concerning financial management. 11 U.S.C. § 727 Fed. R. Bankr. P. 4005.

Youre Relying On Loans To Pay Bills

Relying on loans to pay for your current bills isnt uncommon. Its also not at all sustainable. Youll just be digging yourself in deeper and delaying the inevitable.

This counts for all loans, as well. It goes for withdrawing cash from your credit card. It also goes for services like payday loans.

Either of those scenarios will have exorbitantly high interest rates that are just going to dig you deeper into debt. If youre having to juggle finances constantly, youre going to eventually drop the ball. Filing for bankruptcy offers you the opportunity to start over with a clean slate.

You May Like: How To Have Bankruptcy Removed From Credit Report

Will A Bankruptcy Actually Resolve My Debts

Bankruptcy does not resolve all debt indiscriminately. Some debts, such as student loans, cannot be discharged in bankruptcy. If you’re having trouble making payments toward debts that bankruptcy won’t cover, you should speak with your creditors to determine your options.

About the Author

Here Are Some Things To Avoid Before You File For Chapter 7 Or Chapter 13 Bankruptcy

When you’re experiencing financial stress, it’s tempting to do whatever it takes to alleviate the pressure. But most people find that a bankruptcy case goes more smoothly with a bit of planning. If you’re considering bankruptcy, you won’t want to do the following things:

- file at the wrong time

- prepare bankruptcy paperwork carelessly or incorrectly

- purchase luxury goods and services on credit or take cash advances

- sell or transfer property for less than it’s worth

- pay only your favorite creditors

- file before receiving a valuable asset, like an inheritance, and

- fail to file your tax returns.

Finally, to avoid choosing the wrong bankruptcy chapter, take time to learn about the differences between Chapters 7 and 13.

If you’d like step-by-step guidance through the bankruptcy process, read What You Need to Know to File for Bankruptcy in 2022, or let our 10-question Chapter 7 bankruptcy quiz help you identify complicated bankruptcy issues early.

Recommended Reading: How To File Bankruptcy In Az On Your Own

Right Now I Cannot Pay My Debts Besides Bankruptcy Do I Have Any Options

Yes, there are alternatives that you may use to take care of debts that you cannot pay. Creditors might be willing to settle their claim for a smaller cash payment, or they might be willing to stretch out the loan and reduce the size of the payments. This would allow you to pay off the debt by making smaller payments over a longer period of time. The creditor would eventually receive the full economic benefit of its bargain.

Occasionally, you may “buy time” by consolidating your debts that is, by taking out a big loan to pay off all the smaller amounts of debts that you owe. The primary danger of this approach is that it is very easy to go out and use your credit cards to borrow even more. In that case, you end up with an even larger total debt and no more income to meet the monthly payments. Indeed, if you have taken out a second mortgage on your home to obtain the consolidation loan, you might lose your home as well.

Why Bankruptcy Often Helps Credit

Bankruptcy is often good for your credit.

Why?

Because before a person files for bankruptcy, their credit report is a mess.

The accounts are all listed as:

Lots of people even have judgments on their credit reports.

- When you file bankruptcy, then all of the accounts on your credit report get marked as included in bankruptcy.

Thats right, they are not late or in collections any more.

The balance on these accounts also goes to $0 and the judgments get voided.

Read Also: What Is Foreclosed Homes

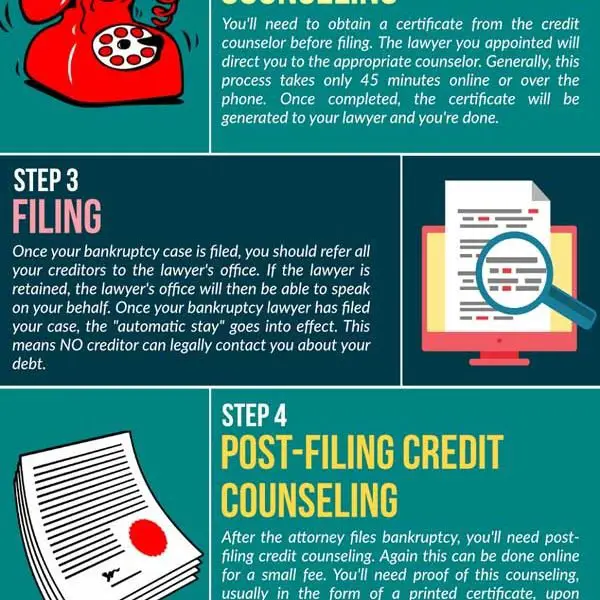

Attending The Credit Counseling Course

Before filing for bankruptcy, you must take a credit counseling course. Unless you do this your petition will not be accepted. After you have filed, you will need to take another course, that is aimed at your situation after the debts are discharged. If you fail to attend this second course then your debts will not be discharged, so do not avoid this course.

What Can You Do To Avoid Bankruptcy

Here are some things you can do to avoid bankruptcy:

- Pay off your credit card balances as soon as possible

- Contact creditors directly and ask them to lower interest rates and monthly payments or waive late fees and penalties.

- Get rid of high-interest rate credit cards and other unsecured debt, such as medical bills.

- Check into loan consolidation programs they allow you to combine multiple debts into one new loan with a lower interest rate so you can pay off your loans faster and save money on interest charges.

- If possible, consider ways to increase income, such as taking on overtime work or getting a second job.

Recommended Reading: Foreclosed Homes Jacksonville Fl

Don’t Rack Up New Debt

If you ran up debt during the 70 to 90 days before filing bankruptcy, beware unless it was for life necessities, such as food, clothing, and utilities. The creditor might object to your discharge by arguing that you took out the loan without any intention of paying it back . As a general rule, if you took out cash advances or used a credit card to buy a luxury item within 70 to 90 days of filing bankruptcy, then you’ve committed “presumptive fraud” and might not get to discharge the debt.

For the most current presumptive fraudulent debt amounts, see Recent Luxury Debts and Cash Advances: Can You Get Rid of Them in Bankruptcy?

What About Chapter 13 Bankruptcy

Did you have a temporary lapse in income which caused you to fall behind on your mortgage or car loan, but your income is steady again? Typically, once someone has fallen behind on their secured debt payments, the only way to prevent a foreclosure or repossession is to pay the full amount in a lump sum. That is not a realistic option for most, even if their income is back to normal. Filing Chapter 13 bankruptcy allows you to catch up on the missed payments over 3 – 5 years instead.

Don’t Miss: Pallets Of Merchandise For Sale

Different Types Of Bankruptcy

For individuals, there are two main types of bankruptcy cases. Most individual debtors file for Chapter 7, which can also be described as âstraightâ bankruptcy or âliquidation.â Under this plan all non-exempt assets are converted to cash , and secured creditors may have the item they financed turned over to them , unless the debtor reaffirms the debt with the courtâs approval prior to obtaining a discharge. Chapter 13, also called âreorganization,â is an option for people with regular income and debts that are less than the limits allowed by law. When you complete a Chapter 13 plan, you have the satisfaction of keeping your assets, paying your creditors, and possibly discharging some of your debts.

Bankruptcy is a serious step. If you choose to file Chapter 7 or Chapter 13, you will probably need to hire an attorney. Be sure to find an attorney who has experience handling the type of bankruptcy case you plan to file. The following overview of Chapter 7 and Chapter 13 will give you some idea of whatâs involved.

What Are The Disadvantages

Since your bankruptcy filing will remain on your credit record for up to ten years, it may affect your future finances. A bankruptcy is a troublesome item in your credit record, but often debtors who file already have a troublesome history.

In one respect, bankruptcy may improve your credit records. Because Chapter 7 provides for a discharge of debts no more than once every eight years, lenders know that a credit applicant who has just emerged from Chapter 7 cannot soon repeat the process.

Research in this area has produced mixed results. A study by the Credit Research Center at Purdue University found that about one-third of consumers who filed for bankruptcy had obtained lines of credit within three years of filing one-half had obtained them within five years. However, the new credit itself may reflect the record of bankruptcy. For example, if you might have been eligible for a bank card with a 14 percent rate before bankruptcy, the best card that you can get after bankruptcy might carry a rate of 20 percentor you might have to rely on a card secured by a deposit that you make with the credit card issuer.

Also Check: How To See If Your Bankruptcy Is Discharged