Contact The Law Offices Of Joseph G Pleva

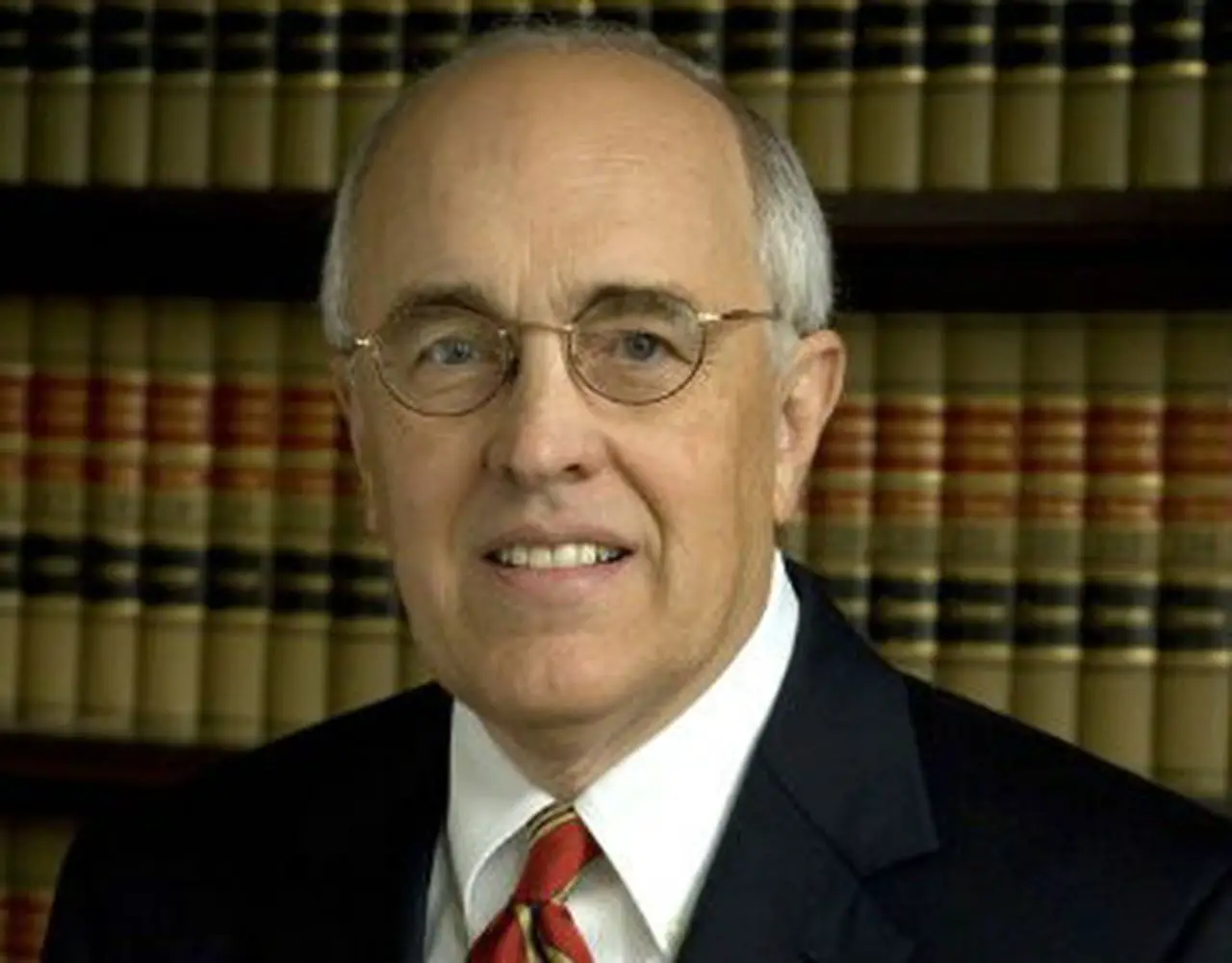

Joseph G. Pleva is an experienced Huntsville Chapter 13 and Chapter 7 bankruptcy attorney who would be proud to guide you through the bankruptcy filing process. Our staff is dedicated to getting to know each client and their specific circumstances, so well create an action plan tailored to your best interests.

Call the Law Offices of Joseph G. Pleva today to schedule a free in-person meeting, video chat, or telephone consultation.

Are Cosigners Protected In Bankruptcy

If you have cosigners that helped you get credit for your bankruptcy debt, its important to consider how this will affect not only you, but them as well. Whether or not cosigners are protected during bankruptcy depends on the type of bankruptcy. If you would like to know more details about when cosigners would be protected and when they would not be, you should consult an experienced bankruptcy attorney.

What Is Chapter 7 Bankruptcy

Chapter 7 bankruptcy is an affordable and simple solution for people struggling with debt. Chapter 7 Bankruptcy is a process which allows individuals to eliminate, or discharge, all, or some, debt in a legal and orderly fashion. Chapter 7 bankruptcy is commonly known to attorneys, lawyers, and others as a liquidating bankruptcy , personal bankruptcy, or just plain âbankruptcy.â It is also referred to as consumer, although businesses can also file under Chapter 7.

You May Like: What Happens If You Declare Bankruptcy In Ontario

Alabama Businesses Can Emerge From Bankruptcy Court With A Debt Repayment Plan Designed To Make Their Company Financially Stronger And Prepared For The Future

Our firm believes that businesses can emerge from bankruptcy stronger and better able to serve their employees, customers, and creditors through the reorganization process of debt relief. We look for clients who share our mentality, are committed to the hard work of running a business, and want to build something that will last.

Things To Keep In Mind When Considering Legal Aid

Getting help from a legal aid organization is a great option if you need guidance but canât afford an attorney.

That said, there are some things that might impact your experience with legal aid.

Itâs important to keep in mind that, although they offer assistance for a variety of legal needs, many legal aid organizations donât do bankruptcy. And, if they do, there might be a waiting list to receive assistance.

Because legal aid organizations offer face-to-face contact with a lawyer, it takes longer for them to help each client. Because of this, itâs important to know what your timeline looks like and how long you are able to wait before getting relief.

Even if legal aid does offer bankruptcy assistance, as we mentioned above, you would still need to qualify for help based on the criteria mentioned above.

These limits in legal aidâs ability to provide service to people in need sometimes complicates things if you need straightforward bankruptcy help.

You May Like: Can You File Bankruptcy Before 7 Years

Take Bankruptcy Course 2

As with the first course, the debtor education course is required to be taken from an approved provider. You can only take this course after you file your Alabama bankruptcy. The Bankruptcy Administratorâs website will give you a complete list of approved debtor education providers. This course can be done online or over the phone. We recommend that you use the same provider you used for the first course as long as they are approved to offer the second course, assuming you were satisfied with them. This course is centered around budgeting to help you prepare for life after bankruptcy. Most folks find it helpful, if a bit long. Leave enough time to do it in one sitting. Also, try to take it within 45 days of the date your 341 meeting is set to take place in your Huntsville bankruptcy.

Exceptions To The Legal Aid Requirements

Itâs possible that you can be eligible to get help from legal aid even if you donât meet any of the above requirements.

This usually happens if youâre amember of a certain group of people. For example, legal aid often have specific services for militaryveterans, senior citizens, or if you are living with certain medical conditions.

The best way to find out whether you can get help is to just call and speak to someone directly.

You May Like: Can You Claim Bankruptcy On Student Loans

What Is It Like Working With Legal Aid

If you call a legal aid organization, you can expect a phone operator or paralegal to first ask questions to determine whether you qualify for their free assistance and to see if youâre a good fit for bankruptcy.

Different legal aid organizations collect this information in different ways.

Sometimes it will entail asking you to come into their office for an interview. Sometimes it will entail filling out a paper or online questionnaire.

As you complete this questionnaire, it is important, once again, to remain totally honest. The information you provide will go onto your bankruptcy forms that are submitted to the court.

If your legal aid organization provides help in a limited assistance capacity, like nonprofits such as Upsolve do, then youâll be responsible for filing the actual bankruptcy forms on your own and showing up by yourself to the 341 meeting.

Why File For Bankruptcy

People wind up filing for bankruptcy for many reasons, often involving outside forces or unforeseen expenses: Medical debt and unexpected health care costs can quickly spiral out of control, credit card debt can accrue due to business expenses or needing to use a credit card during periods of unemployment and low cash flow, investments in the stock market, real estate or other financial vehicles might suffer due to a financial crisis, or a supply chain shutdown can cause debt to cascade in times of pandemic or due to oil price fluctuations. In any of these situations, a bankruptcy attorney can help you find the best course of action.

Don’t Miss: Does Filing Bankruptcy Cover Back Taxes

Bankruptcy Can Provide A Path To Financial Freedom

There are a lot of myths about bankruptcy. The truth is that bankruptcy is simply a means of eliminating debt. It is the path to financial freedom.

As we work to complete your bankruptcy, we will look at the circumstances that brought you to this point, helping you understand what, if anything, can be changed in the future to avoid further financial turmoil. We strive to provide permanent solutions to debt problems.

Our Alabama Bankruptcy Lawyers Provide Sophisticated Creative Solutions

Our Attorneys love to work on challenging legal problems and seek the best solutions for businesses in Huntsville, Alabama, the Southeast, and across the United States. We strive to provide best-in-class service on legal matters relating to bankruptcy restructuring and workouts, Chapter 7 bankruptcy liquidations, UCC Article 9 issues, and tax disputes. We value accountability, professionalism, and integrity with our clients and our communities.

Past businesses served include financial institutions and funds, real estate developers, manufacturers, healthcare practices and physicians, government contractors, and investor groups.

Recommended Reading: What Debts Are Not Covered By Bankruptcy

Attend Your 341 Meeting

When you file your Chapter 7 bankruptcy in Huntsville you may attend your 341 meeting at the Bankruptcy Court in Decatur, where you filed, or it may be somewhere else. You need to read the Notice of Bankruptcy Case you receive shortly after filing bankruptcy in Huntsville to find out the location of your 341 meeting. Itâs important to always open any mail from your Trustee or from the Court. Since some hearings are conducted at other sites it is vital that you show up at the right place. It may take a while for your case to be called, and it would be good to arrive a little early. It can be somewhat comforting to listen to a few hearings before you have your own. The typical hearing for folks in your situation will only last 5 to 10 minutes. Be certain to take your driverâs license and proof of social security. Your Huntsville bankruptcy could be rescheduled if you donât have proper ID.

Dealing With Your Car

When you file your Chapter 7 bankruptcy in Huntsville, you will be able to decide what to do with your car and car loan. To keep the car, you will need to sign so-called reaffirmation agreementconfirming you will keep the car and continue to pay according to the original agreement. The upside is keeping the car. The downside is if you fall behind on your payments, the car can be repossessed, and you can be sued for any balance. Second, you can redeem the car, which makes sense if you owe a lot more than what itâs worth. A redemption allows you to purchase the car at its book value. The downside is that a lot of people filing bankruptcy in Huntsville have to take out a redemption loan which can have a pretty high interest rate. In your Alabama bankruptcy you can also choose to simply surrender the vehicle and walk away. Often times, that may be the best decision. Buy an old car and get what you really want somewhere down the road.

Read Also: How To Check Bankruptcy Discharge Status In Singapore

How Can I Receive Medical Care Without Insurance

Our first concern is for your well-being. Even if you dont have health insurance, Ferguson & Ferguson may be able to help you get the medical care you require in your case. Our firm has services available for you, including hospitals, surgeons, physical therapists, and chiropractors. Remember, insurance companies only take your case serious if you get immediate medical treatment after your accident, and you finish the treatment ordered by your medical provider.

Myth: This Will Ruin Your Financial Future

Its true that your credit score will take a hit and your access to credit will diminish briefly when you file for bankruptcy. However, the damage to your score is not irreparable and the diminished access to credit doesnt last forever. Not filing, oftentimes, can continue to make debtors appear to be a credit risk. By filing, you are getting a fresh start and are able to rebuild your credit.

For filers of Chapter 7, the bankruptcy can remain on your credit report for up to 10 years. For filers of Chapter 13 it can remain up to 7 years. But you can start rebuilding your credit and improving your score immediately after filing. One option is using a secured credit card. These are usually small amounts of credit: $500 to $1000 for example and are generally available for people who have recently filed bankruptcy. As you use the card responsibly and continue to make smart financial decisions, you will likely see your credit steadily grow. Eventually, you can attain an excellent credit score and regain access to a full range of credit options.

Recommended Reading: Can You Apply For Credit During Bankruptcy

See If Youre Eligible

If you think you may qualify for free legal aid help, you should call your local legal aid organization rather than guess whether you qualify for free help or not.

Most legal aid organizations require you to beincome eligible. This means that they can only assist you if you make less than a certain amount of money.

Although it varies, most legal aids help people below 200% of the poverty line or below 125% of the poverty line.

- At 200%, that is about $24,280 for an individual or $50,200 for a family of four.

- At 125%, that is about $15,175/year for an individual and $31,375/year for a family of four.

Bankruptcy Lawyers Huntsville Al

The law firm of Ferguson & Ferguson has been fighting for the consumers of Huntsville, Alabama for over 30 years. We always offer free Huntsville bankruptcy consultations and our bankruptcy fees are among the lowest in Huntsville, Alabama. We can often quote you a fee immediately when you call after just a few simple questions, and we have flexible payment plans for everyone. Give us a call and find out about how affordable our bankruptcy fees can be in your case. At Ferguson & Ferguson, we have the knowledge and skill to help you repair your credit and become debt free. Call 256-534-3435. We can help.

Read Also: How Does A Business Declare Bankruptcy

Complete The Bankruptcy Forms

The number one requirement for completing your forms for your Alabama bankruptcy is the need to provide complete information. Leaving out information can result in having your bankruptcy discharge denied or even revoked. The discharge is why youâre filing bankruptcy in Huntsville in the first place. Itâs the document that shows your debts are gone. Disclose everything. List anything, and everything, that is owned by you. It would be helpful to have a list of everyone you owe money to, and their addresses and account numbers. Be very careful to list all of your income and expenses. One error some folks make is to leave out cash expenses. If you usually pay for something with cash, make sure you account for that in the forms youâre preparing for your Chapter 7 bankruptcy in Huntsville.

What Can Bankruptcy Do For Me

Bankruptcy laws allow individuals such as yourself, the opportunity to eliminate debts caused by past mistakes or unforeseen circumstance. Assuming you need to file a bankruptcy, the only way to determine which Chapter to file under is to first compare your options under the other available Chapters . Under any Chapter, you are required to list all of your assets and all of your debts on your petition. An asset is anything you own or may have a right to own at some future date . Some of your assets will be exempt. Basically, you can exempt any items normally used for your support and maintenance, such as clothing, furniture, household goods, and so forth. After you file your case, a Trustee is appointed. He will liquidate all of your non-exempt assets and pay your creditors according to the priority afforded to them by the Bankruptcy Code. You may voluntarily repay any debt upon agreement with the creditor. Whether this is ever advisable is questionable and is an issue to be discussed with your attorney or lawyer.

Recommended Reading: Does Bankruptcy Erase Tax Debt Canada

Your Qualified Huntsville And North Alabama Bankruptcy Attorney

Its important to utilize the services of a qualified Huntsville lawyer who has a proven track record of successfully helping clients eliminate or restructure their debt. Bankruptcy in north Alabama is a complicated process, and a good north Alabama lawyer will help clients through every step of the legal process, from enrolling in credit counseling to creating a repayment plan. If you are looking for an experienced Huntsville bankruptcy attorney, Joseph G. Pleva has helped thousands of local clients improve their financial health by declaring or bankruptcy.

How Much Does It Cost To File For Bankruptcy Relief

One of the most common questions people ask us is, How much does bankruptcy cost?Regarding representing a client in a Chapter 7 in Huntsville, bankruptcy attorneys usually charge a one-time flat fee for representation. The amount of the fee is based on the complexity of the case. At the Law Offices of Joseph G. Pleva, we offer a free initial consultation to anyone whos interested. During your free consultation, we determine what a prospective clients situation is, how we can best help them, and what the fee will be.

We are able to help our clients come up with an affordable payment plan for paying the balance of the attorney fees over time. In addition to the fees for our services, the clients have to pay the Bankruptcy Court a filing fee of $335 for Chapter 7. Generally, this is due at the time of filing the petition, but we can request the court to allow you to pay it in installments over 3-4 months after filing. In some circumstances, the court will waive the filing fee altogether.

Read Also: What Happens At A Bankruptcy Trustee Meeting

How Is The Bankruptcy Attorney Rate/fee Determined In Huntsville

The bankruptcy attorney fee in Huntsville is often based on a number of factors. Here are some of the factors:

We had mentioned earlier the population of Huntsville is 200574. As such, larger cities may have higher attorney fees and smaller towns may have lower attorney fees. For example, Montgomery may have a lower bankruptcy lawyer fee than Huntsville.

For example, Huntsville has a median household income of 55305. So, the income and general cost of living in Huntsville may dictate the attorney fees.

Secondly, the complexity of the case may dictate the cost of the bankruptcy. This is often the case with Chapter 7 bankruptcy. Do you own a home? Are you married? In Huntsville, approximately 44.8% are married. If you are married and filing with your spouse, you may have additional complexity to the case, potentially in a higher attorney cost. Secondly, are you a home owner? Approximately 56.7% of individuals in Huntsville own a home. With positive equity, you often check Alabama bankruptcy exemptions to determine whether you can keep the home. So, if your case in Huntsville is more complex, your attorney fee may be higher.

Okay, lets dive into how the type of case may result in higher or lower bankruptcy lawyer fees in Huntsville.

Personalized Debt Relief Strategies

We will review your circumstances to determine if bankruptcy is in your best interest. We will listen to you, provide clear answers to your questions and offer our honest opinion about your situation. While bankruptcy can benefit many people, there may be other options as well. If bankruptcy is not your best option, we will suggest alternatives to bankruptcy.

If bankruptcy is in your best interest, we will guide you through the process from start to finish, providing the information you need at every step along the way. We will carefully determine the type of bankruptcy that makes the most sense, either Chapter 7 or Chapter 13, and we will follow through until you have reached solid financial ground.

Read Also: How Long Does Bankruptcy Stay On Your Record