The Qualified Mortgage Debt Ratio Rules

Regardless of the loan program you choose, most lenders follow the Qualified Mortgage Debt Ratio rules. The QM rules began after the housing crisis to keep lenders more accountable and borrowers choosing smarter loans.

According to the Qualified Mortgage Guidelines, your total debt ratio cannot exceed 43%. This means all of your debts cannot take up more than 43% of your gross monthly income. Some lenders work around this rule and dont worry about offering Qualified Mortgages, but these lenders are few and far between. Most lenders want to make sure you can afford the loan beyond a reasonable doubt in order to avoid foreclosure.

Stated Income To Avoid Debt

- For those who have trouble meeting DTI ratio requirements

- A stated income loan could come in handy

- But expect a higher interest rate as a result

- And be prepared to document a significant amount of assets

Its also possible to go the stated income route if you feel you wont qualify for the loan based on your gross income alone. But unlike the liars loans of the early 2000s, todays stated loans rely on a healthy stable of assets to offset any income shortcomings.

One such example is a bank statement loan, which calculates income by using bank deposit history over a certain period of time. So you still need to have lots of money in the bank to get a mortgage.

If you find yourself in this situation, mortgage brokers can be helpful because they work with a variety of banks and lenders, including specialty lenders. The big retail banks may not be able to accommodate you.

Before the crisis, pretty much every bank and lender offer reduced documentation loans such as SIVA loans and No Ratio loans , and very few borrowers actually documented their income. Those days have come and gone.

Many people think reduced-doc loans are just stretching the truth, but they can also come in handy for borrowers who have increased their gross income recently, or those with complicated tax schedules, usually self-employed borrowers.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Don’t Miss: How Long Does Chapter 7 Bankruptcy Affect Your Credit Score

Looking At Your Mortgage To Income Ratio Logically

Above, weve talked about the mortgage to income ratio guidelines according to the lenders. Now its time to talk about the mortgage to income ratio logically. What can you afford? Thats what you need to figure out. Just because you can have a 31% housing ratio for an FHA loan, for example, doesnt mean that you need to borrow that much. If you arent comfortable with a mortgage payment of that size, choose one that you are comfortable with so that you can decrease your chances of foreclosure.

We suggest that you get pre-approved for a loan amount and find out the full payment. Then compare that to your actual budget. Put the numbers in your budget and see how it works. Is it close to the amount you pay now for rent/housing? If its much higher, is it a number that fits within your budget? Do you have enough disposable income after paying the mortgage to cover the cost of everyday living? Consider these factors before deciding on a mortgage.

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

Don’t Miss: Can You File Bankruptcy Against The Irs

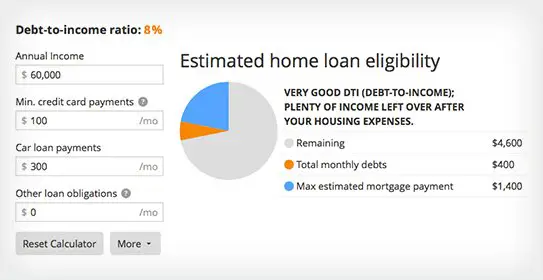

How To Calculate Debt To Income Ratio

Okay easy enough, but your ratio is likely not as clear-cut as half your income . How do you calculate your exact DTI? Theres math involved, but thankfully its pretty basic .

Simply divide all your monthly debt payments by your gross income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes income and debts is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

-

Minimum required credit card payments

Income includes:

-

Pre-tax monthly salary

-

Income from additional jobs or side hustles

-

Revenue from rental property or other investments

-

Regular income from annuities, trust funds, and retirement accounts

-

Any child support or alimony payments you receive

Lets look at a real-world example:

Auto loan: $350 per monthStudent loans: $220 per monthCredit cards: $130 minimum monthly paymentExpected housing costs: $1,800 per month= $2,500 monthly debt obligation

Monthly salary: 5,000 Monthly side-gig income: $1,500

x 100 = 38% DTI

The above scenario is for illustrative purposes only.

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: When Will My Chapter 7 Bankruptcy Be Discharged

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

Pay Off Debt And Limit Your Spending

Now, for the first lever of your DTI: the debt thats weighing you down.

Look for ways to affordably accelerate debt repayment and start making a plan to reach your target DTI, says the NFCCs McClary. You can adjust your budget to pay more than the minimum payments, but that may take some time to get you to the results you seek.

You might trim unnecessary expenses from your monthly budget, for example, to pay down credit card or other debt at a faster pace. Minimizing your current spending will also allow you to avoid taking on additional debt.

More tips from McClary

-

If youre doing well financially, consider using savings or liquidating assets to lower your debt balances.

-

If youre delinquent on debt, contact a NFCC-approved nonprofit credit counseling agency to get your accounts current and get an affordable repayment plan.

Recommended Reading: Can You Be Bonded After Bankruptcy

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Don’t Miss: How Does Insolvency And Bankruptcy Code Work

What Is The Mortgage To Income Ratio

You can calculate your mortgage to income ratio with the following calculation:

Total mortgage payment/Gross monthly income

You figure your total mortgage payment by adding up your principal, interest, monthly real estate tax payment, monthly homeowners insurance payment, and mortgage insurance amounts. Your gross monthly income is the amount of income you bring home each month before taxes.

Why Is Knowing Your Dti Ratio Important

Your DTI ratio is utilized by lenders as a measuring tool. Your DTI ratio helps lenders determine your ability to manage your finances, specifically, your monthly payments to repay the money you borrowed. Keep in mind that lenders do not know what you will do with your money in the future, so they refer to historical data to verify your income and debt totals. Moreover, your DTI ratio illustrates that you have a sufficient balance between your income and debt, thus, are more likely to be able to manage your mortgage payments.

Also Check: How Many Times Has Pg& e Filed Bankruptcy

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Fannie Mae 97 Ltv Conventional Loans For First

For borrowers who had ownership of a home in the past three years, Fannie Mae and Freddie Mac require a 5% down payment on a home purchase. HUD requires a minimum 580 credit score to qualify for a 3.5% down payment home purchase FHA loan. Homebuyers can qualify for FHA loans with credit scores down to 500 FICO. However, if you have under 580 credit scores and are down to a 500 FICO, HUD requires a 10% down payment. VA loans and USDA loans do not require any down payment on a home purchase. The down payment on a home purchase can be gifted.

You May Like: What Is Your Credit Score After You File Bankruptcy

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

What If You Dont Qualify For A Conventional Loan

After reviewing the qualifications above, you might realize that you dont qualify for a conventional loan. That shouldnt dash your homeownership dreams.

Instead, its time to consider alternative loan options. If you are a veteran, take a look at the VA loan. If you dont have a big down payment saved up, consider an FHA loan through the Federal Housing Administration. Or if you live in a rural area, consider a USDA loan.

The right type of loan is out there. If a conventional loan isnt a great fit, thats okay!

Also Check: What Is The Single Greatest Cause Of Personal Bankruptcy

What Is The Minimum Credit Score For A Conventional Loan

Conventional Loans A conventional loan is a mortgage that’s not insured by a government agency. Most conventional loans are backed by mortgage companies Fannie Mae and Freddie Mac. Fannie Mae says that conventional loans typically require a minimum credit score of 620. But lenders can raise their own requirements.

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Also Check: Can You Make Too Much Money To File For Bankruptcy

Tips To Improve Your Debt

Reducing your debt-to-income ratio may seem self-explanatory, but paying down debt is often easier said than done. Follow these tips to make a meaningful, timely impact on your debt-to-income ratio before you apply for a mortgage or another major loan:

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wonât likely have money to handle an unforeseen event and will have limited borrowing options.

Recommended Reading: When Should You File For Chapter 7 Bankruptcy

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.